Hempcrete Market Size

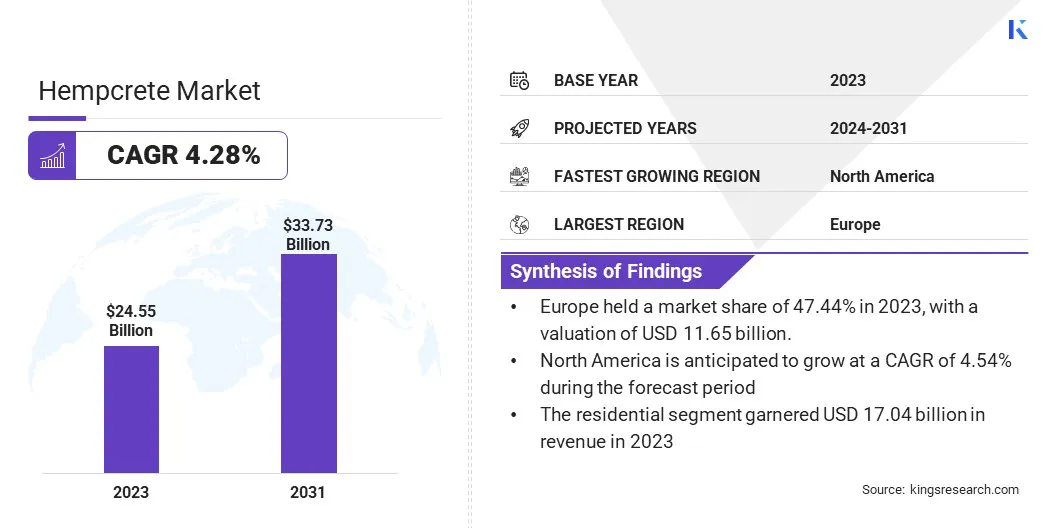

The global Hempcrete Market size was valued at USD 24.55 billion in 2023 and is projected to grow from USD 25.16 billion in 2024 to USD 33.73 billion by 2031, exhibiting a CAGR of 4.28% during the forecast period. The market is expanding as builders and developers seek sustainable alternatives to traditional construction materials.

Growing awareness of hempcrete's environmental benefits, including its ability to reduce carbon emissions and improve indoor air quality, is driving its adoption. Additionally, the material's durability and insulating properties make it an ideal material for green construction projects worldwide.

In the scope of work, the report includes solutions offered by companies such as IsoHemp, American Lime Technology, Hemp Eco Systems Group, HempFlax Group B.V., Hemp Building Company, Just BioFiber, UK Hempcrete, Americhanvre., Hempitecture Inc., The Australian Hemp Masonry Company, and others.

The hempcrete market is experiencing significant growth due to the rising demand for sustainable and eco-friendly building materials.

- According to the World Economic Forum, the building segment is responsible for 37% of the total greenhouse gas emissions. Therefore, governments worldwide are encouraging the adoption of green building solutions. The World Economic Forum further states that the global green transition of the building segment can unlock opportunities worth USD 1.8 trillion.

Therefore, as global construction practices shift toward reducing carbon emissions and improving energy efficiency, bio-based materials like hempcrete are expected to gain adoption due to its excellent thermal insulation and carbon absorption properties.

- In March 2024, The Australian Hemp Masonry Company reported to have tripled its supply of hempcrete in the past decade, from 40 homes per year to 120 homes per year, underscoring the increasing demand.

Government regulations promoting green building certifications and energy-efficient standards are further driving its adoption in both new constructions and renovation projects. Hempcrete is a bio-composite material made from the inner woody core of the hemp plant mixed with a lime-based binder. It is lightweight, durable, and offers excellent thermal and acoustic insulation, making it an eco-friendly alternative to traditional building materials like concrete.

Hempcrete is carbon-negative, meaning it absorbs more CO2 during its growth and curing processes than it emits during production. It is fire-resistant, pest-resistant, and highly breathable, which prevents moisture buildup and mold growth. Hempcrete's sustainable, renewable nature and minimum environmental impact make it an attractive option for green building projects.

Analyst’s Review

Key players are using substantial funding and research to drive hempcrete market growth. They are investing in extensive research and development to refine the material’s performance, and enhance its fire resistance, insulation capabilities, and overall durability. Additionally, companies are expanding their partnerships with research institutions to conduct comprehensive field studies and performance monitoring.

- For instance, Americhanvre Cast Hemp, supported by a USD 1.9 million grant from the U.S. Army, is advancing R&D on hempcrete’s fire resistance, insulation, and carbon footprint. Collaborating with research centers like Penn State University, these efforts are focused on enhancing the material performance and sustainability.

Such initiatives improve hempcrete’s market viability and also drive innovation and adoption in the market.

Hempcrete Market Growth Factors

The emphasis on eco-friendly construction practices is driving the market for hempcrete by increasing its adoption as a sustainable building material. As more construction projects prioritize reducing carbon footprints and adhering to green building standards, the demand for hempcrete gaining pace due to its carbon-negative properties and excellent insulation capabilities.

This trend fuels market expansion as builders and developers seek to align with environmental regulations and sustainability goals, leading to increased production, innovation, and use of hempcrete in both new constructions and renovations projects.

The hempcrete market is expected to face challenges due to the lack of standardized regulations and building codes and the higher initial costs compared to traditional materials. To address these hurdles, key players are collaborating with regulatory bodies and organizations to establish standardized codes and certifications.

Companies are also working on scaling production and refining manufacturing processes to lower costs. Additionally, partnerships with research institutions are being leveraged to highlight hempcrete’s long-term benefits in sustainability and energy efficiency, helping to mitigate the concerns around higher initial expenses.

Hempcrete Market Trends

The regulations and certifications promoting green building practices and energy efficiency is significantly driving the adoption of hempcrete in construction projects. Governments and environmental bodies are implementing stricter policies to reduce carbon emissions and promote sustainable materials.

- In December 2022, Hempitecture announced the opening of its 33,000-sq.-ft. manufacturing facility in Jerome, Idaho, set to produce a variety of non-woven hemp products, including HempWool Thermal insulation. This product serves as a sustainable alternative to traditional mineral wool and fiberglass batts, offering thicknesses from 2 in. to 7-1/2 in., tailored for common framing dimensions.

Certifications like LEED (Leadership in Energy and Environmental Design) reward builders for using eco-friendly materials such as hempcrete, which boasts excellent thermal insulation and a low carbon footprint. These incentives encourage developers to adopt hempcrete in both residential and commercial projects, boosting market demand.

The renovation market is witnessing a growing trend of sustainable materials like hempcrete, particularly for retrofitting existing buildings to improve energy efficiency and reduce environmental impact. As older buildings contribute significantly to carbon emissions and energy waste, the need for eco-friendly solutions is becoming more critical.

Hempcrete is emerging as a preferred material for upgrading thermal performance and durability in various end uses. By enhancing energy efficiency and supporting sustainable construction, hempcrete is driving the renovation industry forward, aligning with the increasing global demand for green building practices.

Segmentation Analysis

The global market has been segmented based on application, type, end use, and geography.

By Application

Based on application, the hempcrete market has been categorized into residential and commercial segments. The residential segment garnered the highest revenue of USD 17.04 billion in 2023. Hempcrete's excellent thermal insulation, breathability, and eco-friendly properties make it an attractive option for both new construction and renovation projects.

Homeowners and builders are choosing hempcrete to align with green building standards, reduce energy consumption, and enhance indoor air quality. Government incentives and green building certifications further drive adoption, making hempcrete a more accessible and appealing choice.

Additionally, advancements in hempcrete technology and expanded supply chains are improving availability and cost-effectiveness. As environmental awareness continues to grow, the demand for hempcrete in residential construction is expected to increase, which is expected to support this segment's growth over the forecast period.

By Type

Based on type, the market has been categorized into precast, cast-in-place, and hybrid. The precast segment captured the largest hempcrete market share of 53.71% in 2023. Precast hempcrete elements, such as panels and blocks, offer significant advantages in terms of speed, quality control, and construction waste.

These benefits make precast hempcrete an attractive option for large-scale and modular construction projects, as well as for applications in commercial and residential buildings. The segment’s growth is driven by advancements in manufacturing technologies that enhance the precision and performance of precast hempcrete components.

Additionally, the push for sustainable building practices and green certifications is fueling the demand for precast solutions that align with environmental goals. Increased adoption in high-performance and eco-friendly building projects is further supporting the expansion of the precast segment.

By End Use

Based on end-use, the market has been categorized into new construction and renovation and retrofitting segments. The new construction segment is expected to garner the highest revenue of USD 20.32 billion by 2031. Hempcrete’s excellent thermal insulation, breathability, and carbon-negative properties, are driving its adoption in the construction of new residential and commercial buildings.

The segment’s growth is bolstered by rising consumer awareness regarding the environmental impact, stringent green building regulations, and incentives for eco-friendly construction practices. Advancements in hempcrete technology and production processes are making it more accessible and cost-effective for new construction projects.

As a result, more architects and builders are integrating hempcrete into their designs to meet sustainability goals and improve energy efficiency. This trend is expected to continue, further propelling the growth of the new construction segment within the market.

Hempcrete Market Regional Analysis

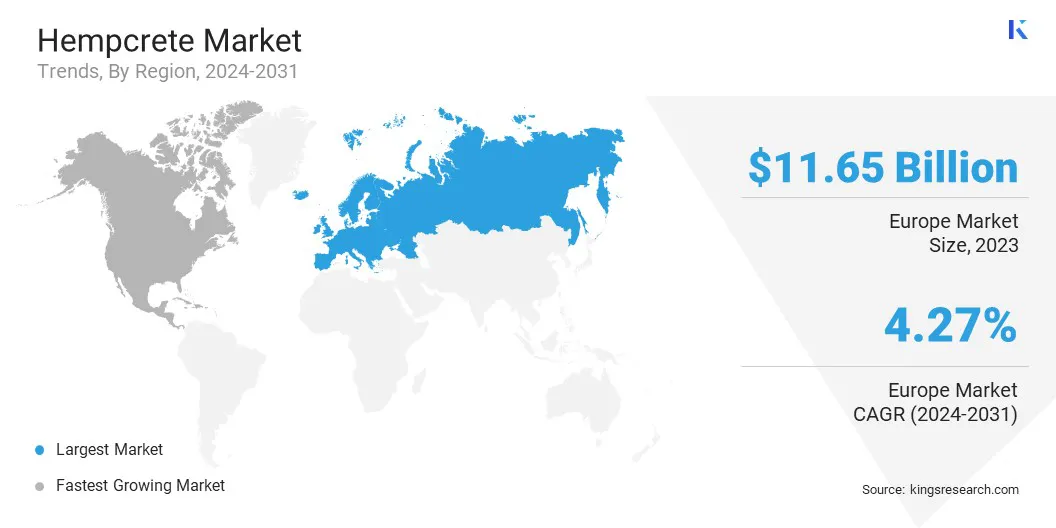

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe hempcrete market share stood around 47.44% in 2023 in the global market, with a valuation of USD 11.65 billion due to the increasing regulatory support for sustainable construction materials and the region's commitment to reducing carbon emissions. European countries, particularly France, the UK, and Germany, are at the forefront of adopting eco-friendly building materials like hempcrete due to their focus on green building practices and strict energy efficiency standards.

The demand for hempcrete in residential and commercial construction is further supported by government initiatives promoting carbon-neutral buildings. Additionally, Europe’s well-established industrial hemp cultivation provides a stable supply of raw materials for hempcrete production. Growing awareness about the environmental benefits of hempcrete, coupled with the increasing focus on sustainability across the construction industry, is significantly boosting market growth in this region.

North America is anticipated to witness the fastest growth at a CAGR of 4.54% over the forecast period due to rising interest in sustainable building materials and government initiatives promoting eco-friendly construction. The U.S. and Canada are key markets characterized by growing awareness of hempcrete’s environmental benefits, such as carbon sequestration and energy efficiency.

Regulatory support for industrial hemp cultivation, following the U.S. Farm Bill, has increased raw material availability, accelerating the adoption of hempcrete in residential and commercial construction.

- During a hearing overseen by the International Code Council (ICC), hempcrete was approved as an appendix for the 2024 International Residential Code (IRC). This approval applies to residential building codes in 49 out of 50 U.S. states, marking a significant milestone for the material's use in sustainable construction.

In addition, investments in research and development (R&D) to study hempcrete's fire resistance and insulation properties are enhancing its credibility as a sustainable alternative to traditional materials, supporting the market's continued growth in the region.

Competitive Landscape

The global hempcrete market report provides valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Hempcrete Market

- IsoHemp

- American Lime Technology

- Hemp Eco Systems Group

- HempFlax Group B.V.

- Hemp Building Company

- Just BioFiber

- UK Hempcrete

- Americhanvre

- Hempitecture Inc.

- The Australian Hemp Masonry Company

Key Industry Development

- December 2024 (Acquisition): The Federation of International Hemp Organizations (FIHO) partnered with ASTM International to advance global standards for the hemp industry. Their collaboration is focused on expanding guidelines for diverse hemp applications, particularly in building materials such as hempcrete. This initiative aims to create comprehensive standards that strengthen the hemp value chain, with an emphasis on promoting sustainable alternatives like hempcrete instead of conventional construction materials like concrete.

The global hempcrete market has been segmented:

By Application

By Type

- Precast

- Cast-in-Place

- Hybrid

By End Use

- New Construction

- Renovation and Retrofitting

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America