Market Definition

The market involves the production, development, and use of inorganic binding materials across various sectors such as construction, transportation, and industrial manufacturing.

It covers the full value chain, including formulation, processing, and end-use applications, involving manufacturers, suppliers, and end-users within both commercial and industrial domains. The report outlines the major factors driving market growth, along with the competitive landscape influencing the market.

Geopolymer Market Overview

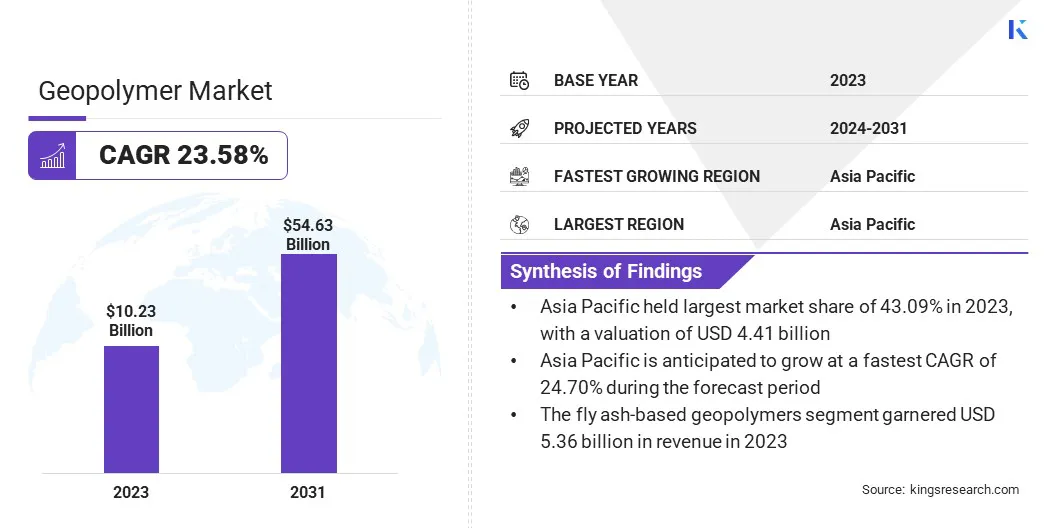

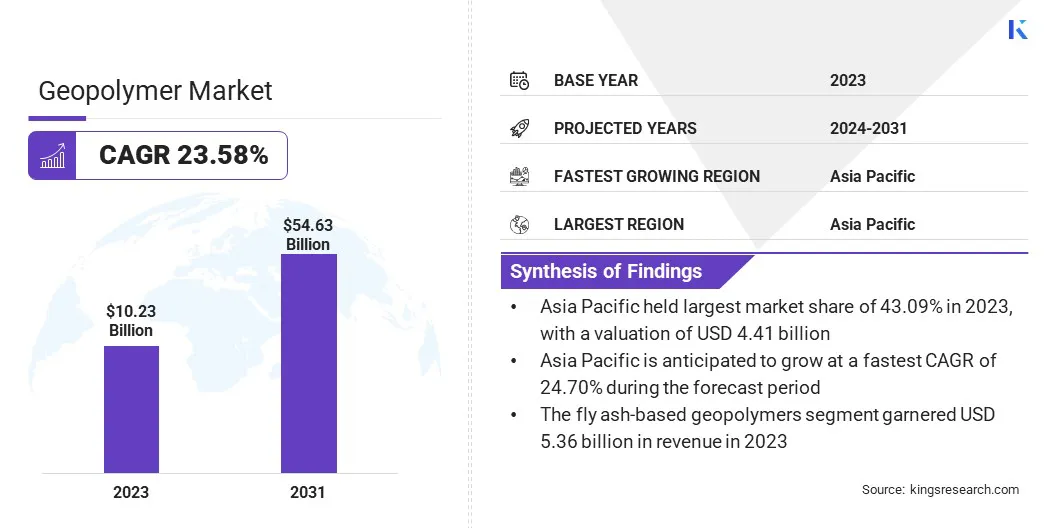

The global geopolymer market size was valued at USD 10.23 billion in 2023 and is projected to grow from USD 12.41 billion in 2024 to USD 54.63 billion by 2031, exhibiting a CAGR of 23.58% during the forecast period.

Market growth is driven by increasing demand for sustainable and environmentally friendly construction materials across various industries. The shift toward green infrastructure and the growing emphasis on reducing carbon emissions have led to a surge in the adoption of geopolymers as sustainable alternatives to traditional cement and concrete.

Their thermal stability, durability, and resistance to chemicals make them suitable for applications such as building materials, fireproofing, and waste encapsulation.

Major companies operating in the geopolymer industry are Wagners, Geopolymer Solutions, LLC, SLB, Cemex S.A.B DE C.V., Critica Infrastructure, Alchemy Geopolymer Solutions, URETEK Baltic, Betolar PLC, ČLUZ a.s., RENCA Inc, Kiran Global Chem Limited, Lucideon, Vortex Companies, Pyromeral Systems, and Ecomaterials.

Increased investment in research and development has further expanded the use of geopolymers in the transportation, defense, and industrial manufacturing. The market is further benefiting from supportive government regulations promoting low-emission construction practices and the development of eco-efficient materials.

Key Highlights:

- The geopolymer industry size was valued at USD 10.23 billion in 2023.

- The market is projected to grow at a CAGR of 23.58% from 2024 to 2031.

- Asia Pacific held a share of 43.09% in 2023, valued at USD 4.41 billion.

- The cement & concrete segment garnered USD 3.94 billion in revenue in 2023.

- The fly ash-based geopolymers segment is expected to reach USD 29.17 billion by 2031.

- The building & construction segment is projected to generate a revenue of USD 27.50 billion by 2031.

- North America is anticipated to grow at a CAGR of 23.82% over the forecast period.

Market Driver

Low-Carbon Alternatives and Industrial Byproduct Utilization

The expansion of the market is propelled by the increasing demand for sustainable alternatives to traditional Portland cement in the construction industry.

Geopolymer production eliminates the need for high-temperature kilns, significantly reducing carbon emissions. Its chemical compostition offers strong mechanical properties while aligning with global climate goals, positioning it as a preferred solution for eco-conscious construction.

Market expansion is further aided by the use of industrial byproducts such as fly ash and slag as raw materials, risch on aluminosilicate. This minimizes reliance on virgin resources and adds value to industrial waste . This enhances both emissions reduction and material efficiency, reinforcing geopolymers’ role in next-generation construction solutions.

Market Challenge

Regulatory Gaps and Standardization Hurdles

A significant challenge hampering the development of the geopolymer market is the lack of standardization and slow regulatory acceptance. Despite their proven performance and sustainability benefits, geopolymers are not supported by uniform industry standards or widely recognized building codes.

This is largely due to the variability in their formulations, often derived from industrial byproducts such as fly ash, slag, or calcined clays, which can lead to inconsistent mechanical properties and durability properties. Moreover, unlike Portland cement, geopolymers lack long-term field data and established benchmarks necessary to validatetheir reliability across diverse structural and enviornmental conditions.

This lack of standardization hinders regulatory approval of geopolymer products for critical infrastructure, prompting engineers and contractors to avoid them due to compliance, liability, and performance concerns. This has led to fragmented market, with manufacturers facing varying regional or project-specific requirements, increasing costs, and limiting scalability.

To address this challenge, stakeholders across the value chain are collaborating to develop global standards and certifications through long-term performance studies, third-party validations, and guidelines byfrom industry associations and research institutions.

Market Trend

3D Printing Integration and Circular Construction Practices

A key trend influencing the market is the integration of 3D printing technology with geopolymer materials, enabling effieicnet production of complex, custom-designed structures while reducing formwork , construction time, and material waste. Additionally, the construction sector is increasingly adopting circular economy practices, emphasizing reuse, recycling, and minimal lifecycle impact.

Geopolymers align well with this goals by utilizing industrial by-products, promoting resource recovery and long-term sustainability. These developments are redefining construction by combining innovation with environmental responsibility.

Geopolymer Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Cement & Concrete, Refractories & Binders, Composites

|

|

By Raw Material

|

Fly Ash-based Geopolymers, Slag-based Geopolymers, Kaolin-based Geopolymers

|

|

By Application

|

Building & Construction, Automotive & Aerospace, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Cement & Concrete, Refractories & Binders, Composites, and Others): The cement & concrete segment earned USD 3.94 billion in 2023 due to its widespread use as a sustainable alternative in infrastructure and residential construction projects.

- By Raw Material (Fly Ash-based Geopolymers, Slag-based Geopolymers, and Kaolin-based Geopolymers): The fly ash-based geopolymers segment held a share of 52.40% in 2023, attributed to the abundant availability of fly ash and its proven performance in reducing carbon footprints.

- By Application (Building & Construction, Automotive & Aerospace, Industrial, and Others): The building & construction segment is projected to reach USD 27.50 billion by 2031, propeeled by rising investments in eco-friendly construction and increasing regulatory support for green building materials.

Geopolymer Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific geopolymer market accounted for a substantial share of 43.09% in 2023, valued at USD 4.41 billion. This dominance is supported by the region's strong manufacturing base, particularly in China, Japan, and South Korea, where geopolymers are increasingly integrated into industrial and infrastructural processes.

The construction boom fueled by large-scale urbanization projects, including smart cities and high-speed rail networks, is fueling demand for advanced construction materials. Moreover, the region’s active mining and metal industries ensure a steady supply of by-products such as fly ash and slag, supporting large-scale, cost-effective production.

North America geopolymer industry is expected to register the fastest CAGR of 23.82% over the forecast period. This growth is fueled by increasing defense and aerospace applications in the U.S., where geopolymers are valued for their thermal and fire-resistant properties.

Academic and institutional research ihas been vital for advancing material innovation, supporting the commercialization of high-performance formulations. Strategic collaborations among universities, government agencies, and private companies are accelerating the adoption of geoploymers in sectors beyond construction, including waste encapsulation and energy sectors.

- In March 2025, Vortex Europe GmbH announced that its Quadex GeoKrete geopolymer mortar received DIBt certification, authorizing its use in Germany for wastewater infrastructure rehabilitation. The certification affirms its corrosion resistance, structural durability, and environmental compliance, strenghtheing its position in the European trenchless construction market.

Regulatory Frameworks

- In the United States, In the United States, the use of geopolymers involving industrial by-products such as fly ash is regulated by the Environmental Protection Agency (EPA) under the Resource Conservation and Recovery Act (RCRA).

- In the European Union, geopolymers are regulated under the Construction Products Regulation, which ensures structural integrity and environmental safety. Performance and durability standards are set by CEN (European Committee for Standardization), with guidelines covering alternativeand low-clinker cements such as geopolymers.

- In China, geopolymers are overssen by the Ministry of Housing and Urban-Rural Development and must meet comply with GB/T standards for inorganic construction materials. Environmental oversight in the reuse of industrial waste is provided by the Ministry of Ecology and Environment.

- In Japan, geopolymers are indirectly regulated through structural material standards set by the Japan Industrial Standards (JIS) and the Architectural Institute of Japan (AIJ). Environmental compliance is governed by the Ministry of the Environment and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), particularly when using industrial by-products such as blast furnace slag.

Competitive Landscape

The geopolymer market is characterized by key players focusing on strategic initiatives to strengthen their market presence and expand application areas.

Leading companies are heavily investing in R&D to refine geopolymers formulations for enhanced performance across sectors such as construction, aerospace, and industrial manufacturing. Partnerships with academic institutions and research centers are fostering innovation and validating new material technologies.

Several players are forming joint ventures and strategic alliances to localize production capabilities, particularly in high-demand regions and reduce supply chain dependencies. Mergers and acquisitions are being employed to integrate raw material sources or specialized technologies, enhancing control over quality and cost.

Additionally, pilot projects are being scaled into commercial operations, supported by proprietary manufacturing techniques that ensure consistency, scalability, and regulatory compliance across multiple end-use applications.

List of Key Companies in Geopolymer Market:

- Wagners

- Geopolymer Solutions, LLC

- SLB

- Cemex S.A.B DE C.V.

- Critica Infrastructure

- Alchemy Geopolymer Solutions

- URETEK Baltic

- Betolar PLC

- ČLUZ a.s.

- RENCA Inc

- Kiran Global Chem Limited

- Lucideon

- Vortex Companies

- Pyromeral Systems

- Ecomaterials

Recent Developments (New Product Launch)

- In July 2024, Verra released the VMR0012 methodology under the Verified Carbon Standard (VCS) Program for the production of geopolymer cement. This revision of the CDM methodology AM0125 strengthens methodological integrity by incorporating a discount factor for upstream emission reductions and enables a broader range of low-carbon cement projects to generate carbon credits and access climate finance.