Market Definition

The fire-rated busway market encompasses electrical systems designed to safely distribute power in buildings while preventing the spread of fire. These busways, constructed with fire-resistant materials, enhance safety in high-risk areas such as factories and data centers. The market involves companies manufacturing fire-resistant busway systems to compy with stringent safety standards.

Fire-Rated Busway Market Overview

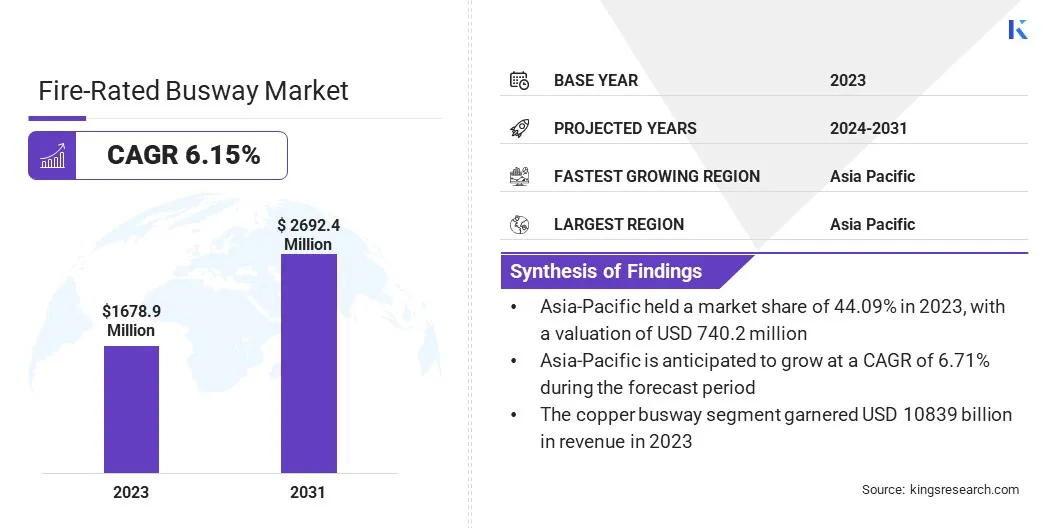

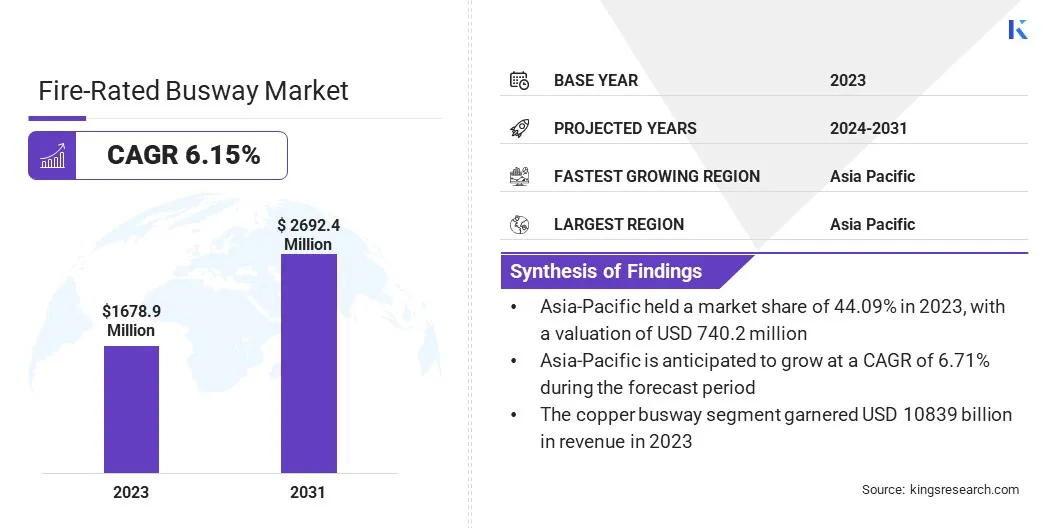

Global fire-rated busway market size was valued at USD 1,678.9 million in 2023, which is estimated to be valued at USD 1,772.6 million in 2024 and reach USD 2,692.4 million by 2031, growing at a CAGR of 6.15% from 2024 to 2031.

The increasing emphasis on electrical safety, fueled by increased awareness of fire risks, is highlighting the need for fire-rated busways. As businesses and industries prioritize fire prevention, fire-rated busways are becoming essential for ensuring safer electrical infrastructure.

Major companies operating in the global fire-rated busway Industry are Schneider Electric, Eaton, Siemens, ABB, Powell Industries, Westinghouse Electric Corporation, Godrej Enterprises, Furukawa Electric Co., Ltd, MEGABBARE EUROPE SRL, DBTS Industries Sdn Bhd, Dynamic Electrical Sdn Bhd, TAIAN-ECOBAR TECHNOLOGY, Shanghai Zhenda Electric Appliance Complete Set Group Co., Ltd, Tai Sin Electric Cables (VN) Co Ltd, C&S, and others.

The market provides advanced electrical distribution solutions designed to resist or contain fires. These systems are increasingly adopted across industries such as construction, manufacturing, and data centers due to their ability to maintain safety standards in environments with high electrical loads.

The market involves the production of busways built with fire-resistant materials, ensuring compliance with safety regulations while supporting the growing demand for secure and efficient power distribution in critical infrastructures.

- In December 2024, Legrand acquired Power Bus Way, a Toronto-based provider of custom-designed cable bus solutions. This acquisition strengthens Legrand's capabilities in the North American data center, industrial, and commercial markets, addressing increasing power demands driven by AI adoption.

Key Highlights:

- The global fire-rated busway market size was recorded at USD 1,678.9 million in 2023.

- The market is projected to grow at a CAGR of 6.15% from 2024 to 2031.

- Asia-Pacific held a share of 44.09% in 2023, valued at USD 740.2 million.

- The low voltage (below 600V) segment garnered USD 906.6 million in revenue in 2023.

- The sandwich insulated busway segment is expected to reach USD 1,516.2 million by 2031.

- The aluminum busway segment is anticipated to grow at a CAGR of 6.81% through the forecast period.

- The construction & infrastructure segment is likely to capture a share of 38.87% by 2031.

- The commercial buildings segment held a notable share of 38.90% in 2023.

- Europe is anticipated to grow at a CAGR of 6.26% over the forecast period.

Market Driver

"Rapid Urbanization and Infrastructure Development"

Rapid urbanization and infrastructure development are fueling the growth of the fire-rated busway market.

- According to the World Bank Group, approximately 56% of the global population currently resides in cities. This urbanization trend is expected to persist, with the urban population projected to exceed 70% by 2050.

The growing construction of buildings, factories, and large-scale commercial projects is boosting demand for reliable and safe power distribution systems. Fire-rated busways play a crucial role in preventing fire hazards in high-load electrical systems. As urbanization and industrial expansion continue, the need for fire-resistant electrical infrastructure is expected to rise, propelling market for fire-rated busways.

Market Challenge

"Complex Installation Requirements"

The complex installation requirements of fire-rated busways pose a major challenge to market expansion, as they often involve intricate procedures and require specialized expertise. This results in higher labor costs and extended project timelines.

To address this challenge, manufacturers can develope more user-friendly and modular systems that are easier to install. Additionally, providing comprehensive training for contractors and offering detailed installation guidelines can help streamline the process, reduce labor costs, and improve efficiency, making fire-rated busways more accessible for widespread use.

Market Trend

"Expansion in Data Centers"

The expansion of data centers is emerging as a notable trend in the fire-rated busway market. As data centers handle increasing data traffic and power demands, the need for reliable and safe power distribution systems becomes critical.

Fire-rated busways ensure that electrical systems can withstand high temperatures and prevent fire hazards, which is particularly crucial in high-load environments. With the rapid growth of cloud computing, AI, and digital infrastructure, the demand for fire-rated busways in data centers is expected to rise significantly.

- As per an October 2024 article by the Indian Industries Association, the government is considering an incentive-based policy to promote data center growth, driven by the rise of cloud computing, AI, and ML, which is expected to increase demand for fire-rated busways.

Fire-Rated Busway Market Report Snapshot

|

Segmentation

|

Details

|

|

By Voltage Rating

|

Low Voltage (Below 600V), Medium Voltage (600V – 38kV), High Voltage (Above 38kV)

|

|

By Insulation Type

|

Air-Insulated Busway, Epoxy-Insulated Busway, Sandwich Insulated Busway

|

|

By Conductor Type

|

Copper Busway, Aluminum Busway

|

|

By End-User Industry

|

Construction & Infrastructure, Manufacturing & Heavy Industry, IT & Telecommunications, Healthcare, Energy & Power Distribution

|

|

By Application

|

Commercial Buildings , Industrial Facilities, Healthcare & Data Centers, Transportation Hubs, Energy & Utilities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Voltage Rating [Low Voltage (Below 600V), Medium Voltage (600V – 38kV), and High Voltage (Above 38kV)]: The low voltage (below 600V) segment earned USD 906.6 million in 2023, due to increased demand for fire safety in residential and commercial buildings.

- By Insulation Type (Air-Insulated Busway, Epoxy-Insulated Busway, and Sandwich Insulated Busway): The sandwich insulated busway segment held a share of 56.76% in 2023, attributed to its superior fire resistance and compact design, making it ideal for high-density environments.

- By Conductor Type (Copper Busway and Aluminum Busway): The copper busway segment is projected to reach USD 1,685.5 million by 2031, mainly fueled by copper’s superior electrical conductivity and fire resistance in high-demand applications.

- By End-User Industry (Construction & Infrastructure, Manufacturing & Heavy Industry, IT & Telecommunications, Healthcare, and Energy & Power Distribution): The construction & infrastructure segment is anticipated to grow at a CAGR of 7.11% over the forecast period, primarily propelled by growing fire safety regulations in new buildings and industrial projects.

- By Application (Commercial Buildings, Industrial Facilities, Healthcare & Data Centers, Transportation Hubs, and Energy & Utilities): The commercial buildings segment is anticipated to capture a substantial share of 43.02% in 2031, largely due to increasing safety standards and infrastructure development boosting demand for fire-rated busways.

Fire-Rated Busway Market Regional Analysis

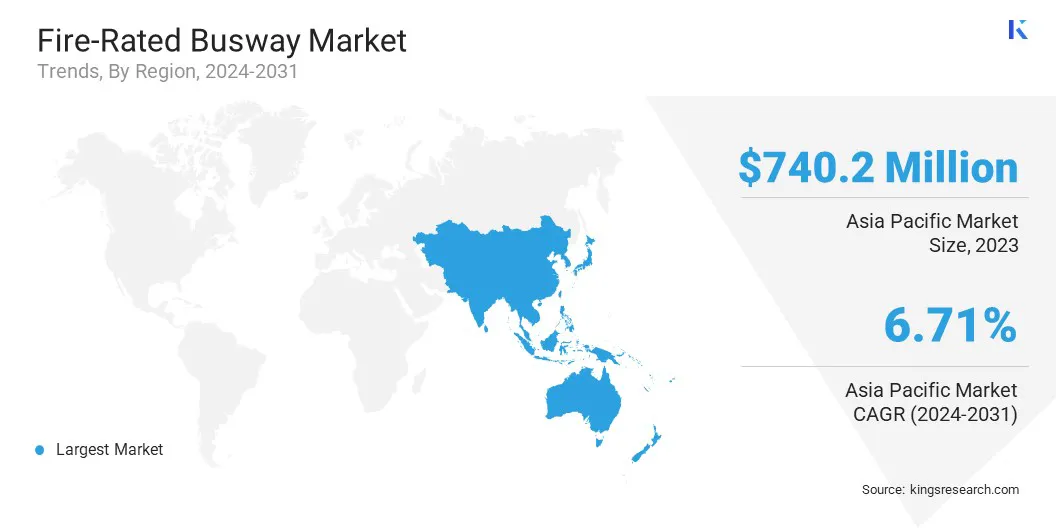

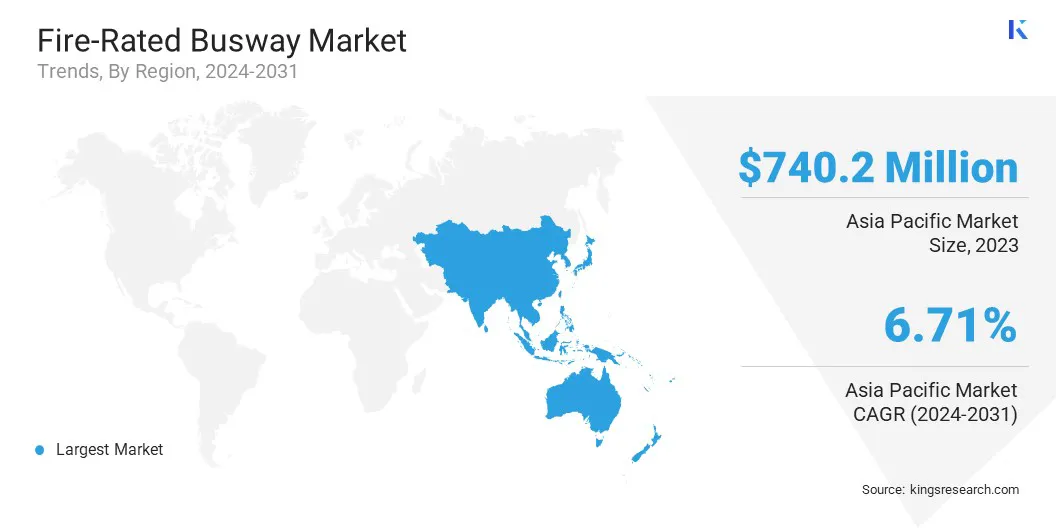

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific fire-rated busway market accounted for a notable share of around 44.09% in 2023, valued at USD 1,243.4 million. This dominance is reinforced by rapid urbanization, industrialization, and infrastructure development across countries such as China, India, and Japan.

The region is experiencing a surge in construction projects, including commercial, residential, and industrial facilities, where the demand for fire-resistant electrical systems is growing.

Additionally, increasing investments in data centers, power generation, and manufacturing sectors further boost the need for fire-rated busways to ensure safety and compliance with fire safety regulations.

Europe fire-rated busway Industry is poised likely to expand at a CAGR of 6.26% through the projection period. This dominace is reinforced by stricter fire safety regulations and the increasing demand for advanced electrical systems in industrial and commercial applications.

The growth of data centers, renewable energy projects, and infrastructure developments in countries such as Germany, the UK, and France is contributing to this expansion. As businesses adopt cutting-edge technologies such as AI and renewable energy, the need for reliable, fire-resistant power distribution systems continues to rise, positioning Europe as a key market.

- As per the January 2025 article by the European Environment Agency, renewable energy sources accounted for 24.5% of the EU’s final energy use in 2023, marking a one-percentage-point increase from 2022. This growth in renewable electricity demand highlights the urgent need for fire-rated busways in power distribution systems.

Regulatory Frameworks

- In the U.S., the National Electrical Code (NEC), or NFPA 70, oversees the safe installation of electrical wiring and equipment.

- In India, the National Building Code of India covers the detailed guidelines for construction, maintenance and fire safety of the structures.

- In Europe, the European Fire Safety Alliance (EuroFSA) is an independent alliance of fire professionals whose mission is to reduce the risks from fire, particularly in domestic areas. Their policy is based on the European Fire Safety Action Plan developed in cooperation with many European experts.

Competitive Landscape

The global fire-rated busway market is characterized by a large number of participants, including both established corporations and emerging players. Companies focus on developing innovative, high-performance solutions to meet increasing safety demands.

By enhancing product offerings, expanding manufacturing capabilities, and targeting high-growth regions, companies are supportingmarket growth. This includes the development of modular, customizable, and energy-efficient fire-rated busway systems to cater to diverse applications in commercial, industrial, and data center.

- In May 2023, LS Cable & System announced its plans to build a new bus duct factory in Mexico, set to be completed by mid-2025. The facility will serve as an export base for the U.S. and Canada, catering to growing demands due to data centers, electric vehicles, and semiconductor industries in North America.

List of Key Companies in Fire-Rated Busway Market:

- Schneider Electric

- Eaton

- Siemens

- ABB

- Powell Industries

- Westinghouse Electric Corporation

- Godrej Enterprises

- Furukawa Electric Co., Ltd

- MEGABBARE EUROPE SRL

- DBTS Industries Sdn Bhd

- Dynamic Electrical Sdn Bhd

- TAIAN-ECOBAR TECHNOLOGY

- Shanghai Zhenda Electric Appliance Complete Set Group Co., Ltd

- Tai Sin Electric Cables (VN) Co Ltd

- C&S

Recent Developments (Acquisition)

- In February 2024, ABB revealed its plan to acquire SEAM Group, expanding its Electrification Service portfolio. This move aims to enhance ABB's capabilities in asset management, predictive maintenance, and electrical safety, while boosting its presence in key sectors such as data centers, healthcare, and renewables.