Market Definition

Enterprise asset management (EAM) encompasses systems and processes used to monitor, maintain, and optimize physical assets throughout their lifecycle. These solutions integrate functionalities such as maintenance scheduling, inventory tracking, and performance analytics to support effective decision‑making.

The scope of the market covers industries such as manufacturing, energy, transportation, and utilities. Enterprises apply enterprise asset management for tasks like preventive and predictive maintenance, resource allocation, regulatory compliance, and lifecycle cost reduction to maximize uptime and operational efficiency.

Enterprise Asset Management Market Overview

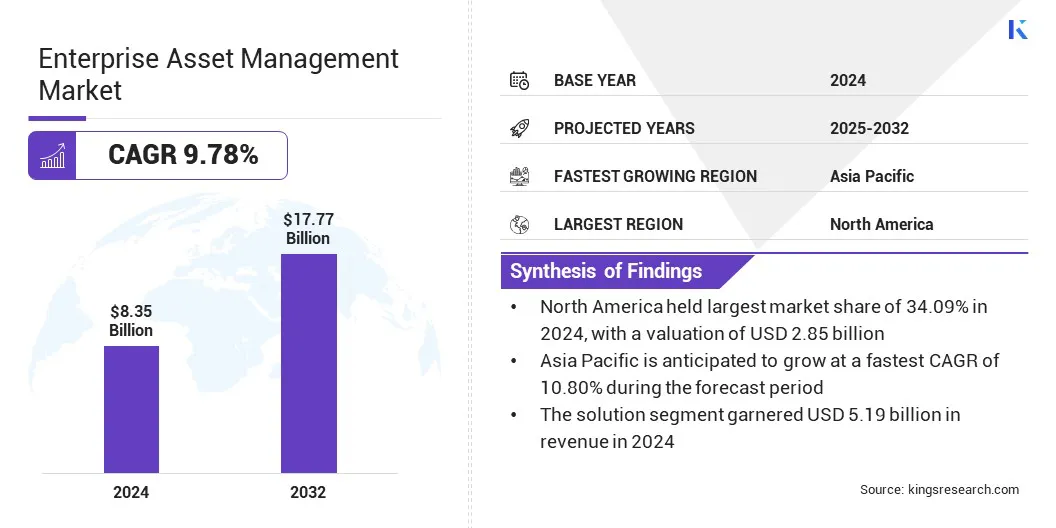

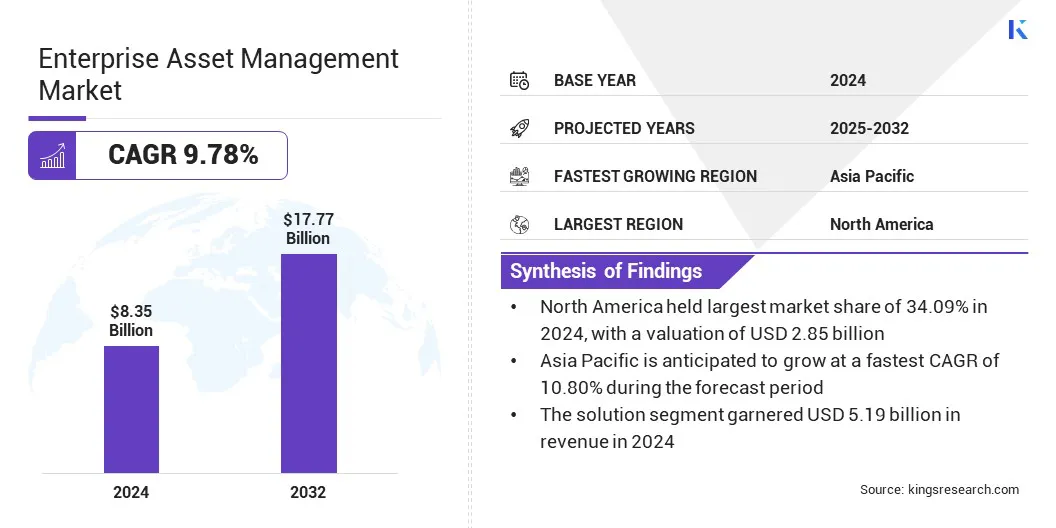

The global enterprise asset management market size was valued at USD 8.35 billion in 2024 and is projected to grow from USD 9.12 billion in 2025 to USD 17.77 billion by 2032, exhibiting a CAGR of 9.78% during the forecast period.

The growth of the market is driven by the integration of IoT, AI, and predictive maintenance, enabling real-time monitoring and proactive repairs. Additionally, the use of digital twins and mobile tools is improving field operations, allowing technicians to access asset data and workflows on-site, thereby increasing operational efficiency.

Key Highlights

- The enterprise asset management industry size was valued at USD 8.35 billion in 2024.

- The market is projected to grow at a CAGR of 9.78% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 2.85 billion.

- The solution segment garnered USD 5.19 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 10.68 billion by 2032.

- The large enterprises segment secured the largest revenue share of 57.49% in 2024.

- The asset lifecycle management is poised for a robust CAGR of 10.14% through the forecast period.

- The manufacturing segment is estimated to secure the largest revenue share of 24.29% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 10.80% during the forecast period.

Major companies operating in the global enterprise asset management market are IBM, Oracle, SAP, Infor, Fluke Corporation, UpKeep Technologies, Inc., Rockwell Automation, Inc., Aptean, Ramco Systems, Real Asset Management Pty Limited, Hexagon AB, Limble CMMS, MaintainX, Copperleaf Technologies Inc., and AVEVA Group Limited.

The growing shift toward digital and cloud-based platforms is driving the expansion of the enterprise asset management (EAM) market. Organizations are increasingly adopting cloud-based EAM solutions to achieve greater scalability, enhance accessibility, and minimize reliance on costly on-premise infrastructure. Flexible subscription-based models allow enterprises to manage assets more efficiently while avoiding significant upfront capital expenditure.

Cloud-based platforms support real-time asset tracking, enable remote maintenance coordination, and centralized data visibility across multiple sites. Integration with IoT devices, mobile applications, and advanced analytics further improves asset performance, predictive maintenance, and lifecycle optimization. These capabilities are helping businesses reduce downtime, extend asset life, and improve operational efficiency.

- In July 2024, Global InterXchange (GIX) launched a privately owned dark fiber corridor across the Hudson River, connecting key data hubs at 60 Hudson Street in Manhattan and 165 Halsey Street in Newark, U.S. This next-generation link is engineered to provide ultra-low latency, high-capacity connectivity specifically suited for hyperscale cloud providers, financial institutions, and 5G network operators.

Market Driver

Integration with IoT, AI, and Predictive Maintenance

The integration of IoT and AI technologies is accelerating the adoption of enterprise asset management (EAM) solutions, particularly in the area of predictive maintenance. Connected sensors continuously monitor equipment health and performance in real time across industrial and infrastructure settings. This stream of data is analyzed by AI algorithms to detect anomalies, identify degradation patterns, and predict failures before they occur.

By enabling proactive interventions, predictive maintenance significantly reduces unplanned downtime, minimizes repair costs, and extends the operational life of critical assets. As a result, organizations are transitioning from reactive to data-driven maintenance strategies, ultimately improving return on assets (ROA).

This shift underscores a broader trend: the growing reliance on intelligent, connected systems to ensure operational efficiency and reliability. As these technologies mature, the EAM market is poised for sustained growth.

- In December 2024, SAP launched its Intelligent Asset Management suite, which integrates IoT sensor data with SAP Business AI to enable real-time monitoring, failure prediction, and prescriptive maintenance across enterprise assets. The platform creates a unified digital thread combining data from ERP, field systems, and manual inspections, allowing organizations to predict equipment failures, optimize maintenance schedules, and automate workflows.

Market Challenge

High Initial Implementation and Integration Costs

A key challenge in the enterprise asset management market is the high upfront cost of deploying EAM systems, including expenses for software licensing, hardware, and customization. Integrating these solutions with legacy ERP or CMMS platforms further adds to the complexity and financial burden.

These financial and operational burdens are particularly restrictive for small and medium enterprises, often delaying or limiting their ability to adopt EAM solutions and advance digital transformation initiatives.

To address this challenge, market players are offering cloud-based EAM solutions, modular platforms, and pay-as-you-go pricing models to reduce financial pressure. Companies are also simplifying integration processes and providing pre-configured templates to accelerate implementation and lower technical barriers.

Market Trend

Enhancing Field Operations with Digital Twin and Mobile Tools

A key trend in the enterprise asset management market is the use of digital twin technology and mobile field applications to improve maintenance efficiency. Organizations are creating virtual replicas of physical assets to provide real-time visibility into asset condition, performance, and lifecycle data. Mobile EAM apps are allowing technicians to access digital asset maps, maintenance records, and workflows directly from the field.

This integration is reducing delays, improving accuracy, and enabling faster decision-making during on-site inspections and repairs. Technicians are completing tasks with greater autonomy by leveraging synchronized data and interactive guidance. As a result, organizations across industries are adopting advanced enterprise asset management (EAM) technologies to streamline field operations and support proactive asset strategies..

- In May 2025, ServiceNow unveiled its AI Control Tower as part of the expanded ServiceNow AI Platform at its Knowledge 2025 event. This platform integrates AI-driven orchestration tools and predictive analytics to monitor enterprise-wide workflows, detect anomalies, and recommend automated remediation paths, enabling more efficient, self-service security and operations across cloud environments.

Enterprise Asset Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, Services

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Organization Size

|

Large Enterprises, Small and Medium Enterprises

|

|

By Application

|

Asset Lifecycle Management, Inventory Management, Work Order Management, Labor Management, Predictive Maintenance, Facility Management, Others

|

|

By Vertical

|

Manufacturing, Education, Healthcare, IT & Telecommunications, Energy & Utilities, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solution and Services): The solution segment earned USD 5.19 billion in 2024 due to the rising demand for integrated platforms that enable real-time asset tracking, predictive maintenance, and streamlined operations across complex asset-intensive industries.

- By Deployment (Cloud-based and On-premises): The on-premises segment held 61.72% of the market in 2024, due to its stronger data control, customization flexibility, and suitability for large asset-intensive industries with strict regulatory and security requirements.

- By Organization Size (Large Enterprises and Small and Medium Enterprises): The large enterprises segment is projected to reach USD 9.94 billion by 2032, owing to their extensive asset bases and complex operational structures, which require advanced, scalable solutions for efficient maintenance, compliance, and lifecycle management.

- By Application (Asset Lifecycle Management, Inventory Management, Work Order Management, Labor Management, Predictive Maintenance, Facility Management, and Others): The asset lifecycle management segment is poised for significant growth at a CAGR of 10.14% through the forecast period, attributed to its critical role in optimizing asset performance, reducing total cost of ownership, and extending asset lifespan across industries with high-value, long-term physical assets.

Enterprise Asset Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America enterprise asset management market share stood at 34.09% in 2024 in the global market, with a valuation of USD 2.85 billion. This dominance is largely due to the strong presence of cloud infrastructure in North America, supported by major providers such as AWS, Microsoft Azure, and Google Cloud. Their extensive presence in North America is accelerating the adoption of cloud-based EAM platforms across industries.

These platforms enable scalable deployment, real-time access to asset information, and seamless integration with other enterprise systems. Mid-sized businesses, in particular, are gaining from this shift, as cloud solutions lower initial investment requirements and reduce ongoing IT management costs.

- In February 2024, IBM launched the Maximo Application Suite as-a-Service on AWS Marketplace, offering a fully managed, subscription-based EAM solution deployed via AWS OpenShift. The SaaS delivery removes the need for on-premises infrastructure, streamlines procurement, licensing, and enables mid-sized organizations to implement asset management with lower upfront investment and reduced IT overhead.

Additionally, the U.S. and Canadian industrial sectors, particularly in automotive, aerospace, and heavy equipment manufacturing is witnessing a strong shift toward predictive maintenance. These factors are significantly fueling the demand for advanced asset management solutions across the region.

Asia Pacific enterprise asset management industry is poised for a significant CAGR of 10.80% over the forecast period. This growth is largely driven by Asia Pacific’s emergence as a global manufacturing hub, with rapid industrial expansion across key sectors such as electronics, automotive, chemicals, and heavy machinery. Rising production volumes are prompting businesses to adopt EAM systems to manage extensive equipment fleets, reduce operational risks, and improve maintenance efficiency.

The increasing complexity of regional supply chains is further influencing organizations to implement structured and efficient asset management practices, supporting sustained market growth across Asia Pacific.

Regulatory Frameworks

- In the U.S., the enterprise asset management market is shaped by several regulatory bodies. The Occupational Safety and Health Administration (OSHA) mandates maintenance and safety standards under 29 CFR Parts 1910 and 1926. The Environmental Protection Agency (EPA) enforces equipment and emissions compliance under the Clean Air Act. Additionally, the Federal Transit Administration (FTA) requires transit operators to maintain asset inventories and performance metrics under the State of Good Repair (SGR) standards.

- In the European Union, the Machinery Directive (2006/42/EC) enforces safety requirements for industrial equipment and mandates structured maintenance. The Digital Operational Resilience Act (DORA) and the Network and Information Systems (NIS) Directive target digital and cybersecurity preparedness, requiring asset visibility and risk controls. These regulations drive the use of EAM systems for lifecycle monitoring, documentation, and operational resilience in sectors such as utilities, transportation, and manufacturing.

- In China, enterprise asset management in state-owned enterprises is governed by the State-owned Assets Supervision and Administration Commission (SASAC) regulations, which require strict internal controls, performance monitoring, and asset accountability. Financial asset management is regulated by the People’s Bank of China (PBC) and the China Securities Regulatory Commission (CSRC), which mandate transparency, risk disclosure, and structured investment oversight. EAM systems help ensure compliance with these national supervisory frameworks.

- Japan regulates asset management through the Financial Instruments and Exchange Act and the Investment Trust Act, both of which enforce operational transparency, risk controls, and compliance monitoring. Institutional asset managers are required to establish audit mechanisms and internal governance structures.

Competitive Landscape

Major players in the enterprise asset management industry are adopting strategies such as technology certifications, product innovation, and strategic collaborations to strengthen their position and support overall market growth. Companies in the market are aligning their solutions with widely used ERP platforms like SAP to enhance system integration and usability.

Moreover, key players are investing in R&D to improve the efficiency and functionality of asset management tools. Additionally, partnerships with cloud providers and industry-specific service firms are helping expand solution reach and relevance across asset-intensive sectors.

- In February 2024, HCLTech’s iMRO/4 MRO solution achieved SAP S/4HANA Cloud certification, which enables enterprises to manage maintenance, repair, and overhaul workflows within SAP’s ERP environment. The solution supports asset-heavy industries by aligning tightly with SAP's digital core for enhanced asset utilization.

List of Key Companies in Enterprise Asset Management Market:

- IBM

- Oracle

- SAP

- Infor

- Fluke Corporation

- UpKeep Technologies, Inc.

- Rockwell Automation, Inc.

- Aptean

- Ramco Systems.

- Real Asset Management Pty Limited

- Hexagon AB

- Limble CMMS

- MaintainX

- Copperleaf Technologies Inc.

- AVEVA Group Limited

Recent Developments (M&A)

- In August 2024, Aptean acquired SSG Insight to expand its global EAM footprint by integrating SSG’s Agility CMMS and asset lifecycle management suite. The deal bolsters Aptean’s cloud-based EAM capabilities across manufacturing, logistics, healthcare, and transportation sectors.

- In June 2024, Trane Technologies completed the acquisition of Nuvolo. Nuvolo’s cloud-based connected workplace and enterprise asset management (EAM) platform enables integrated facilities and asset lifecycle management. Through this acquisition, Trane adds Nuvolo’s software capabilities to its global climate and building management solutions, strengthening its position in intelligent, connected infrastructure offerings.