Market Definition

The market revolves around technologies and systems designed to track and map the precise position of people and assets within enclosed environments.

These solutions leverage a combination of Wi-Fi, Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), RFID, and geomagnetic fields to enable real-time positioning, navigation, and analytics. The process involves data collection from sensors, signal processing, and algorithmic computation to determine exact locations.

Industries such as retail, healthcare, manufacturing, and smart buildings integrate these systems for asset tracking, workforce management, security, and customer engagement. Indoor navigation aids in moving around in malls and airports, while geofencing supports automation in IoT-enabled environments.

Indoor Location Market Overview

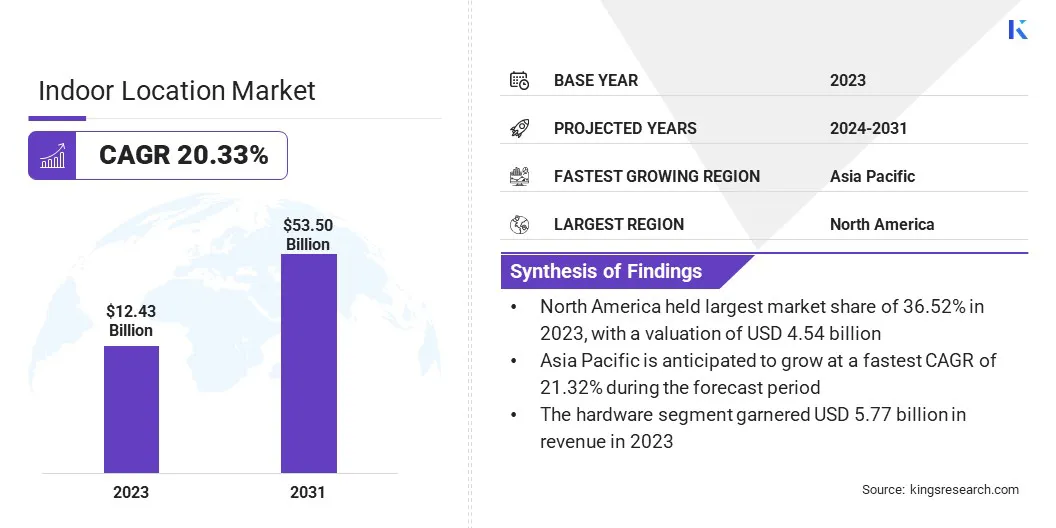

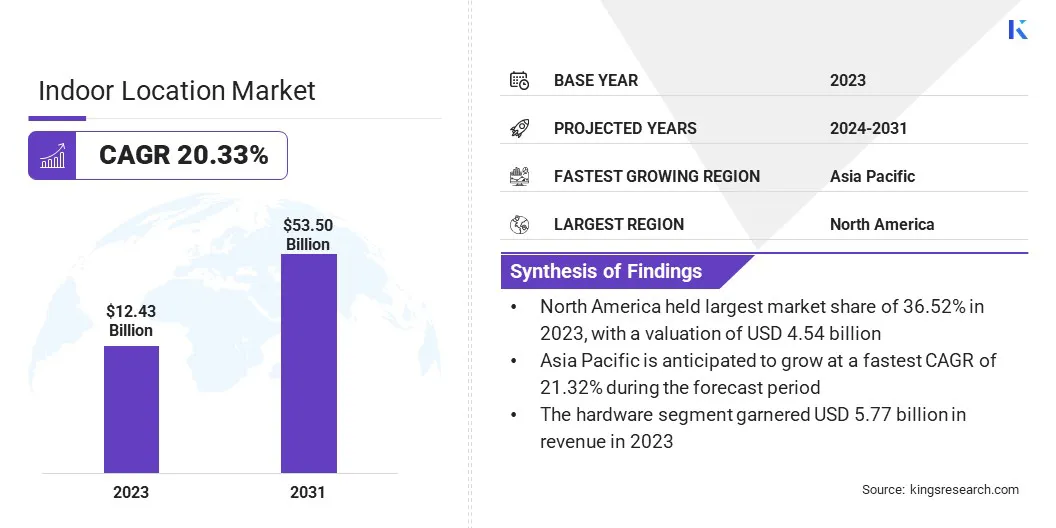

The global indoor location market size was valued at USD 12.43 billion in 2023 and is projected to grow from USD 14.65 billion in 2024 to USD 53.50 billion by 2031, exhibiting a CAGR of 20.33% during the forecast period.

The market is expanding, due to the increasing adoption of AI-driven positioning technologies and real-time data analytics, enhancing accuracy and efficiency across industries such as healthcare, retail, and logistics.

Additionally, the growing demand for smart buildings and IoT-integrated indoor navigation systems is fueling the market, as businesses seek advanced solutions for asset tracking, workforce management, and seamless customer experiences.

Major companies operating in the indoor location industry are Inpixon, InnerSpace Technology Inc., Wemap, Artisight, Navenio Ltd, Cisco, Kinexon, IndoorAtlas, Boingo Wireless, Ericsson, butlr.io, Matterport, Niantic, Zebra Technologies, and Juniper Networks.

Innovations in Wi-Fi, Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), RFID, and geomagnetic positioning have strengthened the accuracy and reliability of indoor location solutions.

Enhanced signal processing, AI-driven positioning, and hybrid location technologies are improving precision in complex environments such as airports, shopping malls, hospitals, and industrial facilities. Companies are deploying multi-modal positioning systems to ensure seamless indoor navigation and asset tracking.

Growing investments in R&D are driving the commercialization of advanced indoor positioning technologies, fueling their usage across sectors that require high-precision tracking and navigation solutions.

- In December 2024, Boingo Wireless deployed cutting-edge wireless networks at the Rhode Island Convention Center (RICC) and Amica Mutual Pavilion (AMP). The converged network at both venues integrates private cellular and Wi-Fi 6/6E to enhance mobile ticketing, exhibitor connectivity, smart lighting, and mobile device performance. Over 500 Wi-Fi 6 access points were installed to provide high-speed connectivity across meeting rooms, exhibitor spaces, ballrooms, and arena seating. Boingo’s networks support over 8.8 billion square feet of convention space in the U.S., including the the Hawaiʻi Convention Center in Honolulu and the Las Vegas Convention Center, which features a multi-carrier DAS for 5G.

Key Highlights:

- The indoor location industry size was valued at USD 12.43 billion in 2023.

- The market is projected to grow at a CAGR of 20.33% from 2024 to 2031.

- North America held a market share of 36.52% in 2023, with a valuation of USD 4.54 billion.

- The hardware segment garnered USD 5.77 billion in revenue in 2023.

- The Wi-Fi-based positioning segment is expected to reach USD 19.87 billion by 2031.

- The manufacturing and industrial segment is poised for a robust CAGR of 22.27% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 21.32% during the forecast period.

Market Driver

"Rising Demand for Real-time Asset & Workforce Tracking"

Organizations in retail, healthcare, logistics, and manufacturing are implementing indoor location solutions to enhance operational efficiency, workforce safety, and inventory management.

Retailers use indoor location technologies for real-time inventory tracking, optimizing shelf stocking and reducing losses caused by misplaced goods. Logistics providers deploy real-time asset tracking to streamline supply chain operations.

Healthcare facilities leverage indoor positioning to track medical equipment and remote nursing & observation, and ensure efficient resource utilization. The demand for real-time visibility into assets and workforce movement is contributing to the growth of the indoor location market, with enterprises adopting location intelligence for better decision-making.

- In February 2024, Artisight, Inc. announced the expansion of its partnership with WellSpan Health across its entire system. This initiative will extend Artisight’s Smart Hospital Platform, incorporating remote nursing, remote observation, and AI-driven services to over 1,000 beds within the WellSpan Health network. The platform integrates AI-powered sensors, computer vision, voice recognition, vital sign monitoring, and indoor positioning technology, delivering real-time analytics and actionable insights. With its advanced deep learning capabilities and open integration framework, the solution enhances patient safety while reducing the workload on healthcare professionals.

Market Challenge

"Privacy and Data Security Concerns"

The growth of the indoor location market is hindered by concerns over data privacy and security, as location-based technologies rely on collecting and processing sensitive user information.

Unauthorized access, data breaches, and regulatory compliance pose significant challenges, particularly in sectors like healthcare and retail, where personal data protection is critical.

Companies are adopting end-to-end encryption, anonymized data processing, and compliance-driven frameworks aligned with regulations such as GDPR and CCPA. Additionally, implementing user consent mechanisms and AI-driven security measures ensures secure data handling while maintaining transparency and trust among users.

Market Trend

"Integration with IoT & AI for Smart Buildings"

The integration of indoor location technologies with Internet of Things (IoT) sensors and Artificial Intelligence (AI) is transforming building automation, space utilization, and predictive maintenance.

Businesses are implementing AI-powered location analytics to optimize facility management, improve workspace efficiency, and enhance visitor experiences. Indoor positioning systems combined with IoT connectivity enable real-time monitoring of energy consumption, HVAC control, and automated security systems.

The deployment of smart building solutions is increasing the demand for indoor location market offerings, allowing companies to create intelligent environments that improve occupant comfort, energy efficiency, and operational performance.

- In March 2025, Niantic announced the spinoff of its geospatial AI division into a new entity, Niantic Spatial Inc., to accelerate innovation and scalability. Led by John Hanke, Niantic Spatial will be launched with USD 250 billion in capital, including USD 200 billion from Niantic’s balance sheet and a USD 50 billion investment from Scopely. The company is developing a Large Geospatial Model, leveraging large-scale ML to enhance spatial reasoning in Large Language Models (LLMs), enabling advanced navigation and understanding of real-world locations.

Indoor Location Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Hardware, Software, Services

|

|

By Technology

|

Wi-Fi-based Positioning, Bluetooth Low Energy (BLE) Beacons, Ultra-Wideband (UWB), Others

|

|

By End Use

|

Healthcare, Retail, Manufacturing and Industrial, Transportation and Logistics, Hospitality, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Offering (Hardware, Software, Services): The hardware segment earned USD 5.77 billion in 2023, due to the widespread deployment of sensors, beacons, and RFID tags, which provide real-time location tracking, high accuracy, and seamless integration with existing infrastructure across industries such as healthcare, retail, and logistics.

- By Technology (Wi-Fi-based Positioning, Bluetooth Low Energy (BLE) Beacons, Ultra-Wideband (UWB), and Others): The Wi-Fi-based positioning segment held 38.52% share of the market in 2023, due to its widespread infrastructure, cost-effectiveness, and high compatibility with existing network systems, enabling seamless indoor navigation, asset tracking, and real-time location services across various industries.

- By End Use (Healthcare, Retail, Manufacturing and Industrial, and Transportation and Logistics): The manufacturing and industrial segment is poised for significant growth at a CAGR of 22.27% through the forecast period, due to the increasing adoption of real-time asset tracking, workflow automation, and IoT-integrated positioning solutions that enhance operational efficiency, reduce downtime, and optimize resource utilization in large-scale production facilities.

Indoor Location Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a indoor location market share of around 36.52% in 2023, with a valuation of USD 4.54 billion. North America is registering the rapid adoption of indoor navigation and positioning systems across smart buildings, airports, shopping malls, and healthcare facilities.

Businesses are deploying location-based technologies to enhance visitor experiences, optimize space utilization, and improve operational efficiency. Smart city initiatives are driving investments in AI-powered indoor mapping, real-time positioning, and digital wayfinding solutions.

Amid the growing demand for seamless indoor mobility and navigation, enterprises are integrating indoor location technologies to enhance customer engagement and workforce productivity, fueling the market in North America.

- In January 2025, KARL STORZ United States initiated its U.S. rollout of Pathway.AI, a tool powered by the Artisight Smart Hospital Platform. The system detects and responds to changes in operating room status, reducing turnover durations and automating manual tasks, which improves overall OR efficiency and data accuracy. Artisight’s solution employs ambient sensors, microphones, and ML algorithms to monitor and analyze operating room workflows in real time. The platform enables healthcare professionals to streamline processes, minimize delays, and optimize resource utilization by automating the capture of operational data.

North America is home to several key players in indoor positioning technology, including Apple Inc., Cisco Systems, Qualcomm Technologies, and Zebra Technologies, driving continuous advancements in Wi-Fi, Bluetooth Low Energy (BLE), Ultra-Wideband (UWB), and RFID-based indoor positioning solutions.

The region is registering rapid commercialization of high-precision location-based services, with companies focusing on hybrid positioning, ML, and cloud-based analytics.

Strong investments in R&D, partnerships, and acquisitions are further strengthening the market, allowing businesses to implement cutting-edge location intelligence solutions.

The indoor location industry in Asia Pacific is poised for significant growth at a robust CAGR of 21.32% over the forecast period. The industrial and logistics sectors in Asia Pacific are embracing AI-driven location intelligence to enhance warehouse automation, inventory management, and real-time asset tracking.

Companies in China, India, and Southeast Asia are integrating IoT-enabled sensors, UWB-based tracking, and geospatial AI to streamline supply chain operations and improve operational efficiency.

Smart factories and logistics hubs utilize indoor positioning technologies to optimize workforce productivity, minimize downtime, and ensure seamless cargo movement, accelerating the growth of the market across the region.

Furthermore, the retail and e-commerce sector in Asia Pacific is registering significant growth, with shopping malls, supermarkets, and online retailers integrating indoor positioning technologies to optimize store layouts, track customer movement, and enable AI-powered personalized shopping experiences.

Leading retailers in countries like China, Japan, and South Korea deploy location-based marketing, digital wayfinding, and BLE beacon technology to enhance customer engagement.

Businesses are focusing on phygital (physical + digital) retail strategies and heavily investing in indoor navigation and location intelligence, boosting the market in the region.

Regulatory Frameworks

- The regulatory framework in the U.S. includes various state-level data protection laws, such as the California Consumer Privacy Act (CCPA), which mandates strict control over personal data usage. The Federal Communications Commission (FCC) oversees radio frequency regulations to prevent interference, ensuring compliance for technologies like Wi-Fi and Bluetooth-based indoor positioning systems.

- The EU enforces stringent data protection laws under the General Data Protection Regulation (GDPR), which governs personal data processing, including location tracking, requiring explicit user consent. The Radio Equipment Directive (RED) ensures that all radio-based devices, including indoor location technologies, meet safety and electromagnetic compatibility standards before entering the European market.

- The Act on the Protection of Personal Information (APPI) governs the use of personal data, including location-based information, requiring organizations to obtain consent and implement robust security measures. Amendments to APPI have strengthened data protection policies, ensuring that companies handling indoor positioning technologies comply with strict privacy regulations to safeguard user information.

- South Korea’s Personal Information Protection Act (PIPA) is one of the world’s most stringent data privacy laws, mandating strict compliance for handling personal location data. Companies must obtain explicit user consent and implement advanced security measures, with severe penalties for violations, ensuring high privacy standards in location-based services.

Competitive Landscape:

The indoor location industry is characterized by several market players that are actively pursuing strategies such as funding initiatives and the integration of advanced indoor monitoring systems, significantly contributing to the growth of the market.

Investments in AI-driven positioning technologies, sensor-based tracking, and real-time data analytics are enhancing location accuracy, operational efficiency, and security applications across sectors like healthcare, retail, and logistics.

Companies are leveraging capital infusion to expand product capabilities, improve interoperability with IoT ecosystems, and develop scalable solutions tailored to enterprise needs. These strategic efforts not only strengthen market presence but also drive continuous innovation, fostering widespread adoption of indoor location technologies.

- In January 2024, Artisight, Inc. secured USD 42 billion in an oversubscribed Series B funding round, attracting several new strategic and client health system investors. Series A investors, including NVIDIA (NVDA), also participated fully. Artisight’s HIPAA-compliant platform integrates computer vision, voice recognition, vital sign monitoring, indoor positioning, and analytics reporting. These capabilities streamline clinical documentation and coordination, allowing healthcare providers to allocate more time to direct patient care, minimize administrative expenses, and enhance patient outcomes & satisfaction.

List of Key Companies in Indoor Location Market:

- Inpixon

- InnerSpace Technology Inc.

- Wemap

- Artisight

- Navenio, Ltd

- Cisco

- Kinexon

- IndoorAtlas

- Boingo Wireless

- Ericsson

- butlr.io

- Matterport

- Niantic

- Zebra Technologies

- Juniper Networks

Recent Developments (Partnerships/Agreements/Product Launch)

- In January 2025, Boingo Wireless secured a Multiple Award Schedule (MAS) contract from the U.S. General Services Administration (GSA). This contract allows federal, state, and local governments, along with tribal organizations and eligible contractors, to streamline the procurement of Boingo’s high-speed wireless networks, ensuring seamless connectivity and operational support.

- In August 2024, Butlr secured USD 38 billion in Series B funding to address the rising demand for its sensors and anonymous data solutions, which enhance spatial awareness in buildings. These technologies optimize collaboration, energy efficiency, and safety in workplaces and living spaces. Butlr primarily serves senior living communities and workplaces, with increasing adoption among brick-and-mortar retailers.

- In February 2024, Butlr introduced a new solution designed for assisted living and long-term care facilities, enhancing energy efficiency, comfort, safety, and patient care. Utilizing opt-in generative AI models, the system combines AI with body heat-sensing technology, embedded in compact, magnetically mounted sensors for seamless wall or ceiling installation.

- In December 2023, Navenio formed a partnership with Pavion to enhance hospital workflow efficiency. This collaboration leverages Navenio’s infrastructure-free, non-invasive technology, seamlessly integrating it with nurse call systems and other essential clinical and operational platforms. The first deployment is set for a federal hospital and research institution with nearly 700 beds near Washington, D.C.