Feminine Hygiene Products Market Size

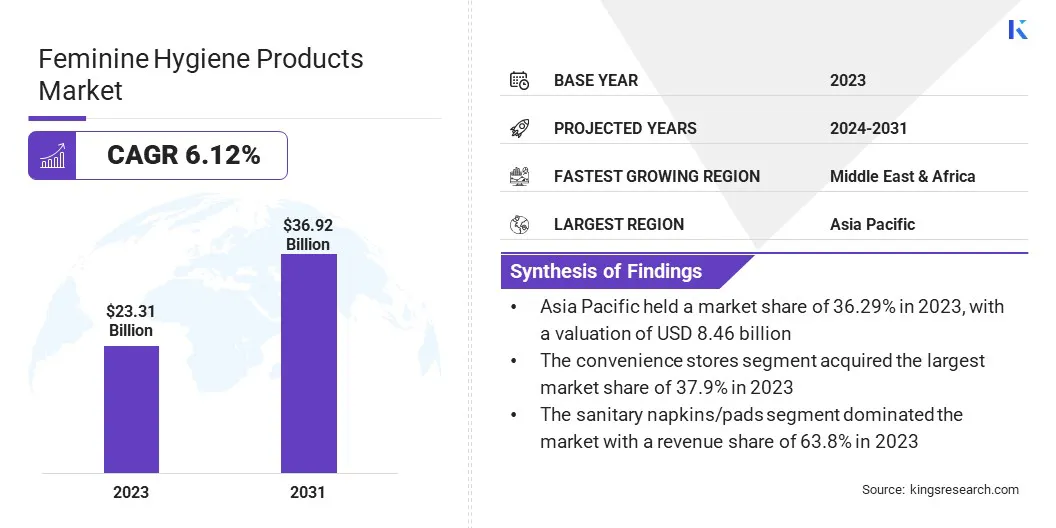

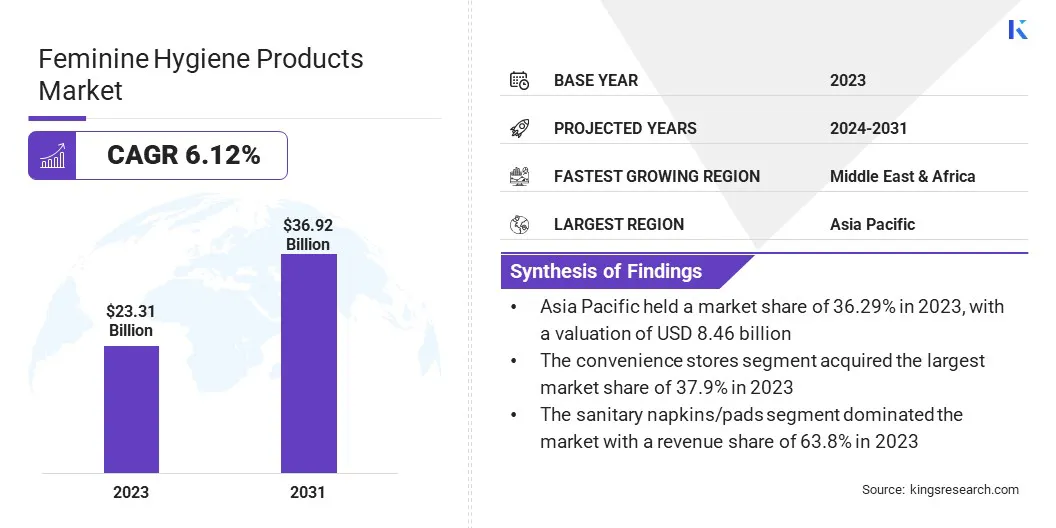

The global Feminine Hygiene Products Market size was valued at USD 23.31 billion in 2023 and is projected to reach USD 36.92 billion by 2031, growing at a CAGR of 6.12% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Johnson & Johnson Private Limited., Procter & Gamble, Kimberly-Clark, Essity Aktiebolag, Kao Corporation, Daio Paper Corporation, Unicharm Corporation, Premier FMCG, Ontex and Others.

The market for feminine hygiene products is experiencing significant expansion, characterized by a diverse portfolio of offerings, including tampons, pads, menstrual cups, and period panties, which cater to varied consumer needs and preferences. This growth is fueled by mounting consumer awareness regarding feminine hygiene, coupled with a shift towards more sustainable and eco-friendly product options.

The market is bolstered by the convenience and accessibility provided by online retail platforms. This accessibility enhances consumer exposure to a broader spectrum of products, thereby stimulating market development.

Additionally, the feminine hygiene products market is growing rapidly, reflecting a broader cultural movement toward emphasizing women's health and general wellness. Along with this, ongoing innovations and product evolution are catering to consumer requirements for comfort, convenience, and environmental responsibility.

Analyst’s Review

The feminine hygiene products market has observed significant growth in recent years driven by increasing awareness and demand for personal care products among women.

Additionally, the market has seen a rise in the introduction of innovative products, such as period-proof underwear and reusable menstrual cups, which cater to a growing segment of environmentally-conscious consumers. This trend is expected to continue shaping the market landscape in the coming years, with companies focusing on sustainability and eco-friendly practices to meet consumer preferences.

As more women prioritize sustainability and eco-friendliness in their purchasing decisions, companies are ramping up efforts to reduce their environmental impact. This includes using recyclable packaging, sourcing ingredients ethically, and investing in renewable energy sources, which is helping firms gain a competitive edge in the sector.

Market Definition

Feminine hygiene products are essential items designed to help women maintain personal hygiene during menstruation. These products include sanitary pads, tampons, menstrual cups, and panty liners. They are typically used to absorb menstrual blood and prevent leakage. The market for feminine hygiene products is characterized by a high demand for convenient and discreet solutions that offer both protection and comfort.

Additionally, advancements in technology and increasing awareness about menstrual hygiene have led to the development of innovative products that cater to the diverse needs of women. For example, menstrual cups have gained popularity in recent years due to their eco-friendly and cost-effective nature.

Many women also prefer organic and natural options, such as cotton pads and chemical-free tampons, to reduce the risk of irritation and allergic reactions. Overall, the evolution of feminine hygiene products reflects a growing emphasis on women's health and well-being, providing a variety of choices to suit individual preferences and needs.

Feminine Hygiene Products Market Dynamics

Increased awareness and education about the importance of feminine hygiene have led to a surge in the demand for feminine hygiene products. Women are now more informed about the potential health risks associated with poor hygiene practices and are seeking products that cater to their specific needs. This growing awareness has also bolstered consumer preference for more sustainable and environmentally friendly products, thereby driving industry growth.

Additionally, initiatives promoting menstrual hygiene management in developing countries have highlighted the need for accessible and affordable feminine hygiene products, further fueling market expansion.

Companies are now focusing on creating products that are not only effective and safe but also eco-friendly and affordable. This shift in consumer preferences has benefited women in both developed and developing nations who previously lacked access to proper menstrual hygiene products. Backed by these factors, the feminine hygiene products market is expected to grow rapidly.

However, environmental concerns surrounding the use of disposable feminine hygiene products have led to a shift in consumer behavior toward more sustainable options. This shift has put pressure on companies to develop eco-friendly alternatives, such as reusable pads and menstrual cups.

Additionally, the backlash against plastic packaging and harmful chemicals in these products has prompted a demand for transparency and accountability within the industry. This has pushed companies to reevaluate their manufacturing processes and sourcing practices to meet the growing demand for environmentally friendly options, which may hamper the growth of the market.

Segmentation Analysis

The global market is segmented based on product type, distribution channel, and geography.

By Product Type

Based on product type, the feminine hygiene products market is bifurcated into sanitary napkins/pads, tampons, menstrual cups, and others. The sanitary napkins/pads segment dominated the market with a revenue share of 63.8% in 2023 due to increased awareness about health and hygiene.

As more women prioritize their health, there has been an increase in the demand for high-quality, dependable feminine hygiene products. Brands have responded by innovating and presenting a diverse selection of products to meet varying interests and demands. From organic cotton pads to ultra-thin liners, manufacturers are focusing on providing them.

By Distribution Channel

Based on distribution channel, the feminine hygiene products market is bifurcated into hypermarkets/supermarkets, convenience stores, drug stores/ pharmacies, and others. The convenience stores segment acquired the largest market share of 37.9% in 2023 due to their strategic location and extended operating hours. Additionally, these stores often carry a wide range of brands and product options, catering to the diverse needs and preferences of female consumers.

Furthermore, the competitive pricing and frequent promotions offered by convenience stores attract budget-conscious shoppers looking for affordable yet quality feminine hygiene products. Overall, the accessibility, variety, and affordability provided by convenience stores have made them the go-to choice for women seeking convenience and value in their feminine hygiene purchases.

Feminine Hygiene Products Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Feminine Hygiene Products Market share stood around 36.29% in 2023 in the global market, with a valuation of USD 8.46 billion, due to the increasing awareness of menstrual hygiene products.

In countries such as Japan and South Korea, there has been a cultural shift toward open discussions about women's health, leading to a higher demand for feminine hygiene products. Additionally, the presence of large populations in countries like China and India has contributed to the growth of the market. Furthermore, the rise of e-commerce platforms in the region has made it easier for women to access a variety of feminine hygiene products, further driving the growth of the market.

Middle East & Africa registered for the highest CAGR over the forecast period, due to increasing awareness and acceptance of personal hygiene among women. With increasing awareness about the importance of maintaining good feminine hygiene, the demand for these products is rising considerably.

Additionally, rapid urbanization and changing lifestyle patterns in countries like Saudi Arabia and Nigeria have also contributed to the surge in demand for feminine hygiene products. Furthermore, the availability of a wide range of products catering to different preferences and needs of women in the region has also played a significant role in driving feminine hygiene products market growth.

Competitive Landscape

The global market study will provide valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers & acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Feminine Hygiene Products Market

Key Industry Developments

- June 2023(Investment): The Procter & Gamble Company completed the investment of USD 24 million in order to set up a personal healthcare manufacturing facility in Gujarat, India.

- April 2022(Product Launch): Kimberly-Clark Corporation launched new Poise Ultra-Thin Pads with Wings. These are the thinnest pads and are 100% clean, dry, fresh protection from bladder leaks.

The global Feminine Hygiene Products Market is segmented as:

By Product Type

- Sanitary Napkins/Pads

- Tampons

- Menstrual Cups

- Other

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Drug Stores/ Pharmacies

- Other

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America