Homomorphic Encryption Market Size

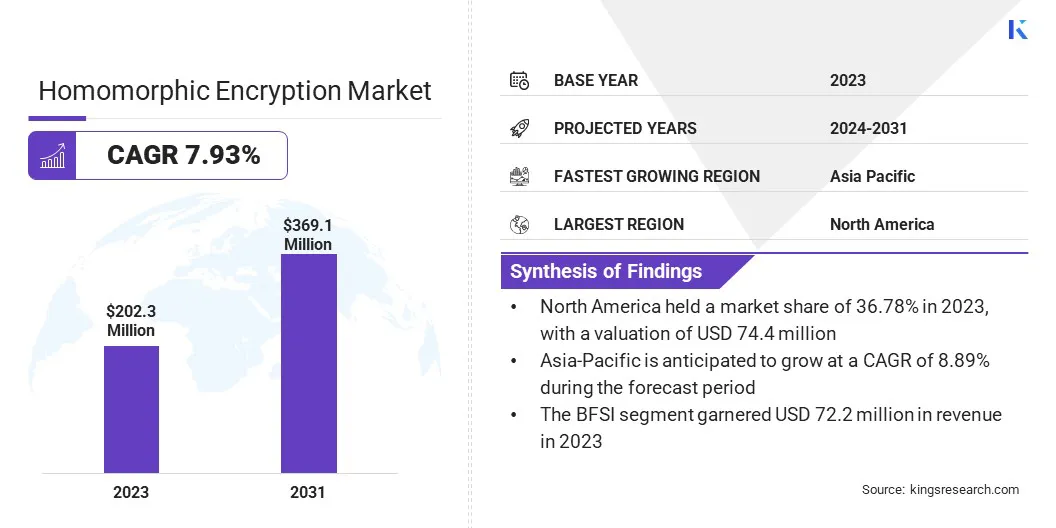

The global Homomorphic Encryption Market size was valued at USD 202.3 million in 2023 and is projected to grow from USD 216.3 million in 2024 to USD 369.1 million by 2031, exhibiting a CAGR of 7.93% during the forecast period. Growing threat regarding cybersecurity and data breaches is generating the demand for encryption, and rising interest in secure data sharing in healthcare and financial services are escalating the market.

In the scope of work, the report includes services offered by companies such as IBM Corporation, Microsoft, Optalysys Ltd, Enveil, Zama, Oracle, Intel Corporation, Inpher, Duality, CryptoExperts, and others.

The expansion of encrypted data processing in AI and machine learning presents a significant opportunity for the market. Since there is an increasing need for secure data handling, homomorphic encryption allows processing of encrypted data without exposing it to unauthorized entities.

This feature is highly valued in AI and machine learning, where large datasets containing sensitive information are analyzed. By applying encryptions, companies can maintain data privacy while still leveraging the full potential of AI algorithms. IBM and Microsoft have been working on implementing homomorphic encryption in their cloud platforms to enable secure AI and machine learning services. This opens up new possibilities for collaborative data analysis and privacy-preserving machine learning models.

As organizations adopt AI-driven solutions, integrating encrypted data processing will enhance security and address growing concerns over regulatory compliance with data protection laws. This can be seen as a potential market opportunity, where businesses investing in advanced encryption technologies can improve trust and reliability in AI applications, opening new avenues for growth in AI-integrated solutions.

Homomorphic encryption is a form of cryptography that allows computations to be performed on encrypted data without needing to decrypt it first. This means sensitive data can be processed without loosing confidentiality, ensuring that it is never exposed in plain text during analysis or manipulation.

There are several types of homomorphic encryptions, including PHE, which supports limited types of operations like addition or multiplication on ciphertexts, and FHE, which allows arbitrary computations on encrypted data, enabling more complex processing.

Another variant is SHE, which offers a middle ground, allowing a limited number of operations before requiring decryption. Deployment of homomorphic encryption is typically seen in cloud computing, where data owners can outsource data processing to cloud servers without revealing the content of their data.

Applications of this technology are wide-ranging and include secure data sharing in healthcare, financial services, and government sectors. It can be especially beneficial for protecting sensitive datasets during machine learning model training, enabling privacy-preserving AI solutions.

Analyst’s Review

Key players in the homomorphic encryption market are actively focusing on advancing their technological capabilities and expanding their solution portfolios to maintain a competitive edge. Their major strategies are heavy investment in research and development to improve the efficiency and scalability of FHE, as current solutions often issues related to computational overhead.

Companies are also forging strategic partnerships with cloud service providers and AI-focused enterprises to integrate encryption into larger frameworks, capitalizing on the growing demand for secure cloud services and encrypted data processing. Furthermore, many companies are concentrating on targeting highly regulated industries like healthcare, finance, and government, where data privacy is a critical concern and encryption solutions are in high demand.

- In 2023, according to Director of National Intelligence, ransomware attacks targeting the healthcare sector witnessed a significant rise, nearly doubling since 2022. In 2023, the sector reported 389 victims worldwide, compared to 214 in the previous year. In the U.S. alone, the increase was more pronounced, with a 128% surge in attacks, impacting 258 victims in 2023, up from 113 in 2022.

The current growth is strongly influenced by increasing cybersecurity threats and evolving data protection regulations, which are driving organizations to seek more robust encryption methods. Key focus areas for market players are enhancing performance, reducing costs, and ensuring compatibility with existing infrastructure, to determine long-term success in a market.

Homomorphic Encryption Market Growth Factors

The growing threats of cyberattacks and data breaches is significantly driving the homomorphic encryption market. Cybercriminals are becoming increasingly sophisticated, targeting organizations across various sectors to steal sensitive data, including financial information, intellectual property, and personal records. These threats have led businesses to prioritize data protection, especially in cloud environments, where vast amount of sensitive information is stored and processed.

- For instance, in May 2024, the Information Commissioner’s Office (ICO) announced that there were over 3,000 cyber breaches, with the finance sector accounting for 22%, retail for 18%, and education for 11% of the incidents.

Homomorphic encryption proves essential in this context because it allows organizations to analyze and process encrypted data without ever exposing it to potential cyber threats. By keeping data encrypted during its entire lifecycle, companies can reduce the risk of breaches and ensure compliance with data privacy laws.

Rising awareness regarding the consequences of data breaches, both financial and reputational, is further encouraging healthcare and banking, and government entities to invest heavily in advanced encryption technologies. This trend will continue to gain momentum as businesses recognize that robust encryption measures are critical for safeguarding data in-line with the rapidly evolving cybersecurity landscape.

The complexity of implementing encryption across diverse platforms and systems remains a significant challenge in the market. Homomorphic encryption requires substantial computational power, which can slow down data processing, making it less practical for real-time applications.

Also, ensuring compatibility among different systems and platforms is challenging, especially as organizations use a variety of technologies and infrastructures. Many systems are not optimized for homomorphic encryption, which can cause integration issues and potential performance bottlenecks.

Addressing this complexity requires the development of more efficient algorithms and improvement of hardware capabilities to support the computational needs of encryption. Companies will also need to prioritize cross-platform compatibility when designing encryption solutions to ensure seamless integration with the existing infrastructure.

Collaboration between technology providers and stakeholders can mitigate this challenge by aiming research and innovation at reducing the computational load and simplifying the integration process. These measures may help ensure homomorphic encryption is widely implemented to enable secure data processing without compromising performance.

Homomorphic Encryption Market Trends

The homomorphic encryption market is witnessing significant growth due to rising data privacy concerns, increased adoption of cloud computing, and advancements in AI and machine learning.

There is a rising interest in secure data sharing within the healthcare and financial services industries, driven by the need to protect sensitive information and comply with regulatory requirements. In healthcare, patient data must be handled with utmost care to maintain confidentiality in concert with data protection laws, such as HIPAA.

Homomorphic encryption offers a promising solution by enabling secure data sharing between healthcare providers, researchers, and insurers, keeping patient information encrypted. Similarly, the financial sector is heavily reliant on data sharing for activities like fraud detection, credit scoring, and regulatory reporting.

It allows financial institutions to analyze encrypted data without exposing it to potential security risks, safeguarding customer information during transactions and assessments. Moreover, companies worldwide continue to digitize their operations, driving the demand for secure data sharing solutions. This trend is shaping the future of encrypted data processing, where homomorphic encryption will play a pivotal role in enabling secure, compliant, and efficient data exchange across industries.

Segmentation Analysis

The global market has been segmented on the basis of type, application, end user, and geography.

By Encryption Type

Based on encryption type, the market has been segmented into FHE, PHE, and SHE. The SHE segment captured the largest homomorphic encryption market share of 44.22% in 2023, largely due to its balance between functionality and efficiency.

Unlike FHE, which allows unlimited mathematical operations on encrypted data but incurs significant computational overhead, SHE supports a limited number of operations, making it more practical for real-world applications where performance is a key concern.

Organizations across industries are adopting SHE because it provides a more scalable and cost-effective solution for securely processing sensitive data without the heavy resource demands of more complex encryption methods. This makes SHE ideal for sectors like finance, healthcare, and retail that require basic data processing and where some operations can be performed securely without the need for complete homomorphic encryption.

By Deployment

Based on deployment, the market has been classified into on-premise and cloud-based. The cloud-based segment is expected to register a staggering CAGR of 8.68% over the forecast period, due to the growing adoption of cloud services across industries and the increasing need for secure data processing in cloud environments.

As businesses migrate more of their operations to the cloud to take advantage of scalability, flexibility, and cost-efficiency, ensuring the security of sensitive data in these environments has become a top priority. The encryption plays a critical role in addressing this by allowing data to be processed in the cloud while remaining encrypted, ensuring that it is protected from unauthorized access during analysis or computation.

Cloud service providers are increasingly integrating encryptions into their platforms to offer clients enhanced data privacy and compliance with regulatory standards. Moreover, the rise of cloud-based AI and machine learning applications, which require processing large volumes of sensitive data, will further accelerate the demand for cloud-based encryption solutions. The segment’s strong growth outlook reflects the broader trend of secure data management in cloud computing.

By Application

Based on application, the homomorphic encryption market has been divided into healthcare, BFSI, government and defense, cloud computing, and others. The BFSI segment accounted for the highest revenue of USD 72.2 million in 2023, driven by the increasing need for advanced data protection and encryption solutions to safeguard sensitive financial information. BSFI handles vast amounts of personal and transactional data, which makes it a prime target for cyberattacks and data breaches.

- In April 2024, the International Monetary Fund (IMF) reported that the financial sector has endured over 20,000 cyberattacks in the past 20 years, resulting in losses exceeding USD 12 billion.

To mitigate these risks, BFSI organizations are investing heavily in homomorphic encryption, which allows them to perform data analytics, fraud detection, and risk assessments while keeping customer information encrypted and secure.

The rise of digital banking, mobile payments, and fintech solutions has further generated the demand for robust encryption technologies within BFSI, as companies look to protect growing volumes of transactional data and comply with stringent regulatory frameworks, such as GDPR and PCI-DSS. The shift toward cloud-based banking platforms has also spurred the adoption of encryption solutions that can secure data in transit and at rest, propelling the sector’s revenue growth in the market.

Homomorphic Encryption Market Regional Analysis

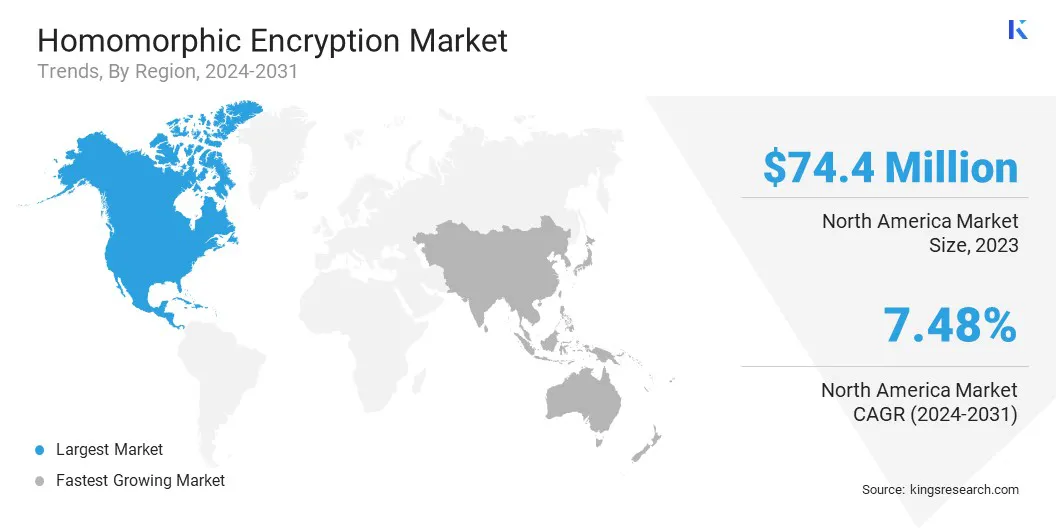

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America homomorphic encryption market share stood at 36.78% in 2023, in the global market and was valued at USD 74.4 million, which made it the largest regional market. This dominance is driven by the region's advanced technological infrastructure, early adoption of encryption technologies, and a strong focus on data privacy. The presence of major cloud service providers, cybersecurity firms, and financial institutions in the U.S. and Canada has significantly contributed to the region’s growth.

Regulatory frameworks, such as HIPAA and CCPA, along with strict compliance requirements for data protection, are compelling organizations across healthcare, finance, and government sectors to adopt homomorphic encryption to safeguard sensitive information. Additionally, North American companies are investing heavily in research and development to advance encryption technologies, further boosting the market's growth.

Asia-Pacific is expected to grow at the highest CAGR of 8.89% over the forecast period due to rapid digitalization and increasing investments in data security across emerging economies. Countries like China, India, Japan, and South Korea are witnessing a surge in cloud computing, AI, and fintech, creating the need for robust encryption solutions. Governments worldwide are also implementing stricter data protection regulations, such as China’s Cybersecurity Law and India’s Personal Data Protection Bill, prompting businesses to adopt homomorphic encryption to ensure compliance.

Furthermore, the growing use of connected devices and IoT technologies has led to an explosion of sensitive data that requires secure processing, further propelling market growth. The region’s expanding healthcare and financial sectors are expected to be key drivers, as these industries increasingly rely on encryption for secure data sharing and processing.

Competitive Landscape

The global homomorphic encryption market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategies, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Homomorphic Encryption Market

- IBM Corporation

- Microsoft

- Optalysys Ltd

- Enveil

- Zama

- Oracle

- Intel Corporation

- Inpher

- Duality

- CryptoExperts

Key Industry Development

- May 2024 (Launch): Vaultree unveiled a next-generation FHE algorithm setting a new benchmark for data privacy. This would enhance encryption without sacrificing performance or scalability, addressing the critical challenge of protecting data during usage and processing a vulnerability in traditional encryption methods.

The global homomorphic encryption market has been segmented:

By Encryption Type

By Deployment

By Application

- Healthcare

- BFSI

- Government and Defense

- Cloud Computing

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America