Market Definition

A hydraulic power unit is a self-contained system designed to generate and supply pressurized hydraulic fluid for powering machinery. It encompasses components such as a pump, reservoir, motor, valves, filters, and cooling systems, converting mechanical energy into hydraulic energy for operating actuators, cylinders, and motors.

These units are widely used across industries such as industrial machinery, construction, marine, aerospace, mining, material handling, and offshore operations for tasks such as lifting, pressing, clamping, and steering.

Hydraulic Power Unit Market Overview

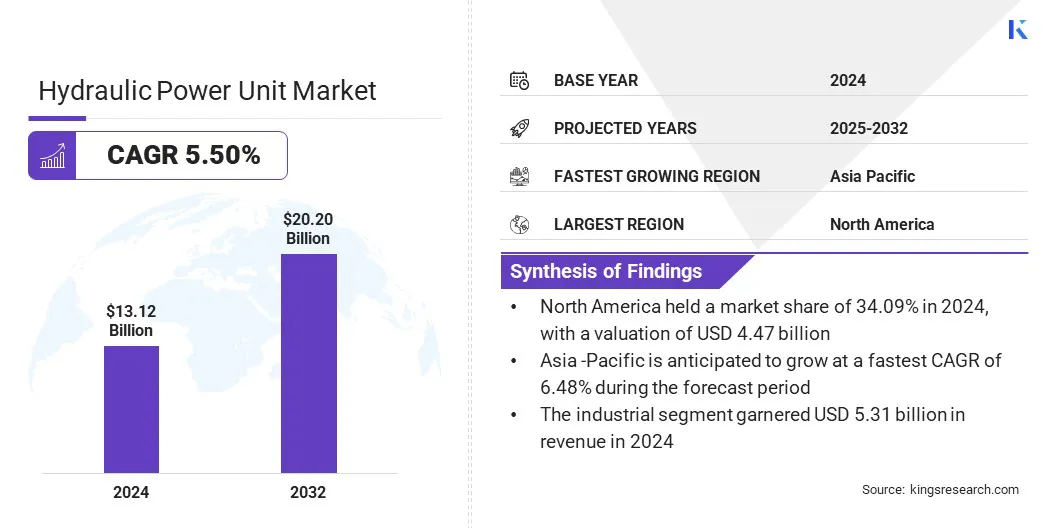

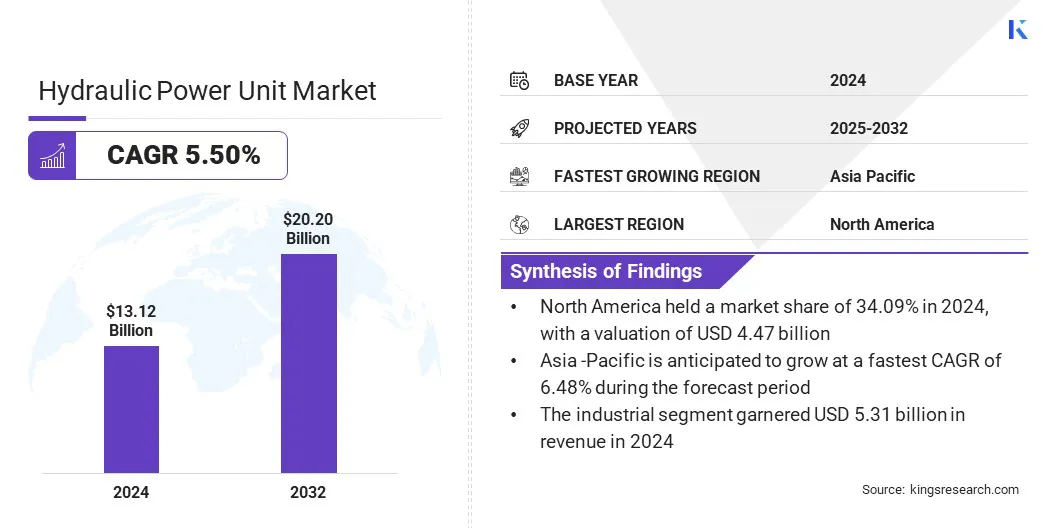

The global hydraulic power unit market size was valued at USD 13.12 billion in 2024 and is projected to grow from USD 13.82 billion in 2025 to USD 20.20 billion by 2032, exhibiting a CAGR of 5.50% during the forecast period.

Market growth is fueled by rising infrastructure investments, creating a strong demand across construction, transportation, and energy sectors. Additionally, the rising use of heavy machinery in mining and material handling is boosting adoption, as these applications require efficient and reliable hydraulic systems to boost productivity.

Key Highlights:

- The hydraulic power unit industry size was recorded at USD 13.12 billion in 2024.

- The market is projected to grow at a CAGR of 5.50% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 4.47 billion.

- The up to 750 PSI segment garnered USD 4.36 billion in revenue in 2024.

- The industrial segment is expected to reach USD 8.09 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.48% over the forecast period.

Major companies operating in the hydraulic power unit market are Eaton, Dana Incorporated, Bosch Rexroth AG, Parker Hannifin Corp, WEBER-HYDRAULIK GMBH, Hydro-Tek, Holstein Hydraulik GmbH, HYDAC International GmbH, Bailey International LLC, Nachi-Fujikoshi Corp., HAWE Hydraulik SE, Related Fluid Power Ltd, HCS Control Systems Ltd, Daikin Industries Ltd, and Bucher Hydraulics GmbH.

Government investments in offshore hydrocarbon exploration are propelling market expansion. These projects increase the need for equipment to power drilling systems, lifting mechanisms, and subsea tools.

Expansion of offshore projects requires reliable, high-pressure hydraulic systems to support both new installations and replacement needs in marine and energy applications. This growing reliance on advanced hydraulic technology is accelerating market growth.

- In July 2024, the Government of India, through the Ministry of Petroleum and Natural Gas, allocated USD 896 million for offshore hydrocarbon exploration to fund seismic data acquisition and stratigraphic well drilling. This initiative is expected to expand exploration capabilities and drive demand for hydraulic power units in offshore drilling and subsea operations.

Market Driver

Rising Investment in Infrastructure Projects

The progress of the hydraulic power unit market is bolstered by rising investments in infrastructure projects aimed at developing and modernizing transportation networks, public facilities, and urban spaces.

Large-scale construction activities require heavy machinery with advanced hydraulic systems to perform lifting, drilling, and material-handling tasks efficiently. This is increasing the demand for hydraulic power units that deliver high pressure, consistent performance, and durability, ensuring reliable operation in intensive construction environments.

- In October 2024, the U.S. Department of Transportation’s Federal Highway Administration allocated USD 62 billion in FY2025 funding under the Bipartisan Infrastructure Law for road, bridge, and tunnel projects across all states. This allocation is expected to drive higher deployment of heavy machinery and increase demand for hydraulic power units in construction.

Market Challenge

High Initial Costs and Maintenance Requirements for Advanced HPUs

A key challenge impeding the expansion of the hydraulic power unit market is the high initial cost and maintenance requirements of advanced systems. These units involve significant upfront investment due to the complexity of components and technology used. Additionally, ongoing maintenance demands skilled technicians to ensure reliability and prevent downtime. These factors deter small and mid-sized companies from adopting advanced HPUs.

To address this challenge, market players are focusing on developing more cost-effective and modular hydraulic power units that simplify servicing and reduce downtime. They are investing in training programs to build skilled maintenance teams and offering comprehensive after-sales support to enhance customer confidence.

Additionally, companies are integrating advanced diagnostics and remote monitoring technologies to enable predictive maintenance, lowering unexpected failures and repair expenses.

Market Trend

Integration of IoT and Remote Monitoring for Predictive Maintenance

A key trend in the hydraulic power unit market is the integration of IoT and remote monitoring for predictive maintenance. Manufacturers are embedding sensors and connected technologies to track real-time parameters such as pressure, temperature, and fluid levels. This enables early facult detection, condition-based maintenance, reduced downtime and lower repair costs, improving reliability and extending equipment life.

- In December 2024, Weber Rescue Systems launched the SMART-COMPACT XL, a hydraulic power unit designed for rescue operations. Equipped with smart technology, an 18V battery, and a new three-stage pump operating three times faster, the unit enables real-time monitoring through a dedicated app and supports multiple power sources, enhancing efficiency and operational flexibility.

Hydraulic Power Unit Market Report Snapshot

|

Segmentation

|

Details

|

|

By Operating Pressure

|

Up to 750 PSI, 750-2000 PSI, 2001-3000 PSI, Above 3000 PSI

|

|

By Application

|

Industrial, Construction, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Operating Pressure (Up to 750 PSI, 750-2000 PSI, 2001-3000 PSI, and Above 3000 PSI): The up to 750 PSI segment earned USD 4.36 billion in 2024, primarily due to its widespread use in low-pressure hydraulic applications across various industries.

- By Application (Industrial, Construction, and Others): The industrial segment held a share of 40.47% in 2024, propelled by the high demand for hydraulic power units in manufacturing and automation processes.

Hydraulic Power Unit Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America

North America hydraulic power unit market share stood at 34.09% in 2024, with a valuation of USD 4.47 billion. This dominance is attributed to strong manufacturing capabilities and advanced product expertise.

Regional players are increasing the production of specialized hydraulic components to serve diverse applications in agriculture, construction, marine operations, including nearshore and offshore activities. Furthermore, the regional market benefits from a robust supply base that supports both standard and custom solutions across industrial sectors.

Moreover, expanding custom engineering capabilities is supporting a broader user base while ensuring consistent quality and performance. Manufacturers are aligning production strategies with the requirements of agriculture, construction, and marine industries, thereby contributing to domestic market expansion.

- In August 2024, Wipro Infrastructure Engineering acquired U.S.-based Columbus Hydraulics to expand its presence in North America and strengthen manufacturing capabilities in hydraulic components. The acquisition expands Wipro's expertise in customized hydraulic solutions across agriculture, construction, turf maintenance, and marine applications.

The Asia-Pacific hydraulic power unit industry is set to grow at a CAGR of 6.48% over the forecast period. This growth is attributed to rising investments and the expansion of manufacturing capabilities. Rising automation, the adoption of energy-efficient systems, and expanding renewable energy projects further support demand for advanced hydraulic power units across the region.

Strong manufacturing expertise and enhanced design capabilities are further addressing demand, particularly in industrial applications such as construction, agriculture, and material handling.

Additionally, manufacturers are improving their capabilities in tailored hydraulic systems and advanced testing equipment, while regional players focus on delivering reliable and efficient hydraulic components to meet growing demand across sectors such as construction, agriculture, and manufacturing. Strengthening infrastructure and expanding local production are fostering regional market growth.

- In August 2024, PMC Hydraulics Group acquired the remaining shares of Hydroquip Hydraulics in Bangalore, India, to expand its presence in the regional market. The acquisition aims to strengthen its design and manufacturing capabilities.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) regulates hydraulic power unit safety by setting standards for equipment design, operation, and maintenance under workplace safety laws. It oversees pressure ratings, guarding of moving parts, fluid handling, and operator training to prevent accidents, leaks, and system failures. OSHA enforces compliance through inspections, citations, and penalties.

- In the UK, the Health and Safety Executive (HSE) regulates hydraulic power units under the Pressure Systems Safety Regulations (PSSR). It oversees system design, installation, inspection intervals, and maintenance protocols. HSE mandates written schemes of examination, safe operating limits, and operator competence, ensuring HPUs operate without risk of explosion, leaks, or equipment failure.

- In China, the State Administration for Market Regulation (SAMR) oversees the market by enforcing product safety, quality certification, and labeling requirements. It regulates manufacturing practices, pressure vessel standards, and conformity with national GB/T specifications. SAMR conducts factory inspections, market surveillance, and product testing to ensure operational safety and quality compliance.

- In India, the Directorate General of Mines Safety (DGMS) regulates hydraulic power units used in mining and heavy industrial operations. It oversees equipment design approval, pressure system safety, periodic testing, and adherence to operational safety protocols under the Mines Act. DGMS ensures that HPUs meet safety norms to prevent mechanical failures and workplace hazards.

Competitive Landscape

Major players in the hydraulic power unit industry are expanding their engineering capabilities through strategic acquisitions. They are enhancing expertise in hydraulic cylinder overhaul, remanufacturing, and repair services to deliver comprehensive solutions. Players are increasing local manufacturing capacity to improve service efficiency and focusing on broadening their product and service portfolios to meet diverse customer needs.

- In May 2024, Hydraquip Hose & Hydraulics acquired Poweram Hydraulics in the UK to expand engineering capabilities and strengthen its market presence. The acquisition enhances Hydraquip’s expertise in hydraulic cylinder overhaul, remanufacturing, and repairs, while increasing service offerings and local manufacturing capacity in the region.

Key Companies in Hydraulic Power Unit Market:

- Eaton

- Dana Incorporated

- Bosch Rexroth AG

- Parker Hannifin Corp

- WEBER-HYDRAULIK GMBH

- Hydro-Tek

- Holstein Hydraulik GmbH

- HYDAC International GmbH

- Bailey International LLC

- Nachi-fujikoshi corp.

- HAWE Hydraulik SE

- Related Fluid Power Ltd

- HCS Control Systems Ltd

- DAIKIN INDUSTRIES, Ltd

- Bucher Hydraulics GmbH

Recent Developments (Product Launch/Expansion)

- In July 2025, Guorui launched a new permanent magnet synchronous hydraulic drive integrated power unit with a compact design that combines a high-efficiency motor, hydraulic pump, oil tank, valves, and control circuits. This unit provides high energy efficiency, uses CAN bus control, and simplified installation.

- In January 2025, Metso introduced the 5th Generation Hydraulic Power Unit for Nordberg MP cone crushers, featuring a modular base design for easier maintenance, enhanced safety, and customization. It is designed to improve standardization, simplify replacement processes, and reduce downtime in mining operations.

- In October 2024, MTS unveiled the hybrid SilentFlo 525 Hydraulic Power Unit at the Automotive Testing Expo North America in Michigan. The unit is designed to conserve energy, reduce carbon emissions, extend equipment lifecycles, and improve test lab productivity.