Enquire Now

Ethylene Propylene Diene Monomer Market Size, Share, Growth & Industry Analysis, By Manufacturing Process (Solution Polymerization Process, Slurry/Suspension Process, Gas-phase Polymerization Process), By End Use (Automotive, Building & Construction, Manufacturing, Electrical & Electronics), and Regional Analysis, 2025-2032

Pages: 140 | Base Year: 2024 | Release: September 2025 | Author: Versha V.

Key strategic points

Ethylene propylene diene monomer (EPDM) is a high-performance synthetic elastomer engineered from ethylene, propylene, and a small amount of diene monomer, enabling effective cross-linking during vulcanization.

It offers superior resistance to heat, ozone, weathering, and aging, while maintaining flexibility across a broad temperature range. It is commonly used in roofing membranes, automotive weather seals, hoses, gaskets, electrical insulation, and various industrial components.

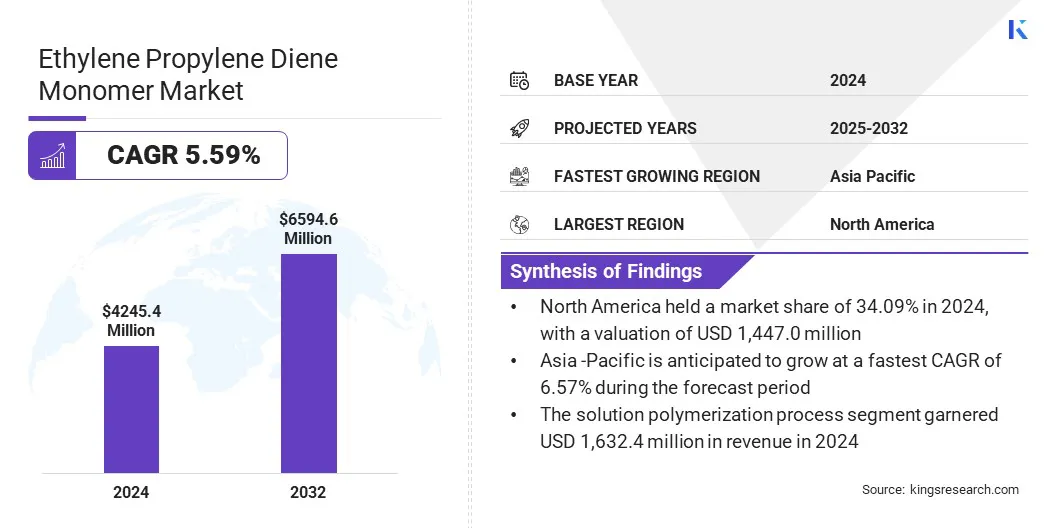

According to Kings Research, the global ethylene propylene diene monomer market size was valued at USD 4,245.4 million in 2024 and is projected to grow from USD 4,470.8 million in 2025 to USD 6,594.6 million by 2032, exhibiting a CAGR of 5.59% during the forecast period.

Market growth is driven by growing demand for durable, weather-resistant, and high-performance materials in automotive, construction, and industrial sectors, boosting EPDM adoption in roofing membranes, seals, and insulation. Additionally, rising preference for sustainable, low-VOC, and eco-friendly EPDM products supports regulatory compliance and environmentally conscious consumer trends.

Major companies operating in the ethylene propylene diene monomer market are ARLANXEO, Dow, Exxon Mobil Corporation, KUMHO POLYCHEM, Lion Elastomers LLC, SK geo centric Co., Ltd, Sumitomo Chemical Co., Ltd., Johns Manville, Versalis S.p.A., Mitsui Chemicals, Inc, ENEOS Materials Corporation, PetroChina Company Limited, LANXESS AG, Holcim Ltd, and Carlisle SynTec Systems.

Increasing adoption of electric vehicles is prompting automakers to use high-performance, heat- and ozone-resistant rubbers. EPDM is widely used for sealing, insulation, and battery protection, ensuring long-term reliability, safety, and durability in vehicles. This is creating a strong demand for EPDM in the automotive sector.

Rise in Renewable Energy Installations

The progress of the ethylene propylene diene monomer market is fueled by the growth of renewable energy installations. The rapid expansion of solar and wind energy projects is increasing demand for durable, weather-resistant materials for panels, cable insulation, and roofing systems.

EPDM's flexibility, UV resistance, and long-term performance make it a preferred choice. This is leading to the widespread adoption in industrial and construction applications, where reliability and low maintenance are critical.

Volatility in Raw Material Prices

A key challenge impeding the expansion of the ethylene propylene diene monomer market is the volatility in raw material prices. Fluctuations in the costs of ethylene, propylene, and diene monomers directly affect production expenses and overall profitability for manufacturers. Such variability increases costs for automotive, construction, and industrial applications, complicating budgeting, long-term planning, and broader adoption of EPDM.

To address this challenge, market players are securing long-term supply contracts and diversifying their sourcing to reduce dependency on single suppliers. Manufacturers are exploring cost-efficient production technologies, optimizing formulations, and engaging in risk-hedging strategies to protect margins. Additionally, they are negotiating flexible pricing agreements and collaborating with suppliers to mitigate short-term price fluctuations.

Development of Advanced Materials for High-Performance Applications

A key trend in the ethylene propylene diene monomer market is the development of advanced materials for high-performance applications. Manufacturers are focusing on fire-resistant, halogen-free, and chemically compatible EPDM to meet stringent safety and durability requirements in electric vehicle battery packs, motor cooling systems, and industrial equipment. This shift prompts innovation in material design, enhancing low-temperature performance, chemical resistance, and longevity.

|

Segmentation |

Details |

|

By Manufacturing Process |

Solution Polymerization Process, Slurry/Suspension Process, Gas-phase Polymerization Process |

|

By End Use |

Automotive, Building & Construction, Manufacturing, Electrical & Electronics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

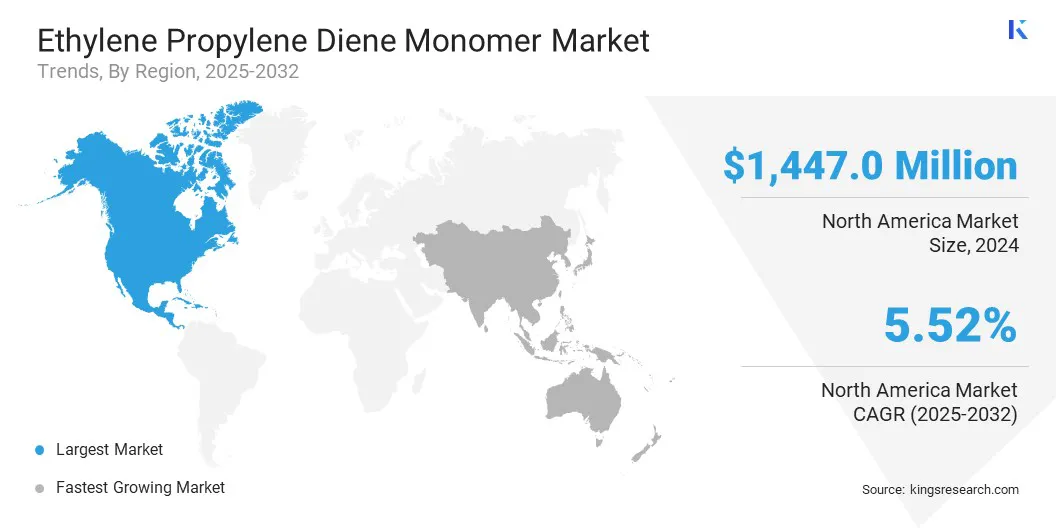

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America ethylene propylene diene monomer market share stood at 34.09% in 2024, valued at USD 1,447.0 million. This dominance is attributed to the rising demand for durable and weather-resistant materials across automotive, construction, and industrial sectors. Increasing focus on sustainable and eco-friendly solutions is leading to the development of bio-based and low-VOC EPDM products.

Rapid urbanization and infrastructure expansion are fueling demand for roofing membranes, sealing systems, and insulation materials. Additionally, the shift toward labor- and time-efficient installation solutions is fostering the adoption of ready-to-use EPDM products in commercial and institutional buildings, contributing to regional market expansion.

The Asia-Pacific ethylene propylene diene monomer industry is set to grow at a CAGR of 6.57% over the forecast period. This growth is attributed to rapid industrialization and urbanization, which generate demand for durable and weather-resistant materials in construction and infrastructure projects.

The expansion of the automotive sector is boosting EPDM use in sealing, insulation, and battery protection. Additionally, the growth of renewable energy installations, including solar and wind power, is prompting EPDM applications in roofing, cable insulation, and panel sealing. Rising investments in sports, recreational, and public infrastructure further present growth opportunities.

Major players in the ethylene propylene diene monomer industry are developing water-based and eco-friendly formulations to reduce environmental impact and volatile organic compounds emissions, thereby strengthening their market position.

They are enhancing material performance, including durability, adhesion, and processability, to meet the requirements of automotive, construction, and industrial applications. Additionally, manufacturers are expanding global distribution networks to ensure improved accessibility and supply reliability for EPDM products.

Frequently Asked Questions