Market Definition

The market comprises the production and sale of high molecular weight, long-chain alcohols derived from natural fats and oils or petrochemical sources. These alcohols serve as key raw materials in personal care products, detergents, lubricants, and industrial chemicals. Market growth is driven by demand for bio-based ingredients, sustainability trends, and advancements in production technologies.

Fatty Alcohols Market Overview

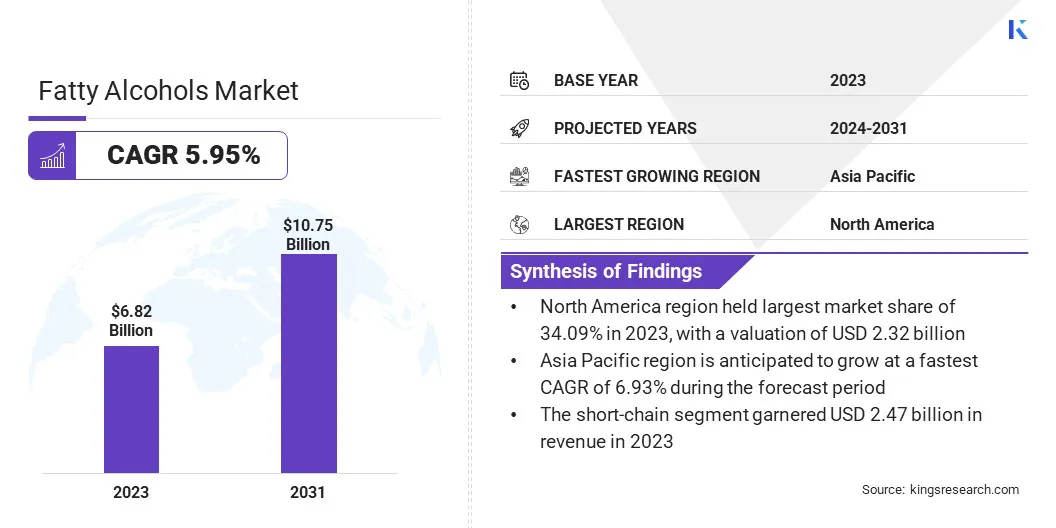

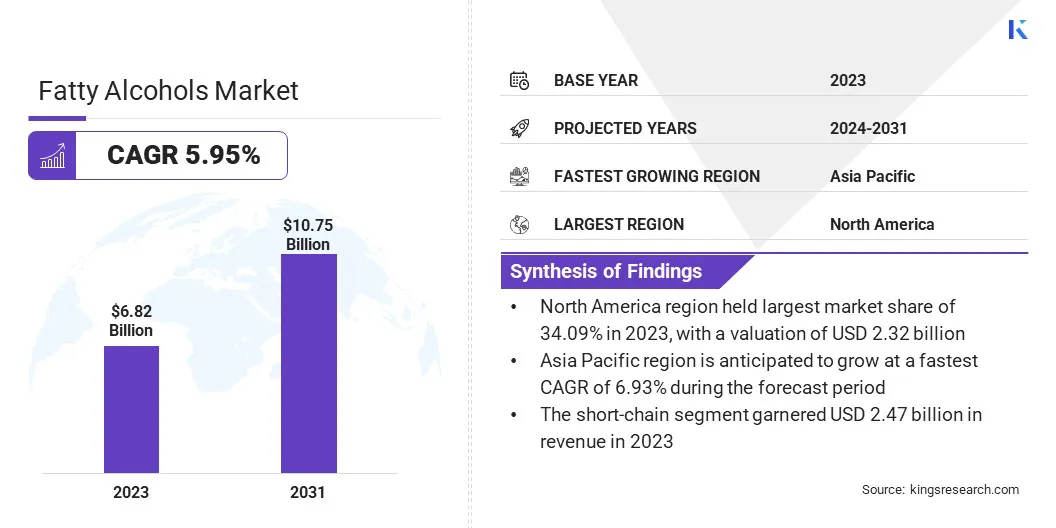

The global fatty alcohols market size was valued at USD 6.82 billion in 2023 and is projected to grow from USD 7.17 billion in 2024 to USD 10.75 billion by 2031, exhibiting a CAGR of 5.95% during the forecast period.

Technological advancements in methanol biotransformation and growing consumer preference for bio-based, non-toxic ingredients are driving the market. These developments are enabling more efficient and sustainable production processes, reducing reliance on fossil-based raw materials.

Major companies operating in the fatty alcohols industry are Wilmar International Ltd, Kao Corporation, KLK OLEO, PT. Ecogreen Oleochemicals, Godrej Industries Limited, Procter & Gamble, MOHINI ORGANICS PVT. LTD, Sasol Limited, Emery Oleochemicals, Saibaba Surfactants PVT LTD., Sinarmas Cepsa Pte. Ltd., Timur Network Sdn Bhd, CREMER OLEO GmbH & Co. KG, KH Neochem Co., Ltd., and Tokyo Chemical Industry Co.Ltd.

The rapidly growing personal care and cosmetics industry is driving demand for fatty alcohols, which act as emulsifiers, emollients, and thickening agents in creams, lotions, and shampoos. These ingredients improve the texture and consistency of formulations while enhancing moisturization and skin protection, making them essential in high-quality cosmetic products.

Key Highlights:

- The fatty alcohols industry size was recorded at USD 6.82 billion in 2023.

- The market is projected to grow at a CAGR of 5.95% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 2.32 billion.

- The short-chain segment garnered USD 2.47 billion in revenue in 2023.

- The soaps & detergents segment is expected to reach USD 2.40 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.93% during the forecast period.

Market Driver

"Advancements in Bio-Based Production Methods"

The global fatty alcohols market is witnessing steady growth, driven by advancements in bio-based production methods. New bioengineering techniques are making it possible to produce fatty alcohols more efficiently and at lower costs.

These methods offer a sustainable alternative to traditional petrochemical processes, aligning with the growing demand for eco-friendly products. As more industries adopt green production technologies, the use of bio-based fatty alcohols is expected to rise, driving long-term market expansion.

- In April 2023, researchers at the Dalian Institute of Chemical Physics (CAS) engineered the yeast Ogataea polymorpha to produce fatty alcohols from methanol more efficiently. By boosting key materials in peroxisomes, they reached a yield of 3.6 g/L and overcame production limits seen in the cell's cytoplasm.

Market Challenge

"Regulatory Compliance Restrict Market Expansion"

A key challenge limiting growth in the fatty alcohols market is the complexity of meeting evolving environmental and regulatory standards. Global regulations related to emissions, sustainability, and product safety vary across regions, creating compliance difficulties for manufacturers. Navigating these frameworks increases operational costs and slows product development.

To address this, companies are investing in regulatory expertise, adopting cleaner production technologies, and seeking internationally recognized certifications. These measures can streamline compliance processes, improve market access, and enhance brand credibility in a regulatory-driven environment.

Market Trend

"Growing Demand for Bio-Based Fatty Alcohols"

The increasing consumer awareness of the harmful effects of petrochemical-based products is driving the shift toward bio-based alternatives. As demand for natural, non-toxic ingredients rises, fatty alcohols derived from renewable sources are gaining traction.

This trend presents significant growth opportunities in the market, as industries focus on offering sustainable and eco-friendly solutions to meet consumer preferences.

- In October 2023, Dow introduced three bio-based and biodegradable personal care ingredients at In-Cosmetics Asia, held in Bangkok. This includes EcoSense APP-5000, a natural oil-in-water emulsifier derived from sugars and fatty alcohols. It features 100% renewable carbon content and natural index per ISO 16128, and emulsifies up to 40% oil-phase content.

Fatty Alcohols Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Short-Chain, Pure & Mid cut, Long Chain, Higher Chain

|

|

By Application

|

Soaps & Detergents, Personal Care, Lubricants, Plasticizers, Amines, Food & Nutrition, Pharmaceutical Formulation, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Short-Chain, Pure & Mid cut, Long Chain, Higher Chain): The short-chain segment earned USD 2.47 billion in 2023 due to its extensive use in detergents and cleaning products, driven by high demand from the household and industrial cleaning sectors.

- By Application (Soaps & Detergents, Personal Care, Lubricants, Plasticizers, Amines, Food & Nutrition, Pharmaceutical Formulation, Others): The soaps & detergents segment held 22.42% of the market in 2023, due to the high consumption of surfactants in household and industrial cleaning products, supported by growing hygiene awareness and demand for effective cleansing agents.

Fatty Alcohols Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America fatty alcohols market share stood at around 34.09% in 2023 in the global market, with a valuation of USD 2.32 billion. The region's dominance is driven by its stable supply of essential raw materials like soybean and other vegetable oils, enabling reliable and cost-efficient fatty alcohol production.

High availability of raw materials supports large-scale manufacturing and enhances supply chain efficiency, thereby driving market growth in North America.

- In February 2025, the U.S. Economic Research Service (ERS) reported that the United States remained the world’s second-largest producer and exporter of soybeans. Rising soybean crush volumes, fueled by growing demand for soybean oil in biomass-based diesel and strong export activity have reinforced the country’s agricultural output. Additionally, U.S. soybean meal exports reached record highs in marketing year (MY) 2023/24, with steady performance expected into MY 2024/25.

Asia Pacific is poised for significant growth at a robust CAGR of 6.93% over the forecast period. Growth in the region is driven by increasing demand across personal care, cosmetics, and household cleaning applications. Accelerated urbanization, a growing middle class, and higher consumer expenditure on hygiene and wellness products are key contributing factors.

Furthermore, the region benefits from a strong base of oleochemical producers and readily available raw materials like palm and coconut oil, enabling efficient, cost-effective manufacturing and robust supply chain operations.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) oversees key regulations impacting the market. Under the Toxic Substances Control Act (TSCA), the EPA monitors the manufacturing, processing, and distribution of chemical substances, including fatty alcohols. The Clean Air Act (CAA) and Clean Water Act (CWA) regulate emissions and wastewater discharges, particularly from large-scale production facilities.

- In China, the Environmental Protection Law (EPL) sets regulations for pollution control, waste management, and ensuring environmental sustainability throughout the fatty alcohol production process.

Competitive Landscape

The fatty alcohols industry is experiencing increased consolidation through strategic acquisitions, with key players expanding their product offerings and operational capabilities.

To stay competitive, leading players are also focusing on diversifying their product portfolios, investing in sustainable production processes, and forming partnerships with suppliers to ensure a steady raw material supply.

Additionally, companies are developing specialized fatty alcohol products for emerging markets, such as bio-based and eco-friendly alternatives, to cater to the growing demand for sustainable and environmentally friendly solutions.

List of Key CompaniesFatty Alcohols Market:

- Wilmar International Ltd

- Kao Corporation

- KLK OLEO

- PT. Ecogreen Oleochemicals

- Godrej Industries Limited

- Procter & Gamble

- MOHINI ORGANICS PVT. LTD.

- Sasol Limited

- Emery Oleochemicals

- Saibaba Surfactants PVT LTD.

- Sinarmas Cepsa Pte. Ltd.

- Timur Network Sdn Bhd

- CREMER OLEO GmbH & Co. KG

- KH Neochem Co., Ltd.

- Tokyo Chemical Industry Co.Ltd

Recent Developments (M&A/New Product Launch)

- In November 2024, Sasol Chemicals introduced NACOL 18-98, a palm-free, biobased stearyl alcohol solution for the personal care industry. NACOL 18-98 is made from segregated rapeseed oil, a renewable resource grown locally in Europe and offers a significantly lower carbon footprint compared to palm-based alternatives. This new formulation is designed as a drop-in replacement for seamless integration with existing products while maintaining the same performance.

- In April 2023, KLK Emmerich GmbH (KLKE), a subsidiary of Kuala Lumpur Kepong Berhad (KLK) acquired a controlling stake in Temix Oleo SpA (Temix Oleo). This acquisition supports KLK's long-term growth strategy by diversifying its product range and expanding access to key customers.