Market Definition

The epoxidized soybean oil (ESBO) market encompasses the production, distribution, and utilization of ESBO, a bio-based stabilizer and plasticizer procured from soybean oil.

Recognized for its environmentally friendly and non-toxic properties, ESBO is a key material in industries such as plastics, food packaging, automotive, pharmaceuticals, and coatings, offering superior chemical and heat resistance.

Epoxidized soybean oil Market Overview

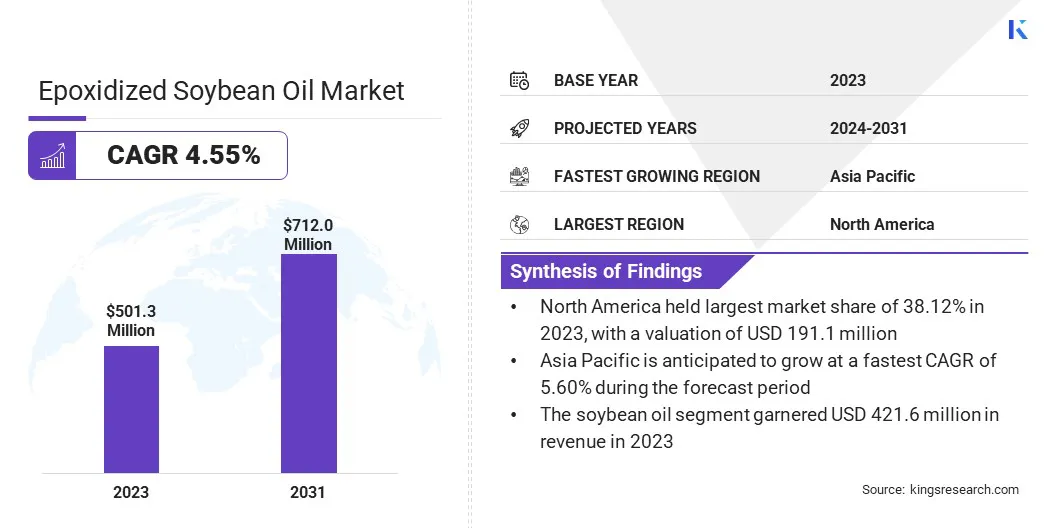

The global epoxidized soybean oil market size was valued at USD 501.3 million in 2023 and is projected to grow from USD 521.3 million in 2024 to USD 712.0 million by 2031, exhibiting a CAGR of 4.55% during the forecast period.

This market is registering significant growth, driven by the rising need for eco-friendly plasticizers and stabilizers across various industries. The increasing adoption of bio-based alternatives in plastics and food packaging has positioned ESBO as a preferred choice, due to its non-toxic nature and high thermal & chemical stability.

Major companies operating in the global epoxidized soybean oil industry are CHS Industrial Products Inc., NAN YA PLASTICS CORPORATION, Chang Chun Group, Cargill, Valtris Specialty Chemicals, Artek Surfin Chemicals Ltd., INBRA INDÚSTRIAS QUÍMICAS LTDA., Dhanraj Organic P. Ltd., The Chemical Company, ChemCeed, Parchem, Acme-Hardesty, ACS Technical Products, Ravago S.A., and MAKWELL PLASTISIZERS PRIVATE LIMITED.

High demand for ESBO in the automotive and construction industries is attributed to its performance-enhancing properties in coatings, adhesives, and sealants. Additionally, technological advancements in biodegradable polymers and green chemistry solutions are fostering innovation, creating opportunities for product development and market expansion.

- For instance, in March 2025, Green Plains secured all rights of way for the ‘Advantage Nebraska’ Carbon Capture Project, with lateral construction in progress. Utilizing renewable corn oil (DCO) as feedstock for renewable diesel offers a ~25-point CI advantage over soybean oil. The scalable compression system supports expanded production and post-combustion carbon capture, with a total capacity of 1.2 million tons annually.

Key Highlights:

- The global epoxidized soybean oil market size was valued at USD 501.3 million in 2023.

- The market is projected to grow at a CAGR of 4.55% from 2024 to 2031.

- North America held a market share of 38.12% in 2023, with a valuation of USD 191.1 million.

- The soybean oil segment garnered USD 421.6 million in revenue in 2023.

- The plasticizers segment is expected to reach USD 172.5 million by 2031.

- The food & beverages segment is expected to reach USD 256.7 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.60% during the forecast period.

Market Driver

"Eco-friendly Plasticizers and Biodegradable Solutions"

The epoxidized soybean oil market is registering significant growth, fueled by the increasing demand for bio-based plasticizers and the expansion of the food packaging industry.

With restrictions on phthalate-based plasticizers, industries are shifting toward eco-friendly alternatives like ESBO, which is non-toxic, biodegradable, and FDA-approved for food contact applications. This transition is particularly evident in PVC-based products, including medical devices, food packaging films, and children’s toys, where ESBO enhances flexibility and thermal stability.

Additionally, the booming food packaging industry is fueling the demand for ESBO as a safe and effective plasticizer. The rising consumption of processed and packaged foods, coupled with food safety regulations, has led manufacturers to incorporate ESBO in PVC food wraps, container seals, and gaskets.

Moreover, ongoing research advancements in sustainable packaging like the development of waterborne acrylated ESBO coatings for kraft paper are further expanding ESO's application scope, reinforcing its role in eco-friendly and biodegradable solutions.

- For instance, in March 2025, Green Science Alliance developed bio-based plasticizers using waste cooking oil and plant-derived ingredients. These sustainable plasticizers repurpose organic waste, contributing to CO₂ emission reduction. Additionally, they are biodegradable, ensuring minimal environmental impact and safety for human health. By leveraging renewable resources, the company promotes eco-friendly innovation in the plasticizer industry.

Market Challenge

"Regulatory Compliance and Raw Material Volatility"

The epoxidized soybean oil market is facing significant hurdles, due to regulatory requirements and fluctuating raw material costs, which impact production, pricing, and overall market growth. One of the primary challenges is regulatory compliance.

ESBO is widely used as a plasticizer in food packaging, medical applications, and consumer goods, hence, it is subject to food safety and environmental regulations set by organizations and other global regulatory bodies.

These organizations impose limits on the allowable migration levels of ESBO in food-contact materials to ensure consumer safety. Thus, manufacturers are focusing on innovation and supply chain optimization. Companies are investing in advanced processing technologies to enhance the efficiency and quality of ESBO production while complying with regulations.

Another key challenge is raw material price volatility, particularly the cost of soybean oil. Soybean oil prices are highly susceptible to climate conditions, geopolitical tensions, agricultural policies, and fluctuations in global demand.

Extreme weather events, trade restrictions, and changing government subsidies for soybean production can lead to supply shortages or price spikes, directly affecting the cost of ESBO manufacturing.

Additionally, soybean oil is widely used in food production and biofuel industries. Hence, competition for its supply intensifies cost pressures on ESBO producers. The diversification of raw material sources and strategic supplier partnerships can help mitigate price fluctuations.

Market Trend

Expanding Applications in Bioplastics and Automotive Industries

The epoxidized soybean oil market is registering dynamic growth, fueled by evolving industry trends focused on bio-based solutions and technological innovation. A key trend shaping the market is the increasing adoption of ESBO in biopolymer and bioplastic production as industries seek renewable and biodegradable alternatives to traditional petrochemical-based materials.

The demand for bio-based polymers in packaging, automotive, and consumer goods has surged, with ESBO being incorporated as a flexible and non-toxic plasticizer in biodegradable plastics such as polylactic acid and polybutylene succinate.

Additionally, the rising use of ESBO in the automotive industry is gaining traction, as manufacturers look for eco-friendly plasticizers in PVC components, such as interior trims, dashboards, and wiring insulation.

With automotive companies focusing on reducing their carbon footprint and enhancing material sustainability, ESBO is emerging as a key bio-based additive. The ESBO market is set to register strong demand across multiple sectors as they continue to shift toward eco-friendly, bio-based materials.

- For instance, in May 2023, North Dakota and McIntosh County farmers supported local first responders while promoting soy-based innovation through soybean checkoff funds. The North Dakota Soybean Council (NDSC) awarded a grant to the McIntosh County Sheriff’s Department for Goodyear soy-based tires. NDSC offers grants up to USD 1,000 per organization, reinforcing community support and advancing soybean applications.

Epoxidized soybean oil Market Report Snapshot

|

Segmentation

|

Details

|

|

By Raw Material

|

Soybean Oil, Hydrogen Peroxide, Acetic Acid

|

|

By Application

|

Plasticizers, UV Cure Applications, Pigment Dispersion Agents, Flavor & Fragrance Stabilizers, Fuel Additives, Others

|

|

By End-use Industry

|

Food & Beverages, Automotive, Healthcare, Construction, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Raw Material (Soybean Oil, Hydrogen Peroxide, Acetic Acid): The soybean oil segment earned USD 421.6 million in 2023, due to its widespread availability, cost-effectiveness, and increasing demand for bio-based raw materials in sustainable plasticizers.

- By Application (Plasticizers, UV Cure Applications, Pigment Dispersion Agents, Flavor & Fragrance Stabilizers, Fuel Additives, Others): The plasticizers segment held 27.12% share of the market in 2023, due to the rising adoption of phthalate-free plasticizers in PVC-based products and regulatory support for eco-friendly alternatives.

- By End-use Industry (Food & Beverages, Automotive, Healthcare, Construction, Others): The food & beverages segment is projected to reach USD 256.7 million by 2031, owing to the growing use of ESBO as a stabilizer and plasticizer in food-grade packaging materials to ensure product safety and compliance.

Epoxidized soybean oil Market Regional Analysis

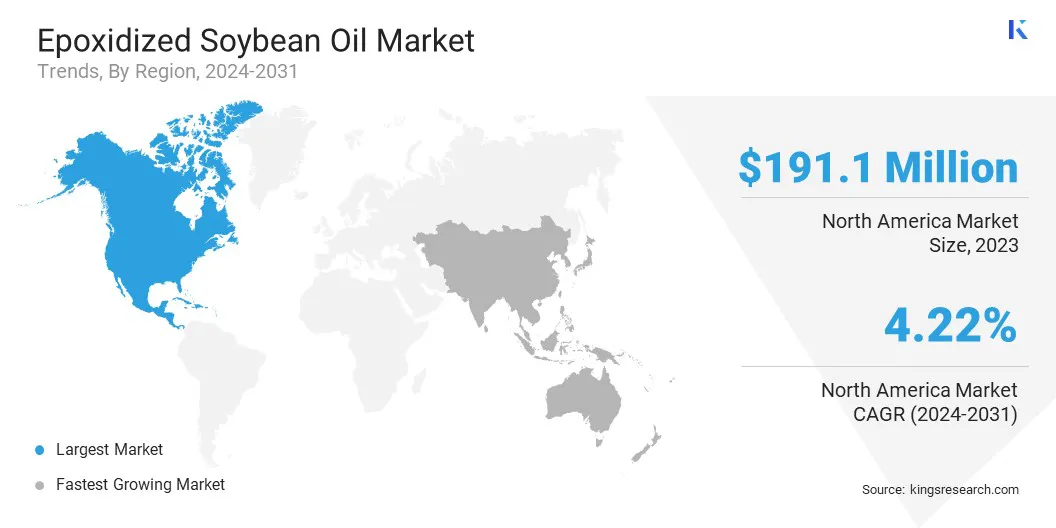

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial epoxidized soybean oil market share of 38.12% in 2023, with a valuation of USD 191.1 million. This expansion is driven by the strong presence of key manufacturers, stringent environmental regulations, and high demand for bio-based plasticizers across various industries.

The U.S. and Canada play a crucial role in market growth, due to their well-established food packaging, automotive, and healthcare sectors, which extensively utilize epoxidized soybean oil as a stabilizer and plasticizer.

Additionally, increasing regulatory restrictions on phthalate-based plasticizers has fueled the adoption of ESBO in PVC products, coatings, and adhesives. The region’s dominance in the global market is further reinforced by a well-established industrial infrastructure, strong research & development initiatives, and increasing investments in bio-based material innovations.

The epoxidized soybean oil industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 5.60% over the forecast period. This growth is driven by the expanding plastics, packaging, automotive, and construction industries.

Countries like China, India, Japan, and South Korea are registering rapid industrialization and urbanization, boosting the adoption of bio-based plasticizers such as ESBO.

Additionally, favorable government policies promoting sustainable manufacturing, increasing investments in food safety standards, and a shift toward non-toxic plasticizers are propelling market expansion. The region also benefits from the large-scale production of soybean oil, ensuring a cost-effective and readily available raw material supply.

- In September 2024, the Government of India raised the Basic Customs Duty on crude and refined edible oils to support domestic oilseed prices. The duty on crude oils (soybean, palm, sunflower) increased from 0% to 20% (effective 27.5%), while refined oils rose from 12.5% to 32.5% (effective 35.75%).

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the use of epoxidized soybean oil (ESBO) as a food-contact substance, particularly in plastic packaging materials.

- In Europe, the European Food Safety Authority (EFSA) and the European Chemicals Agency (ECHA) regulate ESBO under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework. ESBO is approved as a plasticizer in food packaging materials but must comply with strict migration limits to ensure consumer safety.

- In China, the National Medical Products Administration (NMPA) regulates ESBO's use in food packaging and medical applications.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceuticals and Medical Devices Agency (PMDA) oversee ESBO's application in food contact materials. The Ministry of Economy, Trade and Industry (METI) regulates its industrial production and ensures compliance with chemical safety standards.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates ESBO’s use in food packaging applications to ensure consumer safety.

Competitive Landscape

The global epoxidized soybean oil market is characterized by continuous product innovation, expanding industrial applications, and strategic investments by key market players.

Companies are actively engaged in research and development to enhance product efficiency, improve thermal and chemical stability, and cater to diverse industries such as plastics, food packaging, automotive, and healthcare.

Market participants are focusing on capacity expansions, collaborations with raw material suppliers, and technological advancements to strengthen their market position and meet the growing demand.

- For instance, in November 2023, Cargill completed the expansion and modernization of its soybean crush and refined oils facility in Sidney, Ohio. Operational since September, the upgrade nearly doubles crush capacity, enhancing market access for farmers and feed customers. The facility supports rising demand across food, feed, and renewable fuel sectors while improving efficiency in soybean processing and product distribution.

Regulatory compliance with food safety standards and environmental policies plays a significant role in shaping product development and market dynamics. The increasing use of epoxidized soybean oil in PVC products, coatings, and adhesives has driven manufacturers to introduce high-purity and customized formulations that align with industry-specific requirements.

The market is expected to register sustained expansion in the coming years, due to the growing industrial applications and advancements in material sciences.

List of Key Companies in Epoxidized Soybean Oil Market:

- CHS Industrial Products Inc.

- NAN YA PLASTICS CORPORATION

- Chang Chun Group

- Cargill

- Valtris Specialty Chemicals

- Artek Surfin Chemicals Ltd.

- INBRA INDÚSTRIAS QUÍMICAS LTDA.

- Dhanraj Organic P. Ltd.

- The Chemical Company

- ChemCeed

- Parchem

- Acme-Hardesty

- ACS Technical Products

- Ravago S.A.

- MAKWELL PLASTISIZERS PRIVATE LIMITED

Recent Development (New Product Launch)

- In July 2024, Louis Dreyfus Company (LDC) relaunched Vibhor, its consumer-focused edible oil brand in India, aligning with its strategy to expand downstream. Initially targeting North India, LDC plans nationwide growth by 2026, leveraging its global supply chain and market expertise to reach rural and urban consumers via retail stores, supermarkets, and digital platforms.