Fitness Trackers Market Size

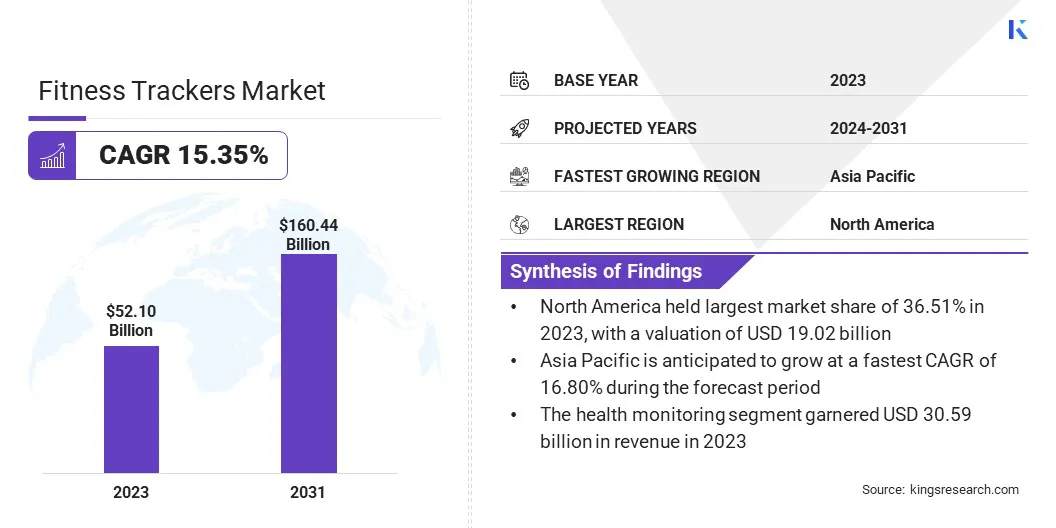

The global Fitness Trackers Market size was valued at USD 52.10 billion in 2023 and is projected to grow from USD 59.05 billion in 2024 to USD 160.44 billion by 2031, exhibiting a CAGR of 15.35% during the forecast period.

The growing incidence of chronic illnesses such as diabetes, hypertension, and obesity is fueling the growth of the market. Fitness trackers are essential for managing these conditions by tracking key metrics such as blood glucose levels, heart rate, and physical activity.

In the scope of work, the report includes products offered by companies such as Google LLC, Apple Inc., Samsung, Garmin Ltd., Xiaomi, Huawei Device Co., Ltd., Zepp Health Corporation, Ltd., Polar Electro, Oura Health Oy, WHOOP, and others.

- A September 2023 report by the World Health Organization highlights that noncommunicable diseases (NCDs) cause 41 million deaths annually, representing 74% of global mortality. Cardiovascular diseases lead with 17.9 million deaths per year, followed by cancers at 9.3 million, chronic respiratory diseases at 4.1 million, and diabetes, including diabetes-related kidney disease, collectively claiming 2 million lives.

Moreover, early detection of irregularities and data-driven insights empower individuals to take proactive steps for their health. These devices play a crucial role in promoting preventive care and reducing healthcare costs. The emphasis on managing chronic conditions effectively is driving the growth of fitness trackers market.

- A study by the University of South Australia found that wearable activity trackers, such as Fitbit, Apple Watch, and Oura Ring, can potentially detect early signs of diseases, particularly atrial fibrillation, associated with stroke and COVID-19.

A fitness tracker is a wearable device or application that monitors and tracks various physical activities and health metrics. These devices use advanced sensors and technology to collect real-time data such as steps taken, distance traveled, heart rate, calories burned, sleep quality, and other biometric information.

Typically worn on the wrist, these devices integrate with mobile applications to provide users with detailed insights, personalized recommendations, and progress tracking. Popular among fitness enthusiasts, athletes, and health-conscious individuals, fitness trackers promote active lifestyles, improve well-being, and assist in achieving health and fitness goals.

Analyst’s Review

Companies are fostering the growth of the fitness trackers industry through significant advancements in wearable technology. By introducing features such as advanced heart rate monitoring, ECG analysis, SpO2 tracking, and stress level assessment, they have elevated the functionality and appeal of these devices, transforming them into essential health tools.

Integration with artificial intelligence (AI) and machine learning (ML) further enhances their value, providing personalized recommendations and predictive health insights that resonate with consumers seeking proactive health management solutions.

In addition, compatibility with smart home ecosystems and improvements in battery performance have strengthened consumer interest, ensuring a seamless and convenient user experience. These innovations have positioned fitness trackers as sophisticated health companions, driving their adoption across various demographics and regions. Companies are also introducing product-specific enhancements tailored to consumer demands.

- For instance, in January 2024, Samsung launched ECG and blood pressure monitoring features for its Galaxy Watch6 series in India, accessible through the Samsung Health Monitor App. This innovation enables users to monitor key health metrics, prioritize regular health checkups, and optimize their fitness routines, showcasing a strategic approach to market expansion through technological advancement.

Fitness Trackers Market Growth Factors

The global rise in smartphone usage has aided the growth of the fitness tracker market, as these devices integrate seamlessly with mobile applications. Fitness trackers leverage smartphone connectivity to deliver detailed analytics, personalized insights, and progress reports, enhancing the user experience.

Consumers prefer the convenience of accessing and managing health data through user-friendly apps, which often features social sharing and goal-setting. Enhanced compatibility with operating systems and synchronization with other smart devices are further contributing to the growing adoption of fitness trackers among tech-savvy users.

- In 2023, the National Library of Medicine reported that smartphone ownership reached approximately 76% in advanced economies, while 45% of individuals in emerging economies owned smartphones. Additionally, the adoption of wearable fitness trackers has grown significantly, with 37% of individuals in the United States owning such devices.

Moreover, fitness trackers are becoming an integral part of the broader smart wearables ecosystem, which includes smartwatches, smart glasses, and health-focused earbuds. Consumers are increasingly drawn to devices that provide interconnected functionality, allowing them to manage fitness, productivity, and entertainment through a single ecosystem.

Fitness Trackers Market Trends

Consumers prefer fitness trackers that offer personalized experiences aligned with their unique health and fitness goals. Manufacturers are incorporating advanced algorithms and AI to provide customized workout plans, dietary recommendations, and health insights.

- In September 2024, Apple launched the Apple Watch Series 10, featuring a refined design, advanced capabilities, and enhanced health and fitness monitoring features. The Series 10 is equipped with the new S10 System in Package (SiP) that supports intelligent features such as on-device Siri and automatic workout detection.

Additionally, the ability to select designs, colors, and strap materials caters to consumer preferences for individuality. These personalized features enhance user satisfaction and loyalty, thus driving the adoption of fitness trackers across different demographic groups.

The integration of advanced health sensors in fitness trackers is attracting a wider audience, particularly individuals with specific health needs. Sensors capable of monitoring blood pressure, hydration levels, and skin temperature have expanded the devices’ applications.

- In August 2024, Huawei introduced the HUAWEI TruSense System, a science-driven health and fitness technology. The system tracks over 60 health and fitness metrics across six major body systems, including emotional well-being. Equipped with advanced sensors, it monitors heart rate and autonomic nervous system data to provide comprehensive health insights.

Fitness trackers equipped with medical-grade sensors are gaining popularity among older adults and individuals managing chronic conditions due to their actionable insights and enhanced accuracy. These innovations are positioning fitness trackers as essential health tools, thus stimulating market expansion.

Segmentation Analysis

The global market has been segmented based on device type, application, distribution channel, and geography.

By Device Type

Based on device type, the market has been segmented into smart watches, fitness bands, and smart clothing. The smart watches segment led the fitness trackers market in 2023, reaching a valuation of USD 23.51 billion. This expansion is mainly fueled by its versatility and advanced features, which integrate health monitoring with smart functionalities.

These devices offer a wide range of features beyond fitness tracking, including notifications, messaging, and integration with other smart devices, making them highly appealing to consumers seeking all-in-one solutions. The growing demand for multifunctional wearables, which serve as both fitness trackers and smart devices, is further propelling the growth of the segment.

Additionally, major brands such as Apple, Samsung, and Fitbit have made significant advancements in smartwatch technology, offering improved sensors, longer battery life, and seamless integration with health apps, boosting consumer adoption.

By Application

Based on application, the market has been classified into health monitoring and sports and fitness. The health monitoring segment is further divided into heart rate monitoring, sleep tracking, stress monitoring, and others. The sports and fitness segment is categorized into running and, cycling, swimming, gym workouts, and others. The health monitoring segment secured the largest revenue share of 58.71% in 2023.

As awareness of chronic health conditions such as cardiovascular diseases, diabetes, and obesity grows, individuals are increasingly turning to fitness trackers for proactive health management. These devices offer features such as heart rate monitoring, blood oxygen levels, ECG, and sleep tracking, enabling users to monitor their well-being continuously.

By Distribution Channel

Based on distribution channel, the fitness trackers market has been divided into specialty stores, department stores, direct sales, and online retailers. The online retailers segment is poised to witness significant growth, recording a robust CAGR of 17.47% through the forecast period. This growth is largely attributed to the convenience, wide selection, and competitive pricing these retailers offer.

E-commerce platforms provide consumers with easy access to a broad range of products from various brands, enabling them to compare features, prices, and reviews before making a purchase. This convenience is further enhanced by home delivery, promotions, and exclusive online discounts. Additionally, the growing reliance on digital shopping platforms and the increased trust in secure online transactions have contributed to the growth of the segment.

Fitness Trackers Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America fitness trackers market held a notable share of around 36.51% in 2023, valued at USD 19.02 billion. The widespread use of smartphones and smartwatches in North America has bolstered the adoption of fitness trackers.

- According to a 2024 Pew Research Center survey, 91% of Americans own a smartphone, a significant increase from 35% recorded in the Center's inaugural survey on smartphone ownership in 2011.

These devices integrate seamlessly with mobile applications, offering users convenient access to their health data. The robust digital infrastructure in the region supports advanced features such as cloud storage, real-time notifications, and app synchronization, increasing the appeal of fitness trackers among tech-savvy consumers.

Businesses in North America are increasingly incorporating fitness trackers into corporate wellness initiatives to promote employee health and productivity. These programs often provide incentives for employees to maintain active lifestyles, using fitness trackers to monitor and reward progress. The emphasis on workplace wellness has significantly contributed to the regional market.

The Asia Pacific fitness tracker market is set to witness significant growth, registering a robust CAGR of 16.80% over the forecast period. The regional market is witnessing the proliferation of cost-effective fitness trackers from regional companies such as Xiaomi, Noise, and Realme.

- In February 2024, Xiaomi globally launched its latest smartwatches and fitness tracker, including the Xiaomi Watch 2, Xiaomi Watch S3, and Xiaomi Smart Band 8 Pro.

These devices offer advanced features at competitive prices, making them accessible to a broad consumer base. The presence of local brands has intensified competition, fostering innovation and increasing market penetration.

Additionally, the rise of e-commerce platforms such as Alibaba, Flipkart, and Tokopedia has significantly improved the accessibility of fitness trackers in Asia Pacific. These platforms offer a wide range of devices, detailed product reviews, and competitive pricing, all of which encourage consumer purchases. Flash sales and exclusive online launches further boost demand for fitness trackers in the region, thus supporting regional market expansion.

Competitive Landscape

The global fitness trackers market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Fitness Trackers Market

- Google LLC

- Apple Inc.

- Samsung

- Garmin Ltd.

- Xiaomi

- Huawei Device Co., Ltd.

- Zepp Health Corporation, Ltd.

- Polar Electro

- Oura Health Oy

- WHOOP.

Key Industry Developments

- July 2024 (Product Launch): Samsung introduced the Galaxy Ring at its Unpacked 2024 event. This AI-powered wearable is designed for holistic health and fitness tracking, offering a complete wellness experience through Samsung’s advanced AI technology. It integrates seamlessly with the Samsung Health app, providing users with a wealth of health data without requiring a subscription.

- In October 2024 (Product Launch): Samsung launched the Galaxy Fit3, a fitness tracker designed to enhance health monitoring and promote a healthier lifestyle. The Galaxy Fit3 features a lightweight aluminum body and a 1.6-inch display that is 45% wider than its predecessor, making it easier for users to view health and wellness data. The device offers up to 13 days of battery life and supports tracking for over 100 workout types, including heart rate and stress levels.

- October 2023 (Product Launch): Amazfit, a prominent global smart wearables brand under Zepp Health Corporation Ltd., launched two new lifestyle smartwatches: the Amazfit Active and Amazfit Active Edge. Featuring the AI-powered Zepp Coach, these devices allow users to create personalized exercise plans and schedules that automatically adjust based on their performance and recovery.

The global fitness trackers market has been segmented as:

By Device Type

- Smart Watches

- Fitness Bands

- Smart Clothing

By Application

- Health Monitoring

- Heart Rate Monitoring

- Sleep Tracking

- Stress Monitoring

- Others

- Sports and Fitness

- Running and Cycling

- Swimming

- Gym Workouts

- Others

By Distribution Channel

- Specialty Stores

- Department Stores

- Direct Sales

- Online Retailers

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America