Market Definition

The HLA typing transplant process involves analyzing human leukocyte antigens to match donors and recipients. It includes instruments, reagents, software, and services that enable accurate and efficient typing.

This process supports diagnostics, research, and clinical transplant procedures, ensuring compatibility and reducing rejection risks. It is applied in solid organ, soft-tissue, and stem cell transplantation and is utilized by hospitals, diagnostic laboratories, research institutes, and biopharmaceutical companies.

HLA Typing Transplant Market Overview

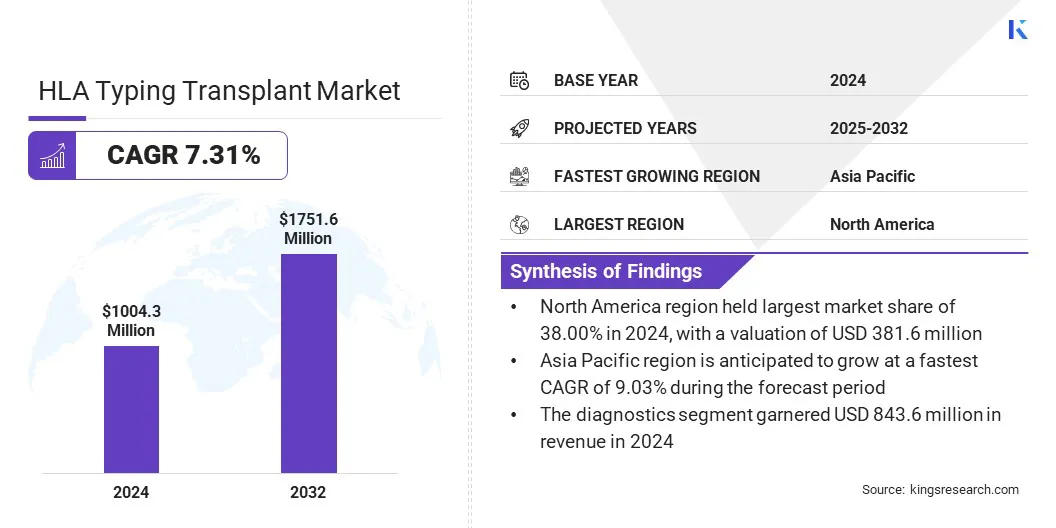

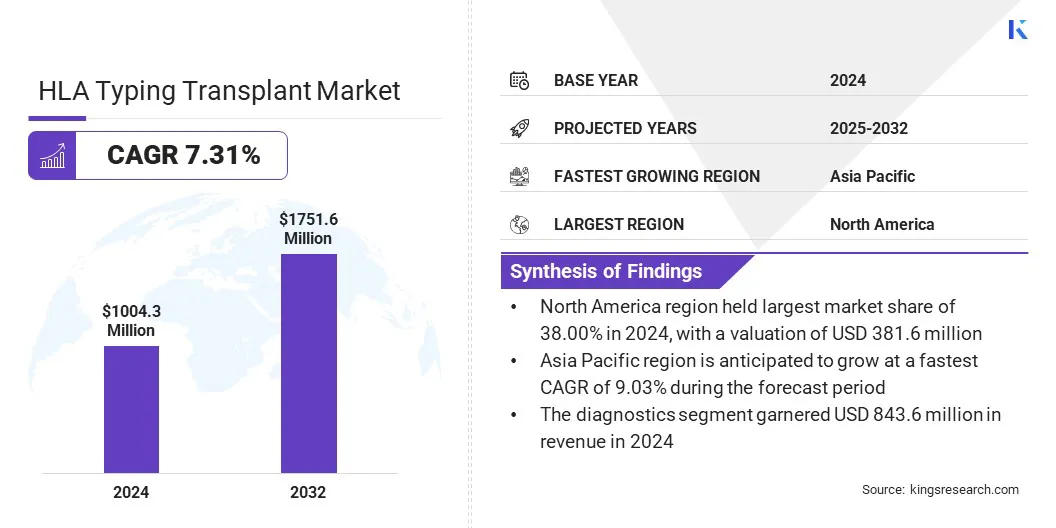

The global HLA typing transplant market size was valued at USD 1,004.3 million in 2024 and is projected to grow from USD 1,068.7 million in 2025 to USD 1,751.6 million by 2032, exhibiting a CAGR of 7.31% during the forecast period.

This growth is driven by the rising global demand for transplantations, which creates a need for precise donor-recipient matching. Advancements in next-generation sequencing (NGS) improve accuracy and enable faster, more comprehensive analysis of HLA genes, enhancing the effectiveness of transplantation procedures.

Key Market Highlights:

- The HLA typing transplant industry size was recorded at USD 1,004.3 million in 2024.

- The market is projected to grow at a CAGR of 7.31% from 2025 to 2032.

- North America held a share of 38.00% in 2024, valued at USD 381.6 million.

- The reagents & consumables segment garnered USD 582.5 million in revenue in 2024.

- The molecular assay technologies segment is expected to reach USD 1,538.1 million by 2032.

- The diagnostics segment is estimated to generate a revenue of USD 1,496.8 million by 2032.

- The solid organ transplantation segment is likely to reach USD 1,055.3 million by 2032.

- The hospitals & transplant centers segment garnered USD 492.1 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 9.03% over the forecast period.

Major companies operating in the HLA typing transplant market are Thermo Fisher Scientific Inc., Illumina, Inc., Werfen, CareDx, Inc., Bio-Rad Laboratories, Inc., GenDx, Diasorin S.p.A., Biofortuna Limited, Becton, Dickinson and Company, H.U. Group company, Hologic, Inc., HistoGenetics LLC, Creative Biolabs, BAG Diagnostics GmbH, inno-train Diagnostik GmbH, and Takara Bio Inc.

Market growth is propelled by the increasing demand for faster turnaround times and high-resolution HLA typing results. Rapid processing of samples allows hospitals and transplant centers to make timely clinical decisions, reducing the risk of transplant rejection.

High-resolution typing provides detailed genetic information, improving compatibility assessment between donors and recipients. These capabilities enhance the efficiency and reliability of transplantation procedures, supporting broader adoption of advanced HLA typing technologies.

Market Driver

Rising Global Demand for Transplantations

The expansion of the market is fueled by the growing global demand for transplantations. Growth in organ, stem cell, and soft-tissue transplants is creating a strong demand for accurate HLA typing to ensure donor-recipient compatibility.

Precise HLA matching reduces the risk of transplant rejection and improves patient outcomes, making advanced typing technologies essential in clinical settings. Rising demand for reliable and efficient donor-recipient matching continues to support the widespread adoption of HLA typing solutions.

- In 2024, the U.S. Department of Health & Human Services, through the Health Resources & Services Administration, reported that 103,223 individuals ere on the national transplant waiting list, with over 48,000 transplants performed during the year.

Market Challenge

High Cost of HLA Typing Tests

A major challenge hindering the expansion of the HLA typing transplant market is the high cost of testing, including next-generation sequencing instruments, reagents, and associated software. Elevated expenses limit accessibility for smaller hospitals and research centers, limiting broader adoption.

To address this challenge, companies are developing cost-efficient kits and optimized workflows that reduce operational costs without compromising accuracy. Laboratories are also implementing automation and scalable platforms to maintain precision while lowering overall testing expenses.

Market Trend

Advancements in Next-Generation Sequencing (NGS) Assays

The market is experiencing a major trend toward the adoption of advanced technologies, particularly high-precision next-generation sequencing (NGS) assays. These assays provide highly accurate and comprehensive HLA typing, minimizing transplant rejection risks and improving patient outcomes.

The technology supports faster sample processing and simultaneous evaluation of multiple genetic markers, increasing efficiency in both clinical and research environments. These advancements are expected to continue transforming HLA typing transplant practices by enhancing diagnostic precision and supporting improved transplant outcomes globally.

- In June 2025, Devyser launched Devyser HLA Loss, a next-generation sequencing (NGS) assay designed to detect HLA loss in post-transplantation research. The assay provides high sensitivity and speed, enabling precise detection of immune escape in hematopoietic stem cell transplantation (HSCT) studies. It complements existing chimerism assays and supports laboratories in understanding post-transplant immune dynamics.

HLA Typing Transplant Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product & Service

|

Reagents & Consumables (PCR Reagents, Sequencing Kits, Flow Cytometry Reagents, Others), Instruments (Sequencing Instruments (NGS Platforms), PCR Systems, Others), Software & Services

|

|

By Technology

|

Molecular Assay Technologies (PCR-based Molecular Typing, Sequencing-based Typing (SBT), Others), Non-Molecular Assay Technologies

|

|

By Application

|

Diagnostics, Research

|

|

By Transplant Type

|

Solid Organ Transplantation, Soft-Tissue Transplantation, Stem Cell Transplantation

|

|

By End User

|

Hospitals & Transplant Centers, Diagnostic Laboratories, Academic & Research Institutes, Biopharmaceutical Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product & Service (Reagents & Consumables, Instruments, and Software & Services): The reagents & consumables segment earned USD 582.5 million in 2024, mainly due to high demand for PCR reagents and sequencing kits in clinical and research applications.

- By Technology (Molecular Assay Technologies and Non-Molecular Assay Technologies): The molecular assay technologies segment held a share of 82.00% in 2024, fueled by their higher accuracy and faster turnaround in HLA typing.

- By Application (Diagnostics and Research): The diagnostics segment is projected to reach USD 1,496.8 million by 2032, owing to increasing transplant procedures and demand for precise donor-recipient matching.

- By Transplant Type (Solid Organ Transplantation, Soft-Tissue Transplantation, and Stem Cell Transplantation): The solid organ transplantation segment is projected to reach USD 1,055.3 million by 2032, propelled by rising organ transplant volumes globally.

- By End User (Hospitals & Transplant Centers, Diagnostic Laboratories, Academic & Research Institutes, and Biopharmaceutical Companies): The hospitals & transplant centers segment accounted for a share of 49.00% in 2024, attributed to their major role in performing transplant procedures and conducting HLA compatibility testing.

HLA Typing Transplant Market Regional Analysis

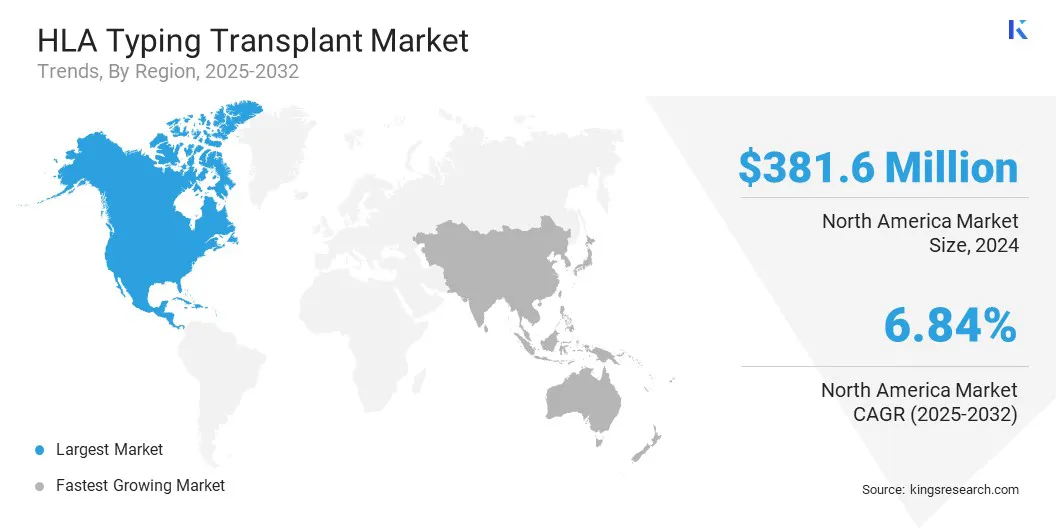

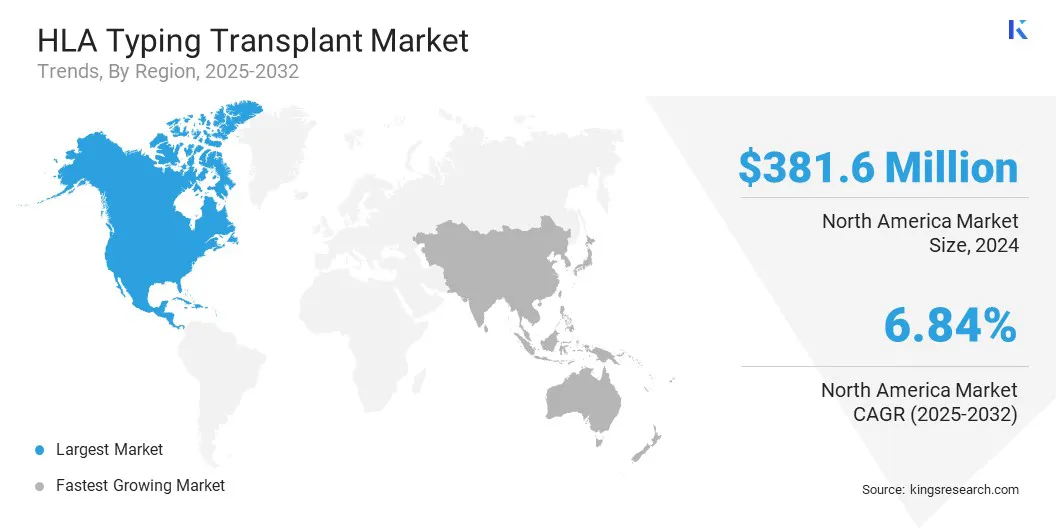

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America HLA typing transplant market share stood at 38.00% in 2024, valued at USD 381.6 million. This dominance is reinforced by its established healthcare infrastructure, which ensures wide access to advanced diagnostic facilities.

Streamlined FDA approvals support the rapid adoption of next-generation sequencing and molecular assay technologies for HLA typing. High investment in clinical research and advanced transplant centers reinforced the region's market dominance.

- In August 2024, Thermo Fisher Scientific announced that its SeCore CDx HLA A Sequencing System received 510(k) clearance from the U.S. Food and Drug Administration (FDA). The system is approved for use as a companion diagnostic with TECELRA (afamitresgene autoleucel), a T-cell receptor (TCR) therapy for adults with unresectable or metastatic synovial sarcoma.

The Asia-Pacific HLA typing transplant industry is poised to grow at a CAGR of 9.03% over the forecast period. This growth is fostered by the increasing number of transplant procedures and rising demand for precise donor-recipient matching.

Expanding molecular diagnostic capabilities and investments in modern hospital infrastructure accelerate the adoption of HLA typing technologies. Additionally, growing awareness of transplantation benefits and improved healthcare access contribute to regional market expansion.

Regulatory Frameworks

- In the U.S, HLA typing for transplantation is regulated by the Food and Drug Administration (FDA) under the in vitro diagnostic (IVD) device framework, requiring premarket approval or clearance for reagents, instruments, and software used in clinical testing.

- In Europe, the In Vitro Diagnostic Regulation (IVDR 2017/746) governs HLA typing kits and instruments, ensuring compliance with safety, performance, and quality standards.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees HLA typing products, requiring clinical validation and registration before use in transplantation.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates HLA typing kits and instruments under IVD guidelines to ensure accuracy and patient safety.

Competitive Landscape

Key players operating in the global HLA typing transplant market are expanding their next-generation sequencing (NGS) portfolios to include HLA typing applications. Companies are developing advanced reagents, instruments, and software solutions to improve accuracy and efficiency in clinical and research settings.

They are forming strategic collaborations and partnerships to enhance technological capabilities and increase market presence. Additionally, there is a growing focus on regional expansion to strengthen distribution networks and consolidate expertise across molecular and non-molecular assay technologies.

- In July 2025, QIAGEN launched QIAseq xHYB Long Read Panels, a set of target enrichment solutions for long-read sequencing of complex genomic regions. Compatible with NGS platforms, including PacBio, the panels facilitate HLA typing, repeat expansion analysis, and structural variant detection.

Top Companies in HLA Typing Transplant Market:

- Thermo Fisher Scientific Inc.

- Illumina, Inc.

- Werfen

- CareDx, Inc.

- Bio-Rad Laboratories, Inc.

- GenDx

- Diasorin S.p.A.

- Biofortuna Limited

- Becton, Dickinson and Company

- H.U. Group company

- Hologic, Inc.

- HistoGenetics LLC

- Creative Biolabs

- BAG Diagnostics GmbH

- inno-train Diagnostik GmbH

- Takara Bio Inc.

Recent Developments (M&A/ Product Launches)

- In October 2024, CareDx presented advancements in HLA typing at ASHI, highlighting improved AlloSeq Tx coverage and reduced ambiguities. Enhancements to QTYPE enable rapid deceased donor typing with single antigen resolution. Novel HLA haplotyping approaches, including long-distance phasing of short NGS reads, support high-resolution genotyping for transplantation.

- In October 2024, Werfen acquired Omixon, a Hungary-based company specializing in next-generation sequencing (NGS) technologies for transplant diagnostics. The acquisition expands Werfen’s portfolio of transplant diagnostic solutions for hospitals and clinical laboratories.