Market Definition

The enterprise search industry encompasses technologies and solutions that allow organizations to efficiently search, access, and retrieve data from various internal and external sources, including documents, databases, emails, and applications.

These platforms utilize advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP) to deliver precise, personalized, and context-aware search results.

Serving a wide array of industries, enterprise search solutions enhance productivity, decision-making, and data management by simplifying the retrieval of information from large and complex datasets.

Enterprise Search Management Market Overview

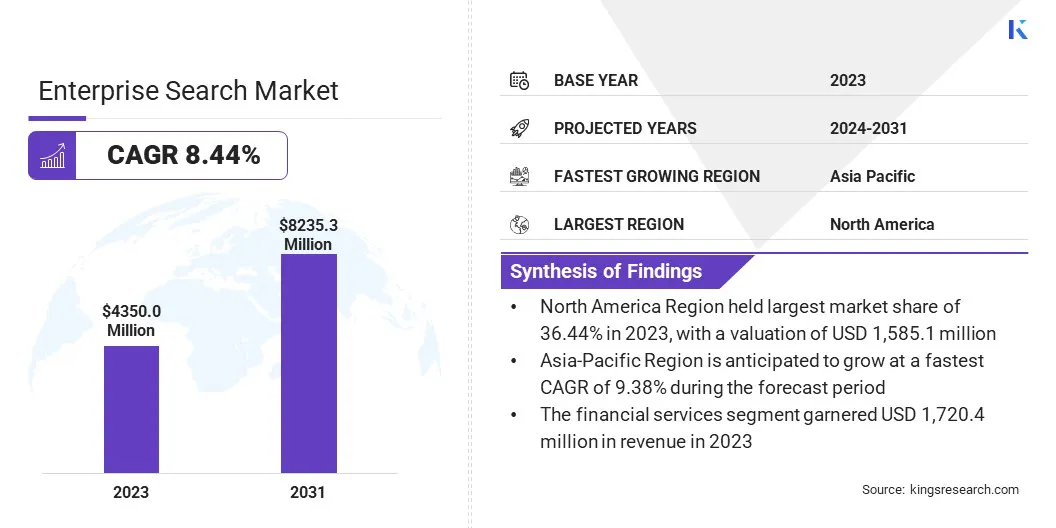

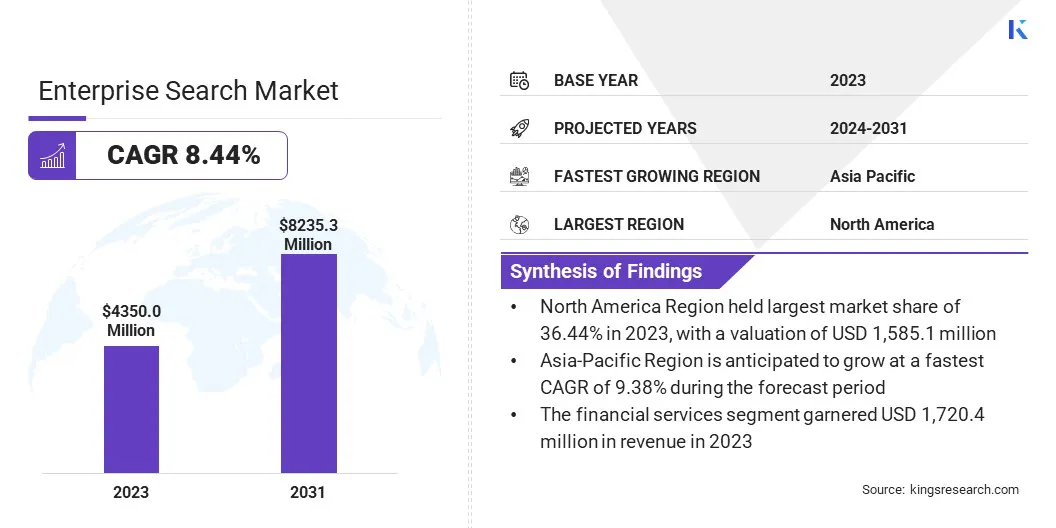

The global enterprise search market size was valued at USD 4,350.0 million in 2023 and is projected to grow from USD 4,669.9 million in 2024 to USD 8,235.3 million by 2031, exhibiting a CAGR of 8.44% during the forecast period.

The market is growing rapidly, due to the increasing volume of data, AI, and ML integration and demand for more personalized search solutions. Cloud adoption, remote work, and advancements in NLP are further driving the market, while the need for secure, compliant search tools is pushing businesses to improve data access and decision-making.

Major companies operating in the enterprise search market are Microsoft, IBM, Google, Amazon Web Services, Inc., Open Text Corporation, Coveo Solutions Inc., Lucidworks, Algolia, Oracle, Dassault Systèmes, X1 Discovery, Sinequa, The Apache Software Foundation, Mindbreeze GmbH, and SearchBlox Software, Inc.

The market is becoming increasingly competitive as major players integrate AI, ML, and cloud technologies to meet the evolving needs of businesses. As companies continue to invest in advanced search solutions, these innovations will drive further growth and improve data management and accessibility across various industries.

Key Highlights:

- The enterprise search market size was valued at USD 4,350.0 million in 2023.

- The market is projected to grow at a CAGR of 8.44% from 2024 to 2031.

- North America held a market share of 36.44% in 2023, with a valuation of USD 1585.1 million.

- The financial services segment garnered USD 1720.4 million in revenue in 2023.

- The data search segment is expected to reach USD 3482.2 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.38% during the forecast period.

Market Driver

"Rising integration of AI and ML"

The integration of AI and ML in enterprise search significantly enhances how businesses manage and retrieve information. AI enables personalized search results by understanding user behavior, past searches, and preferences, delivering more relevant and tailored outcomes.

With NLP, these systems can interpret complex, conversational queries, allowing users to ask questions in a natural way and still receive accurate results.

- In December 2024, Azure Cognitive Search uses AI and ML to deliver advanced search features, such as NLP, image recognition, and custom ranking. Azure Search can index various types of data, including documents and databases, and offers scalable, secure, and highly customizable search experiences. It integrates seamlessly with other Azure services, allowing businesses to create intelligent, efficient search solutions across their platforms.

The integration of AI and ML in enterprise search is transforming how businesses access and utilize data, making it more intuitive and efficient. Solutions like Azure Cognitive Search demonstrate the power of these technologies to create scalable, personalized, and intelligent search experiences that enhance productivity and decision-making.

Market Challenge

"Data fragmentation acts as a challenge for the enterprise search market"

Data fragmentation is a key challenge in enterprise search, as data is spread across multiple systems, platforms, and formats. With data stored in various environments such as on-premises servers, cloud services, and third-party applications, search solutions struggle to index and access all relevant data.

As organizations grow and add more systems, this issue intensifies, making it harder for search tools to deliver comprehensive, consistent results across different data silos. Organizations need enterprise search solutions capable of cross-platform integration to address data fragmentation, pulling data from various sources into a unified index.

This often requires sophisticated connectors, APIs, or custom integrations that can bridge the gaps between disparate systems. In addition, ensuring data consistency and real-time updates to search indexes is crucial for maintaining the relevance and accuracy of results.

Market Trend

"Advanced Natural Language Processing (NLP)"

Advanced Natural Language Processing (NLP) is revolutionizing enterprise search by enabling systems to understand and interpret human language more intuitively.

Unlike traditional keyword-based search, NLP analyzes the context and intent behind queries, ensuring more accurate results. It allows users to interact with search systems in a conversational manner, making the experience more accessible and user-friendly.

- In October 2024, Google Cloud's Natural Language API provides advanced text analysis features that help businesses extract valuable insights from unstructured data. It includes tools for sentiment analysis, entity recognition, syntax parsing, and content classification. The API can assess the emotional tone of text, identify key terms, and analyze sentence structures, all while supporting multiple languages.

NLP also includes features like sentiment analysis to gauge the emotional tone of text, entity recognition to identify key terms and concepts, and topic modeling to categorize content more effectively. With multilingual capabilities, NLP supports global teams by handling queries in multiple languages. This transformation leads to faster, more precise search results, improving productivity and decision-making across enterprises.

Enterprise Search Market Report Snapshot

| Segmentation |

Details |

| By Industry Vertical |

Financial Services, Healthcare, Manufacturing, Government, Others |

| By Functionality |

Document Search, Email Search, Data Search, Others |

| By Enterprise Size |

Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Industry Vertical (Financial Services, Healthcare, Manufacturing, Government, Others): The financial services segment earned USD 1720.4 million in 2023, driven by the growing need for efficient data retrieval and analysis. AI and ML-powered solutions help institutions improve decision-making, customer service, and regulatory compliance, fueling digital transformation across the sector.

- By Functionality (Document Search, Email Search, Data Search, Others): The data search segment held 38.55% share of the market in 2023, driven by the growing need to efficiently search and analyze large volumes of data across various sources. As businesses increasingly rely on data for decision-making, the demand for powerful and scalable data search solutions continues to rise.

- By Enterprise Size (Small and medium-sized Enterprises, Large Enterprises): The large enterprises segment earned USD 2508.6 million in 2023, driven by the need for scalable, secure, and efficient search solutions to manage vast amounts of data across complex systems and improve decision-making in large organizations.

Enterprise Search Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America accounted for a significant enterprise search market share of around 36.44% in 2023, valued at USD 1585.1 million. The dominance of the market in the region can be driven by the increasing demand for data-driven decision-making and the rapid digital transformation of businesses in sectors such as finance, healthcare, and retail.

The region's robust technological ecosystem, coupled with the widespread adoption of cloud computing and AI-powered solutions, enables organizations to manage and retrieve data more efficiently. Regulatory requirements such as GDPR and data privacy concerns push businesses in North America to invest in secure, compliant, and scalable search solutions.

- In December 2024, Azure Cognitive Search, a fully managed search-as-a-service solution from Microsoft, allows businesses to integrate advanced search capabilities into their applications. It utilizes AI and ML to improve features like NLP, custom ranking, and image recognition. Azure Search can index various data types, including documents and databases, offering scalable, secure, and customizable search experiences. The solution seamlessly integrates with other Azure services, enabling businesses to build intelligent search solutions across their platforms.

The enterprise search industry in Asia Pacific is poised to grow at a CAGR of 9.38% through the projection period. Leading countries like China, India, and Japan are driving this growth in Asia Pacific.

China’s expanding tech industry, India’s growing digital workforce, and Japan’s focus on technological innovation in sectors like manufacturing and automotive are all contributing to the increased demand for advanced enterprise search solutions. The adoption of AI, cloud platforms, and digital transformation initiatives in these countries further fuels the market in the region.

- In June 2023, Alibaba Cloud enhanced its global cloud infrastructure, expanding data centers globally to offer scalable, secure, and reliable services. With solutions in AI, big data, and IoT, Alibaba Cloud helps businesses optimize operations and drive innovation, solidifying its position as a leading cloud service provider.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Consumer Financial Protection Bureau (CFPB) is a U.S. government agency that ensures fairness in financial markets, aiming to protect consumers from abusive practices. In the context of the enterprise search market, the CFPB plays a role in enforcing regulations on how companies manage and search sensitive financial data, such as consumer complaints, mortgage details, and credit information. As organizations adopt enterprise search tools, they must ensure compliance with CFPB guidelines to safeguard consumer information and maintain transparency in financial services.

- ISO/IEC 27001 helps organizations ensure that the data accessed, stored, and processed through enterprise search solutions is secure. Implementing ISO 27001 means establishing robust information security measures, such as risk assessments, access controls, and data encryption, to protect sensitive data from breaches or unauthorized access.

- PIPEDA (Personal Information Protection and Electronic Documents Act) is Canada's federal privacy law governing how businesses handle personal information. It sets guidelines for the collection, use, and disclosure of personal data, requiring organizations to obtain consent, safeguard information, and provide access to individuals' data. PIPEDA also mandates that organizations establish security measures and individuals have the right to challenge inaccurate information. The law aims to balance privacy protection with the needs of businesses in the digital economy.

- Health Insurance Portability and Accountability Act (HIPAA) requires organizations to protect sensitive health information through encryption, access controls, and audit trails. It mandates regular risk assessments and safeguards to ensure data privacy and security. Compliance ensures proper access control and monitoring, enabling secure information exchange in healthcare.

- The General Data Protection Regulation (GDPR) enforces strict rules on how businesses handle personal data. It requires clear and transparent communication with customers, ensuring that their data is protected. Businesses must obtain consent before processing personal data, provide individuals with the right to access and delete their information, and be transparent about how the data is used. The regulation aims to safeguard privacy and increase trust in how personal data is handled across the EU.

Competitive Landscape

Companies should integrate AI and ML for more personalized and accurate search results to gain a competitive edge in the enterprise search industry. Cloud-native solutions with providers like AWS or Microsoft Azure offer scalability, while strong data security ensures compliance with regulations like GDPR.

A user-friendly interface, advanced features like NLP, and the ability to search across multiple data sources enhance efficiency and user experience. These strategies will help businesses stay ahead in a rapidly evolving market.

- For instance, in August 2024, Coveo’s AI-powered chatbot enhances customer service by delivering personalized, real-time responses. It uses ML to understand customer queries and provide relevant answers, improving efficiency and customer satisfaction. The chatbot integrates with existing systems and continuously learns from interactions, ensuring that it gets smarter over time. This helps businesses reduce response times, lower support costs, and deliver a more engaging customer experience.

List of Key Companies in Enterprise Search Market:

- Microsoft

- IBM

- Google

- Amazon Web Services, Inc.

- Open Text Corporation

- Coveo Solutions Inc.

- Lucidworks

- Algolia

- Oracle

- Dassault Systèmes

- X1 Discovery

- Sinequa

- The Apache Software Foundation

- Mindbreeze GmbH

- SearchBlox Software, Inc.

Recent Developments

- In August 2024, IBM and Elastic announced a strategic partnership to enhance conversational search capabilities. By combining IBM’s Watsonx Assistant with Elastic’s Elasticsearch, the collaboration aims to deliver AI-driven, personalized search experiences. This integration will allow businesses to provide smarter, more accurate responses through advanced search and chatbot solutions, improving customer interactions across industries.

- In November 2023, Appen announced a strategic partnership with Amazon Web Services (AWS) to enhance AI and ML model development. This collaboration combines Appen’s data and expertise with AWS’s scalable infrastructure to improve the training of AI models, focusing on data quality, security, and efficiency. By integrating Appen’s human-annotated data with AWS’s ML tools, the partnership aims to accelerate AI development across various industries.

- In November 2024, Elastic announced a collaboration with AWS to integrate generative AI capabilities into its enterprise search solutions. This partnership aims to enhance search experiences by combining Elastic's powerful search platform with AWS's AI tools. Together, they will enable businesses to leverage AI for more relevant and personalized search results, improving efficiency and user experience across various applications. The collaboration also emphasizes scalable, cloud-native solutions for organizations.