Market Definition

The market involves the use of audio devices worn in or around the ears, offering advanced features like wireless connectivity, noise cancellation, health monitoring, and smart functionality.

These products include wireless earbuds, smart headphones, and hearing aids, and cater to the growing demand for convenience, fitness tracking, and seamless integration with smartphones and other devices. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Hearables Market Overview

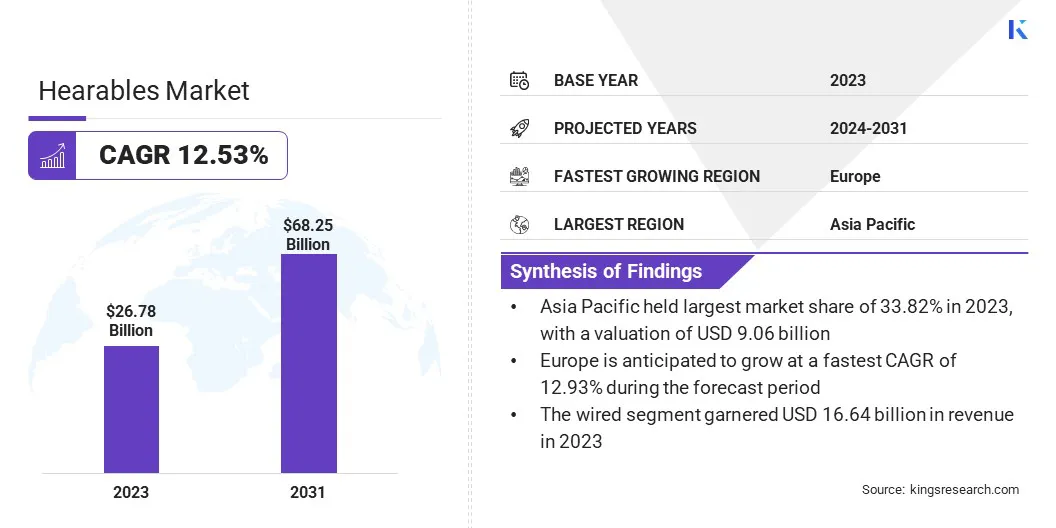

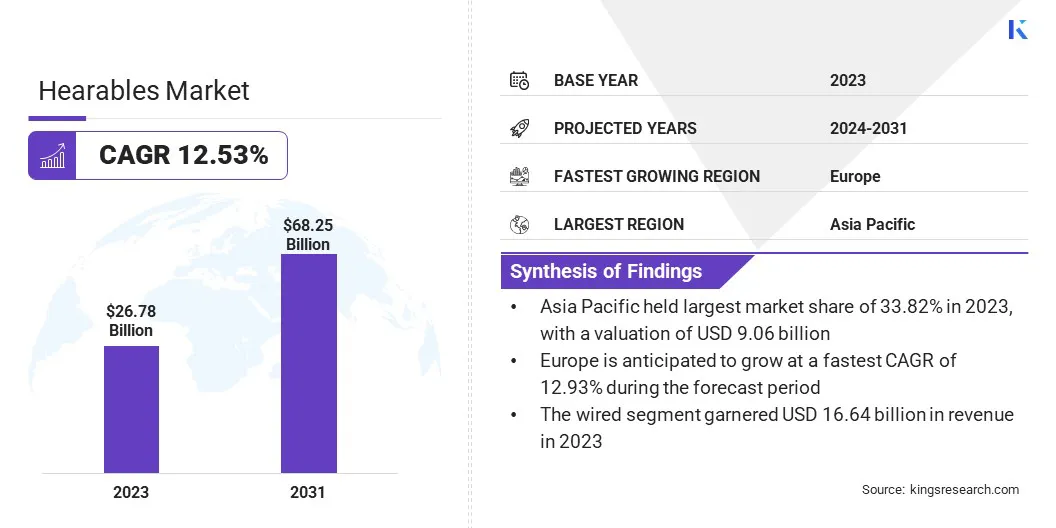

The global hearables market size was valued at USD 26.78 billion in 2023, which is estimated to be USD 29.87 billion in 2024 and reach USD 68.25 billion by 2031, growing at a CAGR of 12.53% from 2024 to 2031.

Rising awareness about hearing health is significantly driving the market, particularly in the smart hearing aids segment. The demand for advanced hearing devices is growing as more individuals prioritize ear health and seek solutions for hearing loss.

Major companies operating in the hearables industry are Demant A/S, WSAudiology, Starkey Laboratories, Inc, SONY ELECTRONICS INC, Apple Inc., Imagine Marketing Limited, Koninklijke Philips N.V., Noise, Xiaomi, Boult Audio, Oticon, Inc., Sonova, GN Hearing A/S, Unitron, and Bernafon AG.

The market is registering rapid demand, driven by consumer demand for audio devices that provide advanced features beyond basic sound. These products, which include wireless earbuds, smart headphones, and hearing aids, offer functionalities like noise cancellation, fitness tracking, and voice assistant integration.

The market is fueled by advancements in wireless technology, rising interest in health monitoring, and the desire for seamless, hands-free experiences. Hearables are becoming a crucial part of daily life fueled by innovations, catering to a broad range of applications.

- In January 2023, boAt unveiled its cutting-edge hearables at the Consumer Electronics Show (CES), showcasing innovative products like TWS, neckbands, and headphones co-engineered with global tech partners like Dolby, Dirac, and CEVA. Its products feature advanced audio technologies, including spatial audio, personalized tuning, and head tracking, reflecting boAt's commitment to next-gen audio experiences.

Key Highlights:

- The hearables market size was valued at USD 26.78 billion in 2023.

- The market is projected to grow at a CAGR of 12.53% from 2024 to 2031.

- Asia Pacific held a market share of 33.82%in 2023, with a valuation of USD 9.06 billion.

- The in-ear segment garnered USD 10.30 billion in revenue in 2023.

- The earbuds segment is expected to reach USD 25.48 billion by 2031.

- The wireless segment is anticipated to register a CAGR of 12.75% during the forecast period.

- The consumer segment held a market share of 24.87% in 2023.

- The supermarkets/hypermarkets segment is anticipated to hold a market share of 40.05% in 2031.

- The market in Europe is anticipated to grow at a CAGR of 12.93% during the forecast period.

Market Driver

Rising Awareness about Hearing Health

Many consumers are seeking solutions to protect and enhance their auditory experience, due to the increasing awareness about the importance of hearing health.

- As per a WHO article dated February 2025, nearly 2.5 billion people are projected to experience some degree of hearing loss by 2050, with over 700 million requiring hearing rehabilitation.

This has led to a surge in the demand for smart hearing aids, which now incorporate advanced features like personalized sound profiles, noise cancellation, and health monitoring. The adoption of smart hearing aids is expected to grow as people become more aware of the potential risks of hearing loss, expanding the market and encouraging further innovations in health-focused audio technology.

- In February 2025, Oticon introduced the Oticon Own SI and Oticon Jet PX hearing aids, featuring advanced AI technology. These devices leverage BrainHearing technology and Deep Neural Networks to enhance connectivity and provide a richer listening experience in complex environments, without compromising size, performance, or battery life.

Market Challenge

Battery Life Limitations

A major challenge in the hearables market is the battery life limitations of compact devices. Consumers are demanding more functionality, such as longer streaming times and advanced features; however, smaller designs often struggle to offer sufficient battery life. This leads to user dissatisfaction, especially in active or all-day usage scenarios.

Manufacturers are increasingly developing energy-efficient components and implementing advanced battery technologies, such as high-density batteries and low-power processors, to enhance battery performance without compromising size or audio quality.

Market Trend

Noise Cancellation

Noise cancellation has become a key trend in the market, especially in premium models. Consumers are demanding higher audio quality and enhanced listening experiences. Thus, manufacturers are integrating advanced noise cancellation technology to minimize background disturbances.

This trend is driven by the need for clearer sound in noisy environments, such as crowded public spaces or offices. Premium hearables now use adaptive algorithms and real-time processing to filter out unwanted noise, ensuring that users enjoy crisp, clear audio for calls, music, and other content needs.

- In July 2024, Dyson unveiled the Dyson OnTrac headphones, featuring advanced noise cancellation and up to 55 hours of listening time. Equipped with deep neural networks and customizable design options, these headphones offer exceptional sound clarity and comfort, making them a top choice for audiophiles.

Hearables Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

In-ear, On-ear, Over-ear

|

|

By Product

|

Headsets, Earbuds, Hearing Aids

|

|

By Technology

|

Wired, Wireless

|

|

By Application

|

Consumer, Healthcare, Construction, Manufacturing, Mining, Others

|

|

By Distribution Channel

|

Supermarkets/Hypermarkets, Specialty Store, Online

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America : Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (In-ear, On-ear, Over-ar): The in-ear segment earned USD 10.30 billion in 2023, due to its popularity for convenience, portability, and comfort, particularly among active users and travelers.

- By Product (Headsets, Earbuds, Hearing Aids): The earbuds segment held 37.74% share of the market in 2023, due to the increasing demand for compact, wireless solutions with advanced features like noise cancellation and long battery life.

- By Technology (Wired, Wireless): The wired segment is projected to reach USD 42.01 billion by 2031, owing to the continued preference for stable, high-quality sound performance in professional environments and audiophile communities.

- By Application (Consumer, Healthcare, Construction, Manufacturing, Mining, Others): The manufacturing segment is anticipated to register a CAGR of 12.82% during the forecast period, due to the growing adoption of noise-cancelling and communication technologies in industrial settings for enhanced worker safety.

- By Distribution Channel (Supermarkets/Hypermarkets, Specialty Store, Online): The supermarkets/hypermarkets segment is anticipated to register a market share of 40.05% in 2031, due to their broad accessibility, competitive pricing, and wide consumer reach across various demographics.

Hearables Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for a market share of around 33.82% in 2023, with a valuation of USD 9.06 billion. Asia Pacific holds a dominant position in the hearables market, due to its large consumer base, technological advancements, and high demand for innovative audio solutions.

This region benefits from rapid urbanization, a growing middle class, and increasing disposable incomes, which drive the adoption of smart devices. Additionally, the widespread use of smartphones, along with a rising preference for wireless and wearable technologies, further the market in Asia Pacific, positioning it as a leading global hub.

- In January 2023, boAt introduced the Rockerz 378, the world’s first neckband with 3D Spatial Bionic Sound tuned by THX. This innovative model offers low-latency audio, large dynamic drivers, 25-hour battery life, and superior comfort, establishing a new standard in hearables.

The market in Europe is poised for significant growth over the forecast period at a CAGR of 12.93%. Europe has emerged as one of the fast-growing regions in the hearables industry, driven by technological innovation, increasing health consciousness, and rising demand for smart, connected devices.

The region's strong emphasis on advanced features like noise cancellation, health monitoring, and superior sound quality attracts consumers seeking high-performance audio solutions. Additionally, the increasing popularity of fitness and wellness trends, coupled with the demand for lifestyle-enhancing wearables, contributes to the rapid market expansion of Europe, making it a key player in the global market.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) ensures the safety, efficacy, and security of medical devices, including hearables classified as hearing aids, by enforcing regulations to guarantee their effectiveness and safety.

- In India, the Bureau of Indian Standards (BIS) regulates the certification of Behind the Ear (BTE) Digital Hearing Aids under IS 16127:2013. Manufacturers must adhere to stringent testing and quality control measures, ensuring compliance with design, power supply, housing, and performance criteria. Conformity is ensured through factory testing, with regular inspections, calibration, and labeling. Non-compliant products are rejected per BIS guidelines, and licensees are authorized to use the standard mark after meeting all criteria for safety and quality assurance.

Competitive Landscape:

Companies in the hearables market are focusing on enhancing audio technology to deliver superior sound experiences. They are integrating advanced features like noise cancellation, spatial audio, and biometric tracking to improve user experience. Additionally, companies are developing more comfortable and ergonomic designs, while optimizing connectivity with multiple devices.

The market is also registering innovations in smart functionalities, such as fitness tracking and voice assistant integration, catering to the growing demand for multifunctional hearables.

- In February 2024, PlayStation launched the Pulse Elite wireless headset, enhancing gaming experiences with immersive audio. Featuring planar magnetic drivers, it offers seamless connectivity across PS5, PC, Mac, and Bluetooth devices, incorporating features like 3D audio, customizable sound settings, and noise rejection technology.

List of Key Companies in Hearables Market:

- Demant A/S

- WSAudiology

- Starkey Laboratories, Inc

- SONY ELECTRONICS INC

- Apple Inc.

- Imagine Marketing Limited

- Koninklijke Philips N.V.

- Noise

- Xiaomi

- Boult Audio

- Oticon, Inc.

- Sonova

- GN Hearing A/S

- Unitron

- Bernafon AG

Recent Developments (M&A/Product Launch)

- In March 2025, Eargo and hearX announced their merger to create a new company called LXE Hearing. This new company aims to enhance the accessibility and affordability of hearing aids for 44 million Americans with hearing loss. Backed by USD 100 million from Patient Square Capital, LXE Hearing combines the strengths of both brands in design, technology, and customer service.

- In February 2025, Signia introduced the Pure Charge&Go BCT IX hearing aids, offering the longest battery life of any Bluetooth Classic hearing aid at 36 hours. Featuring RealTime Conversation Enhancement, it provides superior performance for clearer speech in noisy environments, ensuring universal compatibility and extended functionality.

- In September 2024, Apple unveiled its new AirPods 4 lineup, offering advanced features like Active Noise Cancellation and an open-ear design. The AirPods Max includes USB-C charging and is available in five new colors. Additionally, the AirPods Pro 2 will introduce groundbreaking hearing health features, such as Loud Sound Reduction and a clinically validated Hearing Test.