Market Definition

The market includes the design and production of heavy-duty cables used to transmit power, signals, and data in industrial environments. These cables are formulated with robust insulation materials such as PVC, XLPE, or EPR to endure high temperatures, mechanical stress, chemicals, and moisture.

Manufacturing of industrial cables involves precision extrusion, stranding, and jacketing processes. Applications of these cables span across automation systems, robotics, power plants, oil rigs, and factory machinery. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Industrial Cable Market Overview

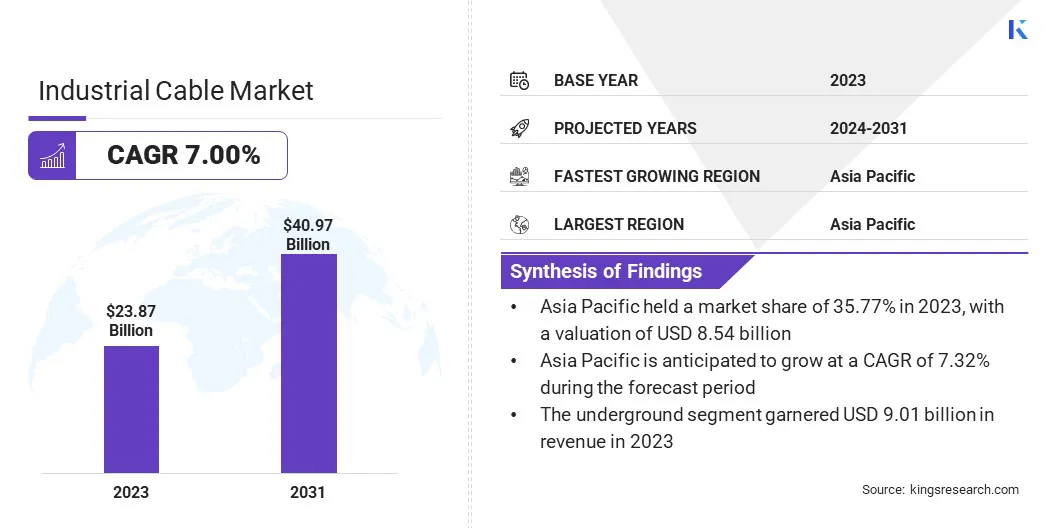

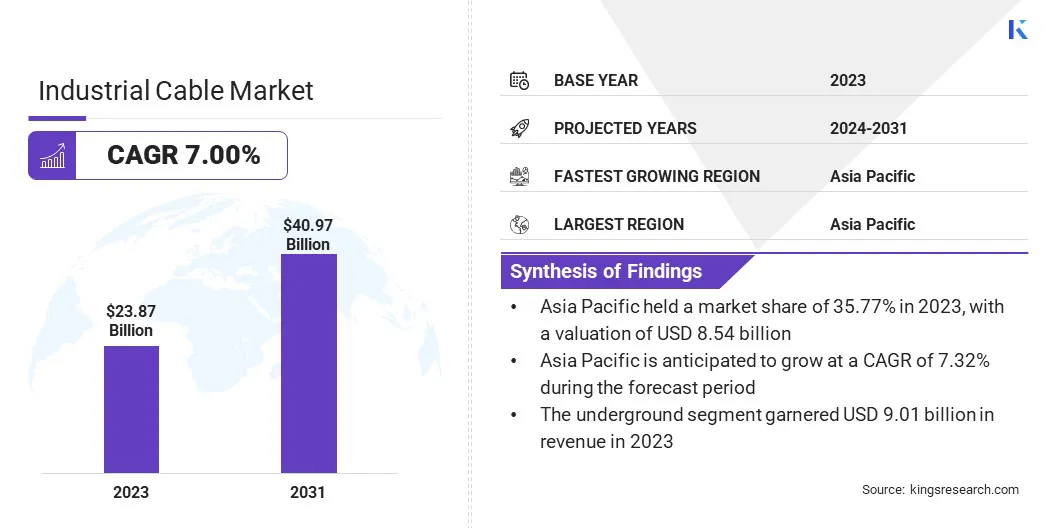

The global industrial cable market size was valued at USD 23.87 billion in 2023 and is projected to grow from USD 25.52 billion in 2024 to USD 40.97 billion by 2031, exhibiting a CAGR of 7.00% during the forecast period.

The market is driven by the rapid expansion of data centers and industrial computing, which require high-performance and reliable cable systems. Additionally, the increasing integration of modular cable systems in industrial environments is improving flexibility and efficiency, further influencing the market growth.

Major companies operating in the industrial cable market are Nexans S.A., Prysmian S.p.A., Sumitomo Electric Industries, Ltd., Southwire Company, LLC, Encore Wire Corporation, Taihan Cable & Solution Co., Ltd., Furukawa Electric Co., Ltd., HUBER+SUHNER, LS Cable & System Ltd., Leoni AG, Belden Inc., Fujikura Ltd., Hengtong Group Co., Ltd., Tratos Ltd., and KEI Industries Ltd.

Large-scale infrastructure projects in countries across Asia, Africa, and Latin America are accelerating the growth of the market. Industrial cables are vital for powering and connecting construction equipment, supporting lighting systems, and enabling communications at project sites.

The need for reliable and long-lasting cabling solutions is increasing as governments prioritize roads, airports, ports, and urban transit systems. This wave of construction activity contributes directly to the rising demand for industrial cables.

- In November 2024, Taihan Cable & Solution commenced the second phase of its submarine cable manufacturing facility in Dangjin, South Korea. The expansion includes the addition of vertical continuous vulcanization (VCV) lines for producing high-voltage direct current (HVDC) cables, catering to the growing global demand for advanced industrial cabling in offshore wind and intercontinental power transmission projects.

Key Highlights

- The industrial cable market size was valued at USD 23.87 billion in 2023.

- The market is projected to grow at a CAGR of 7.00% from 2024 to 2031.

- Asia Pacific held a market share of 35.77% in 2023, with a valuation of USD 8.54 billion.

- The underground segment garnered USD 9.01 billion in revenue in 2023.

- The high segment is expected to reach USD 17.10 billion by 2031.

- The oil & gas segment secured the largest revenue share of 27.44% in 2023.

- The market in Europe is anticipated to grow at a CAGR of 6.92% during the forecast period.

Market Driver

Expansion of Data Centers and Industrial Computing

The global rise in data center construction, especially for industrial computing and edge processing, is fueling the market. These facilities require highly specialized cables for uninterrupted power delivery, temperature resistance, and data transmission under continuous operational loads.

Industrial-grade Ethernet and fiber-optic cables are growing in demand to support high-speed communication. The expansion of digital infrastructure is increasing cable requirements significantly, reinforcing the need for high-capacity industrial cable solutions.

- In December, 2024 , Amazon Web Services (AWS) announced an additional USD 10 billion investment to expand its data center operations in Ohio, bringing its total investment in the state to over USD 23 billion by 2030. This expansion aims to support the growing demands of Artificial Intelligence (AI) and cloud computing, necessitating advanced industrial cabling solutions to handle increased power and data transmission needs.

Market Challenge

Volatility in Raw Material Prices

A significant challenge affecting the growth of the industrial cable market is the volatility in raw material prices, especially copper, aluminum, and polymers. Fluctuating costs disrupt production planning and impact profit margins, making long-term contracts and pricing strategies difficult to manage.

Market players are adopting forward purchasing agreements and strengthening relationships with suppliers to ensure stable pricing. Some are diversifying sourcing channels and investing in material efficiency technologies to reduce dependency on high-cost inputs. These efforts help manufacturers maintain cost control and production stability, supporting consistent supply and competitiveness in the market.

Market Trend

Integration of Modular Cable Systems

Modular cable systems are being adopted for their ease of installation, maintenance, and scalability. These systems allow for plug-and-play functionality, reducing downtime during equipment upgrades or replacements. Industries such as automotive, packaging, and semiconductor manufacturing are adopting modular cabling to increase operational efficiency.

This flexible approach to cabling is shaping how industrial systems are designed, leading to faster deployment and contributing to the continued expansion of the market.

- In June 2024, HUBER+SUHNER introduced its modular cable assembly solution (mCAY) to streamline the manufacturing of electric commercial vehicles, including trucks and buses. These pre-assembled, high-voltage cable systems simplify installation and reduce development time. The company also launched a product configurator, allowing customers to customize cable assemblies to their specific requirements, thereby accelerating the production process for heavy-duty Electric Vehicles (EVs).

Industrial Cable Market Report Snapshot

|

Segmentation

|

Details

|

|

By Installation

|

Overhead, Underground, Submarine

|

|

By Voltage

|

High, Medium, Low

|

|

By End User

|

Aerospace & Defense, Oil & Gas, Energy & Power, Automotive, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Installation (Overhead, Underground, Submarine): The underground segment earned USD 9.01 billion in 2023, due to its ability to ensure higher safety, lower maintenance, and minimal exposure to environmental damage, making it a cost-effective and reliable solution for long-term infrastructure projects.

- By Voltage (High, Medium, Low): The high segment held 42.17% share of the market in 2023, due to its essential role in large-scale power transmission and infrastructure projects that require efficient long-distance energy delivery.

- By End User (Aerospace & Defense, Oil & Gas, Energy & Power, Automotive, Others): The oil & gas segment is projected to reach USD 11.26 billion by 2031, owing to the high demand for robust, heat- and corrosion-resistant cabling systems required in complex and hazardous operational environments.

Industrial Cable Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 35.77% share of the industrial cable market in 2023, with a valuation of USD 8.54 billion. This market dominance is attributed to the large manufacturing base for industries, including electronics, automotive, textiles, and machinery, across the region.

These large-scale operations depend on robust cabling for automation, power distribution, and communication systems, boosting the market. The growth of export-oriented factories and continuous capacity expansion across industrial zones are directly increasing the demand for high-performance industrial cables.

Moreover, regional governments are heavily investing in industrial logistics infrastructure, including ports, freight rail, and dry ports. The rise of container hubs, shipyards, and inland logistics terminals is generating consistent demand for rugged and high-voltage cable systems, driving the market.

Singapore's Tuas mega port is on track to become the largest automated shipping hub globally. The port has successfully handled 10 million containers after commencing operations in September 2022. The port is expected to handle up to 65 million containers annually by the 2040s, when its four-phase development is fully completed.

The port's infrastructure relies heavily on advanced industrial cabling for electrified equipment, smart grid systems, and real-time monitoring, supporting large-scale automated logistics operations.

The industrial cable industry in Europe is poised for significant growth at a robust CAGR of 6.92% over the forecast period. Several European manufacturing and processing plants are shifting from fossil fuels to electricity or hybrid systems. This shift demands reliable, high-efficiency industrial cables for new energy delivery systems and retrofitted equipment.

The need for energy transition-ready cabling is accelerating the growth of the market in Europe, especially in heavy industries and utilities. Furthermore, Europe is advancing large-scale offshore wind farms and green hydrogen production facilities.

These projects require high-voltage and corrosion-resistant cables for harsh marine environments and hydrogen electrolysis systems. The rapid buildout of these renewable energy installations is contributing significantly to the market across the region.

Regulatory Frameworks

- In the U.S., the market is governed by standards set by Underwriters Laboratories (UL), such as UL 1277 and UL 1569, which ensure safety and performance. The National Electrical Code (NEC) regulates installation, while compliance with RoHS ensures cables are free from hazardous substances. These regulations guarantee safety and efficiency in cable usage.

- In the European Union (EU), industrial cables must meet CE marking requirements under the Low Voltage Directive (LVD) 2014/35/EU. European Norms (EN), like EN 50525, specify cable characteristics for fixed installations. The Construction Products Regulation (CPR) mandates fire performance standards for cables, ensuring safety and quality in the region.

- In Japan, industrial cables are regulated by Japanese Industrial Standards (JIS), such as JIS C 3605 for electric cables and JIS C 3606 for power cables. The Electrical Appliance and Material Safety Law further governs cable safety, ensuring that cables used in industrial settings meet rigorous standards for performance and security in various applications.

Competitive Landscape

Market players are adopting strategies such as expanding their production facilities to meet the rising demand for industrial cables. These expansions help improve supply capabilities, reduce lead times, and support large-scale infrastructure and renewable energy projects. Such strategic moves are contributing to the growth of the industrial cable market by strengthening manufacturing capacity and regional availability.

- In May 2024, Sumitomo Electric began building its advanced subsea transmission cable facility in the Scottish Highlands, with commissioning scheduled for 2026. The factory will produce key components essential for strengthening the UK’s electricity transmission network and linking renewable energy generation sites to the national grid.

List of Key Companies in Industrial Cable Market:

- Nexans S.A.

- Prysmian S.p.A.

- Sumitomo Electric Industries, Ltd.

- Southwire Company, LLC

- Taihan Cable & Solution Co., Ltd.

- Furukawa Electric Co., Ltd.

- Encore Wire Corporation

- HUBER+SUHNER

- LS Cable & System Ltd.

- Leoni AG

- Belden Inc.

- Fujikura Ltd.

- Hengtong Group Co., Ltd.

- Tratos Ltd.

- KEI Industries Ltd.

Recent Developments (M&A/Joint Venture/Expansion/Product Launch)

- In November 2024, Belden Inc. introduced new network and data infrastructure products, including Cat6A industrial Ethernet cables, Hirschmann’s EAGLE40-6M firewall, and OpEdge-4D gateway. These products are designed to provide maximum data security and reliable connectivity in critical industrial applications.

- In November 2024, Furukawa Electric Co., Ltd. acquired a 67% stake in Hakusan Inc. This move aims to expand Furukawa's connector business for the hyperscale data center, leveraging Hakusan's expertise in developing optical connectors to achieve a leading position in the low-loss MT connector industry.

- In November 2024, Nexans announced the separation of its specialty industrial cable operations into a new entity named Lynxeo. This strategic move aims to enhance focus on critical industrial segments such as automation, aerospace, shipbuilding, and renewable energy, aligning with Nexans' Electrify the Future strategy.

- In September 2024, Prysmian and Encore Wire announced their joint venture at the NECA 2024 Convention in San Diego. This partnership expands their product offerings, providing innovative and safety-focused wire and cable solutions to electrical contractors across North America.

As governments prioritize roads, airports, ports, and urban transit systems,