Market Definition

The market refers to the industry involved in the production, distribution, and commercialization of immunoglobulin products. These products are primarily derived from human plasma and are widely utilized in the treatment of immunodeficiency disorders, autoimmune diseases, and various inflammatory conditions.

The market includes various formulations such as intravenous immunoglobulin (IVIG), subcutaneous immunoglobulin (SCIG), and intramuscular immunoglobulin (IMIG). The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Immunoglobulins Market Overview

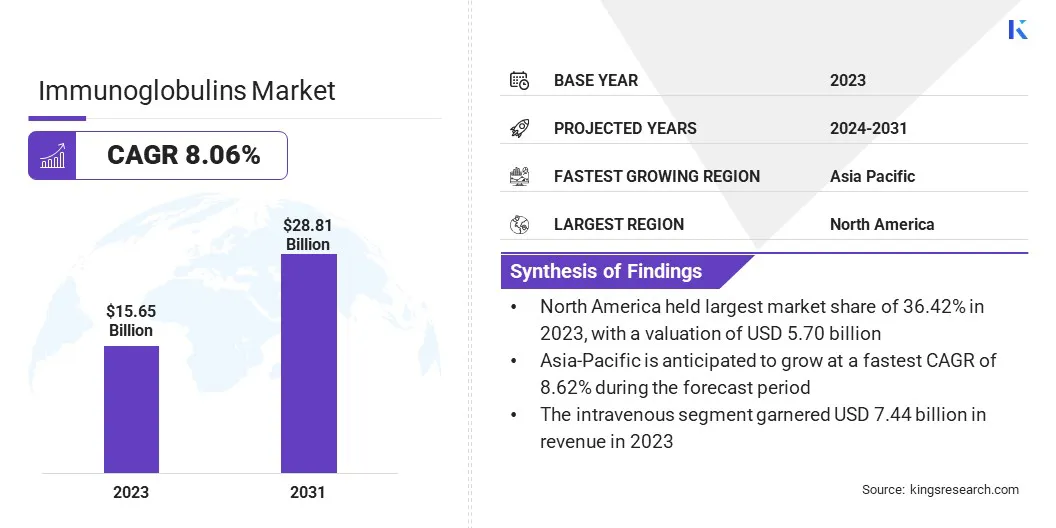

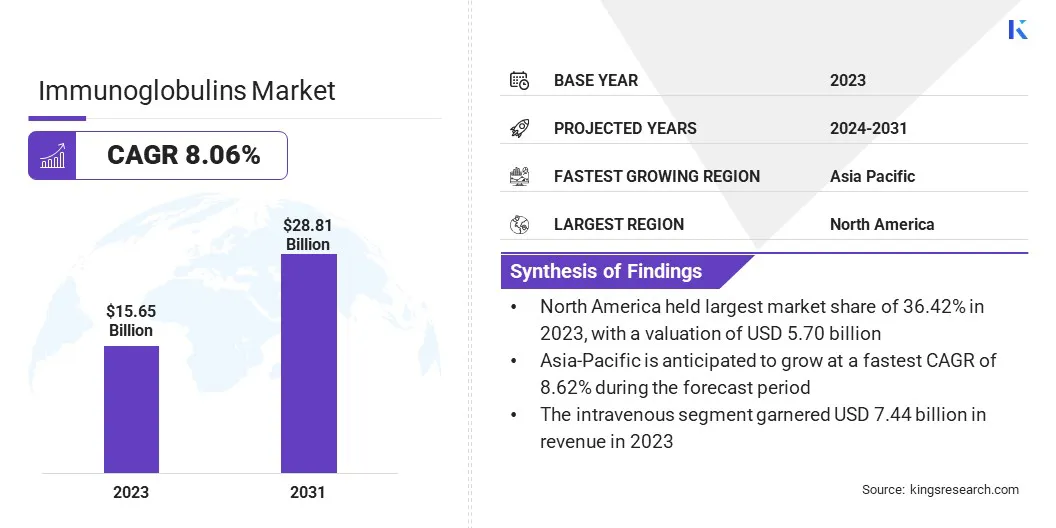

The global immunoglobulins market size was valued at USD 15.65 billion in 2023 and is projected to grow from USD 16.75 billion in 2024 to USD 28.81 billion by 2031, exhibiting a CAGR of 8.06% during the forecast period. This growth is attributed to the increasing prevalence of immunodeficiency and autoimmune disorders, a growing geriatric population, and the broadening scope of clinical applications for immunoglobulin therapies.

Major companies operating in the immunoglobulins industry are Kedrion S.p.A, LFB, Shanghai RAAS Blood Products Co., Ltd., Grifols, S.A., China Biologic Products Holdings, Inc., Bio Products Laboratory Ltd., Takeda Pharmaceutical Company Limited, Octapharma AG, Biotest AG, Lilly and Company, Pfizer Inc., Prothya Biosolutions Netherlands B.V., EMERGENT, ADMA Biologics, Inc, and Baxter.

Furthermore, advancements in plasma-derived product technologies and heightened awareness surrounding early diagnosis and treatment are expected to further support market development. Moreover, improvements in healthcare infrastructure particularly in emerging markets are further driving the adoption of immunoglobulin therapies, in turn, driving market growth.

- In November 2023, Grifols, S.A. received FDA approval for its new immunoglobulin purification and filling facility in Clayton, North Carolina. This approval increases Grifols' global production capacity of Gamunex-C to 60 million grams annually.

Key Highlights

- The immunoglobulins industry size was recorded at USD 15.65 billion in 2023.

- The market is projected to grow at a CAGR of 8.06% from 2024 to 2031.

- North America held a market share of 36.42% in 2023, with a valuation of USD 10.65 billion.

- The IgG (Immunoglobulin G) segment garnered USD 6.79 billion in revenue in 2023.

- The intravenous segment is expected to reach USD 13.16 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.62% during the forecast period.

Market Driver

Rising Prevalence of Immunodeficiency and Autoimmune Disorders

The rising prevalence of immunodeficiency and autoimmune disorders is driving the immunoglobulins market. Increased recognition and diagnosis of primary immunodeficiency diseases (PIDD), along with the growing incidence of secondary immunodeficiencies associated with conditions such as HIV, cancer, and immunosuppressive therapies, are contributing to higher demand for immunoglobulin-based treatments.

Furthermore, the global increase in autoimmune diseases including chronic inflammatory demyelinating polyneuropathy (CIDP), immune thrombocytopenia (ITP), and Guillain-Barré syndrome are expanding the therapeutic use of immunoglobulins, in turn, driving market growth.

- In September 2024, GC Biopharma USA, Inc. launched ALYGL, an FDA-approved, 10% intravenous immunoglobulin therapy for adults with primary humoral immunodeficiency. The product features enhanced safety through a purification process to remove coagulation factor XIa (FXIa) to undetectable levels.

Market Challenge

High Cost of Immunoglobulin Therapies

The high cost of immunoglobulin therapies poses a significant constraint on market accessibility. The complexity of production encompassing plasma collection, advanced purification techniques, and stringent quality control results in elevated manufacturing and logistical expenses.

High costs and inconsistent reimbursement policies across regions limit patient access to treatment, especially in resource-limited healthcare systems, slowing market growth.

To address these challenges, key players are focusing on enhancing production efficiency, increasing plasma collection capacity, and investing in advanced manufacturing technologies. The introduction of biosimilars and supportive reimbursement policies are also helping to lower costs and improve access.

Additionally, public-private partnerships and targeted subsidies, particularly in low- and middle-income countries, are being explored to enhance treatment affordability and availability.

Market Trend

Advancements in Plasma Fractionation Technologies

A growing trend in the market is the advancement of plasma fractionation technologies, which has significantly enhanced the efficiency and scalability of immunoglobulin production.

Innovations such as high-resolution chromatography, enhanced filtration techniques, and automated processing systems are improving the yield, purity, and safety of plasma-derived products. These advancements reduce the risk of contamination and batch variability to streamline production timelines and lower manufacturing costs.

- In January 2024, Takeda Pharmaceutical Company Limited announced that the U.S. Food and Drug Administration (FDA) has approved its GAMMAGARD LIQUID as an intravenous immunoglobulin therapy to improve neuromuscular disability and impairment in adults with chronic inflammatory demyelinating polyneuropathy (CIDP).

Immunoglobulins Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

IgG (Immunoglobulin G), IgM (Immunoglobulin M), IgA (Immunoglobulin A), Others

|

|

By Route of Administration

|

Intravenous, Subcutaneous, Intramuscular

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (IgG (Immunoglobulin G), IgM (Immunoglobulin M), IgA (Immunoglobulin A), Others): The IgG (Immunoglobulin G) segment earned USD 6.79 billion in 2023 due to its widespread use in treating a range of immunodeficiency and autoimmune disorders.

- By Route of Administration (Intravenous, Subcutaneous, Intramuscular): The intravenous segment held 47.53% of the market in 2023, due to its rapid onset of action and preference in the management of acute and severe immunological conditions.

Immunoglobulins Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America immunoglobulins market share stood at around 36.42% in 2023 in the global market, with a valuation of USD 5.70 billion. This regional dominance is supported by a well-established healthcare infrastructure, high awareness of immunoglobulin therapies, and a strong presence of leading biopharmaceutical companies.

Additionally, favorable reimbursement policies and extensive research and development activities contribute to the region's sustained market growth. The increasing prevalence of immunodeficiency and autoimmune disorders, coupled with the early adoption of advanced treatment modalities, further reinforces North America's leading position in the global market.

- In September 2023, The American Association for Cancer Research (AACR) reported a 90% reduction in severe infections among multiple myeloma patients receiving anti-BCMA bispecific antibody therapy with intravenous immunoglobulin (IVIg). The analysis of 37 patients found fewer infections with IVIg treatment.

The immunoglobulins industry in Asia-Pacific is poised for significant growth at a robust CAGR of 8.62% over the forecast period. Asia-Pacific is registering rapid growth in the market, driven by rising healthcare expenditure and the increasing awareness of immunoglobulin-based therapies across developing economies such as China, India, and Southeast Asian countries.

Additionally, the region is witnessing improvements in diagnostic capabilities and a growing focus on rare disease management. Government initiatives aimed at strengthening healthcare infrastructure and encouraging domestic plasma collection and biopharmaceutical production are further supporting market expansion in Asia-Pacific.

- In October 2024, Otsuka America Pharmaceutical, Inc. announced positive interim results from its Phase 3 VISIONARY study evaluating sibeprenlimab for the treatment of Immunoglobulin A nephropathy (IgAN) in adults.

Regulatory Frameworks

- In Australia, the National Immunoglobulin Governance Program regulates the supply and use of government-funded immunoglobulin products. It ensures that immunoglobulin therapies are used appropriately, equitably, and in line with evidence-based clinical practice, given their status as a precious resource derived from human plasma.

- In the international context, the World Health Organization’s (WHO) "Guideline for the Production and Quality Control of Monoclonal Antibodies and Related Products Intended for Medicinal Use" regulates the manufacturing and quality assurance of monoclonal antibodies.

- In the European Union, the European Medicines Agency (EMA) regulates immunoglobulin therapies through the Guideline on the Clinical Investigation of Human Normal Immunoglobulin for Intravenous Administration (CPMP/BPWG/388/95).

Competitive Landscape

The global immunoglobulins market is characterized by intense competition among a mix of established multinational corporations and emerging regional players. Companies are focusing on strategic initiatives such as mergers and acquisitions, product launches, geographic expansion, and collaborations to strengthen their market position.

Continuous investment in research and development for novel formulations and delivery methods, including subcutaneous and recombinant immunoglobulins. Additionally, companies are working to expand their plasma collection networks and enhance manufacturing capabilities to meet growing global demand and ensure supply chain resilience.

- In April 2025, Epsilogen Ltd acquired TigaTx, Inc., forming a leading pan-isotype cancer antibody company. This merger combines Epsilogen's expertise in immunoglobulin E (IgE) antibodies with TigaTx's focus on immunoglobulin A (IgA) antibodies, enhancing the development of novel cancer therapeutics.

List of Key Companies in Immunoglobulins Market:

- Kedrion S.p.A

- LFB

- Shanghai RAAS Blood Products Co., Ltd.

- Grifols, S.A.

- China Biologic Products Holdings, Inc.

- Bio Products Laboratory Ltd.

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Biotest AG

- Lilly and Company

- Pfizer Inc.

- rothya Biosolutions Netherlands B.V.

- EMERGENT

- ADMA Biologics, Inc

- Baxter

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In April 2025, Amgen Inc announced that the U.S. Food and Drug Administration (FDA) has approved UPLIZNA (inebilizumab-cdon) as the first and only treatment for adults with Immunoglobulin G4-related disease (IgG4-RD). This approval was based on the Phase 3 MITIGATE trial, which demonstrated an 87% reduction in the risk of disease flares compared to placebo.

- In June 2024, Amgen Inc. Amgen announced that its Phase 3 clinical trial (NCT04540497) evaluating Uplizna (inebilizumab-cdon) for Immunoglobulin G4-related disease (IgG4-RD) met its primary endpoint, demonstrating an 87% reduction in flare risk compared to placebo. Based on these results, Amgen plans to seek regulatory approval for Uplizna in the United States and other key regions in North America.

- In December 2024, Genethon and Hansa Biopharma initiated a Phase 2 trial to evaluate the safety and efficacy of imlifidase as a pre-treatment to Genethon's gene therapy, GNT-0003, in adults with severe Crigler-Najjar syndrome who have pre-existing anti-AAV8 antibodies. This approach aims to enable gene therapy for patients previously ineligible due to these antibodies.

, expanding access to medical services,