Market Definition

The market encompasses the production, distribution, and application of bioactive compounds, nutrients, and functional additives that offer health benefits when incorporated into food, beverages, dietary supplements, and pharmaceuticals. This market includes various segments such as vitamins, minerals, probiotics, prebiotics, plant-based extracts, omega-3 fatty acids, and proteins.

These ingredients are widely used to enhance immune support, improve digestive health, support cognitive function, and promote overall well-being. The market caters to industries such as functional foods, nutraceuticals, personal care, and sports nutrition, driven by rising consumer awareness of preventive healthcare and increasing demand for fortified and clean-label products.

Health ingredients Market Overview

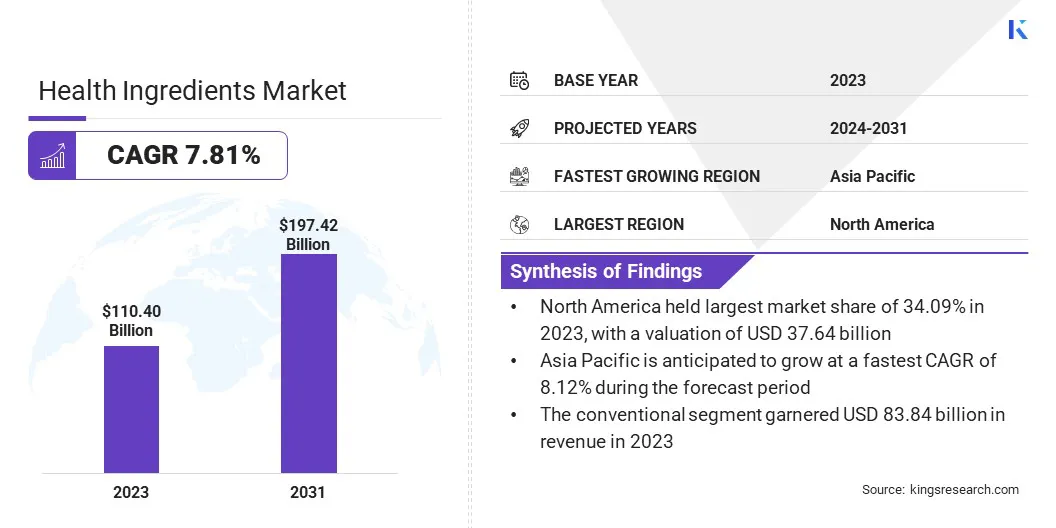

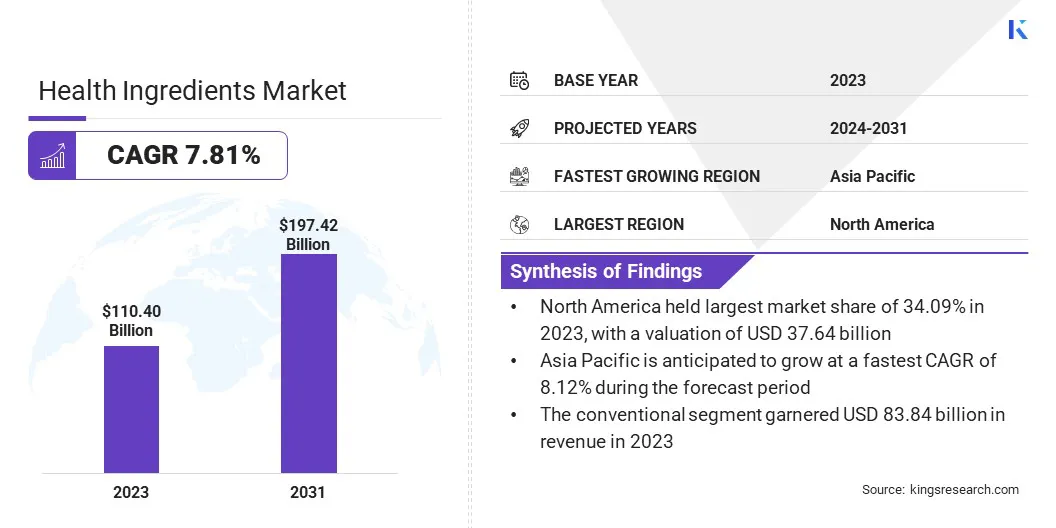

The global health ingredients market size was valued at USD 110.40 billion in 2023 and is projected to grow from USD 117.79 billion in 2024 to USD 197.42 billion by 2031, exhibiting a CAGR of 7.66% during the forecast period.

This market is registering substantial growth, driven by increasing consumer awareness of preventive healthcare and wellness trends. Rising demand for functional foods, dietary supplements, and fortified products has accelerated the adoption of health ingredients, including probiotics, prebiotics, vitamins, minerals, and plant-based extracts.

Growing interest in natural and organic ingredients, coupled with advancements in food science and biotechnology, is further boosting the market.

Major companies operating in the health ingredients industry are Archer Daniels Midland Company, Cargill, Incorporated, dsm-firmenich, Kerry Group plc., BASF SE, Ingredion Incorporated, Tate & Lyle plc, Glanbia plc, Lonza Group Ltd., Symrise AG, Corbion NV, Arla Foods Ingredients Group P/S, International Flavors & Fragrances Inc, Danone, and Top Health Ingredients.

Additionally, the rising prevalence of lifestyle-related disorders has increased consumer preference for products promoting immunity, digestion, and cognitive health, enhancing the demand for innovative and customized health ingredient solutions.

Expanding applications in food, beverages, pharmaceuticals, and personal care are also contributing to the market's growth, as manufacturers increasingly incorporate bioactive compounds to enhance product functionality and nutritional value.

- In December 2024, the World Health Organization (WHO) reported that noncommunicable diseases (NCDs) were responsible for at least 43 million deaths in 2021, accounting for 75% of non-pandemic-related global deaths. Cardiovascular diseases caused the highest number of NCD-related deaths (19 million), followed by cancers (10 million), chronic respiratory diseases (4 million), and diabetes (over 2 million). WHO emphasized that reducing key risk factors such as tobacco use, physical inactivity, unhealthy diets, and air pollution is essential in preventing NCDs.

Key Highlights:

- The health ingredients industry size was valued at USD 110.40 billion in 2023.

- The market is projected to grow at a CAGR of 7.66% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 37.64 billion.

- The vitamins and minerals segment garnered USD 33.23 billion in revenue in 2023.

- The plant-based segment is expected to reach USD 110.64 billion by 2031.

- The conventional segment is expected to reach USD 146.70 billion by 2031.

- The functional foods and beverages segment is expected to reach USD 70.96 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.12% during the forecast period.

Market Driver

Rising Demand for Functional Foods and Advancements in Nutrient Delivery Systems

The market is registering robust growth, primarily driven by the expanding geriatric population and the increasing prevalence of chronic diseases.

The aging population is becoming more susceptible to age-related health concerns such as osteoporosis, arthritis, cardiovascular conditions, and cognitive decline as global life expectancy rises.

This demographic shift is creating greater demand for functional foods, dietary supplements, and fortified beverages enriched with essential vitamins, minerals, and bioactive compounds that support bone health, heart function, and cognitive well-being. Manufacturers are actively developing targeted solutions to address these concerns, resulting in a surge of innovative product launches.

Additionally, advancements in ingredient delivery technologies are revolutionizing the health ingredients market by enhancing bioavailability, stability, and overall efficacy. Techniques such as microencapsulation protect sensitive ingredients from degradation, ensuring their controlled release within the body for improved absorption.

Liposomal delivery systems further enhance nutrient uptake by enclosing active ingredients in lipid layers that mimic cell membranes, facilitating better cellular absorption. Similarly, precision-timed release technologies allow ingredients like amino acids, peptides, and botanicals to be delivered gradually over several hours, maximizing their impact on the body.

These innovations are enabling the development of more effective health products, catering to growing consumer demand for personalized and results-driven solutions.

- In December 2024, Specnova announced the launch of NovaQSpheres, a new delivery system ingredient designed to enhance bioavailability and performance. NovaQSpheres offers a precision-timed controlled release mechanism for ingredients such as minerals, vitamins, botanicals, amino acids, and peptides. This controlled release extends the ingredient's presence in the bloodstream, supporting sustained effectiveness.

Market Challenge

Consumer Misinformation and Misleading Claims

Consumer misinformation and misleading claims present a major challenge in the health ingredients market, significantly impacting consumer trust and industry growth. Amid the rising demand for health-enhancing products such as probiotics, omega fatty acids, and botanical extracts, companies often market their products with exaggerated or unverified claims to gain a competitive edge.

Misleading statements about rapid weight loss, anti-aging effects, or immunity boosts without sufficient scientific evidence are common. Such tactics misguide consumers, fostering unrealistic expectations and skepticism toward genuine products. Digital platforms further amplify this issue, as social media influencers, wellness blogs, and unregulated websites frequently promote unverified health claims.

Consumers may be drawn to trends that lack credible research, resulting in confusion about which products are truly effective. Companies are increasingly adopting evidence-based marketing strategies that emphasize scientific validation and clear communication.

Investing in clinical research, publishing transparent results, and partnering with certified organizations to validate product efficacy are key approaches. Clear labeling with precise dosage information, benefits supported by verified studies, and recognized certifications help reassure consumers.

Market Trend

Preference for Personalized nutrition and Plant-based Solutions

The market is characterized by the growing preference for personalized nutrition and the rising adoption of plant-based ingredients. Personalized nutrition is becoming increasingly popular as consumers focus on individualized health and wellness solutions.

Advances in genetic testing, microbiome analysis, and digital health platforms are enabling tailored dietary recommendations based on unique biological markers, lifestyle factors, and health goals. This trend has driven the development of customized supplements, functional foods, and fortified beverages designed to address specific health needs, including immunity, digestive health, and cognitive function.

Simultaneously, the shift toward plant-based ingredients is reshaping product innovations in the market. Consumers are increasingly choosing plant-derived proteins, fibers, and bioactives, driven by health-conscious lifestyles, environmental concerns, and ethical considerations.

Plant-based alternatives are widely perceived as cleaner, natural, and sustainable options, encouraging manufacturers to develop innovative formulations in categories like vegan protein powders, dairy alternatives, and functional beverages to meet this demand.

- In April 2023, Royal DSM launched its Plant Power Toolkit, an extensive ingredient portfolio designed for plant-based fermented products like yogurt alternatives. The toolkit features DelvoPlant enzymes for creating optimal fermentation bases, DelvoPlant cultures to achieve mildness and freshness, and GELLANEER gellan gums and pectins to enhance mouthfeel, creaminess, and product stability.

Health ingredients Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Vitamins and Minerals, Proteins and Amino Acids, Omega-3 and Omega-6 Fatty Acids, Probiotics and Prebiotics, Plant-Based Extracts, Fibers and Specialty Carbohydrates, Other Health Ingredients

|

|

By Source

|

Plant-based, Animal-based , Microbial

|

|

By Category

|

Conventional, Organic

|

|

By Application

|

Functional Foods and Beverages, Dietary Supplements, Pharmaceuticals, Personal Care and Cosmetics, Animal Nutrition

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Vitamins and Minerals, Proteins and Amino Acids, Omega-3 and Omega-6 Fatty Acids, Probiotics and Prebiotics, Plant-Based Extracts, Fibers and Specialty Carbohydrates, Other Health Ingredients): The vitamins and minerals segment earned USD 33.23 billion in 2023, due to the growing consumer focus on immunity, bone health, and overall well-being.

- By Source (Plant-based, Animal-based, Microbial): The plant-based segment held 52.09% share of the market in 2023, due to the rising demand for vegan, vegetarian, and clean-label products.

- By Category (Conventional, Organic): The conventional segment is projected to reach USD 146.70 billion by 2031, owing to the widespread availability and cost-effectiveness of conventional health ingredients.

- By Application (Functional Foods and Beverages, Dietary Supplements, Pharmaceuticals, Personal Care and Cosmetics, Animal Nutrition): The functional foods and beverages segment is projected to reach USD 70.96 billion by 2031, owing to increasing consumer preference for nutrient-rich, convenience-focused products.

Health ingredients Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 34.09% share of the health ingredients market in 2023, with a valuation of USD 37.64 billion. This expansion is attributed to the strong focus on preventive healthcare and wellness trends in the region.

Consumers are increasingly inclined toward functional foods, dietary supplements, and fortified beverages, driving the demand for essential health ingredients such as vitamins, minerals, probiotics, and plant-based extracts. The presence of key industry players, coupled with continuous advancements in food science and biotechnology, has significantly contributed to product innovation in this region.

Furthermore, regulatory support ensures product quality and safety, enhancing consumer trust. Growing awareness about personalized nutrition, alongside increasing demand for clean-label, and organic ingredients, has further supported market expansion.

The well-developed retail sector and robust distribution networks, including supermarkets, specialty stores, and e-commerce platforms, have improved consumer access to health products, reinforcing North America's market leadership.

- In October 2024, Caldic North America announced a partnership with Infusd Nutrition to introduce the world's first water-soluble Vitamin D solution. This innovative, patent-pending technology enables traditionally fat-soluble ingredients, such as Vitamin D, to be incorporated into beverages like juices, sports drinks, and soft drinks. As part of the collaboration, Caldic will utilize its extensive distribution network and expertise in health and nutrition markets to bring Infusd's novel solutions to consumers across North America.

The health ingredients industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 8.12% over the forecast period. The region’s rapid growth is driven by rising disposable incomes, changing lifestyles, and increasing awareness of nutritional wellness.

Countries such as China, Japan, and India are major contributors to this expansion, where consumers are adopting healthier eating habits and investing in dietary supplements & functional foods. Traditional ingredients such as herbal extracts, green tea, and medicinal mushrooms are gaining prominence alongside modern health ingredients like probiotics, omega-3 fatty acids, and plant-based proteins.

The region’s expanding middle class, urbanization, and growing elderly population have further fueled the demand for products that support immunity, digestion, and cardiovascular health. Additionally, the surge in e-commerce platforms has improved product accessibility, enabling consumers to purchase specialized health products conveniently.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates health ingredients under the Dietary Supplement Health and Education Act (DSHEA). This framework requires manufacturers to ensure ingredient safety before marketing, while the FDA can take action if products are found unsafe or misbranded.

- In Europe, the European Food Safety Authority (EFSA) oversees health ingredients. This regulation mandates scientific evaluation to substantiate claims, ensuring consumer protection and market transparency.

- In China, the National Medical Products Administration (NMPA) regulates health ingredients under the Food Safety Law of the People's Republic of China. Companies must obtain approvals for new health ingredients, ensuring they meet safety and efficacy standards before entering the market.

- In Japan, the Consumer Affairs Agency (CAA) manages the Food with Function Claims (FFC) system, which allows companies to market products with health benefits based on scientific evidence, ensuring consumer safety and accurate labeling.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates health ingredients under the Food Safety and Standards (Health Supplements, Nutraceuticals, Food for Special Dietary Use, Food for Special Medical Purpose, Functional Food, and Novel Food) Regulations, 2016. This framework outlines permissible ingredients, safety limits, and labeling standards to ensure product safety and quality.

Competitive Landscape

The health ingredients industry is characterized by numerous players actively engaged in product innovation, strategic partnerships, and geographic expansion to strengthen their market presence. Companies are actively exploring innovative ingredient formulations that align with evolving consumer preferences for healthier and more functional products.

Bioactive compounds, antioxidants, and personalized nutrition solutions are slowly being incorporated to address specific health concerns such as immunity, gut health, and cognitive well-being. Manufacturers are also investing in advanced extraction techniques sourcing practices to enhance ingredient purity and potency.

Companies are expanding their production capacities and enhancing supply chain capabilities to cater to the rising global demand. Mergers, acquisitions, and collaborations with food & beverage companies are common strategies adopted to introduce innovative ingredient solutions and expand customer reach.

Moreover, advancements in biotechnology and encapsulation techniques are driving the development of targeted health ingredients that improve bioavailability and enhance nutritional benefits.

- In December 2024, Louis Dreyfus Company (LDC) signed a binding agreement to acquire BASF’s Food and Health Performance Ingredients business, including a production site and R&D center in Illertissen, Germany, along with three application labs outside of Germany. This acquisition aligns with LDC’s strategy to expand its presence in the plant-based ingredients market and strengthen its position in nutritional and functional ingredients.

List of Key Companies in Health Ingredients Market:

- Archer Daniels Midland Company

- Cargill, Incorporated

- dsm-firmenich

- Kerry Group plc.

- BASF SE

- Ingredion Incorporated

- Tate & Lyle plc

- Glanbia plc

- Lonza Group Ltd.

- Symrise AG

- Corbion NV

- Arla Foods Ingredients Group P/S

- International Flavors & Fragrances Inc

- Danone

- Top Health Ingredients

Recent Developments (Acquisition/Expansion/Product Launch)

- In December 2024, Yeastup AG secured USD 10 million in Series A funding and announced the launch of a large-scale production site in Switzerland. The facility will have the capacity to upcycle over 20,000 tons of brewers’ spent yeast annually, producing high-quality protein, beta-glucan, and mannoprotein for applications in the food, nutraceutical, and cosmetic industries.

- In May 2024, MegaFood announced the launch of Omega 3-6-9, a plant-powered complex that provides 600 mg of Omega-3 to support heart, brain, vision, and joint health. The product is designed as a sustainable alternative to traditional fish oil supplements. Omega 3-6-9 is formulated using Ahiflower and fish-free algae oil, which minimizes the impact on marine ecosystems.

- In March 2024, EW Nutrition announced the acquisition of the BIOMIN BIOSTABIL product line from dsm-firmenich. This acquisition grants EW Nutrition ownership of a well-established line of silage inoculants, enhancing its presence in the sector. According to Jan Vanbrabant, CEO of EW Nutrition, this strategic expansion aligns with the company's efforts to build a stronger portfolio of market-leading solutions.