Market Definition

The market refers to the industry focused on producing and supplying phosphate-based additives used in animal nutrition. These phosphates, including mono-calcium, di-calcium, and tri-calcium forms, are processed through chemical reactions involving phosphoric acid and calcium sources.

They are formulated to improve bone strength, metabolism, and feed efficiency in livestock and poultry. The market supports various species-specific formulations.

Feed phosphate is vital in commercial animal farming, aquaculture, and pet food production, due to its role in balanced nutrient intake. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the market.

Feed Phosphate Market Overview

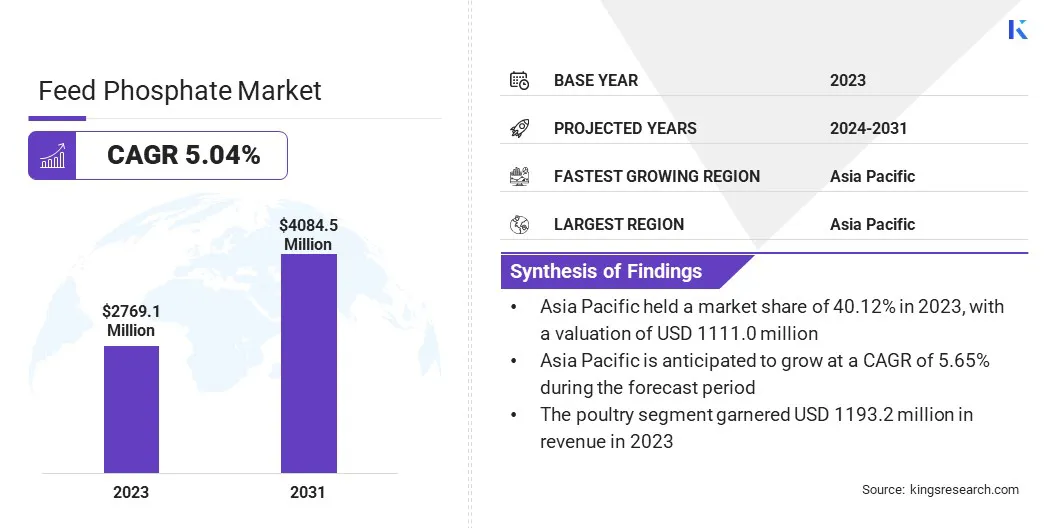

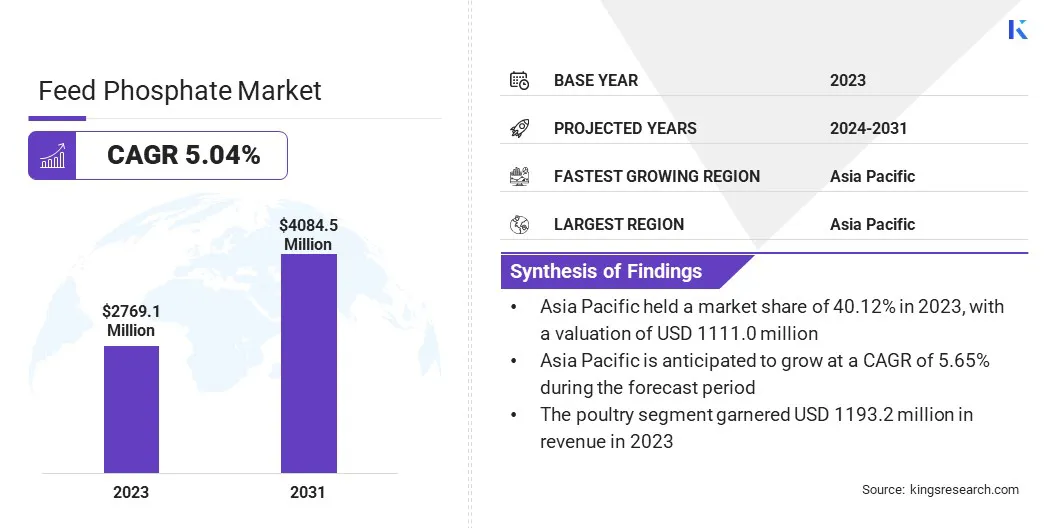

The global feed phosphate market size was valued at USD 2,769.1 million in 2023 and is projected to grow from USD 2,895.0 million in 2024 to USD 4,084.5 million by 2031, exhibiting a CAGR of 5.04% during the forecast period.

The market is registering steady growth, owing to the rapid expansion of the aquaculture industry, which demands high-quality feed to ensure optimal fish health and productivity. Additionally, ongoing research and development initiatives are leading to improved formulations and sustainable alternatives, enhancing feed efficiency and further driving the market.

Major companies operating in the feed phosphate industry are The Mosaic Company, PhosAgro Group, OCP Group, EuroChem Group, Incitec Pivot Limited, Nutrien Ltd., Yara International, J.R. Simplot Company, AG CHEMI Group s.r.o., AB LIFOSA, Fosfitalia Group, Rotem, Groupe Roullier (PHOSPHEA), J. R. Simplot Company, and EcoPhos S.A.

The rise of livestock farming, especially in developing economies, is leading to the increased demand for efficient feed solutions, contributing to the growth of the market. Feed phosphates are integral in large-scale operations to ensure consistent animal growth and health. The scalability and effectiveness of feed phosphates make them suitable for industrial livestock production systems.

- According to the United States Department of Agriculture’s October 2024 report, the global chicken meat production is expected to grow by nearly 2% in 2025, reaching an all-time high of 104.9 million tons. Most major producers, including China, the U.S., Turkey, the EU, Brazil, and Mexico are projected to witness gains. This growth is attributed to moderate improvements in feed costs and rising consumer demand supported by economic expansion. Global exports are also set to rise by 2%, hitting a record 13.8 million tons.

Key Highlights:

- The feed phosphate market size was valued at USD 2,769.1 million in 2023.

- The market is projected to grow at a CAGR of 5.04% from 2024 to 2031.

- Asia Pacific held a market share of 40.12% in 2023, with a valuation of USD 1,111.0 million.

- The dicalcium phosphate (DCP) segment garnered USD 1,193.2 million in revenue in 2023.

- The poultry segment is expected to reach USD 1,571.82 million by 2031.

- The powder/granules segment secured the largest revenue share of 80.24% in 2023.

- The market in Europe is anticipated to grow at a CAGR of 5.13% during the forecast period.

Market Driver

Expansion of the Aquaculture Industry

The aquaculture industry is registering significant growth, particularly in Asia, due to the rising demand for seafood. Feed phosphates are essential in aquafeeds, contributing to the proper development and health of aquatic species. The market is expanding as aquaculture operations scale to meet global seafood consumption.

- In June 2023, the Asian Development Bank (ADB) signed a USD 15 million convertible note agreement with Australis Holdings, Inc. (Australis) to support the development of climate-resilient, ocean-based barramundi and seaweed aquaculture in Vietnam. The funding will supply working capital to expand Australis’ operations in Van Phong Bay, Central Vietnam, and enable the creation of a second regional production facility in the southern region of the country.

Market Challenge

Environmental Concerns Linked to Phosphate Mining

A major challenge facing the feed phosphate market is the environmental impact of phosphate mining, which includes habitat disruption, water pollution, and high energy consumption. These concerns are putting pressure on producers to adopt more sustainable practices.

In response, key market players are investing in recycling technologies such as phosphorus recovery from sewage sludge and industrial waste. Others are exploring low-impact mining methods and improving process efficiency to reduce emissions.

Additionally, collaboration with research institutions is helping to develop eco-friendly alternatives, ensuring long-term market growth while aligning with global sustainability goals and regulatory expectations.

Market Trend

Ongoing Research and Development Initiatives

Continuous Research and Development (R&D) efforts are leading to innovations in feed phosphate products, enhancing their efficacy and environmental compatibility. These initiatives are resulting in feed phosphates with improved bioavailability and reduced ecological footprints. Such advancements are reinforcing the role of phosphates in modern animal nutrition strategies, propelling the market.

- In September 2024, EasyMining and Gelsenwasser, through their joint venture Phosphorgewinnung Schkopau GmbH (PGS), received approval to set up a phosphorus recovery facility in Schkopau, Germany, using the Ash2Phos technology. The plant is now actively recovering phosphorus from sewage sludge, offering a circular approach to phosphorus management. This process enables the extraction of over 90% of the phosphorus contained in the ash produced during sewage sludge incineration, supporting resource efficiency and environmental sustainability.

Feed Phosphate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Dicalcium Phosphate (DCP), Monocalcium Phosphate (MCP), Mono-Dicalcium Phosphate (MDCP), Tricalcium Phosphate (TCP), Defluorinated Phosphate (DFP), Others

|

|

By Livestock

|

Poultry, Swine, Ruminants, Aquaculture, Others

|

|

By Form

|

Powder/Granules, Liquid

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Dicalcium Phosphate (DCP), Monocalcium Phosphate (MCP), Mono-Dicalcium Phosphate (MDCP), Tricalcium Phosphate (TCP), Defluorinated Phosphate (DFP), and Others): The dicalcium phosphate (DCP) segment earned USD 1,193.2 million in 2023, due to its high bioavailability, cost-effectiveness, and suitability across a wide range of livestock diets.

- By Livestock (Poultry, Swine, Ruminants, Aquaculture, Others): The poultry segment held 43.09% share of the market in 2023, due to its high demand for balanced nutrition that supports rapid growth, strong bone development, and efficient feed conversion.

- By Form (Powder/Granules and Liquid): The powder/granules segment is projected to reach USD 3,226.6 million by 2031, owing to its ease of handling, efficient mixing in feed formulations, and consistent nutrient delivery.

Feed Phosphate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America .

Asia Pacific accounted for 40.12% share of the feed phosphate market in 2023, with a valuation of USD 1,111.0 million. The rise of integrated feed production companies in Asia Pacific has strengthened the demand for high-quality feed additives, including phosphates. These companies manage the full value chain, from feed milling to livestock production, requiring consistent and efficient feed formulations.

Moreover, Asia Pacific is registering a steady increase in feedstock consumption, driven by the growing demand for animal-based products and the expansion of intensive farming systems. The volume of compound feed used in the region continues to rise as livestock and aquaculture operations scale up.

This growth is increasing the need for essential feed ingredients, which are vital for ensuring nutrient availability and animal performance, contributing to the growth of the market.

- The Agriculture and Horticulture Development Board forecasts per capita beef consumption to increase by 4% in South Korea, 12% in Vietnam, and 11% in Malaysia between 2022 and 2029. Over the same period, pork consumption per person is expected to rise by 2% in South Korea, with China and Vietnam projected to register a notable 22% growth.

The feed phosphate industry in Europe is poised for significant growth at a robust CAGR of 5.13% over the forecast period. European feed producers prioritize maximizing nutrient absorption while minimizing environmental waste. Feed phosphates are a reliable source of highly bioavailable phosphorus, which helps meet strict nutritional targets without over-supplementing.

This efficiency is vital for producers trying to comply with environmental policies, and it supports the continued use of phosphate additives in animal nutrition, driving the market.

Furthermore, the growing trend of functional and specialty feeds in Europe, particularly for early-stage nutrition and high-performance animals, is boosting the market. These feeds often include precision minerals like mono- and dicalcium phosphate to support targeted growth and health outcomes.

Regulatory Frameworks

- In the U.S., feed phosphate regulations are governed by the Environmental Protection Agency (EPA) and the Association of American Feed Control Officials (AAFCO). The EPA sets emission limits for phosphate fertilizer production under the Clean Air Act, while the AAFCO provides guidelines for animal feed safety, ingredient standards, and nutritional adequacy, influencing feed phosphate use.

- The European Union (EU) enforces regulations such as Regulation (EC) No 1831/2003, which governs the approval and use of feed additives, including feed phosphates. Additionally, Regulation (EC) No 767/2009 addresses feed labeling and marketing, ensuring that phosphate additives are safe and accurately represented. These regulations safeguard animal health and environmental standards across EU member states.

- In China, feed phosphate quality and safety are regulated by national standards like GB 34458-2017, which covers feed additives like dipotassium hydrogen phosphate. Another significant standard, GB 15580-2011, regulates pollutants from phosphate fertilizer industries. These standards help ensure the safe use of feed phosphates and limit environmental impact.

- Japan's feed phosphate regulations are governed by the Act on Safety Assurance and Quality Improvement of Feeds, which ensures the safety of feed additives like phosphates. The Fertilizer and Feed Inspection Services (FAMIC) oversee the safety standards, ensuring that feed phosphates are free from contaminants like heavy metals and other toxins that could impact animal health.

Competitive Landscape:

Market players are increasingly focusing on strategies like R&D and collaborations to drive the feed phosphate market. These efforts enable companies to innovate and improve the quality of feed additives, such as recycled feed phosphates.

Working together with universities and industry partners can help them develop sustainable solutions, enhance product performance, and meet the growing demand for environmentally friendly alternatives. This collaborative approach helps accelerate the adoption of new technologies and strengthens the market's overall growth trajectory.

- In June 2024, EasyMining partnered with Aarhus University and Danish feed company DLG to launch a project assessing the digestibility of a recycled feed phosphate in newly weaned pigs. The recycled phosphorus, produced through the Ash2Phos process, maintains stable quality, due to its robust chemical recycling method. Using recycled phosphorus from sewage sludge as feed phosphate can replace virgin materials and significantly reduce CO2 emissions.

List of Key Companies in Feed Phosphate Market:

- The Mosaic Company

- PhosAgro Group

- OCP Group

- EuroChem Group

- Incitec Pivot Limited

- Nutrien Ltd.

- Yara International

- R. Simplot Company

- AG CHEMI Group s.r.o.

- AB LIFOSA

- Fosfitalia Group

- Rotem

- Groupe Roullier (PHOSPHEA)

- R. Simplot Company

- EcoPhos S.A.

Recent Developments (M&A)

- In February 2025, OCP Group expanded its ownership in GlobalFeed S.L. by acquiring an additional 25% stake in Fertinagro Biotech S.L., raising its total share in the company to 75%. This move builds on the initial acquisition of a 50% stake completed in May 2023. GlobalFeed S.L. specializes in animal nutrition, offering a broad portfolio of products, including phosphate-based and high-value feed solutions.