Market Definition

The market involves the design, manufacturing, and distribution of equipment that uses fluid (usually hydraulic or pneumatic) to transmit and control power. The report presents a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscape, which are expected to determine the growth dynamics throughout the forecast period.

Fluid Power Equipment Market Overview

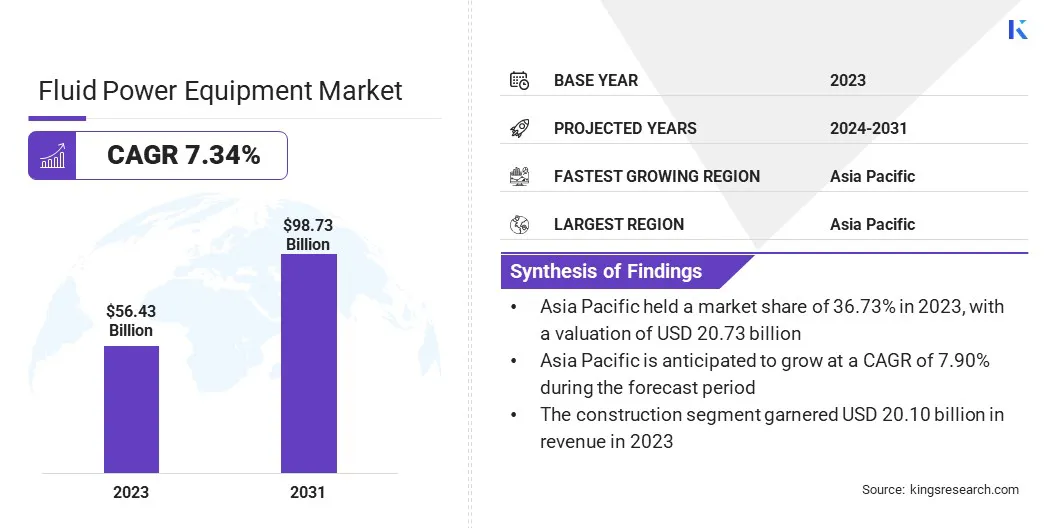

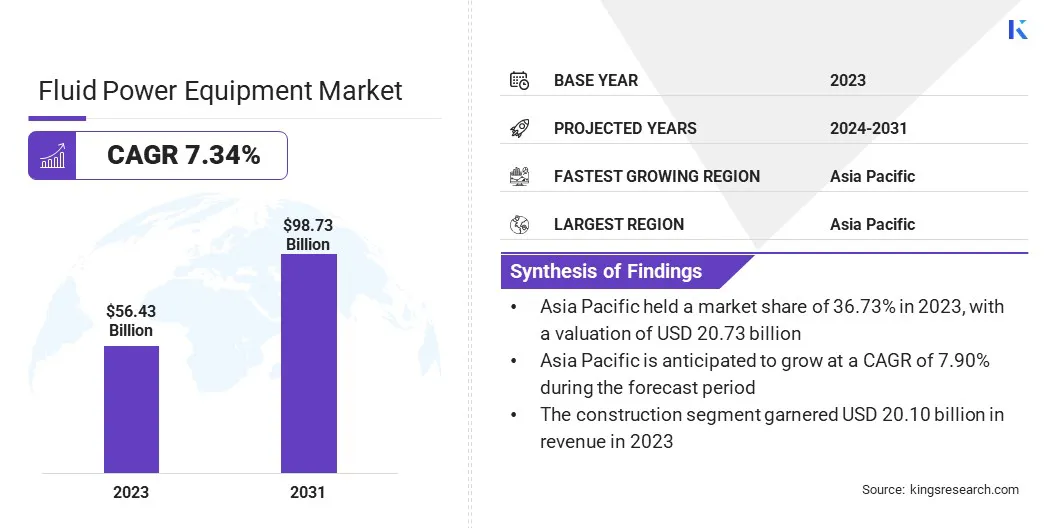

The global fluid power equipment market size was valued at USD 56.43 billion in 2023, which is estimated to be USD 60.14 billion in 2024 and reach USD 98.73 billion by 2031, growing at a CAGR of 7.34% from 2024 to 2031.

The growth of the automotive industry, particularly electric and hybrid vehicles, is driving the demand for fluid power systems, as these technologies are essential for various vehicle applications, enhancing efficiency and performance.

Major companies operating in the fluid power equipment industry are Robert Bosch GmbH, Eaton, PARKER HANNIFIN CORP, Kawasaki Heavy Industries, Ltd., Fluid Power Machines Private Limited, Altrad Sparrows, Applied Fluid Power Holdings, LLC, Suvera, Danfoss, SMC Corporation, Emerson Electric Co., Flowserve Corporation, HYDAC International GmbH., HYLOC HYDROTECHNIC PRIVATE LIMITED., and Mehta Hydraulics and Hoses.

The market encompasses systems that use hydraulic and pneumatic technologies to transmit and control power in various industries. These systems are essential in applications ranging from manufacturing and automotive to construction and agriculture. Fluid power equipment includes components like pumps, valves, actuators, and power units that enable machines to perform heavy tasks with precision and efficiency. Fluid power remains a critical technology for powering automated systems and improving operational capabilities across sectors.

- In January 2025, Cummins and Liberty Energy announced their partnership to develop and deploy the first-ever variable speed, large displacement natural gas engine to power Liberty’s digiPrime hydraulic fracturing platform, advancing fuel efficiency, reducing emissions, and enhancing operational performance in the energy sector.

Key Highlights:

- The fluid power equipment industry size was valued at USD 56.43 billion in 2023.

- The market is projected to grow at a CAGR of 7.34% from 2024 to 2031.

- Asia Pacific held a market share of 36.73% in 2023, with a valuation of USD 20.73 billion.

- The valves segment garnered USD 17.10 billion in revenue in 2023.

- The construction segment is expected to reach USD 36.26 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 7.10% during the forecast period.

Market Driver

Automotive Industry Growth

The expanding automotive industry, particularly the rise of electric and hybrid vehicles, significantly contributes to the demand for fluid power systems. Fluid power technologies, including hydraulic and pneumatic systems, are used in various automotive applications, such as steering, braking, and suspension systems, providing efficiency and precision.

Fluid power plays a crucial role in optimizing electric and hybrid vehicle systems as automakers increasingly prioritize sustainability and performance. This trend drives growth in the market as automakers adopt advanced fluid power solutions for next-gen vehicles.

As per the International Energy Agency (IEA), Electric Vehicle (EV) sales surged to nearly 14 million in 2023, representing 18% of total sales. This rise in electric and hybrid vehicles boosts the demand for fluid power systems, which are vital in enhancing efficiency and performance across automotive applications.

Market Challenge

Lack of Skilled Labor

A significant challenge facing the market is the lack of skilled labor, particularly in designing, maintaining, and repairing complex hydraulic and pneumatic systems. The demand for highly trained personnel to operate and troubleshoot these systems grows as technology advances.

Companies can invest in training programs, collaborate with technical schools, and promote STEM education. Additionally, offering certifications and hands-on training can help build a skilled workforce, ensuring a steady supply of qualified technicians for the evolving market.

Market Trend

Miniaturization

The trend of miniaturization in the market is gaining momentum, as smaller and more compact fluid power components are increasingly in demand. These miniaturized components offer enhanced efficiency, reduced weight, and improved performance, making them ideal for applications in industries like aerospace, automotive, and robotics.

The shift toward smaller, more powerful systems aligns with the need for space-saving, lightweight solutions in advanced machinery, while ensuring the same reliability and functionality as traditional, larger components.

- In January 2024, FPT Fluid Power Technology introduced portable mini pumps for hydraulic torque wrenches, emphasizing technological advancements in fluid power systems. These lightweight, compact pumps offer improved portability and performance, aligning with industry trends for more efficient and versatile equipment.

Fluid Power Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Pumps, Motors, Valves, Cylinders, Accumulators, Others

|

|

By End-user Industry

|

Construction, Automotive, Oil & Gas, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Pumps, Motors, Valves, Cylinders, Accumulators, Others): The valves segment earned USD 17.10 billion in 2023, due to the increased demand for advanced fluid control systems in various industrial applications, boosting overall market growth.

- By End-user Industry (Construction, Automotive, Oil & Gas, Manufacturing, Others): The construction segment held 35.62% share of the market in 2023, due to the rising adoption of hydraulic systems in heavy machinery, improving operational efficiency and performance in construction projects globally.

Fluid Power Equipment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 36.73% share of the fluid power equipment market in 2023, with a valuation of USD 20.73 billion. Rapid industrialization in Asia Pacific, particularly in manufacturing and construction, drives the demand for advanced fluid power systems in the region.

Additionally, the growing automotive sector, especially in countries like China, Japan, and India, further contributed to the market's expansion. The increasing adoption of automation, coupled with government initiatives to boost infrastructure development, is expected to maintain Asia Pacific’s leadership in the market.

The market in North America is poised for significant growth at a robust CAGR of 7.10% over the forecast period. North America is emerging as one of the fast-growing regions for the fluid power equipment industry, driven by increasing demand across various industries such as construction, automotive, and manufacturing.

The region's focus on technological advancements, infrastructure development, and industrial automation has significantly boosted the need for fluid power systems. Additionally, the presence of leading manufacturers and robust distribution networks has facilitated the adoption of innovative fluid power solutions. This growth is further supported by the ongoing push for sustainability and energy-efficient systems in key sectors.

- In April 2024, Dakota Fluid Power expanded its operations by opening a new storefront in Council Bluffs, IA. This expansion enhances their presence in North America, offering innovative fluid power products, technical expertise, and reliable service to a broader customer base

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) sets regulations for hydraulic and pneumatic components to ensure product safety and reliability.

- In the U.S., the Occupational Safety and Health Administration (OSHA) establishes safety standards for fluid power equipment in workplaces, focusing on operational hazards and worker safety.

- The European Union's Machinery Directive (2006/42/EC) mandates safety requirements for fluid power systems used in machinery and equipment.

Competitive Landscape:

Companies in the fluid power equipment industry are focusing on innovation by developing advanced hydraulic and pneumatic systems. They aim to enhance energy efficiency, improve reliability, and reduce maintenance costs.

Emphasis is placed on miniaturization, compactness, and sustainability, alongside expanding applications in various industries such as construction, manufacturing, and renewable energy, driving overall market growth.

- In February 2025, Kawasaki Heavy Industries introduced a high-capacity hydraulic booster hydrogen compressor (600 Nm³/h) for large-scale hydrogen refueling stations. This product highlights the focus on advanced hydraulic solutions to support emerging industries like hydrogen mobility and fuel cell vehicles.

List of Key Companies in Fluid Power Equipment Market:

- Robert Bosch GmbH

- Eaton

- PARKER HANNIFIN CORP

- Kawasaki Heavy Industries, Ltd.

- Fluid Power Machines Private Limited

- Altrad Sparrows

- Applied Fluid Power Holdings, LLC

- Suvera

- Danfoss

- SMC Corporation

- Emerson Electric Co.

- Flowserve Corporation

- HYDAC International GmbH.

- HYLOC HYDROTECHNIC PRIVATE LIMITED.

- Mehta Hydraulics and Hoses

Recent Developments (M&A/Product Launch)

- In January 2025, Halliburton and Coterra Energy launched the Octiv Auto Frac service, introducing autonomous hydraulic fracturing technology. This innovation, part of the ZEUS platform, automates fracture execution, improving efficiency and consistency, while advancing automation in the market.

- In November 2024, Applied Industrial Technologies announced its acquisition of Hydradyne, a leading provider of fluid power solutions. This strategic acquisition strengthens Applied’s position in fluid power, expanding its service offerings and technical capabilities, especially in the Southeast U.S.

- In March 2023, Fluid System Components (FSC) expanded its presence by acquiring Norcan Fluid Power, strengthening its position in North America. This acquisition enhances its service capabilities and geographic reach, enabling FSC to offer innovative fluid power solutions and engineering expertise across a broader market.