Market Definition

Enterprise Fraud Management (EFM) refers to the processes and technologies used to detect, prevent, and respond to fraudulent activities across an organization’s operations. The market includes software solutions and services that provide real-time monitoring, analytics, and case management.

It is applied in banking, insurance, retail, and telecommunications to safeguard assets, ensure regulatory compliance, reduce financial losses, and enhance customer trust through proactive identification and mitigation of fraud risks.

Enterprise Fraud Management Market Overview

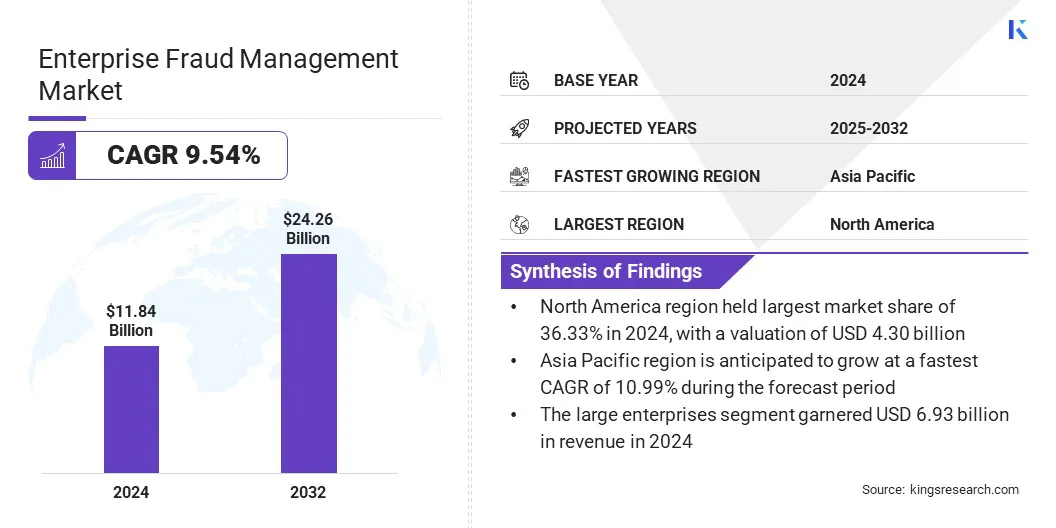

The global enterprise fraud management market size was valued at USD 11.84 billion in 2024 and is projected to grow from USD 12.82 billion in 2025 to USD 24.26 billion by 2032, exhibiting a CAGR of 9.54% during the forecast period.

The market is growing due to rising digital fraud and the need for real-time, AI-powered solutions to counter complex scams. Financial institutions are adopting integrated systems to enhance detection, automate workflows, and strengthen fraud prevention strategies.

Major companies operating in the enterprise fraud management industry are ACI Worldwide, Fiserv, Inc., SEON Technologies Ltd., TransUnion LLC., DataVisor, Inc., Experian Information Solutions, Inc, BPC Group, FICO, Feedzai, Featurespace Limited, IBM, Eastnets, LexisNexis Risk Solutions, NiCE Ltd., and Outseer LLC.

The market is driven by the increasing adoption of real-time fraud monitoring solutions that address the complexity and scale of modern fraud. Rising transaction volumes and expanding data streams are raising the need for systems that provide instant, accurate analysis to detect anomalies and suspicious behavior.

Real-time monitoring enables proactive responses to evolving fraud tactics, ensuring greater protection for customers and reducing financial losses while maintaining transparency and operational efficiency across high-volume, high-dimensional data environments.

- In December 2024, DataVisor launched an advanced AI-powered fraud solution that delivers real-time computation of hotspots, distinct counts, and high-frequency features with 100% accuracy at a massive scale. Overcoming challenges of high-volume streaming data, this innovation eliminates reliance on estimates or delayed batch processing, enabling organizations to detect and respond to modern fraud threats with exceptional speed, precision, and transparency.

Key Highlights:

- The enterprise fraud management industry size was recorded at USD 11.84 billion in 2024.

- The market is projected to grow at a CAGR of 9.54% from 2025 to 2032.

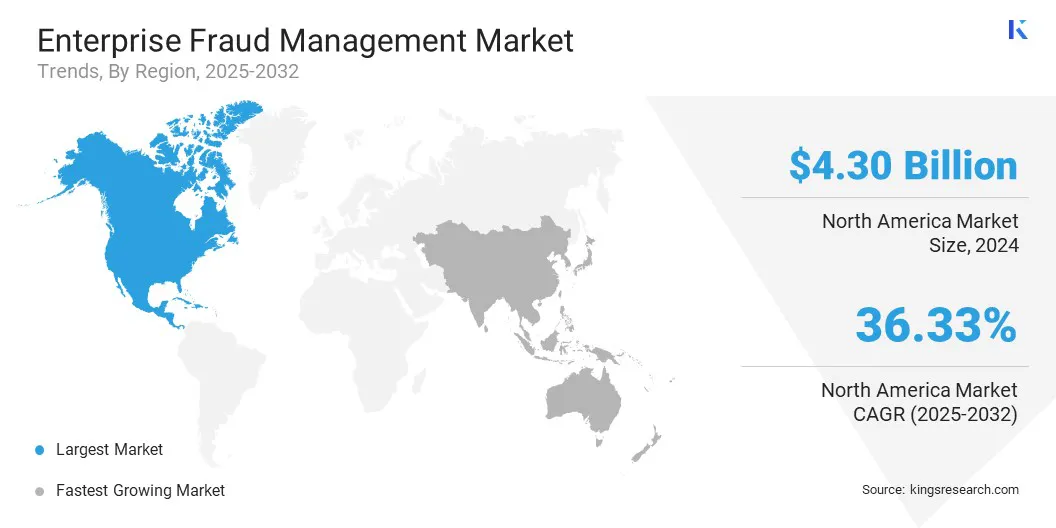

- North America held a market share of 36.33% in 2024, with a valuation of USD 4.30 billion.

- The solutions segment garnered USD 6.91 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 12.67 billion by 2032.

- The small & medium-sized enterprises (SMEs) segment is anticipated to witness the fastest CAGR of 10.44% during the forecast period.

- The BFSI (Banking, Financial Services, and Insurance) segment garnered USD 3.84 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 10.99% during the forecast period.

Market Driver

Rising Global Digital Fraud Crisis

The enterprise fraud management market is driven by a surge in global digital fraud incidents. Escalating financial losses across sectors have compelled organizations to adopt advanced, real-time fraud detection and prevention solutions. Sophisticated scams are increasingly targeting users across multiple channels such as messaging apps, emails, and online marketplaces, making fraud harder to detect.

Financial institutions are deploying integrated systems with real-time monitoring to counter threats like authorized push payment fraud and social engineering, thereby fueling the demand for comprehensive and adaptive fraud management systems.

- In May 2025, ThreatMark launched ScamFlag, a generative AI-powered tool integrated into digital banking apps. ScamFlag enables real-time scam detection across channels, supporting banks in addressing authorized push payment fraud and social engineering threats.

Market Challenge

High False Positives and Alert Fatigue

Key challenges in the enterprise fraud management market are high false positives and alert fatigue. Fraud detection systems often flag legitimate transactions as suspicious, leading to unnecessary investigations and overwhelming security teams. This reduces operational efficiency, delays genuine threat response, and increases the risk of missed fraud incidents.

To address this issue, companies are adopting advanced analytics and machine learning algorithms to enhance detection accuracy. These technologies help in prioritizing alerts based on risk scores, reducing manual efforts. Furthermore, market players are integrating automated workflows and intelligent case management systems to ensures faster, more focused responses to genuine fraud threats.

Market Trend

Integration of AI-powered Fraud Management Solutions

A major trend in the enterprise fraud management market is the integration of AI-powered fraud management solutions that support end-to-end fraud management. Embedding generative AI into workflows allows financial institutions to automate case management, accelerate fraud resolution, and reduce operational costs. These solutions also help maintain regulatory compliance and improve the efficiency of fraud response.

- In September 2024, NICE Actimize launched the first AI-powered fraud investigations solution offering end-to-end management from detection to investigation. It is designed to streamline post-detection workflows and enables financial institutions to reduce costs and save time through automated case management.

Enterprise Fraud Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solutions (Fraud Analytics, Governance, Risk, and Compliance (GRC), Transaction Monitoring, Fraud Investigation and Response, Others (Fraud Risk Assessment and Management, Fraud Detection & Prevention Systems, Authentication), Services (Consulting, System Integration, Others (training, and implementation support))

|

|

By Deployment Type

|

On-Premises, Cloud-Based

|

|

By Organization Size

|

Large Enterprises, Small & Medium-sized Enterprises (SMEs)

|

|

By Industry Vertical

|

BFSI (Banking, Financial Services, and Insurance), Retail & E-commerce, Government & Defense, IT & Telecommunications, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solutions, and Services): The solutions segment earned USD 6.91 billion in 2024 due to the growing demand for advanced, integrated platforms that enable real-time fraud detection and comprehensive risk management.

- By Deployment Type (On-Premises, and Cloud-Based): The on-premises segment held 54.12% of the market in 2024, due to heightened demand for greater data control, security, and compliance with strict regulatory requirements.

- By Organization Size (Large Enterprises, Small & Medium-sized Enterprises (SMEs)): The large enterprises segment is projected to reach USD 13.42 billion by 2032, owing to increased investment in scalable fraud management systems to safeguard complex, high-volume operations and ensure regulatory compliance.

- By Industry Vertical (BFSI (Banking, Financial Services, and Insurance), Retail & E-commerce, Government & Defense, IT & Telecommunications, Healthcare, and Others): The BFSI (Banking, Financial Services, and Insurance) segment garnered USD 3.84 billion in revenue in 2024, due to rising fraud risks and regulatory pressures driving demand for robust, industry-specific fraud management solutions.

Enterprise Fraud Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America enterprise fraud management market share stood at 36.33% in 2024 in the global market, with a valuation of USD 4.30 billion. The region dominates the market due to its early adoption of advanced technologies such as artificial intelligence and machine learning for real-time fraud detection.

Financial institutions in North America are proactively investing in innovative, cloud-based solutions to address the growing risks associated with instant digital payments. These factors are driving the market in North America.

- In April 2024, Cognizant and FICO announced a strategic collaboration to launch a cloud-based real-time payment fraud prevention solution powered by FICO Falcon Fraud Manager. Leveraging advanced AI and ML, the solution aims to help North American banks and payment providers detect and block fraudulent transactions more accurately, reduce losses, and enhance security across instant digital payment platforms.

Asia Pacific enterprise fraud management industry is poised for a significant CAGR of 10.99% over the forecast period. The growth of the market in Asia Pacific is driven by the rising adoption of real-time account verification solutions that enhance payment security. Increasing digital transactions are prompting organizations to implement systems that verify payee authenticity before processing transfers.

Increasing focus on pre-transaction validation, particularly to counter APP fraud, is strengthening the region’s fraud prevention infrastructure and accelerating demand for advanced enterprise fraud management systems.

- In March 2025, LSEG Risk Intelligence launched Global Account Verification (GAV) in APAC to enhance fraud prevention. The solution enables real-time verification of bank account details, ensuring payee information matches before confirming transfers.

Regulatory Frameworks

- In the U.S., enterprise fraud management is primarily regulated by the Federal Trade Commission (FTC) and the Financial Crimes Enforcement Network (FinCEN). These agencies oversee fraud prevention, enforce compliance, and ensure secure financial practices across institutions.

- In India, enterprise fraud management is primarily regulated by the Reserve Bank of India (RBI), which issues guidelines and frameworks to financial institutions to strengthen fraud detection, prevention, and reporting mechanisms across the banking sector.

Competitive Landscape

Companies in the enterprise fraud management industry are actively implementing strategies such as mergers, acquisitions, partnerships, and product launches to enhance their global presence. Leading players are expanding their portfolios by integrating advanced technologies and collaborating with fintech and cybersecurity firms.

Additionally, companies are continuously enhancing their fraud detection platforms through technological innovation. These ongoing advancements are increasing competition and accelerating market growth, enabling key stakeholders to effectively address evolving threats and seize emerging opportunities within the global enterprise fraud management landscape.

- In June 2025, MPL announced a partnership with Clearspeed to enhance fraud management for insurers through advanced voice-based risk assessment technology. Integrated into MPL’s Omnia-powered Digital Estate, this collaboration enables real-time fraud detection within claims infrastructure, setting a new standard for transparency, trust, and operational efficiency in the insurance sector.

List of Key Companies in Enterprise Fraud Management Market:

- ACI Worldwide

- Fiserv, Inc.

- SEON Technologies Ltd.

- TransUnion LLC.

- DataVisor, Inc.

- Experian Information Solutions, Inc

- BPC Group

- FICO

- Feedzai

- Featurespace Limited

- IBM

- Eastnets

- LexisNexis Risk Solutions

- NiCE Ltd.

- Outseer LLC.

Recent Developments (M&A/ Product Launch)

- In May 2025, Airtel launched an AI-powered fraud detection solution that blocks malicious websites in real-time across OTT apps, emails, browsers, and SMS. The platform is available to all Airtel mobile and broadband users at no additional cost and uses integrated domain filtering for automatic threat detection and blocking.

- In October 2024, Swift launched an AI-powered fraud detection service to strengthen cross-border payment security. Leveraging pseudonymised data from billions of transactions, the solution enhances its existing Payment Controls Service by enabling real-time identification of suspicious activity.

- In September 2024, Mastercard upgraded its Consumer Fraud Risk solution with expanded AI capabilities for real-time payment scam prevention in the UK. The system analyzes transaction data and generates real-time risk scores to help banks block Authorised Push Payment (APP) fraud before funds are transferred.

- In February 2024, Perfios acquired Clari5 to strengthen its capabilities in fraud mitigation, risk management, and anti-money laundering. The acquisition is expected to enhance Perfios’ product offerings and expand its reach in India, MENA, and Southeast Asia.