Market Definition

Hydroxyapatite is a naturally occurring mineral form of calcium apatite. It is primarily composed of calcium and phosphate ions, with hydroxyl groups. The market refers to the global industry that produces and distributes hydroxyapatite materials for various applications, particularly in healthcare, biotechnology, and manufacturing sectors. It is primarily driven by the increasing demand for bone grafts, dental implants, and orthopedic devices.

Hydroxyapatite Market Overview

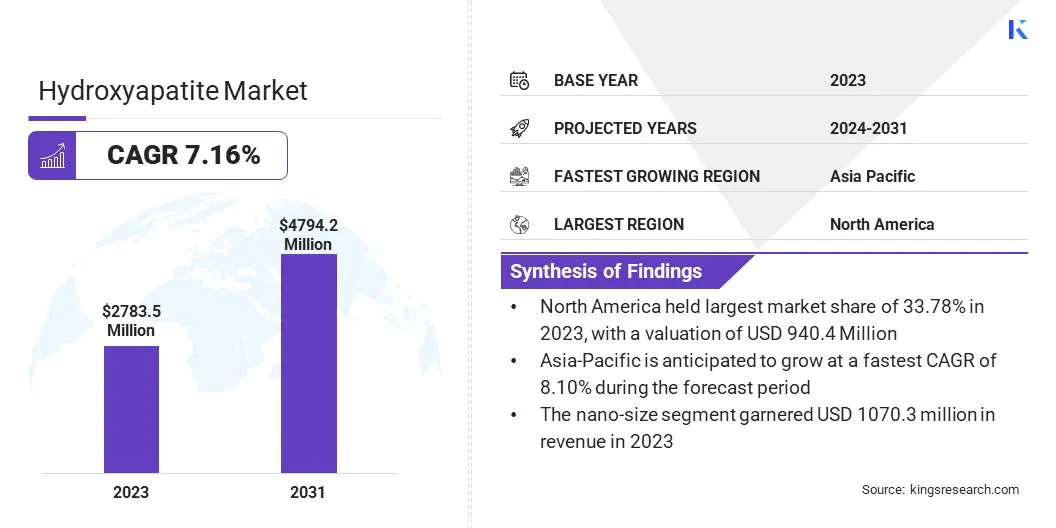

The global hydroxyapatite market size was valued at USD 2783.5 million in 2023, which is estimated to be USD 2953.8 million in 2024 and reach USD 4794.2 million by 2031, growing at a CAGR of 7.16% from 2024 to 2031.

The growing demand for bone grafts, dental implants, and orthopedic devices is driving the market. Its biocompatibility and ability to promote bone healing make it an essential material for these medical applications, boosting the market.

Major companies operating in the hydroxyapatite industry are FLUIDINOVA, S.A., Berkeley Advanced Biomaterials, Taihei Chemical Industrial Co., Ltd., SigmaGraft Biomaterials, CAM Bioceramics, Himed, Merck KGaA, HOYA Technosurgical Corporation, Tomita Pharmaceutical Co.,Ltd., SANGI CO.,LTD., Merz North America, Inc. , APS Materials, Inc., Bio-Rad Laboratories, Inc., CGbio, and Haihang Industry.

The market is expanding rapidly, driven by its versatile applications in healthcare and biotechnology. The material’s biocompatibility and ability to integrate with bone tissue make it a critical component in orthopedic implants, bone grafts, and dental treatments.

As advancements in medical technologies continue, hydroxyapatite is increasingly used in regenerative medicine and tissue engineering. With significant investments in research and development, the market is poised for further innovation, meeting the rising demand for effective bone repair, drug delivery and regeneration solutions.

- In November 2024, researchers from the Thin-film and Nanostructure Electrodeposition Group (GE-CPN) developed an electrochemical method to prepare hydroxyapatite (HAP) micro/nanostructures. These structures are promising for applications in drug delivery, biosensors, and bone regeneration, leveraging HAP’s biocompatibility.

Key Highlights:

- The hydroxyapatite industry size was valued at USD 2783.5 million in 2023.

- The market is projected to grow at a CAGR of 7.16% from 2024 to 2031.

- North America held a market share of 33.78% in 2023, with a valuation of USD 940.4 million.

- The nano-size technology segment garnered USD 1070.3 million in revenue in 2023.

- The dental care segment is expected to reach USD 1520.7 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.10% during the forecast period.

Market Driver

"Aging Population"

The aging population is a significant growth driver of the hydroxyapatite market, as the incidence of bone-related diseases such as osteoporosis increases with age.

- According to the World Health Organizations (WHO), by 2030, 1 in 6 people will be aged 60 or older. By 2050, it will double to 2.1 billion, including 426 million people aged 80+ years.

This demographic shift leads to a higher demand for treatments that promote bone regeneration and healing, including those utilizing hydroxyapatite. Its biocompatibility and ability to mimic natural bone make it a preferred material for bone grafts, implants, and other orthopedic solutions. As the global elderly population grows, hydroxyapatite’s role in addressing bone health continues to expand.

- In June 2023, Biocomposites acquired Artoss GmbH, incorporating its proprietary NanoBone technology into its portfolio. NanoBone combines nanocrystalline hydroxyapatite and silica gel, enhancing bone healing. This acquisition strengthens Biocomposites’ global reach, offering innovative bone regeneration solutions to a broader market.

Market Challenge

"Technical Limitations"

Technical limitations in achieving consistent quality and performance across various production methods for hydroxyapatite can hinder its widespread use. Variations in manufacturing processes may result in differences in particle size, porosity, and bioactivity.

A potential solution is to standardize production methods and implement strict quality control measures throughout the manufacturing process. Research into more efficient, reproducible techniques, such as advanced nanotechnology or 3D printing, could help ensure uniformity and enhance product reliability, meeting the high standards required for medical applications.

Market Trend

"Technological Advancements"

Technological advancements in hydroxyapatite-based materials are driving significant innovation in the market, particularly in medical devices. Ongoing research focuses on improving the material’s properties, such as its bioactivity, mechanical strength, and integration with bone tissue.

New developments, including nanostructured hydroxyapatite and 3D printing techniques, are expanding its use in customized implants, bone grafts, and regenerative medicine. These advancements are enhancing the effectiveness of hydroxyapatite in medical applications, positioning it as a key material in the future of healthcare solutions.

- In February 2024, IIT Kanpur signed an MOU with Conlis Global Inc. to license a new technology promoting bone healing and regeneration. This innovative nano hydroxyapatite-based porous composite scaffold technology offers enhanced bone defect healing, drug delivery, and biocompatibility, promising significant global impact.

Hydroxyapatite Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Nano-size, Micro-size, Greater than Micrometers

|

|

By Application

|

Dental Care, Plastic Surgery, Orthopedics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of AsiaPacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Nano-size, Micro-size, Greater than Micrometers): The nano-size segment earned USD 1070.3 million in 2023, due to its superior biocompatibility and enhanced bone integration properties.

- By Application (Dental Care, Plastic Surgery, Orthopedics, Others): The dental care segment held 31.86% share of the market in 2023, due to the increasing demand for dental implants and restorative treatments.

Hydroxyapatite Market Regional Analysis

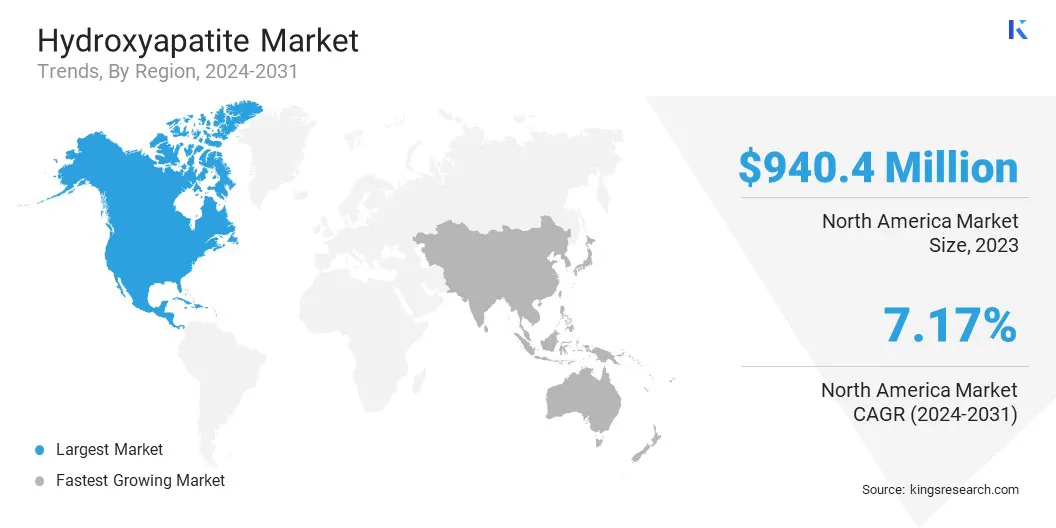

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a share of around 33.78% in 2023 in the global market, with a valuation of USD 940.4 million. North America continues to dominate the hydroxyapatite market, due to its advanced healthcare infrastructure, high adoption rates of medical technologies, and the growing demand for bone regeneration treatments.

The region's well-established medical research and development sector, along with the presence of leading market players, contributes to its strong market position. Additionally, the rising prevalence of bone-related diseases and the increasing use of hydroxyapatite in dental implants and orthopedic surgeries further solidify North America's market leadership, driving its continued growth.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 8.10% over the forecast period. Asia Pacific is the fastest-growing region in the hydroxyapatite industry, fueled by rapid advancements in healthcare, rising disposable incomes, and an expanding elderly population.

Countries like China, India, and Japan are registering increased demand for bone regeneration treatments, dental care, and orthopedic solutions. The region's growing focus on medical tourism, coupled with improving healthcare access and affordability, has led to a surge in the adoption of hydroxyapatite.

Additionally, the rise of local manufacturing capabilities and innovation in the region is expected to drive substantial market growth in the coming years.

- In August 2024, CGBio expanded the use of its hydroxyapatite-based bone substitute, NOVOSIS, in Indonesia. Through collaboration with local medical professionals and academic exchanges, CGBio aims to drive clinical research and broaden its global presence in the market.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) is responsible for protecting public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, medical devices, food supply, cosmetics, and products that emit radiation.

- The letters ‘CE’ appear on many products traded on the extended Single Market in the European Economic Area (EEA). They signify that products sold in the EEA have been assessed to meet high safety, health, and environmental protection requirements.

- Under the Drugs and Cosmetics Act, the Central Drugs Standard Control Organisation (CDSCO) is responsible for approval of new drugs, conduct of clinical trials, laying down the standards for drugs, control over the quality of imported drugs in India and coordination of the activities of state drug control organizations by providing expert advice with a view of bring about the uniformity in the enforcement of the Drugs and Cosmetics Act.

Competitive Landscape:

Partnerships in the hydroxyapatite industry are increasingly common, as companies collaborate to enhance product development, expand market reach, and accelerate innovation.

These alliances often involve joint research, technology licensing, and distribution agreements, enabling firms to leverage each other's expertise and resources. Such collaborations help companies stay competitive, meet regulatory requirements, and introduce advanced hydroxyapatite-based solutions to diverse markets.

- In July 2023, Himed and Lithoz formed a strategic partnership to develop advanced bioceramic feedstocks, combining Himed’s calcium phosphate biomaterials, including hydroxyapatite, with Lithoz’s CeraFab S65 3D printer. This collaboration aims to enhance the production of customizable, osteoconductive implants for the market.

List of Key Companies in Hydroxyapatite Market:

- Merck KGaA

- Cibus Inc.

- Recombinetics

- Sangamo Therapeutics

- Editas Medicine

- Precision BioSciences

- Therapeutics

- Intellia Therapeutics, Inc.

- Caribou Biosciences, Inc.

- Cellectis S.A., and

- Others

Recent Developments (Approval)

- In March 2023, FLUIDINOVA’s nanoXIM CarePaste, a nano-hydroxyapatite product, received an approval from the Scientific Committee on Consumer Safety (SCCS) for oral care products, confirming its safety at specified concentrations. This approval highlights its compliance with EU regulations, ensuring its use in toothpaste and mouthwash formulations.