Market Definition

The market encompasses devices and technologies used in the procedure to treat abnormal uterine bleeding. This minimally invasive technique, involving the removal or destruction of the uterine lining, is gaining popularity on account of its effectiveness, quicker recovery time, and reduced risk compared to traditional surgeries like hysterectomy.

Endometrial Ablation Market Overview

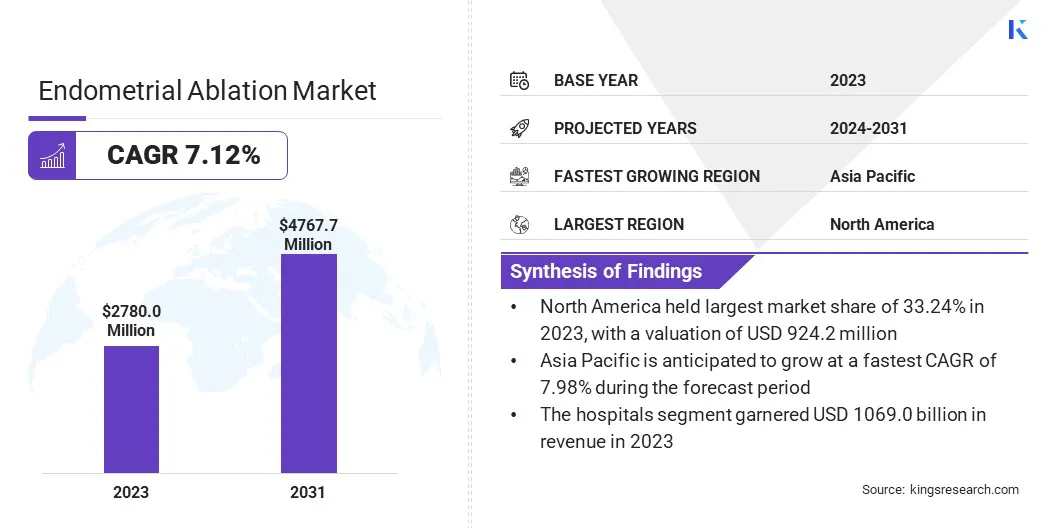

The global endometrial ablation market size was valued at USD 2780.0 million in 2023, which is estimated to be USD 2945.1 million in 2024 and reach USD 4767.7 million by 2031, growing at a CAGR of 7.12% from 2024 to 2031.

The increasing prevalence of uterine disorders such as fibroids, polyps, and endometriosis has led to a rise in abnormal uterine bleeding, fueling the demand for effective treatments like endometrial ablation, which offers relief from heavy bleeding.

Major companies operating in the endometrial ablation industry are Medtronic, Hologic, Inc., CooperSurgical Inc, Boston Scientific Corporation, Olympus, Minerva Surgical, Inc, Inovus Limited, Omnitech Systems, Inc, Channel Medsystems, Inc., Minitouch, BVM Medical Limited, IDOMAN-MED, Richard Wolf GmbH, and AngioDynamics.

The market is characterized by a shift toward minimally invasive procedures as patients and healthcare providers seek safer and more efficient alternatives to traditional surgeries like hysterectomy. Endometrial ablation offers a viable solution, providing effective treatment for abnormal uterine bleeding with reduced pain and faster recovery times.

The market continues to evolve as the demand for less invasive options increases. Furthermore, the market is driven by research and advancements in technology and growing patient preference for procedures that require no large incisions and allow for quicker returns to daily activities.

- In November 2024, Mayo Clinic researchers published a study in the New England Journal of Medicine, recommending minimally invasive alternatives to hysterectomy for uterine fibroids, such as radiofrequency ablation. The study highlights the growing preference for less invasive treatments and emphasizes early detection to reduce health risks.

Key Highlights:

- The endometrial ablation industry size was valued at USD 2780.0 million in 2023.

- The market is projected to grow at a CAGR of 7.12% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 924.2 million.

- The cryoablation segment garnered USD 831.2 million in revenue in 2023.

- The hospitals segment is expected to reach USD 6 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.98% during the forecast period.

Market Driver

Increasing Prevalence of Uterine Disorders

Uterine disorders like fibroids, polyps, and endometriosis are becoming more common among women, contributing to abnormal uterine bleeding, a condition that significantly affects the quality of life. These disorders often lead to heavy or prolonged menstrual cycles, which can be difficult to manage with conventional treatments.

Endometrial ablation has emerged as an effective solution, providing a minimally invasive option to treat excessive bleeding. The demand for endometrial ablation procedures continues to rise as these conditions become frequently diagnosed.

- According to a WHO article from March 2023, endometriosis affects around 10% (190 million) of women and girls globally. The treatment focuses on symptom management, due to the absence of a cure. This growing prevalence highlights the increasing demand for effective treatment options, such as endometrial ablation, especially in regions with limited access to early diagnosis and care.

Market Challenge

Risk of Recurrence

One of the main challenges in the endometrial ablation market is the risk of recurrence, as the procedure may not provide a permanent solution for all patients. Abnormal bleeding can return over time, necessitating repeat procedures or alternative treatments such as hysterectomy.

This calls for advancements in technology, such as more precise and effective ablation techniques, which aim to reduce recurrence rates and provide longer-lasting results. Additionally, better patient selection and early intervention may help minimize recurrence risks.

Market Trend

Integration of AI and Robotics in Ablation Procedures

The integration of Artificial Intelligence (AI) and robotic-assisted technology is revolutionizing endometrial ablation procedures, offering more precise and efficient treatments. These innovations enhance surgical accuracy, minimize human error, and allow for personalized treatment plans based on individual patient anatomy.

Robotic systems provide better visualization and control during the procedure, leading to quicker recovery times and improved patient outcomes. They are expected to further streamline ablation techniques as they evolve, offering enhanced safety & effectiveness and driving the market.

- In March 2024, ETH Zurich's spin-off Scanvio introduced an AI algorithm for faster, more accurate diagnosis of endometriosis using ultrasound. This technology could enhance the precision of endometrial ablation procedures by enabling earlier detection, improving treatment outcomes and potentially reducing the need for invasive surgeries.

Endometrial Ablation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Cryoablation, Radiofrequency, Hydrothermal, Thermal Balloon, Microwave Energy, Others

|

|

By End Use

|

Hospitals, Clinics, Ambulatory Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Cryoablation, Radiofrequency, Hydrothermal, Thermal Balloon, Microwave Energy, Others): The cryoablation segment earned USD 831.2 million in 2023, due to its effective and minimally invasive approach.

- By End Use (Hospitals, Clinics, Ambulatory Centers): The hospitals segment held 38.45% share of the market in 2023, due to their advanced facilities and widespread adoption of endometrial ablation.

Endometrial Ablation Market Regional Analysis

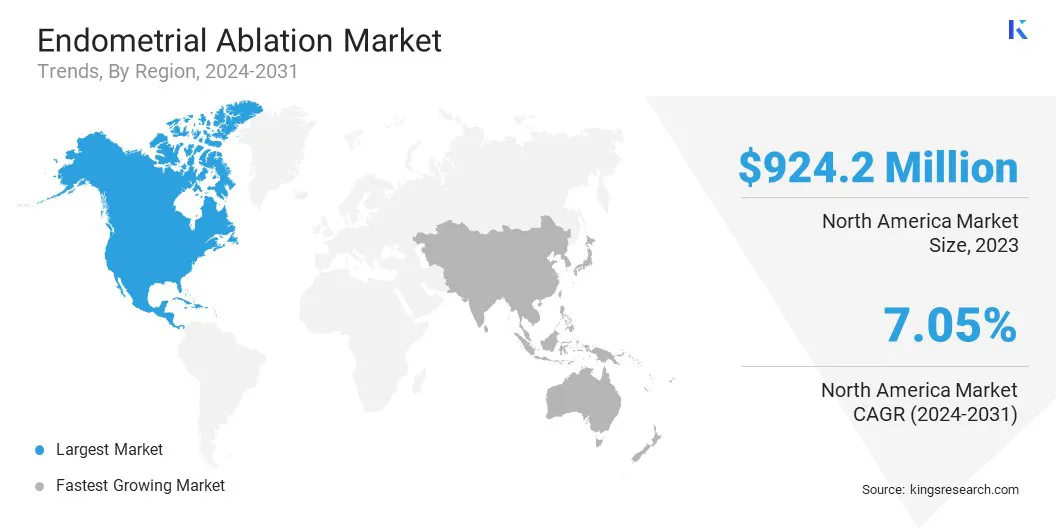

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 33.24% share of the endometrial ablation market in 2023, with a valuation of USD 924.2 million. The well-established healthcare systems and high adoption rates of minimally invasive procedures in the region contribute to its dominant market position.

Additionally, the presence of key medical device manufacturers and a growing focus on cost-effective, outpatient treatments further strengthens North America’s position as the primary market for endometrial ablation procedures, driving growth and innovation.

- In October 2024, Minerva Surgical announced a strategic partnership with Blackmaple Group and Women’s Health Administrative and Purchasing Alliance (WHAAPA) to offer office-based solutions for uterine condition detection and treatment, particularly addressing Abnormal Uterine Bleeding (AUB), predominantly impacting women in North America.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 7.98% over the forecast period. Asia Pacific is the fastest-growing region in the endometrial ablation industry, driven by rapid advancements in medical technology and rising healthcare investments.

The increasing prevalence of uterine disorders, along with a growing awareness of minimally invasive treatments, is fueling the demand for endometrial ablation procedures.

Additionally, improving healthcare infrastructure and government initiatives to enhance women's health are contributing to the market growth. Asia Pacific is expected to register a surge in the demand for these procedures as the region modernizes its healthcare systems.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) ensures the safety, efficacy, and security of medical devices, including endometrial ablation systems, to protect public health and regulate various healthcare products.

- In the EU, endometrial ablation devices receive CE marking, indicating that they meet high safety, health, and environmental protection standards, ensuring that the products are approved for marketing within the European Economic Area (EEA).

Competitive Landscape

In recent years, several products aimed at improving treatment outcomes have been launched in the endometrial ablation industry. These innovations focus on enhancing the effectiveness, safety, and convenience of procedures, with advancements in minimally invasive technologies reducing recovery time and providing more personalized treatment options for patients suffering from abnormal uterine bleeding & related conditions.

- In November 2024, Olympus showcased its wide range of gynecological solutions at the AAGL World Congress, featuring products like the ESG-410 Surgical Energy Platform, Guardenia Containment System, and POWERSEAL Sealer/Divider, enhancing endometrial ablation procedures with advanced technology, efficiency, and improved safety for women’s health treatments.

List of Key Companies in Endometrial Ablation Market:

- Medtronic

- Hologic, Inc.

- CooperSurgical Inc

- Boston Scientific Corporation

- Olympus

- Minerva Surgical, Inc

- Inovus Limited

- Omnitech Systems, Inc

- Channel Medsystems, Inc.

- Minitouch

- BVM Medical Limited

- IDOMAN-MED

- Richard Wolf GmbH

- AngioDynamics

Recent Developments (Product Launch)

- In October 2024, Inovus Medical launched five advanced procedural skills modules for its HystAR platform, including Endometrial Ablation/Resection. These modules provide enhanced clinical training with realistic soft tissue pathologies, expanding the HystAR simulator’s capabilities and offering immersive, hands-on experience for surgical trainees.