Market Definition

The market involves specialized equipment designed to prevent or contain explosions in environments where hazardous materials or gases are present. These environments can include industries like oil & gas, mining, chemicals, and manufacturing.

Explosion-proof equipment is built to withstand potential explosions and keep them from spreading, ensuring the safety of workers and facilities. The report outlines the primary drivers of the market, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the market's trajectory.

Explosion Proof Equipment Market Overview

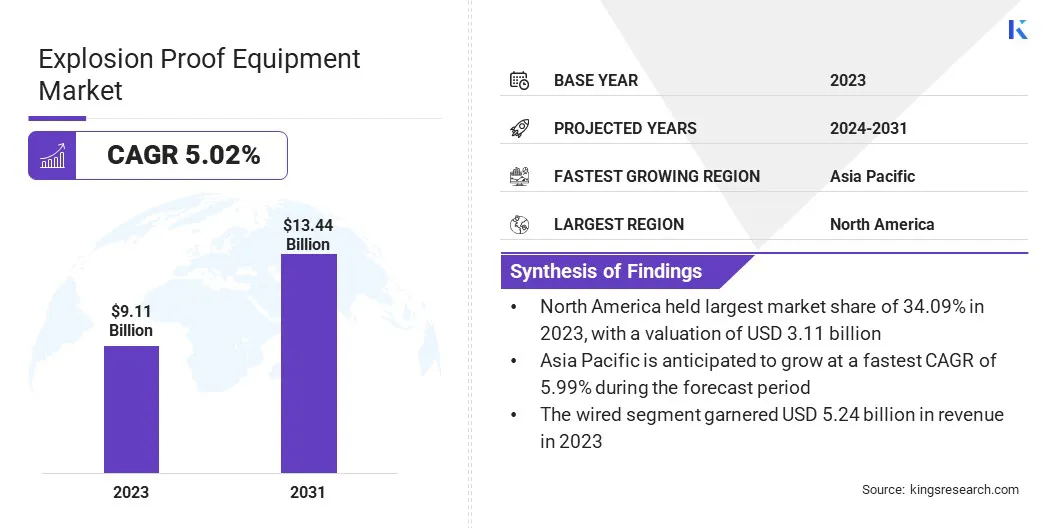

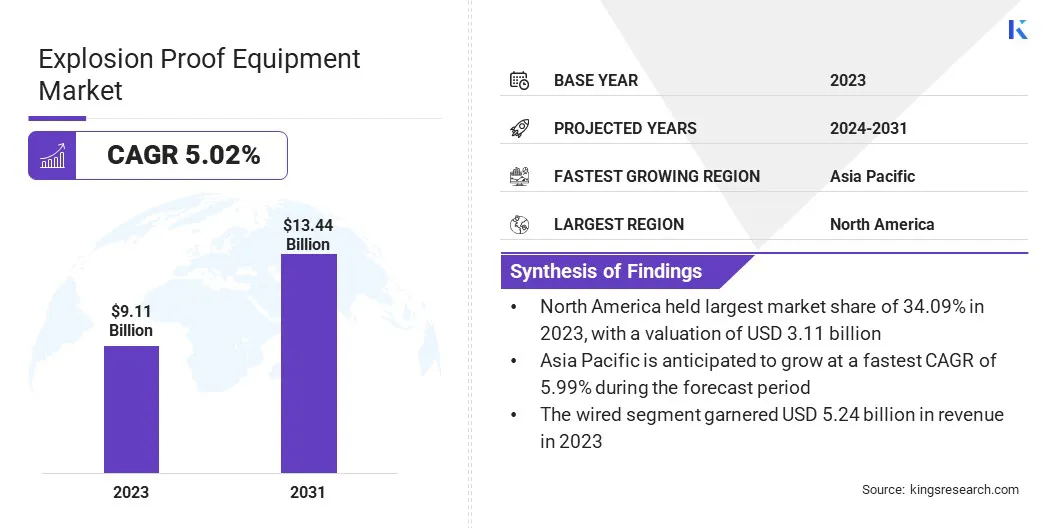

The global explosion proof equipment market size was valued at USD 9.11 billion in 2023, which is estimated to be USD 9.54 billion in 2024 and reach USD 13.44 billion by 2031, growing at a CAGR of 5.02% from 2024 to 2031.

Rising safety regulations across industries such as oil & gas, chemicals, and manufacturing are driving the demand for explosion-proof equipment, ensuring both worker safety and compliance with stringent operational safety standards.

Major companies operating in the explosion proof equipment industry are Siemens, PATLITE CORPORATION, European Safety Systems Limited, NHP, Supermec Pte. Ltd., Quintex GmbH, Honeywell International Inc., Eaton, Emerson Electric Co., Worksite Lighting, TOMAR Industrial, Potter Electric Signal Company, LLC, Pepperl+Fuchs SE, ABB, and Warom Technology Incorporated Company.

The market is expanding rapidly, driven by stringent safety regulations and the need for reliable solutions in hazardous environments. Industries such as oil & gas, chemicals, pharmaceuticals, and mining require durable, high-performance equipment to prevent explosions and ensure worker safety.

With increasing focus on operational efficiency, the demand for advanced technologies like explosion-proof sensors, cameras, lighting, and communication devices is growing. These innovations are critical for compliance with safety standards, minimizing risks, and enhancing overall safety in high-risk industries.

- In March 2024, Axis Communications launched the world’s first explosion-protected thermometric camera designed for Zone/Division 2 hazardous locations, alongside its first Zone/Division 1 explosion-protected network horn speaker. These products enhance safety, efficiency, and security in critical infrastructure by enabling remote monitoring and automated alerts.

Key Highlights:

Key Highlights:

- The explosion proof equipment industry size was valued at USD 9.11 billion in 2023.

- The market is projected to grow at a CAGR of 5.02% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 3.11 billion.

- The junction boxes & enclosures segment garnered USD 1.57 billion in revenue in 2023.

- The explosion proof segment is expected to reach USD 5.61 billion by 2031.

- The wired segment held a market share of 57.53% in 2023.

- The chemical & petrochemical segment is anticipated to grow at a CAGR of 5.16% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.99% during the forecast period.

Market Driver

"Rising Safety Regulations"

Rising safety regulations is driving the demand for explosion-proof equipment, especially in high-risk industries like oil & gas, chemicals, and manufacturing. Governments and organizations are imposing stricter safety standards. Thus, businesses are increasingly adopting explosion-proof solutions to protect workers and assets from hazardous environments.

Compliance with these regulations not only enhances safety but also ensures operational continuity and minimizes risks. The growing emphasis on safety protocols in these sectors continues to fuel the demand for specialized explosion-proof equipment globally.

- In June 2024, Baker Hughes introduced advanced sensor technologies, including the XMTCpro, HygroPro XP, and T5MAX Transducer. These solutions, designed for hydrogen and industrial applications, enhance safety, reliability, and performance in hazardous environments, aligning with explosion-proof equipment market requirements.

Market Challenge

"High Initial Costs"

High initial costs, including installation, maintenance, and certification, present a significant challenge for the explosion proof equipment market, particularly for small and medium-sized enterprises with limited budgets. These expenses can discourage businesses from investing in essential safety measures, jeopardizing worker safety and regulatory compliance.

Manufacturers in the explosion-proof equipment market are focusing on developing more cost-effective solutions, such as modular systems, while offering financing options and government incentives to make safety equipment more accessible and affordable for businesses.

Market Trend

"Focus on Durability and High-temperature Operations"

A key trend in the explosion proof equipment market is the use of durable solutions for operation in extreme conditions. Industries like oil & gas, chemicals, and manufacturing are focusing on equipment designed to withstand high temperatures and hazardous environments.

This shift is driven by the need for reliable, long-lasting products that can function efficiently in harsh conditions without compromising safety. Equipment with high-temperature ratings and certifications for hazardous areas is becoming essential for maintaining operational efficiency and ensuring worker safety in these industries.

- In March 2024, Emerson launched the Rosemount SAM42 Acoustic Particle Monitor, a non-intrusive, explosion-proof device designed to measure entrained sand in oil and gas wells. This monitor provides real-time data to help optimize production, minimize erosion risk, and enhance asset safety.

Explosion Proof Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By System

|

Junction Boxes & Enclosures, Lighting Systems, Monitoring Systems, Communication & Networking Systems, Signaling Devices, Automation Systems, Cable Glands, HVAC Systems, Others

|

|

By Method of Protection

|

Explosion Proof, Explosion Prevention, Explosion Segregation

|

|

By Connectivity

|

Wired, Wireless

|

|

By End use Industry

|

Oil & Gas, Pharmaceutical, Chemical & Petrochemical, Food Processing, Energy & Power, Mining, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK , Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E. , Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By System (Junction Boxes & Enclosures, Lighting Systems, Monitoring Systems, Communication & Networking Systems, Signaling Devices, Automation Systems, Cable Glands, HVAC Systems, Others): The junction boxes & enclosures segment earned USD 1.57 billion in 2023, due to the increasing demand for safe and durable equipment for hazardous environments in industries like oil & gas.

- By Method of Protection (Explosion Proof, Explosion Prevention, Explosion Segregation): The explosion proof segment held 42.17% share of the market in 2023, due to stricter safety regulations and the need for protection in explosive environments across various industries.

- By Connectivity (Wired, Wireless): The wired segment is projected to reach USD 7.54 billion by 2031, owing to the growing adoption of wired systems for reliable and secure data transmission in hazardous environments.

- By End Use Industry (Oil & Gas, Pharmaceutical, Chemical & Petrochemical, Food Processing, Energy & Power, Mining, Others): The chemical & petrochemical segment is anticipated to register a CAGR of 5.16% during the forecast period, driven by the increasing need for explosion-proof solutions in hazardous chemical processing and storage operations.

Explosion Proof Equipment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America explosion proof equipment market share stood at around 34.09% in 2023, with a valuation of USD 3.11 billion. North America remains the dominant region for the market, driven by well-established industrial sectors such as oil & gas, chemicals, and manufacturing.

North America explosion proof equipment market share stood at around 34.09% in 2023, with a valuation of USD 3.11 billion. North America remains the dominant region for the market, driven by well-established industrial sectors such as oil & gas, chemicals, and manufacturing.

The region benefits from advanced safety regulations, technological innovations, and a high level of awareness regarding worker and operational safety. The presence of key market players and the robust adoption of explosion-proof equipment across critical infrastructure further reinforce North America's leadership. Additionally, continuous investments in upgrading facilities and enhancing safety standards contribute to the region's market dominance.

The explosion proof equipment industry in Asia Pacific is poised for significant growth at a robust CAGR of 5.99% over the forecast period. Asia Pacific is emerging as the fastest-growing market for explosion-proof equipment, driven by rapid industrialization, stringent safety regulations, and increasing demand in sectors such as oil & gas, chemicals, and manufacturing.

Countries like China, India, and Japan are investing heavily in infrastructure development and upgrading safety standards, which is boosting the demand for explosion-proof solutions. Additionally, the region's growing focus on worker safety and operational efficiency in hazardous environments is further propelling the market.

Regulatory Frameworks

- In the U.S., Part 1910.307 under Occupational Safety and Health Administration’s (OSHA's) Occupational Safety and Health Standards outlines safety requirements for electrical equipment in hazardous locations. It covers areas like fuel stations, chemical plants, and those with combustible dusts, ensuring that equipment is suitable for such environments.

- In the European Union (EU), the ATEX Directive 2014/34/EU regulates equipment and protective systems for explosive atmospheres. It outlines essential health and safety requirements, along with conformity assessment procedures, ensuring that products meet safety standards before entering the EU market.

- In India, IS 2148 under the Bureau of Indian Standards (BIS) provides guidelines for electrical equipment in explosive gas atmospheres to ensure safety and compliance.

Competitive Landscape

Companies in the explosion proof equipment industry are continuously innovating to meet the growing demand for safety in hazardous environments. They are focusing on developing advanced products with higher durability, enhanced functionality, and compliance with stringent safety regulations.

Manufacturers are integrating cutting-edge technologies like smart sensors, real-time monitoring, and increased energy efficiency into their products. Additionally, companies are expanding their offerings to include explosion-proof motors, blowers, lighting, and control systems, catering to industries such as oil & gas, chemical, and manufacturing.

- In June 2024, Fuji Electric launched the EXV1000-7W 10 HP explosion-proof blower, designed for hazardous environments with flammable gases, vapors, or combustible dust. It features a T4 certified explosion-proof motor, maximum pressure of 191 in H2O, and airflow of 406 SCFM. Ideal for aeration, ventilation, and pneumatic transport systems, this blower provides high reliability and durability, supporting industries like remediation and fume exhaust.

List of Key Companies in Explosion Proof Equipment Market:

- Siemens

- PATLITE CORPORATION

- European Safety Systems Limited

- NHP

- Supermec Pte. Ltd.

- Quintex GmbH

- Honeywell International Inc.

- Eaton

- Emerson Electric Co.

- Worksite Lighting

- TOMAR Industrial

- Potter Electric Signal Company, LLC

- Pepperl+Fuchs SE

- ABB

- Warom Technology Incorporated Company

Recent Developments (Funding/Product Launch)

- In August 2024, ABB introduced the DP200 Crush+ severe-duty motor, engineered for demanding environments like mining and aggregate operations. This motor offers high starting torque, flexibility, and modular design. It is compatible with the ABB Ability Smart Sensor, which meets ATEX, IECEx, and NEC500 certifications, ensuring compliance with the highest safety standards for equipment in explosive atmospheres.

- In July 2024, Sviluppo Sostenibile, a private equity fund managed by DeA Capital Alternative Funds SGR, completed its investment in GM International, a leading provider of intrinsic safety equipment. GM International specializes in explosion-proof systems for hazardous environments and aims to expand further with the support of this partnership.

Key Highlights:

Key Highlights: North America explosion proof equipment market share stood at around 34.09% in 2023, with a valuation of USD 3.11 billion. North America remains the dominant region for the market, driven by well-established industrial sectors such as oil & gas, chemicals, and manufacturing.

North America explosion proof equipment market share stood at around 34.09% in 2023, with a valuation of USD 3.11 billion. North America remains the dominant region for the market, driven by well-established industrial sectors such as oil & gas, chemicals, and manufacturing.