Market Definition

The market comprises technologies, equipment, and services used in minimally invasive internal imaging and diagnostics. It includes EUS systems, echoendoscopes, and related accessories across hospitals, ambulatory surgical centers, and specialty clinics.

Key clinical applications include oncology, gastroenterology, pulmonology, and interventional endoscopy. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Endoscopic Ultrasound Market Overview

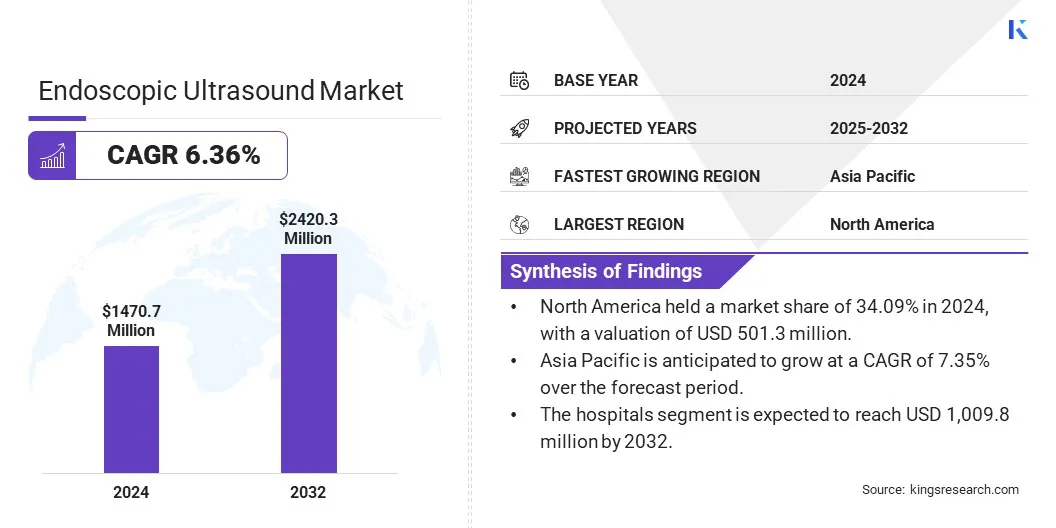

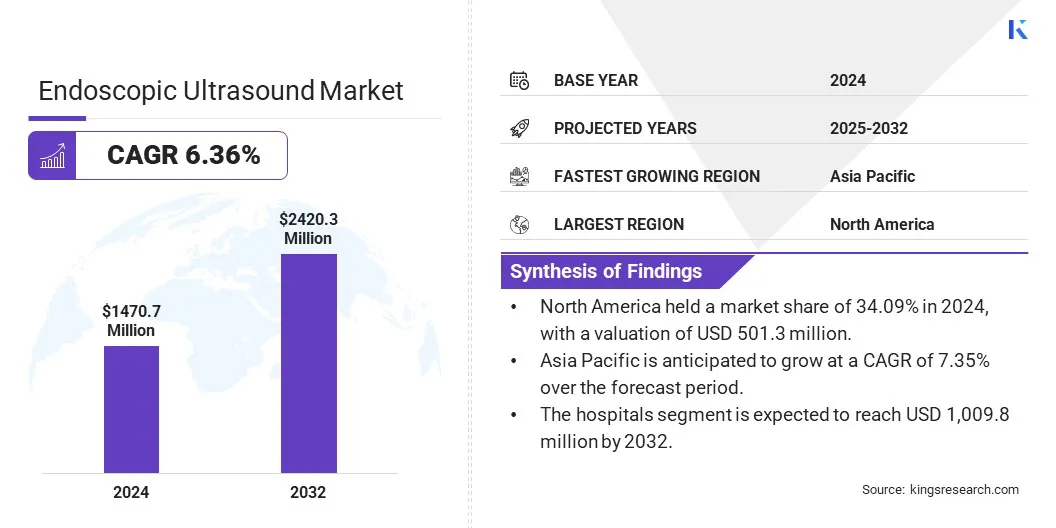

The global endoscopic ultrasound market size was valued at USD 1,470.7 million in 2024 and is projected to grow from USD 1,559.5 million in 2025 to USD 2,420.3 million by 2032, exhibiting a CAGR of 6.36% during the forecast period.

The market is witnessing significant expansion due to rising demand for minimally invasive diagnostic procedures. Increasing prevalence of gastrointestinal and pancreatic disorders is driving the use of EUS in early detection and staging. Advancements in imaging technologies are improving diagnostic accuracy, supporting wider clinical adoption.

Major companies operating in the endoscopic ultrasound industry are Olympus Corporation, RICOH IMAGING COMPANY, LTD., FUJIFILM Corporation, Boston Scientific Corporation, Medtronic, CONMED Corporation, Cook, Medi-Globe GmbH, Esaote SPA, SAMSUNG, Lepu Medical Technology(Beijing)Co.,Ltd., InnerMedical Co., Ltd., Huaco Healthcare Technologies Co. Ltd., Avinger, and Endosound, Inc.

Advancements in imaging technologies are improving diagnostic accuracy and procedural precision across various medical fields. Enhanced real-time visualization supports better clinical outcomes, while growing adoption of advanced ultrasound systems is leading to increased demand. Expanding applications in minimally invasive procedures and a stronger emphasis on early disease detection are further fueling market growth.

- In July 2024, Olympus launched the Aplio i800 endoscopic ultrasound (EUS) system in Europe. The processor features Superb Microvascular Imaging (SMI), Differential Tissue Harmonic Imaging (D-THI), and Shear Wave Elastography with 2D mapping capability (2DSWE), supporting accurate diagnosis of hepato-pancreato-biliary conditions and respiratory conditions.

Key Highlights

- The endoscopic ultrasound market size was valued at USD 1,470.7 million in 2024.

- The market is projected to grow at a CAGR of 6.36% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 501.3 million.

- The endoscopes segment garnered USD 439.7 million in revenue in 2024.

- The gastrointestinal cancer segment is expected to reach USD 874.3 million by 2032.

- The hospitals segment is expected to reach USD 1,009.8 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.35% over the forecast period.

Market Driver

Advanced Imaging Precision and Greater Device Maneuverability

The market is witnessing notable expansion, largely propelled by advancements in crystal technology. This technology offers higher image resolution and increased sensitivity, improving diagnostic accuracy and treatment precision. Increased device flexibility allows access to hard-to-reach areas, facilitating more effective therapeutic interventions.

This is leading to greater adoption of endoscopic ultrasound, reduced procedure times, and enhanced patient safety. Consequently, healthcare providers are investing heavily in advanced endoscopic ultrasound systems, supporting the growth of minimally invasive treatments.

- In March 2025, FUJIFILM Healthcare released the EG-740UT interventional ultrasonic endoscope across Europe. The device features single crystal technology, enhanced visibility, and maneuverability, designed for therapeutic use in endoscopic ultrasound procedures.

Market Challenge

High Cost of Endoscopic Ultrasound Equipment

The endoscopic ultrasound market faces significant challenges due to the high cost of equipment. Advanced technology and specialized components make these systems expensive to acquire and maintain. This limits their availability, particularly in smaller healthcare facilities and developing regions, thereby restricting patient access to advanced diagnostic and therapeutic procedures.

To overcome this, manufacturers are focusing on developing more affordable devices without compromising performance. Additionally, improving clinician training and procedure efficiency can help reduce overall operational costs. These measures aim to increase accessibility and support wider adoption of endoscopic ultrasound technology.

Market Trend

Integration of AI and Advanced Ultrasound Processing

The market is experiencing a notable trend toward the integration of artificial intelligence (AI) and advanced ultrasound processing technologies. AI enhances diagnostic accuracy by assisting clinicians in detecting abnormalities with greater precision and consistency.

Advanced ultrasound processing improves image quality through techniques such as contrast enhancement and harmonic imaging. These innovations enable better visualization of tissues and lesions, supporting earlier and more accurate diagnosis.

AI and enhanced processing streamline workflows, reduce interpretation errors, and improve patient outcomes. Such technological progress is shaping current trends, leading to the widespread adoption of more sophisticated endoscopic ultrasound systems across healthcare settings.

- In May 2025, Olympus unveiled the OLYSENSE Platform with the CADDIE AI-based detection device at DDW, enhancing polyp detection during colonoscopy. The company also introduced the EU-ME3 ultrasound processor for improved lesion visualization in endoscopic ultrasound procedures.

Endoscopic Ultrasound Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Endoscopes, Ultrasound Probes, Ultrasonic Processors, Imaging Systems, Needles, Accessories

|

|

By Application

|

Gastrointestinal Cancer, Lung Cancer, Pancreaticobiliary Disease, Others

|

|

By End User

|

Hospitals, Ambulatory Surgery Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Endoscopes, Ultrasound Probes, Ultrasonic Processors, Imaging Systems, Needles, and Accessories): The endoscopes segment earned USD 439.7 million in 2024 due to their widespread use in diagnostic and therapeutic procedures across gastroenterology and oncology.

- By Application (Gastrointestinal Cancer, Lung Cancer, Pancreaticobiliary Disease, and Others): The gastrointestinal cancer segment held a share of 36.22% in 2024, fueled by increasing incidence rates and the clinical need for early-stage detection.

- By End User (Hospitals, Ambulatory Surgery Centers, and Others): The hospitals segment is projected to reach USD 1,009.8 million by 2032, owing to high patient inflow, advanced equipment, and skilled professionals.

Endoscopic Ultrasound Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America endoscopic ultrasound market accounted for a substantial share of 34.09% in 2024 , valued at USD 501.3 million. This growth is propelled by strong clinical adoption of endoscopic ultrasound in oncology and gastroenterology. Widespread use in large hospitals and academic medical centers, particularly in the U.S., has supported sustained growth.

Technological innovation, led by key manufacturers headquartered in the region, continues to advance diagnostic precision. High awareness among healthcare professionals and patients about the benefits of minimally invasive diagnostics has influenced demand.

The presence of specialized endoscopy suites and integration of EUS in routine cancer evaluations have further solidified North America’s position in the global market.

The Asia Pacific endoscopic ultrasound industry is expected to register the fastest CAGR of 7.35% over the forecast period. Growth is supported by rising incidence of gastric, pancreatic, and esophageal cancers in countries such as China, Japan, and South Korea. Expanding access to advanced diagnostic tools in urban hospitals is boosting demand for EUS procedures.

In Japan, high healthcare standards and a strong focus on cancer screening is contributing to this uptake. India and Southeast Asia are seeing increased investment in endoscopy services across private hospitals. The growing number of trained endosonographers, combined with improving infrastructure in tertiary care centers, is fueling procedural volumes and accelerating regional market growth.

- In January 2024, Canon Medical Systems Corporation and Olympus Corporation agreed to collaborate on endoscopic ultrasound systems. Canon Medical will develop and manufacture diagnostic ultrasound systems for EUS, while Olympus will handle sales and marketing. The partnership aims to provide advanced EUS equipment with high-quality imaging, focusing on technological advancements and global expansion starting in Japan and Europe.

Regulatory Frameworks

- In the U.S., the regulatory authority for endoscopic ultrasound devices is the Food and Drug Administration (FDA). The FDA regulates the manufacturing, labeling, and marketing of EUS devices to ensure their safety and effectiveness.

- In Europe, endoscopic ultrasound (EUS) is regulated under the Medical Devices Regulation (MDR). The MDR ensures safety, performance, and clinical evaluation standards before market approval.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA), in collaboration withthe Ministry of Health, Labour and Welfare (MHLW) oversees the approval, safety monitoring, and compliance of EUS with national standards.

Competitive Landscape

The endoscopic ultrasound market is characterized by established manufacturers focusing on technological differentiation and clinical integration. Key players prioritize product innovation through high-resolution imaging, improved needle designs, and compact system configurations for specific procedures.

They engage in strategic collaborations with hospitals and research institutions to support clinical validation and broaden procedural applications. Companies expand their presence in high-growth regions by increasing distribution networks and providing localized training for endosonographers.

Ongoing investment in research and development and portfolio expansion into interventional EUS applications help maintain competitiveness. Some firms adopt modular system designs to offer adaptable solutions across different care settings, including outpatient and specialty centers.

- In March 2025, NVIDIA and GE HealthCare collaborated to advance autonomous X-ray and ultrasound imaging using the NVIDIA Isaac for Healthcare simulation platform. The platform enables virtual training, testing, and validation of autonomous systems to improve patient access and address healthcare workload challenges.

List of Key Companies in Endoscopic Ultrasound Market:

- Olympus Corporation

- RICOH IMAGING COMPANY, LTD.

- FUJIFILM Corporation

- Boston Scientific Corporation

- Medtronic

- CONMED Corporation

- Cook

- Medi-Globe GmbH

- Esaote SPA

- SAMSUNG

- Lepu Medical Technology(Beijing)Co.,Ltd.

- InnerMedical Co., Ltd.

- Huaco Healthcare Technologies Co. Ltd.

- Avinger

- Endosound, Inc.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In September 2024, FUJIFILM Healthcare Europe announced that the ARIETTA 750 FF ENDO ultrasound system is now compatible with FUJIFILM ultrasound endoscopes and the EB-530US bronchoscope. This upgrade, available for new and existing ARIETTA 750 systems, integrates advanced imaging technologies to enhance diagnostic and therapeutic performance.