Market Definition

The flexible foam market involves the production, distribution, and application of soft, cushion-like polymer-based foams, primarily made from polyurethane (PU), polyethylene (PE), and other elastomeric materials. Known for their resilience, flexibility, and durability, these foams are widely used across various industries.

Flexible Foam Market Overview

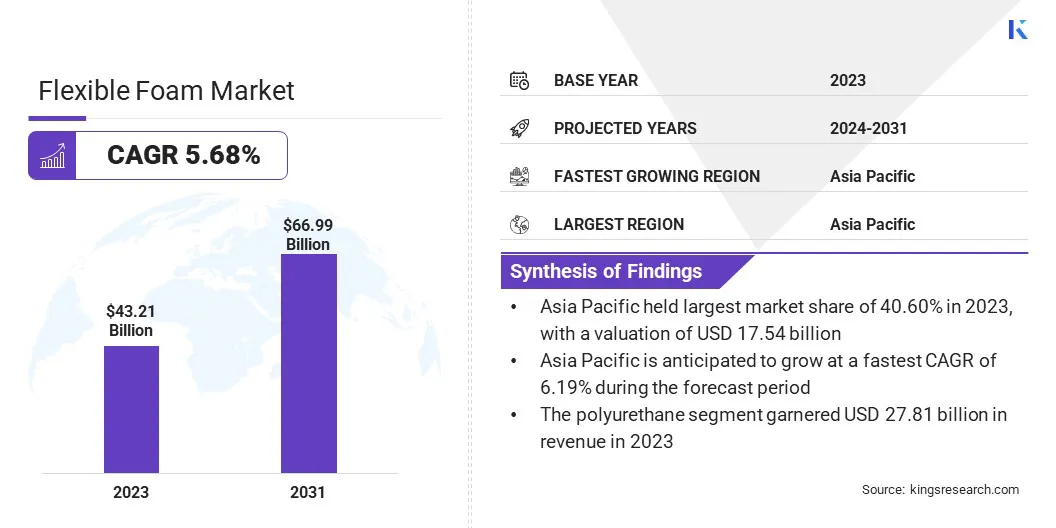

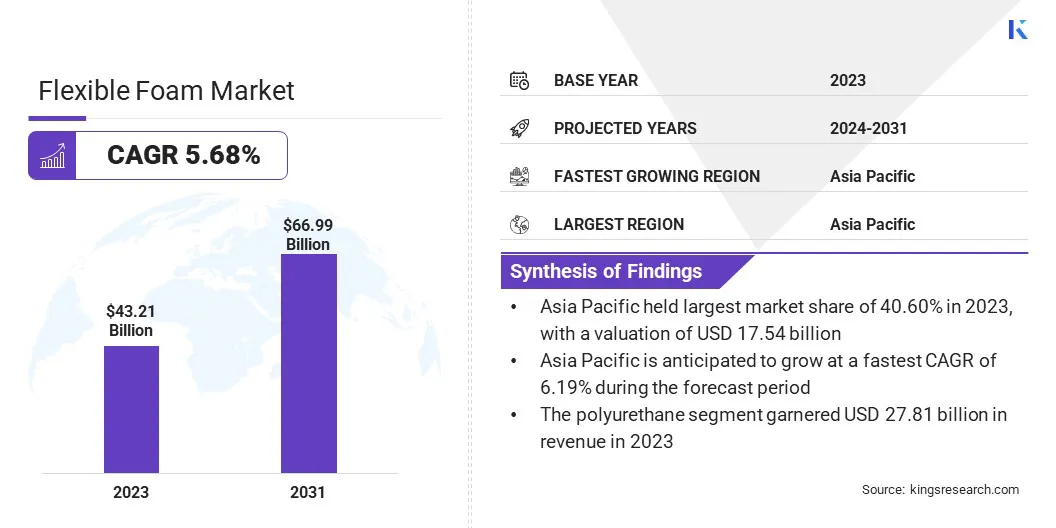

The global flexible foam market size was valued at USD 43.21 billion in 2023 and is projected to grow from USD 45.51 billion in 2024 to USD 66.99 billion by 2031, exhibiting a CAGR of 5.68% during the forecast period.

This market is experiencing significant growth, driven by increasing demand across industries, including furniture, bedding, automotive, packaging, and construction. The rising preference for comfort-driven products such as memory foam mattresses and upholstered furniture is fueling market expansion.

In the automotive sector, the growing focus on passenger comfort, noise reduction, and lightweight materials is boosting the use of flexible foam in seating, headrests, and interiors. The packaging industry's demand for protective and shock-absorbing foam solutions is growing, fueled by the expansion of e-commerce and global trade.

Major companies operating in the global flexible foam industry are Rogers Foam Corporation, Woodbridge Foam Corporation, Carpenter Co., FXI, INOAC CORPORATION, Armacell, Filson Purification Equipment Co., LTD., UFP Technologies, Inc., Covestro AG, BASF SE, Mitsui Chemicals, Inc., The Dow Chemical Company, Huntsman International LLC, FoamPartner, and NEVEON Holding GmbH.

Advancements in foam manufacturing, including high-performance and eco-friendly materials, are contributing to market expansion. Innovations such as bio-based and recycled polyurethane foams are gaining traction as industries shift toward sustainable solutions.

The construction sector is experiencing a rising demand for flexible foam in sealing, insulation, and soundproofing applications. Rapid urbanization and global infrastructure development worldwide are creating new opportunities for flexible foam manufacturers.

- In April 2024, Hennecke launched the JFLEX EVO , an advanced slabstock foam production system offering enhanced flexibility, efficiency, and precision. It features continuous width adjustment, SMARTJECTORS technology, and FOAMWARE software for automated control, improved safety, and reduced waste. With a compact design and plug-and-play installation, the JFLEX evo strengthens Hennecke’s position in polyurethane processing technology.

Key Highlights

- The global flexible foam market size was valued at USD 43.21 billion in 2023.

- The market is projected to grow at a CAGR of 5.68% from 2024 to 2031.

- Asia Pacific held a share of 40.60% in 2023, valued at USD 17.54 billion.

- The polyurethane segment garnered USD 27.81 billion in revenue in 2023.

- The furniture & upholstery segment is expected to reach USD 24.0 billion by 2031.

- Europe is anticipated to grow at a CAGR of 5.97% over the forecast period.

Market Driver

"Sustainability and Expanding End-Use Industries"

The flexible foam market is witnessing substantial expansion due to the increasing need for sustainable products and the expansion of end-use industries. The shift toward sustainability is a primary factor, prompting businesses to adopt eco-friendly solutions.

Manufacturers are focusing on creating flexible foams made from renewable materials such as bio-based polyols and low-carbon-footprint additives to reduce the environmental impact. This trend is particularly strong in industries such as automotive, packaging, and furniture, where demand for sustainable alternatives in car seats, packaging materials, and upholstery is rising.

- In September 2024, BASF and Future Foam launched the first commercial production of flexible foam for the bedding industry using 100% domestically produced Biomass Balance (BMB) Lupranate T 80 toluene diisocyanate (TDI). Manufactured at BASF’s Louisiana facility, this TDI allows Future Foam to integrate sustainable raw materials into its bedding products without requiring reformulations or changes to its supply chain. The collaboration supports BASF’s net zero emissions goal by 2050 and Future Foam’s commitment to sustainable bedding solutions.

Additionally, the expansion of end-use industries is fueling the expansion of the market. In the automotive sector, flexible foams are integral to seat cushions, insulation materials, and vibration-dampening components, enhancing comfort, safety, and energy efficiency.

The increasing automotive production and the need for lightweight materials are bolstering the use of flexible foam. The home furniture industry extensively utilizes flexible foam in mattresses, cushions, and upholstered furniture, supported by consumer demand for comfort, durability, and affordability.

Market Challenge

"Raw Material Price Volatility"

A key challenge hampering the development of the flexible foam market is the volatility of raw material prices, particularly petrochemical-based products. Polyurethane foam, a major component, relies heavily on petrochemical derivatives, making it highly susceptible to fluctuations in global oil prices. These fluctuations impact production costs, complicating pricing stability and profit margins.

The challenge is further exacerbated raw material shprtages and supply chain disruptionscaused by natural disasters, geopolitical tensions, and logistical constraints. Additionally, evolving supply-demand dynamics and regulatory pressures on carbon emissions and waste management add further complexity for manufacturers.

To address this challenge, companies are actively exploring cost-stable alternatives, including bio-based polyols and recycled materials.Innovations in production processes, including the incorporation of recycled foam in new products, are further reducing dependency on expensive raw materials. These strategies enhance pricing stability and strengthen supply chain resilience.

Market Trend

"Eco-friendly Production and Enhanced Comfort Technologies"

The flexible foam market is witnessing a shift toward sustainable and environmentally friendly production processes, with advanced techniques such as water-based foaming gaining traction.

Unlike traditional solvent-based methods, water-based foaming reduces the need for harmful substances, making production greener and safer. These innovations also enhance energy efficiency and thermal insulation, benefiting applications such as construction, automotive, and appliances.

Additionally, the integration of smart and thermal comfort technologies into flexible foams is revolutionizing industries such as automotive, furniture, and bedding. Innovations in flexible foam technology are expanding its applications across various industries.

In the healthcare sector, advanced foam materials are being integrated into medical bedding and prosthetics to enhance patient comfort and support. Additionally, the rising emphasis on lightweight and high-durability materials is driving demand in packaging and protective gear manufacturing.

With increasing investments in sustainable and high-performance foam solutions, the market continues to evolve to meet the needs of both industries and consumers.

- In February 2025, Lear Corporation announced a strategic integration with General Motors to launch the ComfortMax Seat, featuring advanced thermal comfort technology for enhanced occupant comfort and efficiency. As a sustainable alternative to traditional polyurethane foam, FlexAir is part of Lear's Thermal Comfort Systems portfolio.

Flexible Foam Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Polyurethane (Slabstock, Polyether, Polyester, Molded, Integral), Polyethylene, Polypropylene, Others

|

|

By Application

|

Automotive, Packaging, Furniture & Upholstery, Construction, Consumer Goods, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Polyurethane, Polyethylene, Polypropylene, and Others): The polyurethane segment earned USD 27.81 billion in 2023 due to its widespread use in furniture, bedding, automotive seating, and insulation applications.

- By Application (Automotive, Packaging, Furniture & Upholstery, Construction, Consumer Goods, and Others): The furniture & upholstery segment held a share of 35.27% in 2023, attributed to the rising demand for comfortable and durable cushioning materials in residential and commercial furniture.

Flexible Foam Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific flexible foam market accounted for a substantial share of 40.60% in 2023, valued at USD 17.54 billion. This expansion is fueled by rapid industrialization, urbanization, and increasing demand across key sectors such as furniture, bedding, automotive, and construction.

The presence of large manufacturing hubs in China, India, and Japan, along with cost-effective raw material availability and high production capacities, is propelling market growth. Improvement in living standards has boosted demand for premium mattresses, upholstered furniture, and automotive seating, stimulating regional market expansiom.

Additionally, the booming e-commerce sector has led to increased use of flexible foam in protective packaging applications, while government initiatives promoting infrastructure development and sustainable materials have supported domestic market expansion.

- In July 2024, Evonik showcased its latest innovations for the flexible polyurethane (PU) foam industry in Shanghai. The company introdcued the ORTEGOL NOP additive, which assists formulators in incorporating natural oil-based polyols (NOPs) into flexible foam formulations, improving sustainability and performance. Evonik also introduced the ORTEGOL 70X series, designed to enhance the recovery of compressed flexible foams and NOP-containing foams by reducing curing time before compression.

Europe flexible foam industry is expected to register the fastest CAGR of 5.97% over the forecast period. This growth is attributed to advancements in high-performance foam technologies.

The region's automotive sector is contributing significantly to this growth, with the increasing adoption of lightweight and durable materials to enhance vehicle comfort and efficiency. Furthermore, the furniture and bedding industry is experincing strong growth, supported by a rising demand for luxury and ergonomic products.

In the construction sector, the emphasis on energy-efficient buildings and insulation materials is increasing the use of flexible foam for thermal and acoustic applications. Additionally, European manufacturers are investing in advanced production techniques and material innovations, boosting domestic market expansion.

Regulatory Frameworks

- In the United States, the Environmental Protection Agency (EPA) regulates the production and use of flexible foam under the Toxic Substances Control Act (TSCA) to ensure compliance with environmental and safety standards. The Consumer Product Safety Commission (CPSC) oversees flammability regulations for flexible polyurethane foam used in furniture and bedding, ensuring compliance with the Federal Flammability Standard.

- In Europe, the European Chemicals Agency (ECHA) enforces the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation to ensure the safety of chemicals used in flexible foam production. Additionally, the European Committee for Standardization (CEN) sets flammability and safety standards for flexible foam used in mattresses, automotive applications, and furniture.

- In China, the Ministry of Ecology and Environment (MEE) regulates the environmental impact of flexible foam manufacturing, ensuring compliance with chemical safety laws. The Standardization Administration of China (SAC) establishes national safety and quality standards for flexible foam products, including flame retardancy and emissions control.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates chemicals in flexible foam under the Chemical Substances Control Law (CSCL) to protect public health. Additionally, the Japan Upholstered Furniture Safety Standard (JIS standards) outlines fire safety and material quality requirements for furniture and consumer products.

- In India, the Bureau of Indian Standards (BIS) establishes safety and quality standards for flexible foam used in furniture, automotive, and packaging applications.

Competitive Landscape

In the flexible foam market, collaborations between foam producers and automotive, furniture, and packaging companies are accelerating the development of customized, high-resilience materials for specific applications.

Additionally, increased research and development (R&D) investments focus on enhancing foam durability, comfort, and performance to align with evolving consumer needs. Manufacturers are further expanding production facilities to address rising demand for furniture, automotive interiors, and insulation materials.

Investments in new plants, facility upgrades, and supply chain optimization aim to improve efficiency and better serve diverse market needs.

- In April 2024, BASF introduced innovative recyclable polyurethane solutions at UTECH Maastricht, promoting circular economy initiatives. The company unveiled mechanically recyclable PU flexible foams, adopted by Vitra for furniture and ZF Lifetec for a recyclable steering wheel prototype.

List of Key Companies in Flexible Foam Market:

- Rogers Foam Corporation

- Woodbridge Foam Corporation

- Carpenter Co.

- FXI

- INOAC CORPORATION

- Armacell

- Filson Purification Equipment Co., LTD.

- UFP Technologies, Inc.

- Covestro AG

- BASF SE

- Mitsui Chemicals, Inc.

- The Dow Chemical Company

- Huntsman International LLC

- FoamPartner

- NEVEON Holding GmbH

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In October 2024, Serta Simmons Bedding (SSB), LLC launched the new Tuft & Needle (T&N) mattress collection, incorporating T&N Flex Foam for enhanced cooling, responsive comfort, and bounce-back support.

- In May 2024, Ecomaison, Covestro, Secondly, and Federal Eco Foam launched the Foam Recycling Ecosystem Evolution (FREE) project to develop an advanced recycling system for end-of-life polyurethane (PU) mattress foams. Coordinated by Covestro and partly funded by Ecomaison, the 24-month initiative integrates chemical and mechanical recycling to maximize material recovery. It focuses on precise foam sorting at dismantling plants for polyol and isocyanate TDI recovery.

- In April 2024, Huntsman launched SHOKLESS polyurethane systems to enhance structural integrity and thermal protection for electric vehicle (EV) batteries. The innovative foam technologies include low to high-density foams suitable for potting, fixation, and moldable encapsulation of battery cells, modules, and packs. These systems offer superior mechanical properties, fast processability, and compatibility with various manufacturing methods, addressing key challenges in EV battery safety and durability.

- In November 2023, Carpenter Co. acquired the flexible foam assets of NCFI’s Consumer Products Division, strengthening its position as the world’s largest vertically integrated manufacturer of polyurethane foams. The acquisition expands Carpenter’s Engineered Foams business, integrating NCFI’s advanced foam solutions across the furniture, mattresses, aerospace, marine, and medical industries.