Market Definition

The market refers to the industry focused on the development, distribution, and application of radar-based systems designed for subsurface investigation. It encompasses a range of equipment , including cart-based, handheld, and vehicle-mounted platforms, each tailored to specific field conditions and operational demands.

The market serves diverse applications, including the inspection of transportation infrastructure, detection of underground utilities, environmental and geological surveys, archaeological site analysis, and support for law enforcement and military operations. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Ground Penetrating Radar Market Overview

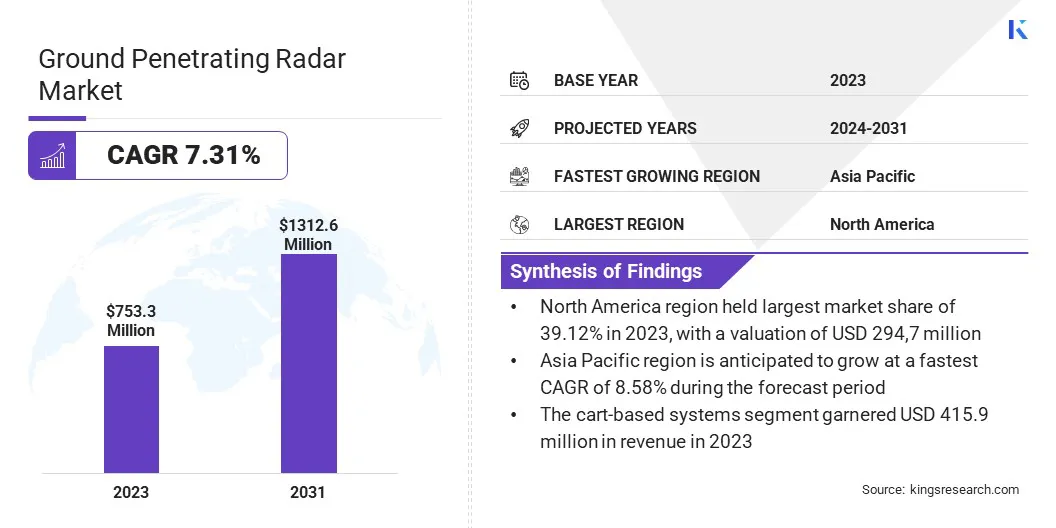

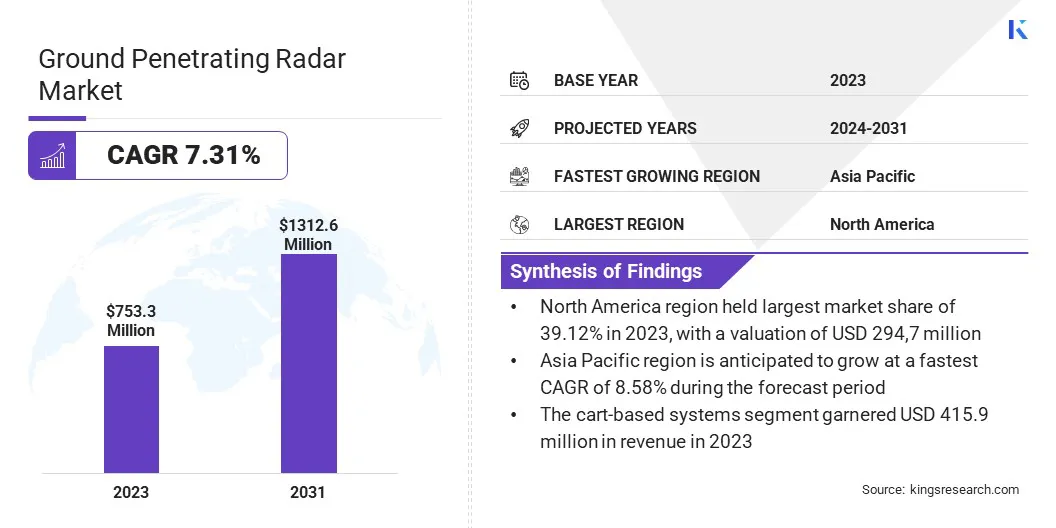

The global ground penetrating radar market size was valued at USD 753.3 million in 2023 and is projected to grow from USD 801.2 million in 2024 to USD 1312.6 million by 2031, exhibiting a CAGR of 7.31% during the forecast period.

This market is driven by the increasing need for non-invasive subsurface investigations across sectors such as construction, utilities, transportation, and environmental studies. The market is also seeing steady demand for compact, user-friendly systems and integration with positioning technologies to improve accuracy and workflow efficiency accelerating the adoption for GPR solutions in the market..

Major companies operating in the ground penetrating radar industry are US Radar, Chemring Group PLC, Kontur, SPX TECHNOLOGIES, Sensors & Software Inc., Screening Eagle Technologies, Radiodetection Ltd., Guideline Geo., Penetradar, ImpulseRadar, Hexagon AB, Pipehawk plc., Thales, Hilti India Pvt. Ltd., and GSSI Geophysical Survey Systems, Inc.

A key driver for the market is the rising adoption of aerial GPR systems, which allow for effective surveying in remote, inaccessible, or hazardous areas. The integration of dual-mode systems capable of switching between terrestrial and airborne operations further boosts demand by enhancing deployment flexibility across sectors such as glaciology, archaeology, and environmental monitoring.

- In September 2024, SPH Engineering, in collaboration with Radar Systems, Inc., launched the Zond Aero 500 NG, a GPR system designed for drone-mounted as well as terrestrial applications. This dual-purpose model enhances operational flexibility and efficiency across applications such as geology, utility scanning, and sinkhole detection.

Key Highlights

- The ground penetrating radar market size was recorded at USD 753.3 million in 2023.

- The market is projected to grow at a CAGR of 7.31% from 2024 to 2031.

- North America held a market share of 39.12% in 2023, with a valuation of USD 294.7 million.

- The cart-based systems segment garnered USD 415.9 million in revenue in 2023.

- The transportation infrastructure segment is expected to reach USD 563.0 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 8.58% during the forecast period.

Market Driver

Growing Demand for Non-Destructive Testing

The global market is driven by the rising demand for non-destructive testing methods across various industries. As businesses and government agencies increasingly prioritize cost-effective and efficient techniques for infrastructure inspection, utility detection, and environmental assessments, the need for non-invasive solutions like GPR has surged.

GPR allows for the accurate and real-time analysis of subsurface conditions without the need for excavation. This makes it a preferred choice for detecting underground utilities, evaluating concrete structures, and assessing geological conditions. Growing reliance on non-destructive testing to minimize disruption and reduce costs is accelerating the adoption of GPR solutions.

- In September 2023, Guideline Geo launched the MALA MIRA Compact, a versatile array solution for 3D GPR mapping. MALA MIRA Compact is designed for near-surface high-resolution GPR surveys and supports non-destructive testing by allowing subsurface scanning without the need for excavation.

Market Challenge

Limited Penetration Depth in Certain Soil Conditions

One of the major challenges facing the ground penetrating radar market is signal interference and limited penetration depth in certain soil conditions, such as clay-rich or water-saturated environments. These ground types significantly weaken the radar signal, reducing the accuracy and reliability of subsurface data. This limitation poses difficulties for industries like construction and utility detection, where precise imaging is critical.

To address this, key payers are developing frequency-adjustable and multi-frequency GPR systems, which allow users to switch between low and high frequencies depending on the ground conditions. This adaptability improves signal penetration and data resolution, enabling more consistent performance across diverse terrains.

Market Trend

Increasing Adoption of Airborne GPR Technology

The increased adoption of airborne GPR technology is a key trend in the market. These systems are typically mounted on drones or aircraft for large-area surveys in sectors like geology, environmental monitoring, and infrastructure assessment.

Airborne GPR allows for faster and more efficient data collection over wide or hard-to-reach areas, making it useful for remote locations. This approach saves time and expands the application of GPR in industries that require quick and comprehensive subsurface mapping.

- In September 2024, Guideline Geo introduced the MALA GeoDrone 600, an intelligent airborne ground penetrating radar (GPR) solution designed for near-surface examination in remote and challenging environments. The GeoDrone 600, built with HDR GPR technology, enables high-quality data collection across difficult terrains such as snow, rivers, rocky landscapes, and avalanche-prone areas.

Ground Penetrating Radar Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Cart-based Systems, Handheld Systems, Vehicle-mounted Systems

|

|

By Application

|

Transportation Infrastructure, Utility Detection, Concrete Investigation, Geology & Environment, Archaeology, Law Enforcement & Military

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Cart-based Systems, Handheld Systems, Vehicle-mounted Systems): The cart-based systems segment earned USD 415.9 million in 2023 due to their widespread use in large-area surveys and infrastructure inspections requiring high accuracy and stability.

- By Application (Transportation Infrastructure, Utility Detection, Concrete Investigation, and Geology & Environment): The transportation Infrastructure held 39.54% of the market in 2023, due to increased investment in road and bridge maintenance and the growing need for non-destructive evaluation methods.

Ground Penetrating Radar Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America ground penetrating radar market share stood around 39.12% in 2023 in the global market, with a valuation of USD 294.7 million. This dominance is primarily driven by the region’s advanced infrastructure development and widespread adoption of non-destructive testing technologies.

Moreover, high investment in public safety, transportation maintenance, and military applications is further driving the market in North America. Additionally, the presence of key market players that are developing advanced GPR solutions is further contributing to the market growth.

- In March 2025, Canada-based Hexagon and NovAtel announced a collaboration with GPR, Inc. to enhance their SPAN GNSS+INS solution by integrating GPR’s WaveSense ground-penetrating radar technology. This collaboration aims to explore the potential of combining NovAtel's SPAN system with subsurface mapping technology of GPR, Inc. to provide a superior positioning solution.

Asia Pacific is poised to grow at a CAGR of 8.58% over the forecast period. This growth is supported by rapid urbanization, increasing infrastructure development projects, and rising demand for utility detection and geological surveys in countries like China, India, and Japan.

Government initiatives aimed at modernizing transport networks and improving underground utility mapping are also accelerating the adoption of GPR technologies across the region. Moreover, growing awareness of non-invasive testing methods, rising construction safety standards, and a surge in smart city developments are expected to further boost market demand in Asia Pacific.

Regulatory Frameworks

- In the U.S., ground penetrating radar (GPR) devices are regulated by the Federal Communications Commission (FCC) under Part 15 of Title 47 of the Code of Federal Regulations. These regulations specify operational frequencies, emission limits, and usage restrictions to prevent harmful interference with other radio services.

- In Europe, GPR systems are regulated under the European Telecommunications Standards Institute (ETSI) standard EN 302 066, which sets technical requirements for UWB Ground- and Wall-Probing Radar applications. Each EU member state also manages licensing and operational approval for GPR use in line with national spectrum management policies.

Competitive Landscape

The ground penetrating radar market is highly competitive, with a mix of established players and emerging companies vying for market share. Key players in the market are focusing on continuous product innovation to enhance the performance and versatility of GPR systems.

This includes developing more portable, lightweight, and user-friendly devices tailored for various industries such as construction, transportation, and archaeology.

Companies are also working to improve the imaging quality and data processing capabilities of their GPR systems, making them more efficient and precise for subsurface analysis. Strategic partnerships and collaborations are a key focus for companies aiming to expand their reach and improve product offerings.

Key players are forming alliances with research institutions, government agencies, and service providers to jointly develop new applications for GPR technology and reach broader markets. These partnerships help companies offer more specialized solutions and extend their market presence.

In addition to technological advancements, key players are expanding their geographic footprint, targeting emerging markets with localized products and services.

- In February 2024, IDS GeoRadar, part of Hexagon, launched new concrete inspection solutions. The company introduced the C-thrue XS, a handheld GPR scanner with dual-polarisation for easy concrete scanning, and an integrated software NDT Reveal for handling the subsurface data.

List of Key Companies in Ground Penetrating Radar Market:

- US Radar

- Chemring Group PLC

- Kontur

- SPX TECHNOLOGIES

- Sensors & Software Inc.

- Screening Eagle Technologies

- Radiodetection Ltd.

- Guideline Geo.

- Penetradar

- ImpulseRadar

- Hexagon AB

- Pipehawk plc.

- Thales

- Hilti India Pvt. Ltd.

- GSSI Geophysical Survey Systems, Inc.

Recent Developments (Product Launch)

- In March 2025, Sensors & Software Inc. launched GPR-SG, a new plug-and-play GNSS positioning system compatible with all LMX series, pulseEKKO systems, and other ground-penetrating radar (GPR) platforms. It is designed to simplify integration and supports seamless setup allowing users to easily incorporate accurate positioning into their GPR workflows.