Market Definition

The market refers to the global industry focused on the development, production, integration, and maintenance of flight data recording systems used in aircraft. The market encompasses various stakeholders, including OEMs, airlines, military operators, and MRO service providers, and is governed by stringent international aviation regulations.

The report offers a thorough assessment of the main factors driving the market, along with detailed regional analysis and the competitive landscape influencing market dynamics.

Flight Data Recorder Market Overview

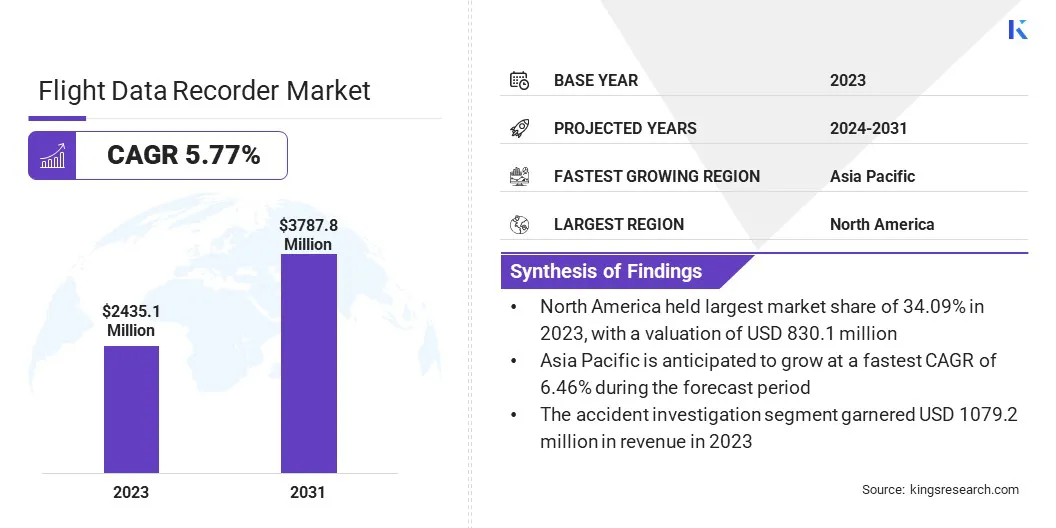

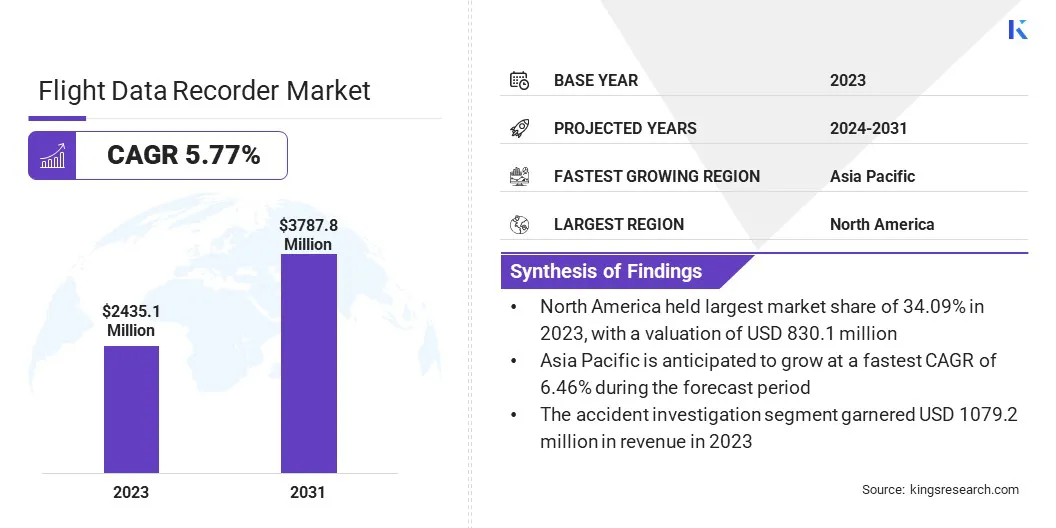

The global flight data recorder market size was valued at USD 2435.1 million in 2023 and is projected to grow from USD 2557.7 million in 2024 to USD 3787.8 million by 2031, exhibiting a CAGR of 5.77% during the forecast period.

The increasing emphasis on aviation safety and compliance is driving the demand for advanced Flight Data Recorders (FDRs). Airlines and aviation authorities are prioritizing the adoption of reliable, regulation-compliant recording systems to enhance overall flight safety as awareness grows around the critical role of flight data in accident investigations and operational efficiency.

Major companies operating in the flight data recorder industry are Elbit Systems Ltd., Safran, Honeywell International Inc., General Electric Company, Leonardo DRS, L3Harris Technologies, Inc., Curtiss-Wright Corporation, Teledyne Controls LLC, AstroNova, Inc., FLIGHT DATA SYSTEMS, AERTEC, SLN Technologies, AMETEK, Inc., Flight Data Vision, and Aversan.

The increasing emphasis on aviation safety regulations is a key factor driving the market. The stringent regulations by global aviation authorities, such as the Federal Aviation Administration and European Union Aviation Safety Agency, are mandating the use of advanced flight data recording systems to ensure compliance with safety protocols.

These regulations are pushing airlines and aircraft manufacturers to invest in innovative FDR technologies that meet safety and performance standards. As these regulations evolve, they will continue to drive the demand for more advanced and reliable flight data monitoring solutions, expanding the overall market opportunities.

- In Europe, ORO.AOC.130 of Commission Regulation (EU) 965/2012 requires operators to establish and maintain a flight data monitoring programme for aeroplanes with a maximum certificated take-off mass (MTOW) of more than 27,000 kg. The programme must be integrated into the operator’s management system and follow non-punitive principles, ensuring adequate safeguards to protect the sources of the data. This regulation ensures enhanced safety and operational monitoring within the aviation industry.

Key Highlights:

- The flight data recorder market size was valued at USD 2435.1 million in 2023.

- The market is projected to grow at a CAGR of 5.77% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 830.1 million.

- The recorder units technology segment garnered USD 977.0 million in revenue in 2023.

- The flight data recorder segment is expected to reach USD 1638.3 million by 2031.

- The accident investigation segment held a market share of 44.32% in 2023.

- The aircraft OEMs segment is anticipated to grow at a CAGR of 6.99% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.46% during the forecast period.

Market Driver

Increasing Demand for Sustainable Flight Recorder Solutions

The increasing demand for advanced flight data recording technologies is significantly driving the market. Airlines and aviation companies seek to improve safety and meet the evolving regulatory standards. This drive for innovation reflects the growing need for more efficient, reliable, and sustainable systems in aviation, which are vital for maintaining operational safety and compliance.

- In April 2024, L3Harris Technologies finalized a significant deal with Air India to provide its SRVIVR25 voice and data recorders for the airline’s Boeing 737-8 fleet. This collaboration, covering 100 aircraft with an option for 40 more units, marks the first avionics partnership between L3Harris and Air India following the airline's acquisition by the Tata Group.

Market Challenge

High Cost of Advanced Technology

A major challenge for the flight data recorder market is the high cost of advanced FDRs and related technologies, which can be a barrier for smaller airlines and maintenance providers. This leads to limited adoption of FDRs, especially in emerging markets.

Companies are focusing on developing cost-effective solutions and offering flexible pricing models to make these technologies more accessible. They are also providing training and support services to help operators better understand the value and long-term benefits of investing in flight data management systems.

Market Trend

Advancement in Flight Recorder Technology

The trend toward lighter and more efficient flight data recorders is transforming the market, as companies focus on improving operational efficiency and reducing costs. The shift toward compact and adaptable systems is not only streamlining operations but also enabling easier integration with modern aircraft. Such technological advancements are shaping the future of flight data recording in the aviation industry.

- In November 2023, sensor solution provider HENSOLDT introduced its new Cockpit Voice and Flight Data Recorder (CVFDR) at the European Rotors 2023 event in Madrid. The CVFDR, designed for enhanced reliability and reduced weight, weighs just 2.8 kg (6.17 lbs), making it one of the lightest ED112A-certified combined recorders in the market. This new recorder features field-loadable software and allows data readout without needing to power the aircraft, improving maintenance flexibility.

Flight Data Recorder Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Recorder Units, Memory Modules, Data Management System, Interface & Accessories

|

|

By Type

|

Cockpit Voice Recorder (CVR) (Short-duration CVRs (2 hours), Long-duration CVRs (25+ hours), Combined CVR+FDR units), Flight Data Recorder (Solid-state FDRs, Magnetic tape FDRs (obsolete)), Combined Voice & Data Recorder (Integrated modular units, Deployable recorders)

|

|

By Application

|

Accident Investigation, Fleet Monitoring, Air Traffic Analysis, Performance Analysis

|

|

By End-Use Industry

|

Commercial Airlines, Defense & Military, Aircraft OEMs, Aviation Authorities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Recorder Units, Memory Modules, Data Management System, Interface & Accessories): The recorder units segment earned USD 977.0 million in 2023, due to the increasing demand for reliable FDRs and advancements in technology ensuring compliance with stricter safety regulations.

- By Type (Flight Data Recorder, Cockpit Voice Recorder, Combined Voice & Data Recorder): The flight data recorder (FDR) segment held 45.09% share of the market in 2023, due to its critical role in enhancing aviation safety by continuously recording important flight data and aiding in accident investigations.

- By Application (Accident Investigation, Fleet Monitoring, Air Traffic Analysis, and Performance Analysis): The accident investigation segment is projected to reach USD 1678.1 million by 2031, propelled by the growing emphasis on improving safety protocols and the increasing use of flight data in investigating and preventing aviation incidents.

- By End Use Industry (Commercial Airlines, Defense & Military, Aircraft OEMs, Aviation Authorities): The aircraft OEMs segment is anticipated to register a CAGR of 6.99% during the forecast period, driven by the growing demand for advanced flight data recorders in newly manufactured aircraft and the need for enhanced data management in modern aviation.

Flight Data Recorder Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a market share of around 34.09% in 2023, with a valuation of USD 830.1 million. The flight data recorder market in North America is growing as the region works to improve aviation safety, compliance, and efficiency.

Amid the rising need for advanced flight data solutions, airlines and maintenance providers are turning to specialized services to meet global safety standards. These services help improve data management, offer faster response times, and enhance overall safety and reliability.

- In April 2023, Flight Data Systems (FDS) introduced its FDR, CVR, and Datalink Readout services to the North American market. These services, covering parameter correlation checks, incident analysis, CVR intelligibility assessments, and datalink message monitoring, have already been well-established in Europe and Asia-Pacific. With over 3,500 readouts completed annually for more than 300 clients globally, FDS aims to strengthen its presence in North America by offering fast turnaround times (TAT), including a 24-hour AOG service. This expansion reinforces FDS's position as a reliable provider of flight data compliance and safety solutions in the region.

The flight data recorder industry in Asia Pacific is poised for significant growth at a robust CAGR of 6.46% over the forecast period. Asia Pacific is registering substantial growth in the aviation industry, driven by an increase in both passenger and cargo traffic. The expansion of flight networks and higher flight frequencies are contributing to this surge in demand.

The need for advanced flight data management solutions is increasing to ensure safety, efficiency, and regulatory compliance. Airlines and maintenance providers are turning to specialized services, such as FDRs and real-time data analysis, to handle the growing volume of flights and cargo operations. These advancements are essential for supporting operational excellence and improving aviation safety across the region.

- In 2024, Asia Pacific Airlines saw a 30.5% increase in international passengers, reaching 365 million. This growth, driven by expanded flight networks and increased demand, also led to a 14.9% rise in air cargo volumes. The surge in both passenger and cargo traffic highlights the growing need for advanced flight data management solutions. Airlines and maintenance providers in the region will rely on FDRs and specialized services to ensure safety, efficiency, and compliance.

Regulatory Framework

- In the U.S., the Federal Aviation Administration (FAA) mandates the use of FDRs on various aircraft, particularly in commercial aviation, to enhance safety and ensure regulatory compliance.

- The International Civil Aviation Organization (ICAO), a UN agency, establishes global standards for aviation safety, including FDR requirements.

Competitive Landscape

Key players in the flight data recorder market are focusing on strategic initiatives to enhance the safety and efficiency of aviation operations. These include the development of more compact and lightweight FDR systems, which are increasingly equipped with extended storage capabilities and real-time data streaming to support better incident analysis and maintenance practices.

Companies are also incorporating advanced cybersecurity measures to protect flight data from cyber threats, ensuring data integrity. These strategies collectively contribute to the expansion and growth of the market.

- In June 2023, Honeywell International Inc. and Curtiss-Wright Corporation announced the type certification of their jointly developed Honeywell Connected Recorder-25 (HCR-25) cockpit voice and flight data recorders for Boeing 737, 767, and 777 production aircraft. This certification allows airlines to directly order and install the HCR-25 through Boeing, facilitating global compliance with EASA's mandate for 25-hour cockpit voice recording.

List of Key Companies in Flight Data Recorder Market:

- Elbit Systems Ltd.

- Safran

- Honeywell International Inc.

- General Electric Company

- Leonardo DRS

- L3Harris Technologies, Inc.

- Curtiss-Wright Corporation

- Teledyne Controls LLC

- AstroNova, Inc.

- FLIGHT DATA SYSTEMS

- AERTEC

- SLN Technologies

- AMETEK. Inc.

- Flight Data Vision

- Aversan

Recent Developments (Agreements/Product Launch)

- In March 2023, Flight Data Systems announced that Arista Aviation, a prominent provider of MRO services for both commercial and military rotorcraft, had selected its SENTRY CVFDR along with the Modular Acquisition Unit (MAU) for deployment.

- In February 2023, Hindustan Aeronautics Limited (HAL) secured Indian Technical Standard Order (ITSO) approval from the Directorate General of Civil Aviation (DGCA) for its domestically developed Cockpit Voice Recorder (CVR) and FDR during Aero India 2023.

As awareness grows around the critical role of flight data in accident investigations and operational efficiency,