Market Definition

A grid forming inverter is a power conversion device that can operate independently or in conjunction with the grid by establishing voltage and frequency references. It enables the stable integration of renewable energy sources and storage systems into power networks.

The market encompasses the development, production, and deployment of inverters capable of providing grid stability, supporting renewable integration, and operating in grid-connected and islanded modes. The device includes various configurations, power ratings, and applications such as solar PV plants, wind farms, microgrids, and energy storage systems across utility, commercial, and residential sectors.

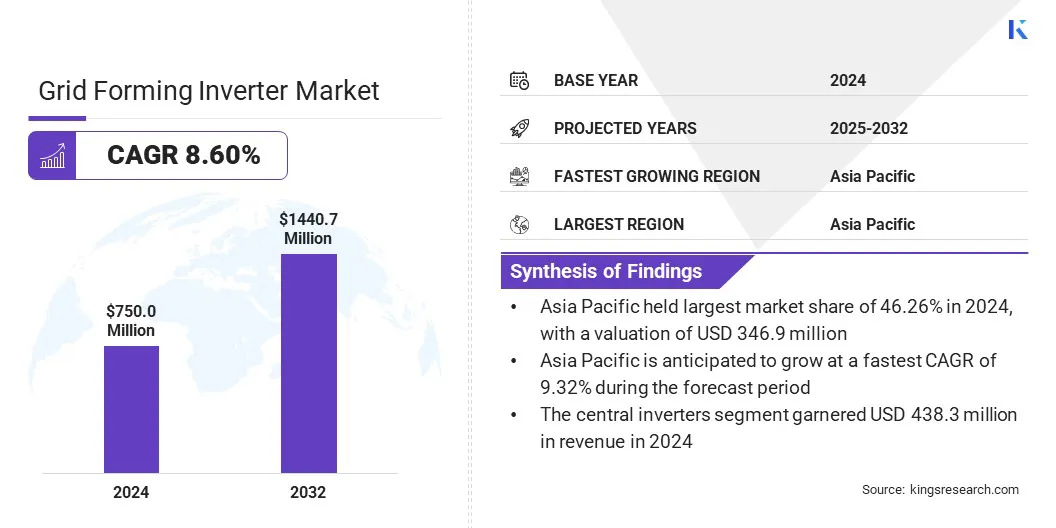

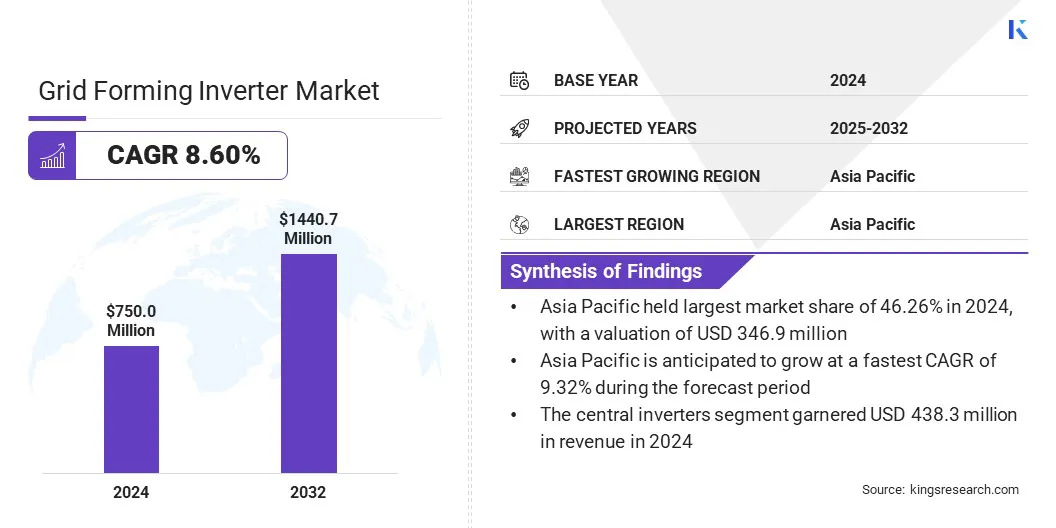

The global grid forming inverter market size was valued at USD 750.0 million in 2024 and is projected to grow from USD 808.7 million in 2025 to USD 1,440.7 million by 2032, exhibiting a CAGR of 8.60% during the forecast period.

This market is experiencing significant growth due to the rising deployment of renewable energy sources and the increasing need for advanced grid stabilization technologies. Expansion of utility-scale solar and wind projects, along with the integration of large-scale energy storage systems is further boosting the adoption of grid forming inverter systems.

Key Highlights

- The grid forming inverter industry was valued at USD 750.0 million in 2024.

- The market is projected to grow at a CAGR of 8.60% from 2025 to 2032.

- Asia Pacific held a market share of 46.26% in 2024, with a valuation of USD 346.9 million.

- The above 500 kW segment garnered USD 423.4 million in revenue in 2024.

- The central inverters segment is expected to reach USD 827.6 million by 2032.

- The solar PV plants segment is expected to reach USD 452.6 million by 2032.

- The market in North America is anticipated to grow at a CAGR of 8.14% over the forecast period.

Major companies operating in the grid forming inverter market are Huawei Technologies Co., Ltd., SMA Solar Technology AG, General Electric Company, Gamesa Electric, S. A. Unipersonal, SUNGROW, Schneider Electric, Siemens AG, KACO new energy GmbH, Enphase Energy, Power Electronics S.L., Ginlong Technologies, Sineng Electric Co., Ltd., GoodWe, Fronius International GmbH, and Growatt New Energy.

The market growth is propelled by the adoption of all-scenario grid-forming energy storage systems (ESS) that support utility, commercial, industrial, and residential applications. These systems enhance grid stability, enable seamless renewable energy integration, and support microgrid operations.

Advanced grid-forming functions, scalable designs, and digital platforms enhance efficiency and position energy storage systems as a key growth driver for the global grid-forming inverter market.

- In May 2025, Huawei Digital Power launched its all-scenario Grid Forming Energy Storage System (ESS) at Intersolar Europe 2025. It introduced next-generation grid-forming photovoltaic (PV) + ESS solutions for utility, microgrid, commercial & industrial (C&I), and residential applications worldwide.

Market Driver

Growing Demand for Advanced Grid Stability Solutions

The grid forming inverter market is expanding significantly due to the rising deployment of renewable energy sources, particularly large-scale solar and wind projects. Grid-forming inverters provide synthetic inertia, autonomous voltage support, and seamless transition between grid-connected and islanded modes. Their advanced control capabilities enable stable and reliable operation of power systems, while supporting higher renewable integration.

These inverters enhance grid resilience, improve power quality, and facilitate the modernization of electrical infrastructure. The accelerating pace of renewable energy installations worldwide is driving demand for grid-forming inverters, positioning them as essential components in the transition toward cleaner and more decentralized energy systems.

- In May 2025, SolarPower Europe reported that global solar installations totaled 597 GW in 2024, marking a 33 percent increase compared to 2023. The organization projects that annual deployment could reach 1 TW by 2030, underscoring the accelerating pace of solar adoption worldwide.

Market Challenge

Grid Stability and Reliability Challenges

A major challenge impeding the growth of the grid-forming inverter market is developing inverters that reliably maintain grid stability while integrating with diverse renewable energy systems. Designing devices with high power ratings, scalable modularity, and advanced control capabilities requires complex engineering and rigorous testing, which increases development costs and lengthens commercialization timelines.

Manufacturers are addressing this challenge by incorporating features such as AI-driven fault detection, modular designs for easy maintenance, and advanced grid-forming technology that supports strong and weak grids. These solutions enhance performance, ensure interoperability, and reduce operational risks, enabling manufacturers to deliver reliable and high-quality inverters capable of handling the growing complexity of modern power systems.

- In April 2025, Sungrow Power Supply Co., Ltd. launched the 1+X 2.0 Modular Inverter for utility-scale solar, featuring scalable 800 kW–9.6 MW blocks, AI-driven fault detection, DC- and AC-coupled solar-plus-storage compatibility, and grid-forming capabilities. The inverter stabilizes frequency, supports microgrids, and enhances reliability and efficiency.

Market Trend

High-Performance Silicon Carbide Grid-Forming Inverters

The grid forming inverter market is evolving with the adoption of compact and high-efficiency inverters, utilizing advanced semiconductors such as silicon carbide (SiC). Improved thermal management and efficiency lower operational and maintenance costs, enhancing the overall reliability of power systems.

Additionally, inverter-based inertia and optimized short-circuit ratios contribute to grid stability, ensuring consistent voltage and frequency regulation. This supports the integration of variable renewable energy sources and decentralized power systems, enabling resilient and flexible grids capable of meeting growing energy demands and maintaining long-term operational stability.

- In March 2025, SMA Solar Technology AG launched the Sunny Central Storage UP-S battery inverter, featuring silicon carbide (SiC) MOSFET technology. It enables over 99% efficiency, reduced thermal losses, high power density, and reliable grid-forming capabilities for large-scale energy storage projects in Australia, Europe, and the U.S.

|

Segmentation

|

Details

|

|

By Power Rating

|

Above 500 kW, 100–500 kW, Below 100 kW

|

|

By Type

|

Central Inverters, String Inverters, Micro Inverters

|

|

By Application

|

Solar PV Plants, Energy Storage Systems, Microgrids / Distributed Energy Systems, Wind Power Plants, Electric Vehicle Charging Infrastructure, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Power Rating (Above 500 kW, 100–500 kW, and Below 100 kW): The above 500 kW segment earned USD 423.4 million in 2024, due to the growing adoption of utility-scale renewable energy projects requiring high-capacity inverters.

- By Type (Central Inverters, String Inverters, Micro Inverters): The central inverters segment held 58.44% of the market in 2024, due to their efficiency and suitability for large-scale solar and wind installations.

- By Application (Solar PV Plants, Energy Storage Systems, Microgrids / Distributed Energy Systems, Wind Power Plants, Electric Vehicle Charging Infrastructure, and Others): The solar PV plants segment is projected to reach USD 452.6 million by 2032, owing to the rapid expansion of solar energy capacity worldwide.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific grid forming inverter market share stood at around 46.26% in 2024, with a valuation of USD 346.9 million. The region’s growth is driven by the increasing deployment of renewable energy, particularly in countries experiencing rapidly expanding electricity demand.

The rise in solar and wind farms has created grid stability challenges due to variable power output, which in turn increases demand for grid-forming inverters to stabilize frequency, support microgrids, and ensure reliable electricity supply. Industrialization and the expansion of off-grid communities are further contributing to the need for resilient and flexible power systems that can sustain continuous electricity delivery under diverse conditions.

- In February 2025, Sineng Electric commissioned a 50MW/200MWh microgrid battery energy storage system in Xinjiang, China. The storage system features grid-forming technology, voltage and frequency regulation, fault ride-through, and black start capabilities to enable resilient and efficient energy supply across diverse off-grid and industrial applications.

North America grid forming inverter industry is expected to register the fastest growth in the market, with a projected CAGR of 8.14% over the forecast period. This expansion is driven by public sector programs, supporting renewable energy integration and microgrid deployment across remote and industrial regions.

Large-scale funding initiatives focus on utility-scale battery storage and advanced inverter systems, enabling reliable frequency regulation, seamless islanding, and enhanced grid stability. Ongoing innovations in inverter modularity, efficiency, and control technology further improve system performance and scalability. These measures strengthen grid resilience, optimize renewable utilization, and position North America as a leader in deploying advanced grid-forming solutions.

- In June 2025, the U.S. Department of Energy (DOE) Office of Electricity awarded over USD 8 million through the Community Microgrid Assistance Partnership to 14 projects, supporting microgrid innovation in remote areas, providing direct funding, technical expertise, and construction-ready engineering plans.

Regulatory Frameworks

- In the U.S., the Department of Energy (DOE) regulates grid-forming inverters through the UNIFI initiative, specifying performance requirements for inverter-based resources to support grid stability, frequency, and voltage control.

- In China, the National Energy Administration (NEA) supports the deployment of grid-forming inverters, demonstrated through hybrid battery energy storage systems for grid stability in Shandong Province.

- In India, the Central Electricity Authority (CEA) regulates inverter-based resources through grid codes, setting technical standards to integrate renewable energy while maintaining grid stability, laying the groundwork for future adoption of grid-forming inverters.

Competitive Landscape

Key players operating in the grid forming inverter industry are focusing on strategic partnerships, collaborations, and technology alliances to accelerate the development and deployment of next-generation grid-forming solutions.

They are co-developing advanced inverters with enhanced efficiency, compact designs, and grid-forming capabilities to cater to utility, commercial, and microgrid applications. These partnerships often emphasize integrating energy storage systems, smart grid software, and power electronics innovations to improve system flexibility and reliability.

Key strategies include joint R&D initiatives, pilot projects, and the demonstration of next-generation inverters in real-world conditions to validate performance, scalability, and interoperability, enabling firms to expand their technological footprint and secure a competitive edge in the market.

- In June 2024, the Commonwealth Scientific and Industrial Research Organisation (CSIRO) and Tapestry collaborated to prototype a smart inverter with grid-forming software, advanced sensors, and back-to-back connections. The partnership aims to enhance grid stability, renewable integration, and microgrid applications in Australia.

Key Companies in Grid Forming Inverter Market:

- Huawei Technologies Co., Ltd.

- SMA Solar Technology AG

- General Electric Company

- Gamesa Electric, S. A. Unipersonal

- SUNGROW

- Schneider Electric

- Siemens AG

- KACO new energy GmbH

- Enphase Energy

- Power Electronics S.L.

- Ginlong Technologies

- Sineng Electric Co., Ltd.

- GoodWe

- Fronius International GmbH

- Growatt New Energy

Recent Developments (Product Launches)

- In June 2025, ASCO Power Technologies introduced new versions of its SourcePacT solution, supporting various voltage applications, enabling grid isolation for inverter-supplied power projects, and allowing inverters to switch to grid-forming mode during utility outages.

- In April 2025, Hitachi Industrial Equipment Systems Co., Ltd. launched a next-generation grid-forming inverter at its Narashino Works facility in Chiba Prefecture, Japan. The system stabilizes electric power grids by recreating inertia once provided by large power plants, supporting a reliable power supply and renewable energy integration.