Market Definition

The market involves the global production and distribution of GMA, a reactive monomer used in adhesives, coatings, plastics, electronics, and healthcare. It serves as a key ingredient in modifying polymers and enhancing product performance across various industries such as automotive, construction, electronics, medical devices, packaging, and printing.

GMA is a specialty monomer with both epoxy and methacrylate functional groups, making it highly reactive and versatile in polymer chemistry. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Glycidyl Methacrylate Market Overview

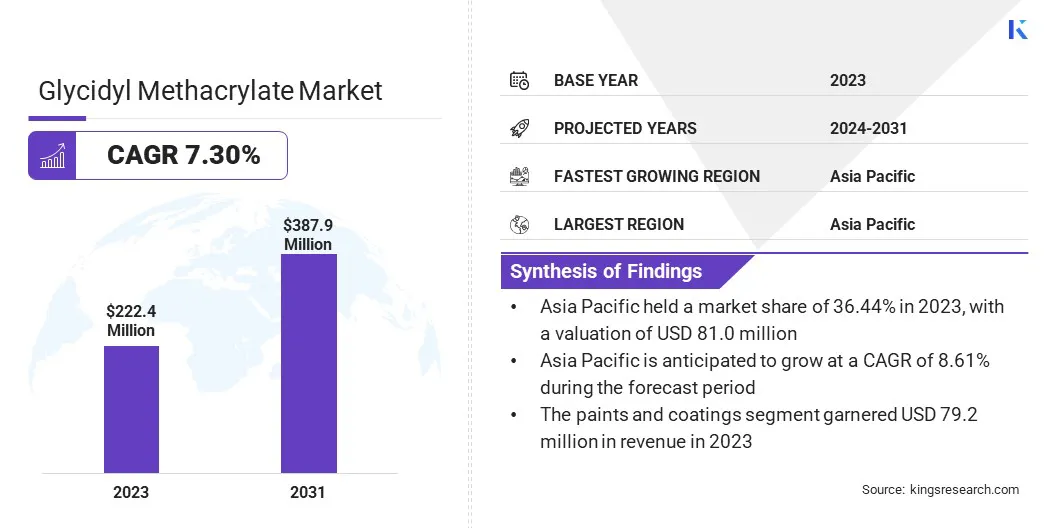

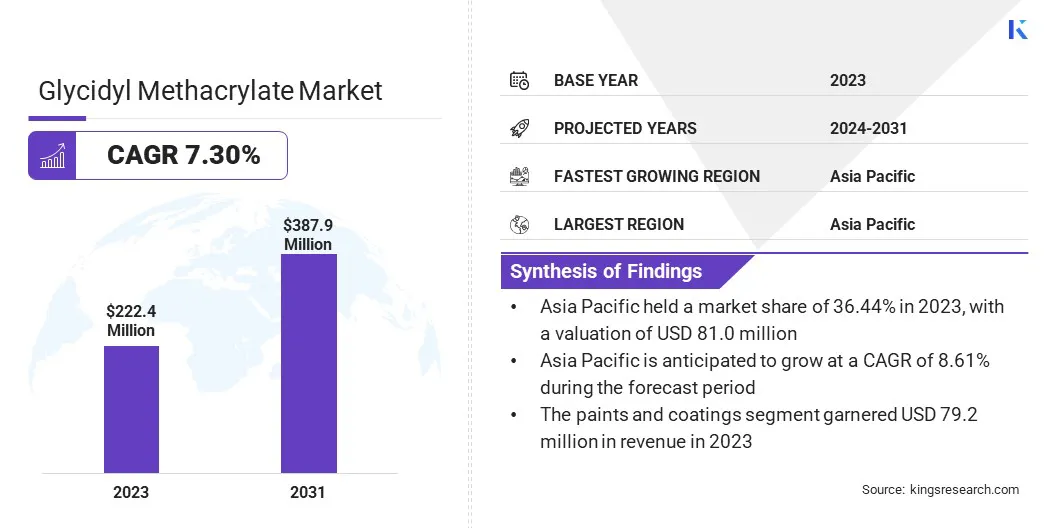

The global glycidyl methacrylate market size was valued at USD 222.4 million in 2023 and is projected to grow from USD 236.9 million in 2024 to USD 387.9 million by 2031, exhibiting a CAGR of 7.30% during the forecast period. This growth is fueled by the increased adoption of GMA in electronics and advanced materials.

It enhances performance through improved thermal stability, adhesion, and mechanical strength, leading to its increased use in printed circuit board (PCBs), nanocomposites, and high-performance applications across key industrial sectors.

Major companies operating in the glycidyl methacrylate industry are MITSUBISHI GAS CHEMICAL COMPANY INC., Evonik group, Estron, Sumitomo Chemical Co.Ltd, Dow, Lianyungang Ningkang Chemical Co., Ltd, JINDUN CHEMICAL, Junsei Chemical Co. Ltd., KOWA AMERICAN Corporation, GP Natural Products Co. Ltd., Parchem, Kowa Holdings America, Inc., Tokyo Chemical Industry (India) Co.Ltd., Merck KGaA, and Nacalai Tesque Inc.

The growth of the market is driven by the increasing demand for high-performance adhesives and coatings, particularly in the automotive and construction industries. GMA’s unique chemical structure enhances adhesion, durability, and resistance to heat and chemicals, making it ideal for use in harsh environments.

As manufacturers seek advanced materials to improve product performance and longevity, GMA-based formulations are gaining traction. This demand is further supported by infrastructure development and automotive innovations requiring reliable, long-lasting surface protection and bonding solutions.

Key Highlights:

- The glycidyl methacrylate industry size was recorded at USD 222.4 million in 2023.

- The market is projected to grow at a CAGR of 7.30% from 2024 to 2031.

- Asia Pacific held a market share of 36.44% in 2023, with a valuation of USD 81.0 million.

- The paints and coatings segment garnered USD 79.2 million in revenue in 2023.

- The automotive segment is expected to reach USD 153.3 million by 2031.

- North America is anticipated to grow at a CAGR of 7.23% over the forecast period.

Market Driver

"Expansion in Biomedical Sector"

The surging adoption of GMA in the biomedical sector is fueling the expansion of the glycidyl methacrylate market, particularly in hydrogel-based materials for blood-contacting medical devices. GMA enhances hydrophilicity, mechanical strength, and biocompatibility, making it suitable for developing safer vascular catheters.

Its ability to reduce thrombogenicity and support prolonged blood contact fuels demand in healthcare applications. As innovation in medical devices accelerates, GMA’s role in next-generation biomaterials continues to rise.

- In March 2025, researchers from Ain Shams University developed a hydrogel composed of gelatin, glycidyl methacrylate (GMA), and graphene oxide (GO) for use in blood-contacting devices. This advancement highlights GMA’s growing role in biomedical applications, fostering its adoption as manufacturers seek high-performance, hemocompatible materials for advanced vascular devices.

Market Challenge

"Health and Environmental Safety Issues"

Environmental and health concerns represent a significant challenge in the glycidyl methacrylate (GMA) market due to the presence of reactive epoxide groups, which are associated with toxicity, skin irritation, and potential respiratory hazards during handling and processing.

To mitigate these risks, companies must implement stringent safety protocols, including proper ventilation systems, the use of personal protective equipment (PPE), and regular employee training.

Additionally, investing in research to develop safer formulations or low-toxicity alternatives can enhance sustainability and reduce environmental impact, thereby improving workplace safety and supporting long-term operational efficiency.

Market Trend

"Integration in Nanocomposites and Advanced Materials"

The glycidyl methacrylate (GMA) market is experiencing a notable trend of integration into nanocomposites and advanced materials. GMA improves nanoparticle dispersion and compatibility in polymer matrices, enhancing mechanical strength, thermal stability, and chemical resistance.

This trend is particularly prominent in high-performance applications across electronics, aerospace, and automotive industries, where advanced material properties are critical. The use of GMA in these composites supports the advancement of next-generation functional materials.

Glycidyl Methacrylate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Application

|

Adhesives and Sealants, Paints and Coatings, Plastics and Composites, Medical Devices, Others

|

|

By End-use Industry

|

Automotive, Construction, Electronics, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Application (Adhesives and Sealants, Paints and Coatings, Plastics and Composites, Medical Devices, and Others): The paints and coatings segment earned USD 79.2 million in 2023 due to the increasing demand for high-performance, durable coatings in automotive, construction, and industrial applications.

- By End-use Industry (Automotive, Construction, Electronics, Healthcare, and Others): The automotive segment held a share of 35.63% in 2023, fueled by the growing use of GMA-based materials in lightweight components, high-performance coatings, and durable adhesives to enhance vehicle efficiency and durability.

Glycidyl Methacrylate Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific glycidyl methacrylate market share stood at around 36.44% in 2023, valued at USD 81.04 million. This dominance is reinforced by the region's rapid industrialization, robust growth in the manufacturing sector, and expanding end-use industries such as automotive, electronics, and construction.

The region's competitiveness is strengthened by cost-effective production, abundant raw materials, and supportive government policies. Additionally, rising consumer demand for high-performance materials and increased investment in infrastructure and electronics manufacturing are accelerating GMA consumption in countries such as China, India, South Korea, and Japan.

The North America methacrylate industry is estimated to grow at a CAGR of 7.23% over the forecast period. This growth is stimulated by the strong demand for high-performance composite materials in the automotive and aerospace industries.

The region's well-established industrial base and focus on lightweight, durable materials to enhance fuel efficiency and performance have significantly boosted the use of glycidyl methacrylate in advanced polymer applications. Additionally, the presence of major market players and strategic collaborations are accelerating product development and commercial adoption across various end-use sectors.

Regulatory Framework

- In the US, the Food and Drug Administration (FDA) regulates the use of glycidyl methacrylate (GMA) in food contact materials, by setting permissible limits and preventing harmful substance migration into food.

- In India, glycidyl methacrylate (GMA) is regulated by the Department of Chemicals and Petrochemicals (DCPC) under the Ministry of Chemicals and Fertilizers, which oversees its industrial use, production, and safety standards.

- In the European Union, glycidyl methacrylate is regulated by the European Chemicals Agency (ECHA), which enforces EU chemical laws under REACH. It ensures the safe use, registration, and evaluation of chemicals, including GMA, across member states.

Competitive Landscape

Key players in the glycidyl methacrylate (GMA) industry are actively adopting strategic initiatives to strengthen their market position. These include mergers and acquisitions to expand their geographic footprint and production capacity, along with the introduction of new product lines to diversify their portfolio.

Companies are further engaging in partnerships and joint ventures to enhance R&D capabilities and improve supply chain efficiency. These strategic moves indicate a highly competitive landscape aimed at expanding presence and strengthening market positioning.

List of Key Companies in Glycidyl Methacrylate Market:

- MITSUBISHI GAS CHEMICAL COMPANY INC.

- Evonik group

- Estron

- Sumitomo Chemical Co.Ltd

- Dow

- Lianyungang Ningkang Chemical Co.,Ltd

- JINDUN CHEMICAL

- Junsei Chemical Co. Ltd.

- KOWA AMERICAN Corporation

- GP Natural Products Co. Ltd.

- Parchem

- Kowa Holdings America, Inc.

- Tokyo Chemical Industry (India) Co.Ltd.

- Merck KGaA

- Nacalai Tesque Inc.

Recent Developments (Product Innovation)

- In August 2024, ACS Publications reported that researchers from Gazi University and Ankara University developed innovative coatings using Glycidyl Methacrylate (GMA) and short-chain fluorinated methacrylates to combat hydrocarbon-based fouling. These low-surface energy coatings effectively repel water and oil, offering a durable solution to hydrocarbon-based fouling across industries such as textiles, electronics, and filtration, while aligning with the growing demand for eco-friendly, high-performance materials.