Market Definition

The functional films market encompasses a wide range of advanced polymeric and composite films designed to offer specific functional properties, such as optical enhancement, electrical conductivity, thermal insulation, or barrier protection.

These films are formulated using materials like polyethylene terephthalate (PET), polyvinyl chloride (PVC), polypropylene (PP), and other high-performance polymers, often combined with coatings or nanomaterials to enhance their properties.

Functional films find applications across multiple industries, including electronics, automotive, packaging, construction, and healthcare. They are extensively used in displays, photovoltaic modules, touchscreens, insulation systems, protective coatings, and antimicrobial surfaces, making them essential components in modern technological advancements.

Functional Films Market Overview

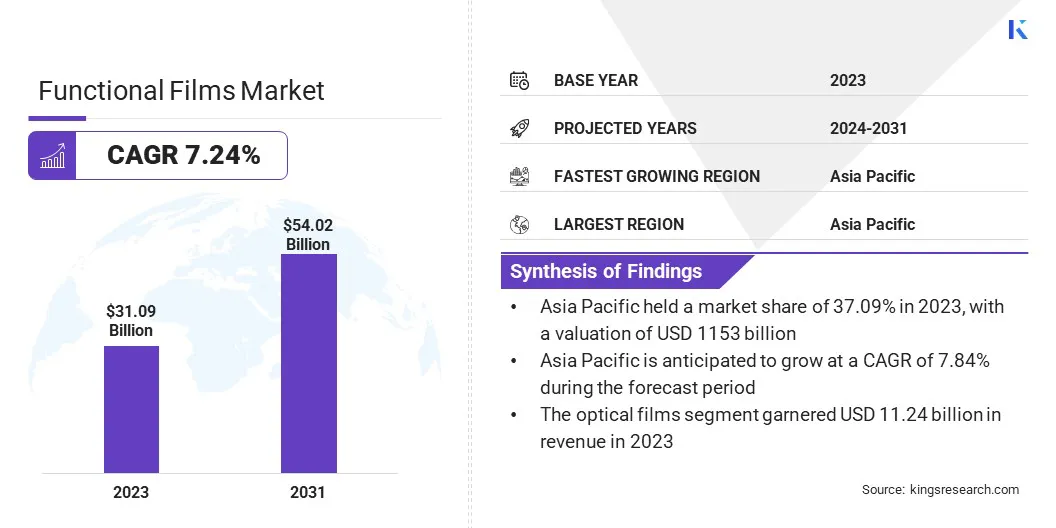

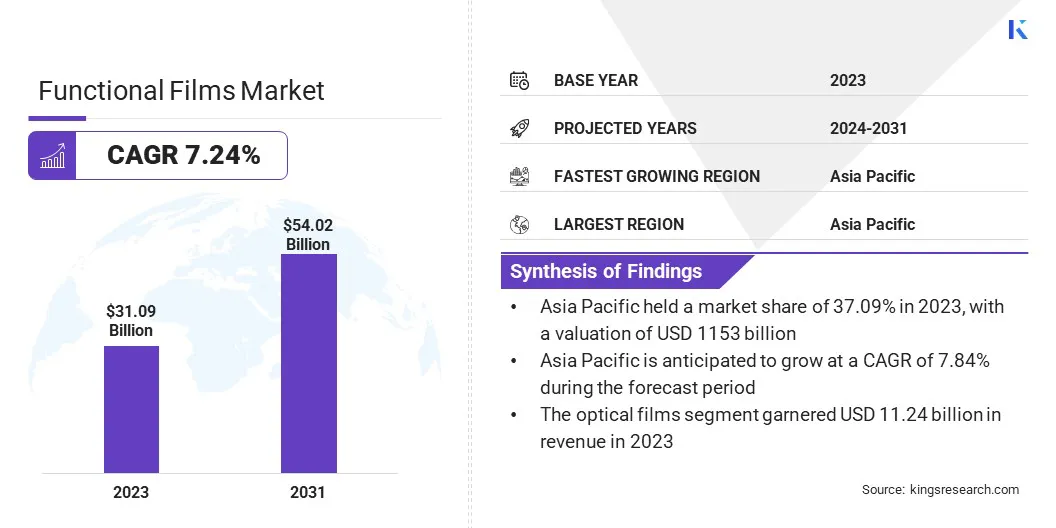

The global functional films market size was valued at USD 31.09 billion in 2023 and is projected to grow from USD 33.11 billion in 2024 to USD 54.02 billion by 2031, exhibiting a CAGR of 7.24% during the forecast period. The market is growing, due to the increasing demand for advanced display technologies and energy-efficient solutions in the construction sector.

Rising adoption of OLED and flexible displays in consumer electronics is driving the need for high-performance optical films. Additionally, growing investments in solar energy are fueling the demand for photovoltaic films, which enhance energy conversion efficiency and durability, further contributing to market expansion.

Major companies operating in the global functional films industry are 3M, Eastman Chemical Company, DuPont, Mitsubishi Chemical Group Corporation., Toray Industries, Inc., Teijin Limited, Covestro AG, Sumitomo Chemical Company, Limited, FILMTACK PTE LTD., LG Chem, Ltd., Saint-Gobain, Nanofilm, Kuraray Co., Ltd., Dai Nippon Printing Co., Ltd., and Mondi.

The surge in demand for high-performance displays is fueling the market. Consumer electronics manufacturers are incorporating advanced films into OLED screens, LCD panels, and touchscreen interfaces to improve durability, optical clarity, and anti-glare properties. The shift toward flexible and foldable displays has increased the need for thin, high-strength films with enhanced conductivity and protective coatings.

Rising investments in next-generation display technologies, including quantum dot and micro-LED screens, are accelerating the adoption of specialty films. The proliferation of smart devices, wearables, and augmented reality applications is further supporting the expansion of the market.

- In December 2023, Hon Hai Technology Group and Poro Technologies Ltd announced a strategic collaboration in MicroLED microdisplays for augmented reality (AR) applications. This partnership combines Foxconn’s expertise in semiconductor wafer manufacturing, packaging, IC drivers, CMOS backplanes, module assembly, and system integration with Porotech’s cutting-edge technologies, including PoroGaN MicroLED-on-Silicon (uLEDoS), Dynamic Pixel Tuning (DPT), and its GaN-on-Silicon platform. This collaboration enables both companies to accelerate the research and commercialization of MicroLED technology, driving the advancement of AR applications into a new era.

Key Highlights:

- The global functional films market size was valued at USD 31.09 billion in 2023.

- The market is projected to grow at a CAGR of 7.24% from 2024 to 2031.

- Asia Pacific held a market share of 37.09% in 2023, with a valuation of USD 11.53 billion.

- The optical films segment garnered USD 11.24 billion in revenue in 2023.

- The polyethylene terephthalate (PET) segment is expected to reach USD 20.28 billion by 2031.

- The construction segment is poised for a robust CAGR of 10.71% through the forecast period.

- The market in North America is anticipated to grow at a CAGR of 7.25% during the forecast period.

Market Driver

"Growing Adoption of Functional Films in the Construction Sector"

The increasing demand for energy-efficient and protective coatings in the construction sector is driving the market. Functional films are widely used in architectural glass for UV protection, heat insulation, and glare reduction.

Smart glass technologies incorporating switchable films are enhancing building efficiency by controlling light transmission. Safety films designed to prevent glass shattering are gaining traction in commercial and residential properties.

- In March 2024, Window Films Depot (WFD), an authorized 3M Dealer, announced its involvement in the launch of the 3M ScotchShield Security Window Films S2400. Engineered to strengthen security measures, these advanced 3M films are set to revolutionize window protection across various industries. Key applications of these films include safety glazing, blast mitigation, break-in deterrence, and minimizing the risk of spontaneous glass breakage.

Furthermore, the expansion of green building initiatives and stringent energy efficiency regulations have accelerated the adoption of films that improve insulation and reduce cooling costs, strengthening their role in sustainable infrastructure development.

Market Challenge

"High Production Costs and Complex Manufacturing Processes"

The growth of the functional films market is hindered by high production costs and the complexity of manufacturing advanced films materials. The development of high-performance films requires specialized raw materials, precision engineering, and stringent quality control, leading to increased operational expenses.

Companies are investing in advanced manufacturing technologies, automation, and material innovations to enhance production efficiency and reduce costs. Strategic partnerships and collaborations with research institutions are also helping manufacturers develop cost-effective formulations while maintaining high performance, ensuring long-term market competitiveness.

Market Trend

"Increasing Demand for Lightweight and High-strength Materials in Aerospace and Industrial Applications"

The adoption of functional films in the aerospace and industrial sectors are contributing to the expansion of the functional films market with the rising demand for lightweight, high-strength materials. Functional films are playing a crucial role in enhancing structural integrity, thermal management, and corrosion resistance in aerospace components.

The push for fuel efficiency and material optimization is accelerating the use of lightweight films in aircraft interiors, windows, and protective surfaces. Industrial applications, including manufacturing, chemical processing, and protective coatings, are driving the demand for films with superior mechanical strength, chemical resistance, and thermal insulation. The increasing focus on performance-driven materials is further strengthening the market.

- In January 2024, Toray Industries, Inc. developed plastic films with a tensile strength of up to 1,200 megapascals, rivaling the strength of stainless steel. This material combines the lightweight, insulating, and flexible properties of polymers, making it suitable for superconductivity, space exploration, and cryogenic applications. Its nanostructure enables a maximum in-plane thermal conductivity of 18 watts per meter-kelvin. Additionally, the films exhibit high chemical resistance, low moisture absorption, and a low dielectric constant, offering performance characteristics comparable to fluoropolymers.

Functional Films Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Optical Films, Conductive Films, Adhesive Films, Water-soluble Films, Protective Films

|

|

By Material

|

Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyimide (PI), Others

|

|

By Application

|

Flat Panel Displays, Electronics & Semiconductors, Automotive, Construction, Energy, Healthcare & Pharmaceuticals

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Optical Films, Conductive Films, Adhesive Films, Water-soluble Films, and Protective Films): The optical films segment earned USD 11.24 billion in 2023, due to the increasing adoption of high-performance display technologies in consumer electronics, automotive displays, and solar panels, where these films enhance light transmission, glare reduction, and energy efficiency.

- By Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyimide (PI), and Others): The polyethylene terephthalate (PET) segment held 34.21% share of the market in 2023, due to its superior mechanical strength, thermal stability, and excellent barrier properties, making it highly suitable for applications in flexible electronics, optical films, and high-performance packaging.

- By Application (Flat Panel Displays, Electronics & Semiconductors, Automotive, Construction, Energy, and Healthcare & Pharmaceuticals): The construction segment is poised for significant growth at a CAGR of 10.71% through the forecast period, due to the rising adoption of energy-efficient glazing, protective coatings, and weather-resistant films, driven by building regulations and increasing demand for sustainable infrastructure.

Functional Films Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a functional films market share of around 37.09% in 2023, with a valuation of USD 11.53 billion. The market in Asia Pacific is registering growth, driven by the region’s dominance in electronics and display manufacturing. Countries such as China, South Korea, and Taiwan are global leaders in producing OLED, LCD, and microLED panels, increasing the demand for high-performance optical, conductive, and protective films.

The presence of major display manufacturers, including BOE Technology, LG Display, and AU Optronics, has led to the extensive adoption of advanced functional films for improving durability, brightness, and energy efficiency in next-generation screens. The rapid expansion of consumer electronics and smart device production further strengthens the demand for innovative films technologies in the region.

The rapid expansion of the Electric Vehicle (EV) market in Asia Pacific is accelerating the demand for functional films in automotive applications. China, the world’s largest EV market, and emerging players such as India and South Korea are increasing the adoption of advanced films for battery insulation, thermal management, and smart glass applications.

- The International Energy Agency (IEA) reported that China registered 8.1 million new electric cars in 2023, marking a 35% increase from the previous year.

The push for intelligent vehicle technologies, including heads-up displays (HUDs) and adaptive window tinting, is further driving innovation in automotive functional films. Government incentives promoting EV adoption, coupled with investments in vehicle lightweighting solutions, are expanding the role of high-performance films in improving energy efficiency and vehicle safety.

The functional films industry in North America is poised for significant growth at a robust CAGR of 7.25% over the forecast period. The market in North America is registering significant growth, due to the rising demand for energy-efficient solutions in commercial and residential buildings.

The adoption of smart window films, including electrochromic and thermochromic variants, is increasing as builders and homeowners seek to enhance energy savings and indoor comfort.

Government regulations, such as the U.S. Department of Energy’s initiatives promoting energy-efficient construction, and state-level incentives for smart glass installations are further driving demand. The rising popularity of net-zero energy buildings and Leadership in Energy and Environmental Design (LEED) certifications is accelerating the integration of advanced functional films in building envelopes.

Furthermore, the increasing focus on national security and defense modernization in North America is driving the demand for functional films used in ballistic protection, infrared camouflage, and sensor technology. The U.S. Department of Defense and Canadian military contractors are integrating smart films into protective eyewear, vehicle armor, and stealth coatings to enhance operational capabilities.

Anti-fog and anti-scratch films are also gaining traction in defense-grade optics and helmet visors. With continuous investment in next-generation defense technologies, functional films are becoming critical components in military and law enforcement applications.

Regulatory Frameworks:

- In the U.S, the Environmental Protection Agency (EPA) enforces the Toxic Substances Control Act (TSCA), which mandates reporting, record-keeping, and testing requirements for chemical substances, including those used in functional films. Additionally, the Occupational Safety and Health Administration (OSHA) sets standards to ensure safe working conditions, including exposure limits to hazardous chemicals during manufacturing processes.

- The European Chemicals Agency (ECHA) administers the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation, requiring manufacturers and importers to register chemical substances used in functional films. The Restriction of Hazardous Substances (RoHS) Directive restricts the use of specific hazardous materials in electrical and electronic equipment, impacting functional films used in these applications. The European Chemicals Agency (ECHA) oversees compliance with these regulations.

- In China, the Ministry of Ecology and Environment (MEE) oversees the Regulation on the Environmental Management of New Chemical Substances (China REACH), requiring registration of new chemical substances used in functional films. The National Standardization Technical Committee on Plastics (SAC/TC15) sets standards for plastic films, including those with functional properties, to ensure quality and safety.

- In Japan, the Chemical Substances Control Law (CSCL) regulates the manufacture and import of chemical substances, including those used in functional films, to prevent environmental pollution. The Ministry of Economy, Trade, and Industry (METI) enforces these regulations, ensuring that substances are evaluated for safety before use.

Competitive Landscape

The global functional films market is characterized by several market players that implement strategies such as expanding production facilities to strengthen their market presence and meet the rising demand for functional films. Companies are investing in advanced manufacturing technologies and increasing their production capacities to enhance efficiency and cater to diverse industry needs.

This expansion allows manufacturers to streamline operations, improve supply chain management, and offer a wider range of high-performance films. Additionally, the establishment of new production plants in key regions enables companies to reduce lead times and gain a competitive edge. These strategic investments are contributing significantly to the growth of the market.

- In October 2024, the Mitsubishi Chemical Group announced plans to expand its production facility for optical polyvinyl alcohol (PVOH) films at its Central Japan-Ogaki (Kanda) Plant. The upgraded facility is set to commence operations in the second half of FY2027, incorporating advanced technology to enhance both quality and productivity beyond conventional standards. With a single-line production capacity of 27 million square meters per year, this expansion is expected to increase the company's total production capacity to 154 million square meters annually.

List of Key Companies in Functional Films Market:

- 3M

- Eastman Chemical Company

- DuPont

- Mitsubishi Chemical Group Corporation.

- Toray Industries, Inc.

- Teijin Limited

- Covestro AG

- Sumitomo Chemical Company, Limited

- FILMTACK PTE LTD.

- LG Chem, Ltd.

- Saint-Gobain

- Nanofilm

- Kuraray Co., Ltd.

- Dai Nippon Printing Co., Ltd.

- Mondi

Recent Developments (Partnerships/Agreements/Expansion/Product Launch)

- In December 2024, Toray Industries, Inc. announced the expansion of its REACTIS high-recovery films technology with the development of a stretchable film featuring a high dielectric constant and superior recoverability. Integrating this advanced film into dielectric elastomer actuators is expected to enhance the responsiveness of soft robots, creating applications in healthcare, medical, and industrial sectors to improve quality of life.

- In May 2024, Toray Industries, Inc., Dow Inc., Comexi Group Industries, S.A.U., Sakata Inx Corporation, and SGK Japan jointly announced the development of a surface printing mono-material films packaging technology. Designed for diverse applications in food and daily necessities, this innovation aligns with the European Union’s Packaging and Packaging Waste Regulation, supporting the transition toward a low-carbon, circular global economy.

- In April 2024, LG Chem announced the successful development of SGF (Switchable Glazing Film) and signed a nomination agreement with Webasto, a Germany-based company and global leader in sunroof systems. Under this agreement, LG Chem will supply SGF films to Webasto. SGF is an innovative film that regulates light and heat transmission by responding to electrical signals, offering advanced control over glazing performance.

- In December 2024, LG Chem and extrusion machine manufacturer Reifenhäuser signed a Memorandum of Understanding (MOU) to strengthen their collaboration. The partnership focuses on advancing and commercializing high-performance Machine Direction Oriented (MDO)-PE blown films and flat films for recyclable packaging, enhancing sustainability in the packaging industry.