Market Definition

Industrial cleaning solvents are chemical agents used to remove grease, oil, dirt, and residues from machinery, equipment, and surfaces. They are applied across manufacturing, automotive, food processing, pharmaceuticals, and electronics industries to ensure equipment reliability and maintain cleanliness standards.

The market includes oxygenated, hydrocarbon, and halogenated solvents from petrochemical and bio-based sources, for applications such as degreasing, surface preparation, and specialized industrial cleaning.

Industrial Cleaning Solvents Market Overview

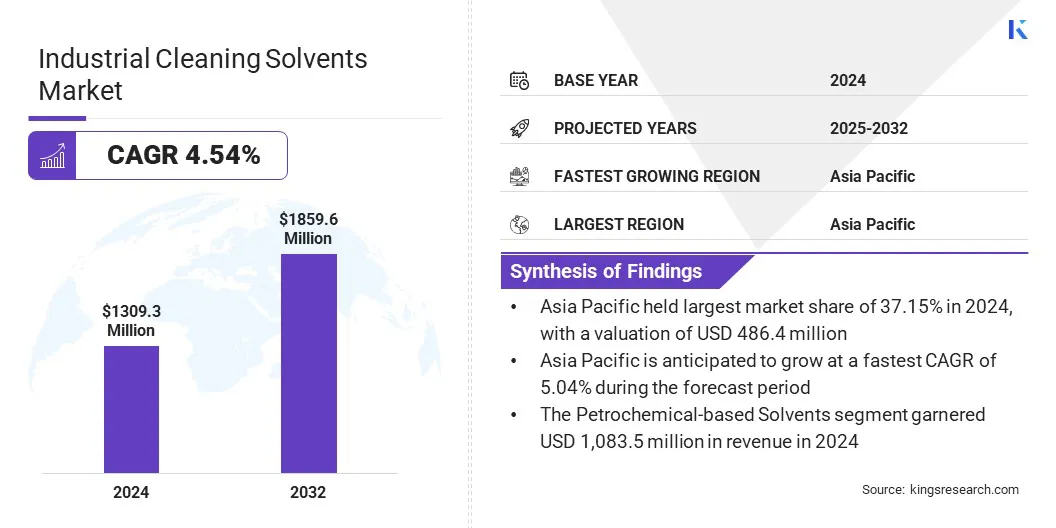

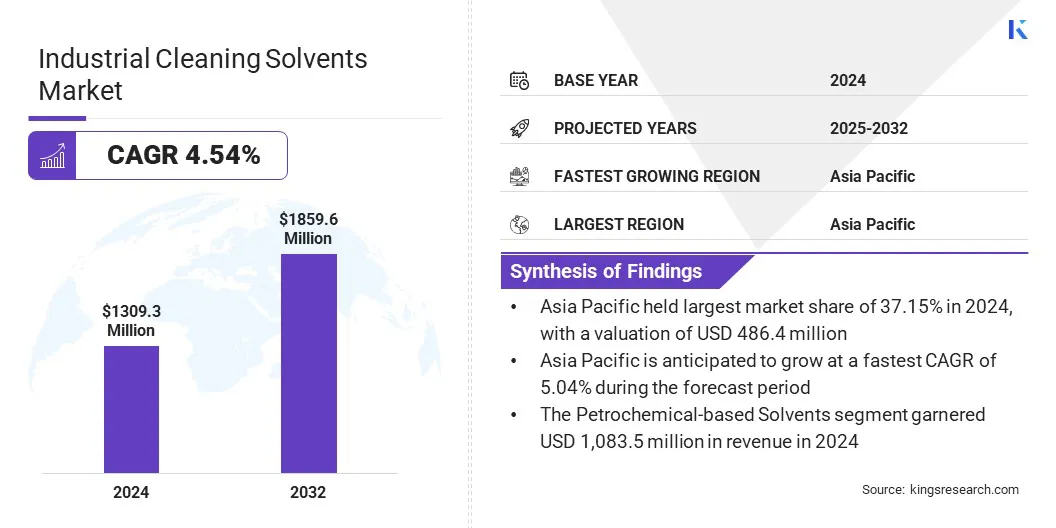

The global industrial cleaning solvents market size was valued at USD 1,309.3 million in 2024 and is projected to grow from USD 1,362.7 million in 2025 to USD 1,859.6 million by 2032, exhibiting a CAGR of 4.54% during the forecast period.

The market is witnessing significant growth due to rising demand for efficient cleaning solutions across manufacturing, automotive, electronics, and pharmaceutical sectors. Emphasis on maintaining equipment performance, hygiene standards, and operational efficiency is fueling the adoption of advanced solvent formulations. Furthermore, increasing industrial output and the rapid expansion of key end-use sectors are supporting this growth.

Key Highlights

- The industrial cleaning solvents industry size was USD 1,309.3 million in 2024.

- The market is projected to grow at a CAGR of 4.54% from 2025 to 2032.

- Asia Pacific held a share of 37.15% in 2024, valued at USD 486.4 million.

- The petrochemical-based solvents segment garnered USD 1,083.5 million in revenue in 2024.

- The oxygenated solvents segment is expected to reach USD 824.2 million by 2032.

- The degreasing and oil removal segment is projected to generate a value of USD 803.8 million by 2032.

- The manufacturing segment is expected to reach USD 597.0 million by 2032.

- North America is anticipated to grow at a CAGR of 4.47% over the forecast period.

Major companies operating in the industrial cleaning solvents market are 3M, Ecolab Inc., Procter & Gamble, BASF, Brenntag SE, AkzoNobel N.V., Kimberly-Clark Worldwide, Inc., Solenis, Evonik Industries AG, Albemarle Corporation, CleanGo Innovations, CleanPlanet Chemical, Betco Corporation, Clariant, and Croda International Plc.

The industrial cleaning sector is evolving with advancements in product performance and material design. Enhanced absorbency, strength, and chemical compatibility enhance the removal of oils, water, and grease, supporting efficient operations and promoting sustainable, reliable cleaning practices in industrial and manufacturing settings.

- In April 2025, Kimberly-Clark Professional launched upgraded WypAll X70 and X80 industrial cleaning cloths featuring enhanced absorbency, larger sheet size, and stronger construction. These improvements deliver superior performance for cleaning oil, water, and grease in industrial and manufacturing settings, while supporting efficient and reliable solvent-based cleaning applications.

Market Driver

Expanding Manufacturing and Industrial Standards

The industrial cleaning solvents market is experiencing substantial growth, fueled by expanding manufacturing activities across major economies. Increased output in sectors such as automotive, aerospace, and machinery is highlighting the rising need for cleaning solutions in production and maintenance processes. Stringent cleanliness standards in critical industries, including medical devices and semiconductors, are propelling the adoption of advanced solvents.

Furthermore, increasing equipment maintenance requirements and complex electronics production are boosting demand for precision cleaning. Rapid urbanization and infrastructure development further support market expansion through increased requirements for surface preparation and coating processes.

- According to the United Nations Industrial Development Organization (UNIDO), major manufacturing economies recorded steady growth in Q1 2024, with China and India at 1.3%, the United Kingdom at 1.4%, and Germany at 0.8%. This sustained rise in global manufacturing activity is expected to boost production and maintenance operations, driving demand for industrial cleaning solvents across key industrial sectors.

Market Challenge

Regulatory and Environmental Challenges

The industrial cleaning solvents market is facing increasing regulatory pressure due to the harmful effects of hazardous chemicals and volatile organic compounds (VOCs) on health and the environment. Strict environmental policies restrict the use of traditional petrochemical-based solvents, raising compliance costs and limiting formulation options.

To address this challenge, manufacturers are developing bio-based, low-toxicity, and biodegradable solvents that deliver effective cleaning performance within regulatory limits. Significant investments in research and development aim to improve solvent efficiency and reduce VOC emissions. Strategic collaborations with technology partners are further accelerating the introduction of innovative solutions tailored to meet evolving environmental standards globally.

- In March 2025, CleanGo Innovations launched CG-Industrial, a high-performance, green-certified industrial cleaner and disinfectant. It offers broad-spectrum efficacy for degreasing, disinfection, odor control, and versatile industrial applications, enhancing hygiene standards and supporting sustainable industrial cleaning practices.

Market Trend

Advancement in Solvent Recycling and Recovery Technologies

The industrial cleaning solvents market is witnessing a notable trend toward the rising adoption of recycling and recovery systems as industries prioritize cost control and waste reduction. Companies are increasingly implementing closed-loop and on-site recovery processes that extend solvent life and reduce dependency on virgin materials.

This trend supports circular economy principles and helps lower overall operational costs while improving resource efficiency. Manufacturers are investing in advanced purification and distillation technologies to achieve high-quality recycled solvents suitable for critical applications. This shift enhances process sustainability, fosters innovation, and creates long-term value for industrial users seeking economic and environmental benefits.

- In March 2025, Nuveen invested USD 30 million in CleanPlanet Chemical to support the growth and scaling of its on-site industrial solvent recycling technology. This investment provides sustainable and cost-effective alternatives to traditional solvent disposal for industries including coatings, automotive, chemicals, and flexible packaging.

Industrial Cleaning Solvents Market Report Snapshot

|

Segmentation

|

Details

|

|

By Source

|

Petrochemical-based Solvents, Bio-based Solvents

|

|

By Chemical Type

|

Oxygenated Solvents, Hydrocarbon Solvents, Halogenated Solvents

|

|

By Application

|

Degreasing and Oil Removal, Paint and Coatings Removal, Adhesive Cleaning, Precision and Electronics Cleaning, Others

|

|

By End-use Industry

|

Manufacturing, Healthcare and Pharmaceuticals, Electronics, Food and Beverage, Oil & Gas and Petrochemicals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Source (Petrochemical-based Solvents and Bio-based Solvents): The petrochemical-based solvents segment earned USD 1,083.5 million in 2024, largely due to widespread industrial adoption and established supply chains.

- By Chemical Type (Oxygenated Solvents, Hydrocarbon Solvents, and Halogenated Solvents): The oxygenated solvents segment held a share of 43.12% in 2024, supported by high effectiveness in degreasing and cleaning applications.

- By Application (Degreasing and Oil Removal, Paint and Coatings Removal, Adhesive Cleaning, Precision and Electronics Cleaning, and Others): The degreasing and oil removal segment is projected to reach USD 803.8 million by 2032, owing to the increasing industrial maintenance and operational efficiency requirements.

- By End-use Industry (Manufacturing, Healthcare and Pharmaceuticals, Electronics, Food and Beverage, and Oil & Gas and Petrochemicals): The manufacturing segment is estimated to reach USD 597.0 million by 2032, attributed to the rising industrial production and equipment cleaning needs.

Industrial Cleaning Solvents Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific industrial cleaning solvents market accounted for a substantial share of 37.15% in 2024, valued at USD 486.4 million. This growth is propelled by the rapid expansion of the manufacturing, automotive, and electronics sectors in China and India.

Strong emphasis on local engineering capabilities and adoption of advanced, sustainable cleaning technologies are enhancing operational efficiency and product innovation, spurring the demand for high-performance industrial cleaning solutions across diverse industrial applications.

- In June 2025, L&T Technology Services signed a strategic agreement with Tennant Company to establish a dedicated Offshore Development Center in India. The center will support new product development, lifecycle management, and engineering for sustainable industrial cleaning technologies and smart automation solutions.

The North America industrial cleaning solvents industry is expected to register the fastest CAGR of 4.47% over the forecast period. This growth is supported by stringent regulatory standards for hygiene, safety, and environmental compliance across the manufacturing, healthcare, and electronics sectors.

Strategic partnerships and exclusive distribution agreements have expanded the availability of advanced and sustainable solvent formulations, including high-performance surfactants and specialty additives. These collaborations enhance market reach and ensure efficient supply to industrial and institutional customers, leading to the widespread adoption of innovative cleaning solutions while supporting operational efficiency and sustainability goals.

- In March 2025, Evonik signed an exclusive U.S. distribution agreement with Sea-Land Chemical to supply its cleaning solutions, including sustainable surfactants and additives, for home care, vehicle care, and industrial and institutional cleaning markets across the U.S.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates industrial cleaning solvents under the Clean Air Act (CAA) and the Toxic Substances Control Act (TSCA), focusing on controlling volatile organic compounds (VOCs), hazardous air pollutants, and chemical safety.

- In Europe, industrial cleaning solvents are governed under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation and the Classification, Labelling and Packaging (CLP) regulation, ensuring chemical safety, proper labeling, and environmental protection.

- In China, the Ministry of Ecology and Environment (MEE) regulates chemical substances and solvents under the Measures for Environmental Management of New Chemical Substances.

- In Japan, the Ministry of Economy, Trade and Industry (METI) and the Chemical Substances Control Law (CSCL) oversee chemical safety and solvent use.

- In India, the Central Pollution Control Board (CPCB) regulates chemical emissions and VOC content in industrial cleaning solvents under the Environment Protection Act, 1986.

Competitive Landscape

Key players operating in the industrial cleaning solvents industry are actively leveraging strategic agreements and collaborations to strengthen their market presence and expand product portfolios. Companies are entering into partnerships to enhance distribution networks, access new regional markets, and jointly develop sustainable and high-performance solvent solutions.

Additionally, collaborations focused on research and development enable the co-creation of innovative formulations, improving cleaning efficiency, environmental compliance, and adaptability across diverse industrial applications. These strategies allow market participants to maintain competitiveness, accelerate product innovation, and ensure long-term growth while responding to evolving customer demands.

- In March 2025, Brenntag and GFBiochemicals signed a sole distribution agreement to supply safer, sustainable levulinate ester solvents for the coatings, adhesives, sealants, and elastomers (CASE) markets in Europe. These solvents offer biodegradable, non-flammable alternatives to petrochemical solvents for industrial solvent-based applications.

Key Companies in Industrial Cleaning Solvents Market:

- 3M

- Ecolab Inc.

- Procter & Gamble

- BASF

- Brenntag SE

- AkzoNobel N.V.

- Kimberly-Clark Worldwide, Inc.

- Solenis

- Evonik Industries AG

- Albemarle Corporation

- CleanGo Innovations

- CleanPlanet Chemical

- Betco Corporation

- Clariant

- Croda International Plc

Recent Developments (Agreement/Product Launch)

- In July 2025, BASF expanded its liquid enzyme portfolio for the laundry and cleaning industry by introducing lipase, cellulase, and amylase. These enzymes enhance stain removal, fabric care, whiteness, and anti-redeposition, providing high-performance solutions for industrial cleaning applications while supporting low-temperature, sustainable, and efficient cleaning formulations.

- In September 2024, HighChem Co., Ltd. signed a distribution agreement with Shenzhen Prechem New Materials Co., Ltd. to supply high-performance and eco-friendly Ethyl 3-ethoxypropionate (EEP) solvent in Japan, expanding availability for industrial and high-performance applications, including automotive and semiconductor industries.