Market Definition

The market includes the development and production of components that convert optical images into electronic signals, using CMOS and CCD technologies. These sensors are integrated into devices such as smartphones, automotive cameras, industrial equipment, and medical imaging systems.

The process involves photodiode fabrication, micro-lens integration, and advanced signal processing. Their scope spans consumer electronics, healthcare, security, and robotics. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Image Sensors Market Overview

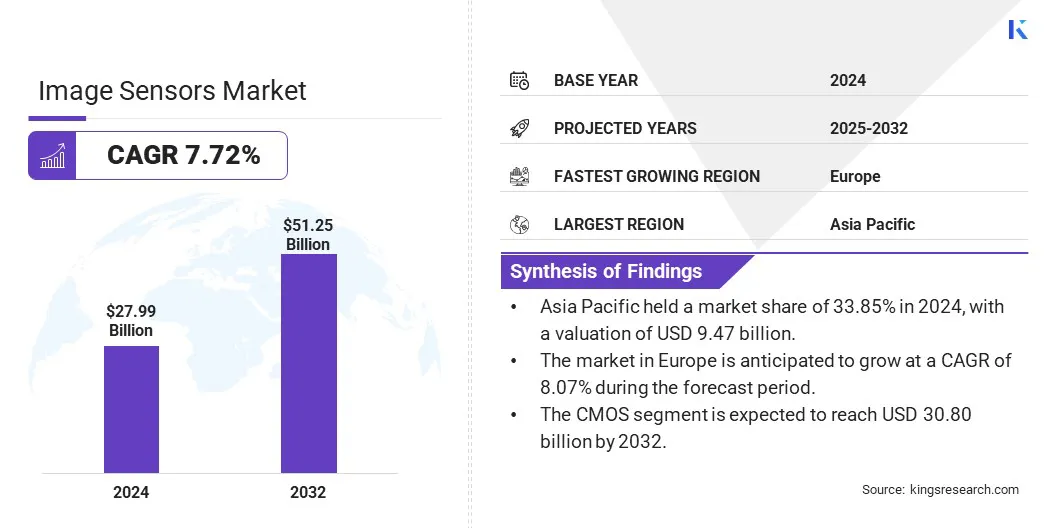

The global image sensors market size was valued at USD 27.99 billion in 2024 and is projected to grow from USD 29.98 billion in 2025 to USD 51.25 billion by 2032, exhibiting a CAGR of 7.72% during the forecast period.

The market is driven by the increasing demand for image sensors in consumer electronics, where high-quality imaging is essential. Technological advancements in CMOS sensor design have improved performance and efficiency, enabling wider applications and fueling significant expansion in the global market.

Major companies operating in the image sensors industry are SONY ELECTRONICS INC., SAMSUNG, OMNIVISION, Semiconductor Components Industries, LLC, STMicroelectronics N.V., Panasonic Corporation, Canon Inc., Hamamatsu Photonics K.K., Teledyne Technologies Incorporated, Sharp Corporation, Infineon Technologies AG, SmartSens (Shanghai) Electronic Technology Co., Ltd., GENTEX CORPORATION, Newsight Imaging, and FRAMOS.

The growth of the market is influenced by the increasing integration of advanced driver-assistance systems (ADAS) in vehicles. Automotive manufacturers are adopting high-resolution image sensors for lane detection, pedestrian recognition, and parking assistance.

Regulatory mandates for collision avoidance systems and rear-view cameras further push the demand for image sensors. With the ongoing shift toward autonomous driving, the market is witnessing a rise in investments in vision-based technologies across electric and traditional vehicles.

- In October 2024, Sony Semiconductor Solutions announced the release of the ISX038 CMOS image sensor for automotive cameras. This is the industry's first sensor to process and output RAW and YUV images, catering to both ADAS functionalities and infotainment applications. The integration of Sony's proprietary Image Signal Processor (ISP) allows a single camera to serve multiple functions, simplifying automotive camera systems and reducing space, cost, and power consumption.

Key Highlights

- The image sensors market size was valued at USD 27.99 billion in 2024.

- The market is projected to grow at a CAGR of 7.72% from 2025 to 2032.

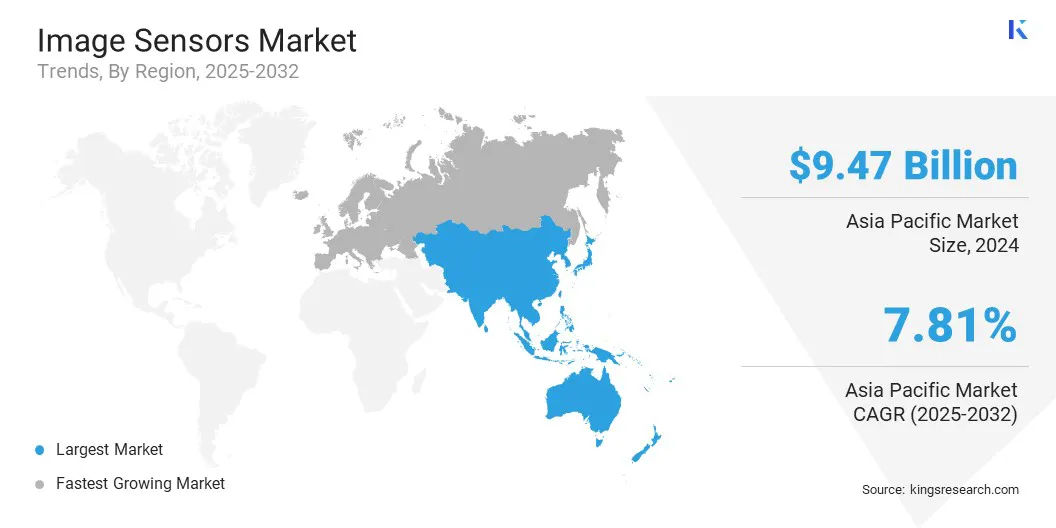

- Asia Pacific held a market share of 33.85% in 2024, with a valuation of USD 9.47 billion.

- The 3D segment garnered USD 16.75 billion in revenue in 2024.

- The CMOS segment is expected to reach USD 30.80 billion by 2032.

- The Visible segment secured the largest revenue share of 53.83% in 2024.

- The 6 MP to 12 MP segment is poised for a robust CAGR of 7.99% through the forecast period.

- The aerospace & defense segment secured the largest revenue share of 24.29% in 2032.

- The market in Europe is anticipated to grow at a CAGR of 8.07% during the forecast period.

Market Driver

Increasing Demand in Consumer Electronics

Consumer electronics remain a key application area supporting the growth of the market. Image sensors are integrated in wearables, tablets, and laptops for facial recognition and video communication. The constant shift in smartphone camera quality has fueled innovation in compact and high-resolution sensors with enhanced low-light performance.

The rising need for camera-based features in personal electronics continues to drive advancements in miniaturization and power efficiency, expanding the market globally.

- In April 2025, OMNIVISION introduced the OV50X CMOS image sensor, offering the highest dynamic range currently available in the mobile phone industry for capturing cinematic-quality videos. This 50MP sensor integrates TheiaCel and Dual Conversion Gain HDR technologies, enabling single-exposure HDR imaging while minimizing motion blur. It also features quad phase detection autofocus with full-pixel coverage, significantly improving performance in low-light environments.

Market Challenge

Managing Heat and Power Consumption in High-performance Sensors

A key challenge in the image sensors market is the rising heat generation and power consumption associated with high-resolution and high-speed sensors. These issues can affect image quality and device performance, especially in compact devices like smartphones and wearables.

Key market players are adopting advanced semiconductor materials, optimizing pixel architectures, and integrating on-chip intelligence to reduce processing loads. They are also developing low-power sensor designs and using advanced packaging techniques for better heat dissipation. These strategies help manufacturers balance performance demands with thermal and energy efficiency in next-generation image sensors.

Market Trend

Technological Advances in CMOS Sensor Design

Constant innovations in CMOS technology play a vital role in the growth of the market. Improvements in pixel design, backside illumination, and stacking technologies have enhanced the image quality and power efficiency of sensors.

These advancements are enabling new features in consumer devices, automotive systems, and medical equipment. CMOS sensors are now preferred over CCDs, due to their affordability, scalability, and integration capabilities, which further promotes their adoption across various sectors.

- In January 2025, Canon unveiled a groundbreaking 410-megapixel 35mm full-frame CMOS sensor. This sensor offers a resolution of 24,592 x 16,704 pixels, equivalent to 24 K. Designed for specialized applications like surveillance and medical imaging, it features a back-illuminated stacked formation and enhanced circuitry, enabling a readout speed of 3,280 megapixels per second and capturing full-resolution images at eight frames per second.

Image Sensors Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technique

|

2D, 3D

|

|

By Type

|

CCD, CMOS

|

|

By Spectrum

|

Visible, Non-visible

|

|

By Resolution

|

Up to 5 MP, 6 MP to 12 MP, 13 MP to 16 MP, Above 16 MP

|

|

By End User

|

Aerospace & Defense, Consumer Electronics, Healthcare & Lifesciences, Industrial, Automotive, Security & Surveillance, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technique (2D and 3D): The 3D segment earned USD 16.75 billion in 2024, owing to its growing use in facial recognition, depth sensing, and advanced imaging across smartphones, automotive systems, and industrial automation.

- By Type (CCD and CMOS): The CMOS segment held 61.58% share of the market in 2024, due to lower production costs, faster readout speeds, and easier integration with digital processing systems.

- By Spectrum (Visible and Non-visible): The visible segment is projected to reach USD 27.13 billion by 2032, on account of its widespread use in consumer electronics, security systems, and automotive applications, where clear and color-accurate imaging is essential for functionality and user experience.

- By Resolution (Up to 5 MP, 6 MP to 12 MP, 13 MP to 16 MP, and Above 16 MP): The 6 MP to 12 MP segment is poised for significant growth at a CAGR of 7.99% through the forecast period, attributed to its extensive use in mid-range smartphones, surveillance systems, and automotive applications, where balanced image quality, cost-efficiency, and performance are prioritized.

Image Sensors Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 33.85% share of the image sensors market in 2024, with a valuation of USD 9.47 billion. The region leads the world in smartphone assembly, which drives constant demand for image sensors. Leading smartphone brands operate manufacturing and R&D centers in Asia Pacific, using high-resolution sensors in multi-camera systems.

Camera upgrades are a major selling point in this sector, prompting the rapid adoption of advanced sensors. This trend plays a significant role in the growth of the regional market, especially in mid-range and flagship mobile devices.

- In October 2024, Vivo unveiled its X200 series of flagship Android smartphones, equipped with high-resolution AMOLED displays, MediaTek Dimensity 9400 chipsets, and a Zeiss-engineered triple-lens camera system. All models feature a 50MP Sony LYT-818 main sensor with optical image stabilization, and a 50MP ultra-wide lens using the Samsung JN1 sensor.

Moreover, the rise of regional electronics brands has increased the local demand for in-house components, including image sensors. Several firms in Asia Pacific are developing their own smartphones, wearables, and smart home devices, creating a strong market for sensor suppliers.

The image sensors industry in Europe is poised for significant growth at a CAGR of 8.07% over the forecast period. It is focusing on adopting Industry 4.0 technologies, where image sensors play a vital role in machine vision systems. Factories increasingly use sensors for quality inspection, robot guidance, and process control to enhance efficiency.

The region’s focus on precision manufacturing and automation accelerates the demand for sophisticated image sensors, accelerating the market expansion. Furthermore, European cities and businesses are upgrading their surveillance networks with advanced video monitoring systems. Image sensors with enhanced low-light capabilities and high resolution are preferred for public safety and critical infrastructure protection.

- In March 2025, IDS Imaging Development Systems GmbH collaborated with Prophesee SA and launched the uEye EVS camera line. This series includes the Prophesee-Sony IMX636HD event-based vision sensor, offering high speed, high dynamic range, and data efficiency. The camera is designed for industrial machine vision applications requiring real-time processing, such as optical monitoring of vibrations and high-speed motion analysis.

Regulatory Frameworks

- The market in the U.S. is regulated by the Export Administration Regulations (EAR) under the Bureau of Industry and Security, which controls the exports of high-spec sensors. The Federal Communications Commission (FCC) regulates radiofrequency emissions in sensor-based devices, while the Consumer Product Safety Commission (CPSC) ensures product safety for consumer electronics. These frameworks maintain technical compliance, export control, and public safety standards within the market.

- In the EU European Union, the General Data Protection Regulation (GDPR) oversees the capturing and use of visual data, which requires transparent processing practices for any imaging system. The Restriction of Hazardous Substances (RoHS) Directive limits harmful materials in sensor components, promoting environmentally responsible manufacturing.

- China regulates image sensors through the Personal Information Protection Law (PIPL), which governs how devices collect and manage image data by prioritizing consent and data localization. The Export Control Law restricts the international trade of sensitive technologies, including high-grade sensors. These regulations are enforced alongside cybersecurity protocols, which impact surveillance, smartphones, and automotive applications.

- Japan’s image sensors market is regulated by the Act on the Protection of Personal Information (APPI), which outlines data processing rules for devices capturing personal visuals. The Electrical Appliance and Material Safety Law (DENAN) ensures that electronic products, including imaging devices, meet specific safety standards before they enter the market.

Competitive Landscape

Major market players are actively focusing on expanding their product portfolios by introducing advanced image sensor lines, made for evolving smartphone and imaging needs. This approach helps them address specific performance requirements such as enhanced zoom, dynamic range, and low-light clarity.

By aligning product innovation with technological trends, companies are strengthening their market position and meeting growing demand across mobile and imaging applications.

- In June 2024, Samsung introduced three new mobile image sensors tailored for main and sub smartphone cameras: ISOCELL HP9, ISOCELL GNJ, and ISOCELL JN5. The ISOCELL HP9 features a large optical format, making it ideal for telephoto modules, offering image quality, autofocus, dynamic range, and frame rate, which is on par with flagship main cameras. The GNJ integrates dual pixel technology and in-sensor zoom to enhance video clarity and deliver high-resolution images without artifacts or moiré patterns.

List of Key Companies in Image Sensors Market:

- SONY ELECTRONICS INC.

- SAMSUNG

- OMNIVISION

- Semiconductor Components Industries, LLC

- STMicroelectronics N.V.

- Panasonic Corporation

- Canon Inc.

- Hamamatsu Photonics K.K.

- Teledyne Technologies Incorporated

- Sharp Corporation

- Infineon Technologies AG

- SmartSens (Shanghai) Electronic Technology Co., Ltd.

- GENTEX CORPORATION

- Newsight Imaging

- FRAMOS

Recent Developments (Partnerships/Product Launches)

- In June 2024, Nikon introduced the Z6 III camera, featuring a partially stacked CMOS sensor that enhances video capabilities and focus speed. This innovative sensor design allows for instant readouts by stacking circuitry, leading to a faster and more efficient performance. The Z6 III can shoot 6K videos at 60fps and capture 50 full-resolution JPGs per second.

- In January 2024, Eyeris partnered with OmniVision and Leopard Imaging to develop a production reference design, which integrates Eyeris' advanced monocular 3D sensing AI software into Leopard Imaging's 5-megapixel global shutter camera. This design enhances safety and comfort throughout the automobile cabin by providing depth-aware driver and occupant monitoring systems.

- In December 2023, STMicroelectronics unveiled a new global shutter image sensor, tailored for compact devices like smart glasses and AR/VR headsets. This sensor delivers high-resolution imaging in an ultra-small form factor, supporting the growing demand for advanced computer vision in wearable technology.