Market Definition

Extended detection and response (XDR) is a cybersecurity approach that integrates multiple security products into a unified system to detect, investigate, and respond to threats across an organization’s entire IT environment.

XDR collects and correlates data from endpoints, networks, cloud workloads, servers, and applications. The XDR market encompasses solutions and platforms that provide cross-layered security analytics, real-time monitoring, incident response automation, threat intelligence integration, and centralized management.

Extended Detection and Response Market Overview

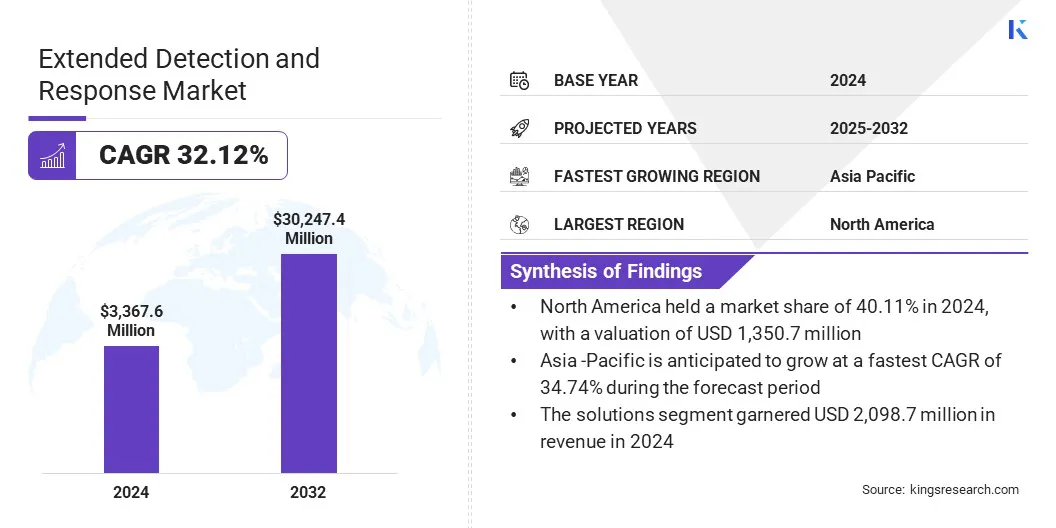

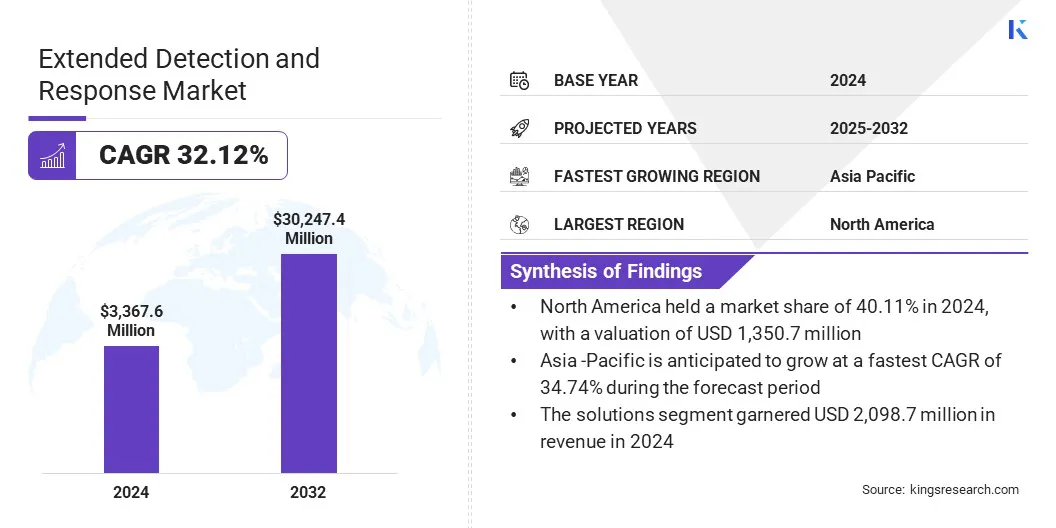

The global extended detection and response market size was valued at USD 3,367.6 million in 2024 and is projected to grow from USD 4,305.1 million in 2025 to USD 30,247.4 million by 2032, exhibiting a CAGR of 32.12% over the forecast period.

Market growth is driven by the increasing adoption of cloud services, which are expanding the digital footprint and creating complex security challenges. The rise in remote and hybrid work is further accelerating demand for comprehensive XDR solutions that provide real-time threat detection for endpoints and applications.

Key Highlights:

- The extended detection and response industry size was recorded at USD 3,367.6 million in 2024.

- The market is projected to grow at a CAGR of 32.12% from 2024 to 2032.

- North America held a share of 40.11% in 2024, valued at USD 1,350.7 million.

- The solutions segment garnered USD 2,098.7 million in revenue in 2024.

- The cloud-based segment is expected to reach USD 20,205.1 million by 2032.

- The small and medium enterprises (SMEs) segment is anticipated to witness the fastest CAGR of 34.24% over the forecast period.

- The BFSI segment held a share of 28.76% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 34.74% over the forecast period.

Major companies operating in the extended detection and response market are Palo Alto Networks, Inc, Microsoft Corporation, CrowdStrike, Inc, SentinelOne, Inc, Trend Micro Incorporated, Cisco Systems, Inc, Cybereason Inc, Sophos Ltd, Musarubra LLC, Fortinet, Inc, Rapid7, Inc, S.C. BITDEFENDER S.R.L, Elasticsearch B.V., Secureworks, Inc, and Cynet.

Increasing sophistication of cyber threats is compelling organizations to adopt advanced security solutions that offer real-time monitoring and automated response. Enterprises are facing more complex attacks, including ransomware and phishing, which can breach multiple layers of IT infrastructure, thereby driving market growth.

- The Ministry of Home Affairs reported that India lost USD 2.64 billion to cyber fraud in 2024, a 206% increase from the previous year.

Market Driver

Growing Awareness of Insider Threats

A key factor propelling the growth of the extended detection and response market is the increasing awareness of insider threats and their financial impact on organizations.

Enterprises are adopting XDR solutions to provide comprehensive visibility across endpoints, networks, cloud workloads, and applications, enabling the identification of potential threats in real time. These platforms also support automated response, helping organizations contain incidents quickly and protect sensitive data while maintaining regulatory compliance.

- In August 2024, the Cybersecurity and Infrastructure Security Agency (CISA) reported that the average cost of an insider threat incident rose to USD 16.2 million per organization in 2023.

Market Challenge

Integration Complexity with Existing Security Tools

A key challenge impeding the growth of the extended detection and response market is the complexity of integrating XDR solutions with existing security tools and IT infrastructure. Organizations operate diverse environments with multiple legacy systems, point solutions, and cloud-based applications, making seamless integration difficult.

Ensuring compatibility and effective communication between these tools requires significant technical expertise and resources. This complexity can delay the deployment of XDR solutions and limit their ability to deliver efficient threat detection across the enterprise.

To address this challenge, market players are developing XDR solutions with enhanced compatibility and interoperability with existing security tools and IT infrastructure. Vendors are offering pre-configured connectors and standardized APIs to streamline deployment and data correlation across diverse systems. Additionally, they are investing in professional services, training, and support to assist organizations in implementing XDR platforms.

Market Trend

Integration of AI in XDR Solutions

A key trend influencing the extended detection and response market is the integration of AI into detection and response solutions. Vendors are incorporating AI-driven capabilities such as autonomous triage, threat hunting, and real-time response across XDR platforms.

These innovations are helping reduce alert fatigue, prioritize vulnerabilities, and accelerate the remediation of security incidents. This shift is driving the adoption of intelligent, unified cybersecurity platforms across enterprises to strengthen the security framework.

- In April 2025, Infopercept launched Invinsense 6.0, the latest version of its flagship cybersecurity platform. The platform integrates Agentic AI across its XDR, OXDR, and compliance modules, enabling autonomous detection and response and threat exposure management.

Extended Detection and Response Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solutions, Services

|

|

By Deployment Mode

|

Cloud-based, On-premises, Hybrid

|

|

By Organization Size

|

Small and Medium Enterprises (SMEs), Large Enterprises

|

|

By End-Use Industry

|

BFSI, Healthcare and Life Sciences, IT & Telecom, Government and Defense, Retail and E-commerce, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solutions and Services): The solutions segment earned USD 2,098.7 million in 2024, driven by increasing adoption of integrated XDR platforms for comprehensive threat detection and response.

- By Deployment Mode (Cloud-based, On-premises, and Hybrid): The cloud-based segment held 53.23% of the market in 2024, fueled by the growing preference for scalable, remotely managed security solutions.

- By Organization Size (Small and Medium Enterprises (SMEs), and Large Enterprises): The small and medium enterprises (SMEs) segment is projected to reach USD 16,214.1 million by 2032, owing to rising demand for cost-effective managed XDR and automated cybersecurity services.

- By End-Use Industry (BFSI, Healthcare and Life Sciences, IT & Telecom, Government and Defense, Retail and E-commerce, and Others): The IT & telecom segment is anticipated to witness the fastest CAGR of 35.37% over the forecast period, driven by digital transformation and increasing cyber threats.

Extended Detection and Response Market Regional Analysis

Based on region, the Market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America extended detection and response market share stood at 40.11% in 2024 in the global market, valued at USD 1,350.7 million. This dominance is attributed to the increasing sophistication and frequency of cyberattacks, which are prompting organizations to adopt advanced XDR solutions for threat detection.

The rising adoption of cloud services and hybrid IT environments in the region is creating demand for unified security platforms that provide centralized visibility and monitoring. Stringent regulatory compliance requirements, such as the Health Insurance Portability and Accountability Act (HIPAA) and the California Consumer Privacy Act (CCPA), are prompting enterprises to strengthen security frameworks to ensure data protection.

Additionally, regional players are expanding their XDR capabilities through technology integration, platform enhancements, and strategic acquisitions to improve operational efficiency, further driving market expansion in the region.

- In February 2025, Sophos completed its USD 859 million acquisition of XDR specialist Secureworks from Dell Technologies to enhance its threat detection and response capabilities. The acquisition strengthens Sophos’ XDR offerings by integrating Secureworks’ expertise and technologies in XDR to enable improved visibility and operational efficiency for clients.

Asia Pacific is set to grow at a robust CAGR of 34.74% over the forecast period. This growth is driven by rapid digitalization in the banking, healthcare, and government sectors, prompting organizations to adopt XDR solutions for proactive threat detection and response. The region’s expanding small and medium-sized enterprise (SME) sector is accelerating demand for managed XDR and cost-effective cybersecurity solutions.

Rising investments in cloud infrastructure and hybrid IT environments by large enterprises and government across the region are creating a need for unified security platforms with centralized visibility. Additionally, increasing adoption of integrated XDR solutions with threat exposure management is strengthening cybersecurity, further driving market growth in the region.

- In March 2025, Infopercept launched its ‘Real MDR Solution’ through the Invinsense platform in Ahmedabad, India. The solution integrates XDR, Deception Technology, threat exposure management, and compliance services. It enables organizations to strengthen security, manage vulnerabilities, and streamline cybersecurity operations.

Regulatory Frameworks

- In the U.S., the Cybersecurity and Infrastructure Security Agency (CISA) oversees national cybersecurity across critical sectors such as finance, energy, healthcare, and communications. It sets guidelines for incident reporting, real-time threat detection, and response. CISA ensures compliance with federal regulations, including FISMA and the NIST Cybersecurity Framework, promoting secure IT infrastructure and operational resilience.

- In the UK, the National Cyber Security Centre (NCSC) supervises cybersecurity measures for public and private organizations. It evaluates technologies such as XDR for threat detection and response, issues compliance frameworks, and shares threat intelligence. NCSC enforces regulations such as the UK Data Protection Act 2018 and Network and Information Systems (NIS) Regulations, enhancing organizational resilience against cyber risks.

- In China, the National Information Security Standardization Technical Committee (TC260) regulates cybersecurity standards, network protection, and enterprise security technologies. It oversees compliance with the Cybersecurity Law of the People’s Republic of China and related data protection regulations, setting standards for threat monitoring, vulnerability management, and detection-response solutions such as XDR across critical industries.

- In India, the Indian Computer Emergency Response Team (CERT-In) monitors cybersecurity incidents, evaluates detection and response systems, and provides guidance for endpoint, network, and cloud security. It enforces compliance with the Information Technology Act, 2000, and related data protection rules, ensuring adoption of automated threat detection and real-time response.

Competitive Landscape

Companies operating in the extended detection and response industry are actively strengthening their platform capabilities by integrating endpoint, network, and application security into unified solutions.

They are expanding product offerings to include services such as exposure monitoring, compliance, and device management, enabling organizations to streamline operations while enhancing security. Additionally, players are focusing on strategic acquisitions to expand their market presence, improve operational efficiency, and deliver comprehensive XDR solutions to enterprises.

- In May 2024, Lumifi Cyber acquired Netsurion, a managed XDR provider, to enhance MDR capabilities for over 400 clients. The acquisition integrates Netsurion’s customer base with Lumifi’s U.S.-based Security Operations Center (SOC) and proprietary SHIELDVision platform. This move expands Lumifi’s market presence and improves operational efficiency for clients.

Top Key Companies in Extended Detection & Response Market:

- Palo Alto Networks, Inc

- Microsoft Corporation

- CrowdStrike, Inc

- SentinelOne, Inc

- Trend Micro Incorporated

- Cisco Systems, Inc

- Cybereason Inc

- Sophos Ltd

- Musarubra LLC

- Fortinet, Inc

- Rapid7, Inc

- C. BITDEFENDER S.R.L

- Elasticsearch B.V.

- Secureworks, Inc

- Cynet

Recent Developments

- In September 2025, Sophos integrated Sophos Endpoint directly into its cloud-native cybersecurity platform, Taegis, for both XDR and MDR subscriptions, providing unified endpoint protection and threat response across all subscribers. The integration simplifies security operations, reduces licensing costs, and strengthens ransomware protection through automated threat mitigation.

- In September 2025, Kaspersky launched its Kaspersky Next XDR Optimum and Kaspersky Next MXDR Optimum solutions, along with a managed XDR service. These offerings are designed for small and medium-sized enterprises (SMEs), providing protection and automated response to help them detect and mitigate threats effectively.

- In September 2025, Hexnode expanded its product line to include XDR and DEX solutions. These solutions provide integrated security and device management capabilities, enabling enterprises to strengthen threat detection and improve endpoint visibility.

- In May 2025, Proficio expanded its Managed XDR services through a partnership with Cisco SolutionsPlus. The managed XDR service combines Proficio’s SOC-as-a-Service expertise with Cisco’s Managed XDR platform, providing 24×7 threat detection and active response for enterprises. This collaboration enhances security operations and improves threat visibility for enterprises of all sizes.