Market Definition

The market includes the use of high-frequency sound waves to enhance food processing tasks such as extraction, homogenization, crystallization, drying, and preservation. This technology supports cleaner formulations by reducing the need for chemical additives.

It is used across dairy, meat, beverages, and bakery sectors for improving texture, flavor release, and shelf life. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Food Ultrasound Market Overview

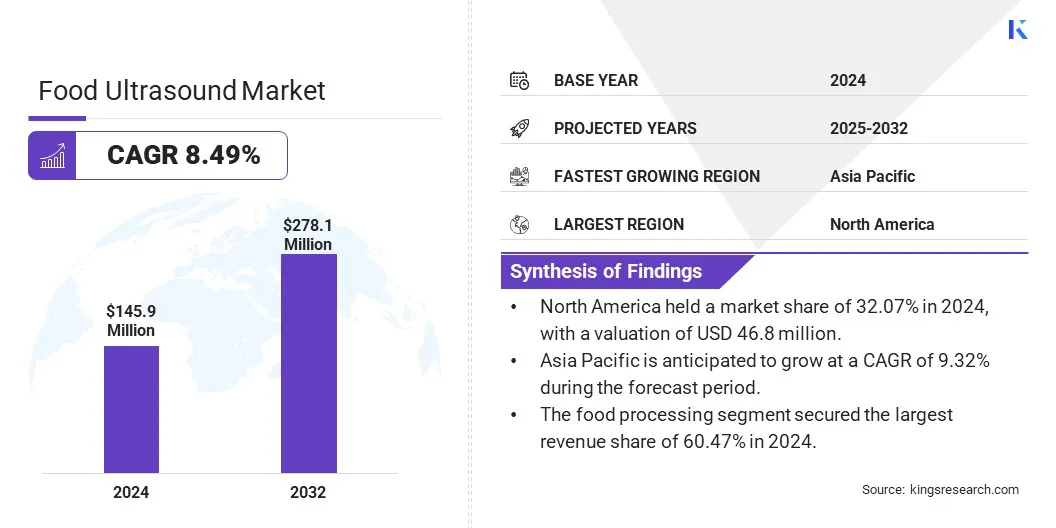

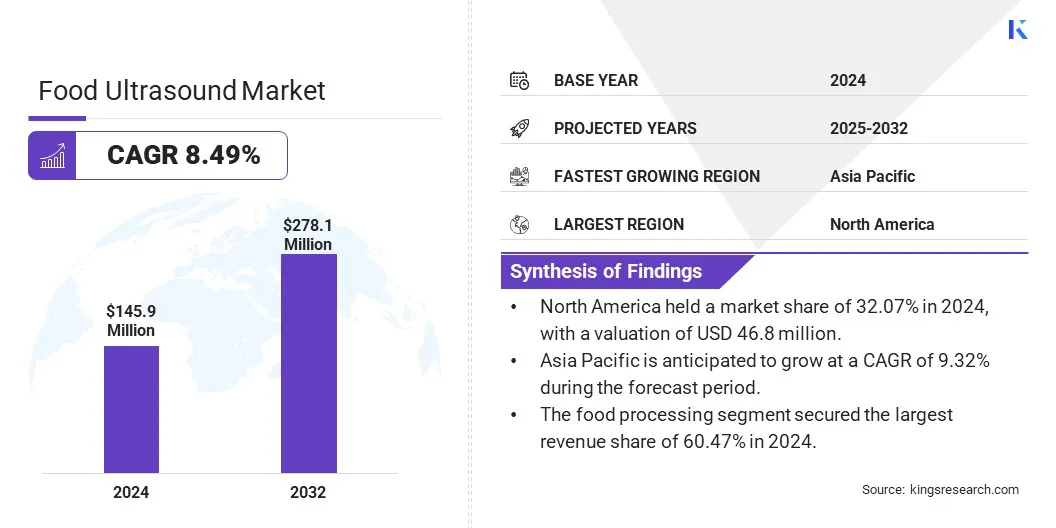

The global food ultrasound market size was valued at USD 145.9 million in 2024 and is projected to grow from USD 157.2 million in 2025 to USD 278.1 million by 2032, exhibiting a CAGR of 8.49% during the forecast period.

The market is driven by the rising preference for cleaner formulations, as manufacturers seek to reduce chemical additives while maintaining product quality. Additionally, the integration of ultrasound with hybrid food processing technologies enhances efficiency and functionality, making it a preferred solution in modern food manufacturing environments.

Major companies operating in the food ultrasound industry are Robert Bosch GmbH, Bühler, Siemens, General Electric Company, Emerson Electric Co, Dukane Corp., Hielscher Ultrasonics GmbH, newtech, CHEERSONIC ULTRASONICS EQUIPMENTS CO., LIMITED, Rinco Ultrasonics, Revvity (Omni Inc.), Sonics & Materials, Inc., Elliptical Design, Marchant Schmidt, and Sonomechanics.

The increasing focus on non-thermal processing methods is driving the growth of the market. Food companies are shifting toward technologies that preserve nutritional and sensory properties without using heat. Ultrasound processing achieves microbial safety while maintaining product integrity.

As a result, it is increasingly adopted in applications such as juice clarification, dairy preservation, and meat tenderization. The market is driven by the use of processors aimed at offering clean-label food with extended shelf life and minimal changes in taste or texture.

- In November 2024, researchers at North Carolina A&T State University developed a variable-frequency non-thermal ultrasonic drying prototype. This technology significantly reduces drying time and energy consumption for fruits, vegetables, and plant proteins, maintaining high-quality attributes comparable to freeze-dried products.

Key Highlights

- The food ultrasound industry size was valued at USD 145.9 million in 2024.

- The market is projected to grow at a CAGR of 8.49% from 2025 to 2032.

- North America held a market share of 32.07% in 2024, with a valuation of USD 46.8 million.

- The quality assurance segment garnered USD 50.0 million in revenue in 2024.

- The meat & seafood segment is expected to reach USD 112.5 million by 2032.

- The food processing segment secured the largest revenue share of 60.47% in 2024.

- The food processing industries segment is poised for a robust CAGR of 8.76% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.32% during the forecast period.

Market Driver

Rising Preference for Cleaner Formulations

The food ultrasound market is witnessing growth due to rising demand for products with fewer chemical additives. Ultrasonic techniques help reduce or eliminate the need for preservatives by enhancing microbial inactivation. This aligns with clean-label trends, where consumers prefer food with natural ingredients.

Ultrasound-assisted processes, such as emulsification and extraction, improve stability and quality without synthetic agents. Manufacturers are adopting this technology to meet regulatory expectations and changing consumer preferences around food composition.

- In October 2024, researchers at the International Iberian Nanotechnology Laboratory developed a plant-based mayonnaise using ultrasound-assisted emulsification. This method incorporated lupin protein, citrus fiber, and psyllium to create a stable nanoemulsion without synthetic additives. The resulting mayonnaise maintained quality and texture for 50 days under refrigeration, demonstrating the potential of ultrasound technology in producing clean-label food products.

Market Challenge

High Initial Investment and Equipment Cost

A significant challenge hindering the growth of the food ultrasound market is the high cost of advanced ultrasonic equipment and system integration. Many small and mid-sized food processors hesitate to adopt this technology due to budget limitations and uncertainty about return on investment.

To address this, key players are developing modular and scalable systems that allow gradual integration into existing production lines. Moreover, manufacturers are offering leasing options or pilot-scale trials to reduce financial risk. Collaborations with research institutions are also helping to create cost-effective designs, making ultrasound technology more accessible to a broader range of food producers.

Market Trend

Integration with Hybrid Food Processing Technologies

The combination of ultrasound with other advanced technologies such as pulsed electric fields, high-pressure processing, and microwave heating is expanding its industrial relevance. These hybrid methods enhance process efficiency and improve outcomes in complex food systems.

The expansion of the food ultrasound market is supported by its compatibility with multi-step processing, especially in high-throughput environments. Such integration allows manufacturers to optimize texture, flavor, and stability while achieving better energy and time management.

- In August 2023, CSIRO patented a process enabling oil recovery during both aqueous-based edible oil extraction processes and oil refining by applying high frequencies beyond 400 kHz, known as megasonics. This technology will be commercially used in the palm oil industry to recover an additional 200,000 liters of crude oil per annum in a traditional palm oil plant.

Food Ultrasound Market Report Snapshot

|

Segmentation

|

Details

|

|

By Function

|

Quality Assurance, Microbial Inactivation, Homogenization, Cleaning, Emulsification, Others

|

|

By Food Product

|

Meat & Seafood, Fruits & Vegetables, Dairy Products, Beverages, Bakery & Confectionery, Others

|

|

By Application

|

Food Processing, Food Preservation, Food Analysis/Testing

|

|

By End User

|

Food Processing Industries, Research Institutions, Testing Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Function (Quality Assurance, Microbial Inactivation, Homogenization, Cleaning, Emulsification, and Others): The quality assurance segment earned USD 50.0 million in 2024 due to its critical role in ensuring consistent product safety, texture, and shelf life across diverse food categories.

- By Food Product (Meat & Seafood, Fruits & Vegetables, Dairy Products, Beverages, Bakery & Confectionery, and Others): The meat & seafood segment held 39.45% of the market in 2024, due to its high demand for non-thermal processing methods that improve shelf life, texture, and microbial safety without compromising product quality.

- By Application (Food Processing, Food Preservation, and Food Analysis/Testing): The food processing segment is projected to reach USD 172.1 million by 2032, owing to its widespread adoption for improving product texture, shelf life, and processing efficiency across diverse food categories.

- By End User (Food Processing Industries, Research Institutions, and Testing Laboratories): The food processing industries segment is poised for significant growth at a CAGR of 8.76% through the forecast period, attributed to its large-scale adoption of ultrasound technology for enhancing product quality, shelf life, and processing efficiency across diverse applications.

Food Ultrasound Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America food ultrasound market share stood at around 32.07% in 2024 in the global market, with a valuation of USD 46.8 million. North America’s strict food safety standards encourage food processors to adopt advanced technologies like ultrasound.

The demand for safer, minimally processed foods pushes manufacturers to use ultrasound for effective microbial control and quality retention, driving regional market growth. Moreover, consumers in North America increasingly prefer foods with fewer additives and preservatives. Ultrasound technology helps produce cleaner formulations by reducing the need for chemicals, supporting the region’s shift toward natural and transparent food labeling.

Asia Pacific is poised for significant growth at a CAGR of 9.32% over the forecast period. The region’s growing food processing sector is investing in advanced technologies to enhance product safety and efficiency. Ultrasound systems offer cost-effective solutions for improving texture, flavor, and preservation, encouraging their adoption.

Furthermore, the growing consumer preference for functional and fortified foods is prompting manufacturers to use ultrasound for extracting bioactive compounds efficiently. This is boosting the market in the Asia Pacific by expanding its use in nutraceutical and health-focused products.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) oversees regulations related to food processing technologies, including ultrasound. Ultrasound applications are regulated under the FDA’s Food Additive Petition process or as part of the Generally Recognized As Safe (GRAS) status for processing aids. Manufacturers must demonstrate that ultrasound processing does not adversely affect food safety or quality. The FDA also monitors ultrasound when used for microbial inactivation to ensure compliance with pasteurization standards.

- European regulations follow the European Food Safety Authority (EFSA) guidelines, which evaluate emerging food technologies including ultrasound. In the UK and Germany, ultrasound use in food processing must comply with the EU’s Novel Food Regulation (EU) 2015/2283 when ultrasound changes the food’s structure or composition significantly. Safety assessments must confirm no harmful effects arise from processing.

- In China, the National Health Commission alongside the State Administration for Market Regulation (SAMR) regulates food processing technologies. Ultrasound processing requires product-specific safety assessments to meet the Food Safety Law standards, emphasizing microbial safety and ingredient integrity.

- India’s Food Safety and Standards Authority of India (FSSAI) governs food processing innovations, requiring manufacturers to submit detailed safety data before commercial application of ultrasound. The regulatory framework emphasizes adherence to Good Manufacturing Practices (GMP) and Hazard Analysis Critical Control Point (HACCP) principles.

Competitive Landscape

Market players are actively investing in research and development to push the boundaries of ultrasound technology in food processing. These efforts focus on designing equipment with greater precision, energy efficiency, and adaptability to diverse food types, including solids, liquids, and emulsions.

Advances in technology are enabling improved control over processing parameters like frequency and power, resulting in higher product quality and consistency. By continuously innovating, companies can address specific industry challenges, reduce production times, and lower operational costs.

List of Key Companies in Food Ultrasound Market:

- Robert Bosch GmbH

- Bühler

- Siemens

- General Electric Company

- Emerson Electric Co

- Dukane Corp.

- Hielscher Ultrasonics GmbH

- newtech

- CHEERSONIC ULTRASONICS EQUIPMENTS CO., LIMITED

- Rinco Ultrasonics

- Revvity (Omni Inc.)

- Sonics & Materials, Inc.

- Elliptical Design

- Marchant Schmidt

- Sonomechanics

Recent Developments (Product Launch)

- In April 2025, Fujitsu introduced the Sonofai machine in Kawasaki, Japan, which utilizes ultrasound waves and artificial intelligence to assess the fattiness of tuna fish, a key quality determinant in sashimi and sushi. This method significantly reduces the time required for assessment from about 60 seconds to just 12 seconds per fish. The machine is designed for operators without prior expertise, ensuring efficiency and hygiene in commercial fish-processing settings.