Market Definition

The erythrosine market involves the production, distribution, and consumption of erythrosine, a synthetic red dye commonly used in food, beverages, cosmetics, and pharmaceuticals.

Erythrosine, also known as Red No. 3, is a water-soluble dye that imparts a bright red color and is primarily used in products such as candies, cakes, gelatin, and other processed foods. It is also utilized in certain medical applications, including as a colorant in pharmaceutical tablets.

Erythrosine Market Overview

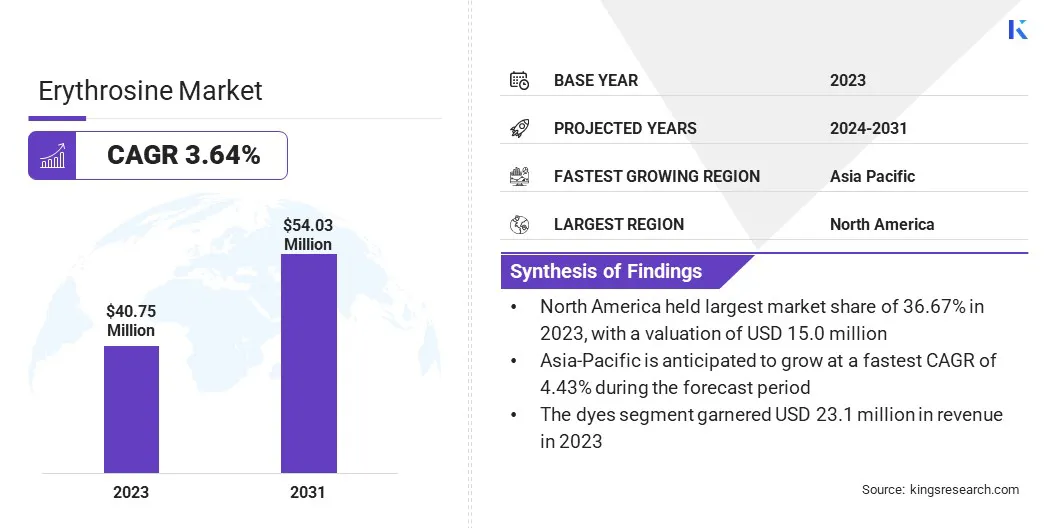

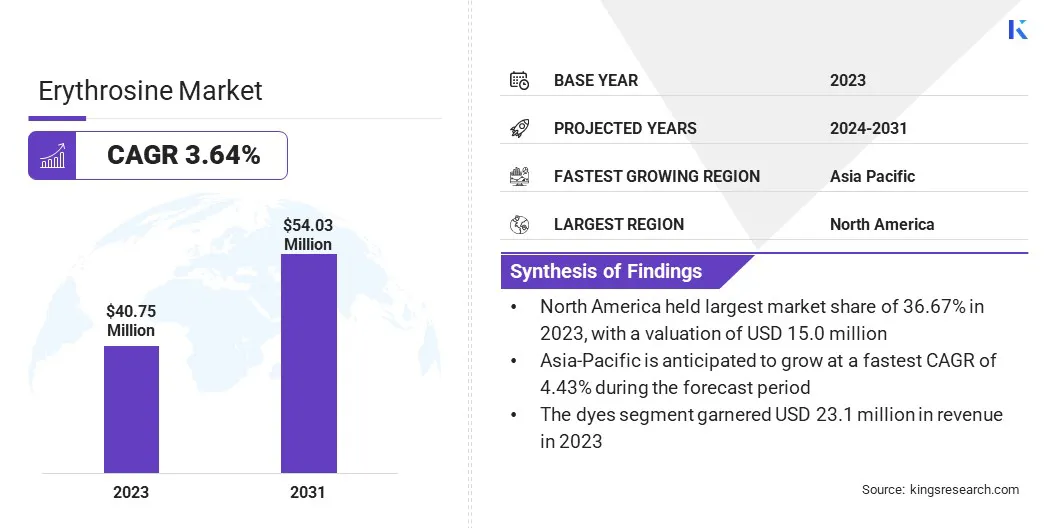

The global erythrosine market size was valued at USD 40.75 million in 2023 and is projected to grow from USD 42.06 million in 2024 to USD 54.03 million by 2031, exhibiting a CAGR of 3.64% during the forecast period.

The global market is driven by its widespread use as a synthetic red dye in various industries, including food and beverages, pharmaceuticals, and cosmetics.

Despite growing concerns over synthetic colorants, erythrosine continues to be favored for its vibrant color, cost-effectiveness, and stability. The increasing demand for processed foods, confectionery products, and pharmaceuticals is expected to continue supporting the market growth.

Major companies operating in the global erythrosine industry are Macsen Labs, Thermo Fisher Scientific Inc., Ajanta Colours, vizagchemical.com, ROHA Group, MEGHA INTERNATIONAL, Univar Solutions LLC, Dynemic Products Ltd., Sigma-Aldrich Co. LLC, sunfoodtech., Kolorjet Chemicals Pvt Ltd, Jagson, Matrix Pharma Chem, Rung International, and Sensient Colors LLC.

Key Highlights

- The global erythrosine market size was valued at USD 40.75 million in 2023.

- The market is projected to grow at a CAGR of 3.64% from 2024 to 2031.

- North America held a market share of 36.74% in 2023, with a valuation of USD 14.97 million.

- The powder segment garnered USD 17.78 million in revenue in 2023.

- The dyes segment is expected to reach USD 31.60 million by 2031.

- The pharmaceutical segment is anticipated to register the fastest CAGR of 4.97% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 4.43% during the forecast period.

Market Driver

"Cost Effectiveness for Manufacturers"

Erythrosine is cost-effective for manufacturers, due to its low production costs, stable supply, and scalability. As a synthetic dye, it benefits from economies of scale, making it cheaper to produce in large quantities compared to many natural colorants. Its long shelf life and color stability reduce the need for frequent replacements, saving costs in production.

Erythrosine’s versatility across various industries food, beverages, and cosmetics helps manufacturers streamline their formulations and avoid higher costs associated with sourcing multiple colorants. This combination of affordability and consistency keeps erythrosine a popular choice in mass-market products.

- In October 2023, Phytolon secured additional funding to advance its commercialization efforts for the upcoming launch of its fermentation-based natural food colors in the food & beverage sector. The investment comes from Nextgen Nutrition Investment Partners (NGN), backed by Dunedain Ventures, and led by seasoned CPG industry experts James Cali and Andrew Towle.

Market Challenge

"Health Concerns and Regulatory Challenges"

Health concerns surrounding erythrosine have been a significant challenge for its erythrosine market growth. The dye has been linked to potential adverse effects, particularly in children, where it has been associated with hyperactivity and behavioral issues, often within the context of broader concerns about artificial food colorants.

These health risks have prompted regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), to impose stricter regulations on erythrosine’s usage in various products, particularly food & beverages. In some regions, these concerns have led to bans or limitations on its use, thereby limiting the overall market potential.

Companies can explore alternatives, such as developing safer synthetic colorants or shifting to natural, plant-based dyes that align with the growing demand for clean-label products. Educating consumers on the regulatory approvals and safety standards governing erythrosine can also help mitigate concerns.

Furthermore, adapting to regional regulations and innovating within permissible limits will allow manufacturers to maintain erythrosine’s market presence while aligning with consumer preferences for safety and transparency.

"Increasing Focus on Regulatory Compliance and Safety Standards"

Concerns regarding the health implications of synthetic colorants persist, prompting regulatory authorities such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) to continuously update their guidelines and enforce more stringent restrictions on the use of dyes like erythrosine.

Manufacturers are placing increased emphasis on ensuring compliance with these evolving regulations. This includes adhering to prescribed usage limits, conducting comprehensive safety assessments, and implementing transparent labeling practices to address consumer concerns. Companies are actively exploring alternative colorants, both natural and synthetic, while preserving the visual appeal of their products.

Market Trend

"Expanding Use in Cosmetics and Pharmaceuticals"

The expanding use of erythrosine in the cosmetics and pharmaceutical industries drives the market. In cosmetics, it provides vibrant colors for lipsticks, eye makeup, and nail polishes, meeting the consumer demand for bold, long-lasting products.

The rising global demand for cosmetics, driven by greater disposable incomes and growing beauty consciousness, further fuels its usage in this industry. In pharmaceuticals, erythrosine is used to color tablets, capsules, and liquids, improving product identification and patient compliance, especially for children.

Erythrosine is also found in oral care products like mouthwashes and children's toothpaste. Its stability, cost-effectiveness, and regulatory approval in both industries contribute to its continued growth in these industries.

- In December 2024, according to the Ministry of Chemicals and Fertilizers, India’s pharmaceutical market for FY 2023-24 was valued at USD 50 billion, with domestic consumption at USD 23.5 billion and exports at USD 26.5 billion. The Department of Pharmaceuticals has established seven National Institutes of Pharmaceutical Education & Research (NIPERs) , fostering advanced research and postgraduate education in pharmaceutical sciences.

Erythrosine Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Liquid, Powder, Granules

|

|

By Solubility

|

Dyes, Lakes

|

|

By Application

|

Food and Beverages, Cosmetics and Personal Care, Pharmaceutical, Others (Textile, Diagnostics/Microscopy, Chemical)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Liquid, Powder, Granules): The powder segment earned USD 17.78 million in 2023, due to its widespread use in various applications, including food processing and pharmaceuticals, where it offers ease of handling and stable color retention.

- By Solubility (Dyes, Lakes): The dyes segment held 56.72% share of the market in 2023, due to its superior solubility in water-based products, making it ideal for use in beverages, processed foods, and cosmetics.

- By Application (Food and Beverages, Cosmetics and Personal Care, Pharmaceutical, Others (Textile, Diagnostics/Microscopy, Chemical)): The food and beverages segment is projected to reach USD 19.58 million by 2031, owing to the growing demand for vibrant and visually appealing products, particularly in confectionery, beverages, and processed foods.

Erythrosine Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a erythrosine market share of around 36.74% in 2023, with a valuation of USD 14.97 million. The market in North America is driven by strong demand in the food & beverage industry, particularly for use in processed foods, snacks, and confectionery.

The region benefits from a well-established regulatory framework that allows for the controlled use of synthetic colorants, supporting market growth. The pharmaceutical and cosmetics sectors in North America continue to be significant consumers of erythrosine, further contributing to the market's strong performance.

Increased consumer interest in product esthetics and the popularity of brightly colored foods are expected to support the market expansion in this region over the forecast period.

The erythrosine industry in Asia Pacific is poised for significant growth at a robust CAGR of 4.43% over the forecast period, driven by the increased adoption of synthetic dyes in the rapidly expanding food processing, pharmaceutical, and cosmetics industries in the region.

The growth is also fueled by the demand for cost-effective and consistent colorants in products targeting a young and dynamic consumer base. Furthermore, advancements in manufacturing capabilities and the availability of affordable erythrosine are expected to create opportunities for market players in this region.

Regulatory Frameworks

- European Food Safety Authority (EFSA): EFSA sets the Acceptable Daily Intake (ADI), an estimated amount of a substance in food or drinking water that can be consumed daily over a lifetime without presenting an appreciable risk to health.

- U.S. Food and Drug Administration (FDA): Federal Food, Drug, and Cosmetic Act. regulates color additives in food.Color additives must be approved by the FDA for safety before they can be used in food products, and their use is subject to specific limits to ensure public safety.

- European Union (EU) - Regulation (EU) 2020/228 governs the approval and use of food additives within the EU. It sets specific limits on the concentrations of erythrosine allowed in food products and mandates rigorous safety assessments to ensure consumer protection.

- The South African Department of Health regulates food colorants through the Foodstuffs, Cosmetics and Disinfectants Act (R.1008 of 1996). Food colorants must be approved for safety before use in food products, with specific guidelines on the acceptable types, quantities, and labeling requirements to protect public health.

Competitive Landscape

Leading market participants often focus on leveraging their extensive production capabilities and global distribution networks, while smaller and regional players emphasize innovation, cost-effective production, and the development of safer or more sustainable alternatives.

Competitive strategies include mergers, strategic partnerships, and investments in new technologies. Companies are placing greater emphasis on transparency, consumer education, and adhering to evolving regulations to build brand trust and meet the increasing demand for natural and clean-label products.

- In June 2023, Oterra announced the launch of its ready-to-use Red and Pink ColorFruit and FruitMax blends for plant-based meat and seafood. These palm oil-free, plant-derived solutions enable manufacturers to meet the rising consumer demand for clean-label products that replicate the appearance and functionality of animal-based alternatives.

List of Key Companies in Erythrosine Market:

- Macsen Labs

- Thermo Fisher Scientific Inc.

- Ajanta Colours

- vizagchemica.com

- ROHA Group

- MEGHA INTERNATIONAL

- Univar Solutions LLC

- Dynemic Products Ltd.

- Sigma-Aldrich Co. LLC

- sunfoodtech

- Kolorjet Chemicals Pvt Ltd

- Jagson

- Matrix Pharma Chem

- Rung International

- Sensient Colors LLC

Recent Developments (Expansion)

- In December 2023, Sun Chemical, a subsidiary of DIC Corporation, expanded its SunPURO Naturals line to address the increasing demand for sustainably sourced natural colorants in cosmetics and personal care. The addition of these two new products reinforces its commitment to innovation and responsible sourcing within the SunPURO Naturals portfolio.