Market Definition

The market involves the production and commercialization of emollient esters, which are derived from the reaction between fatty acids and alcohols.

These compounds are commonly used in cosmetics, personal care products, and pharmaceuticals, due to their ability to enhance skin feel, moisturize, and improve product texture. Emollient esters serve as key ingredients in lotions, creams, shampoos, and sunscreens, as they provide lubrication, smoothness, and a non-greasy finish.

Emollient Esters Market Overview

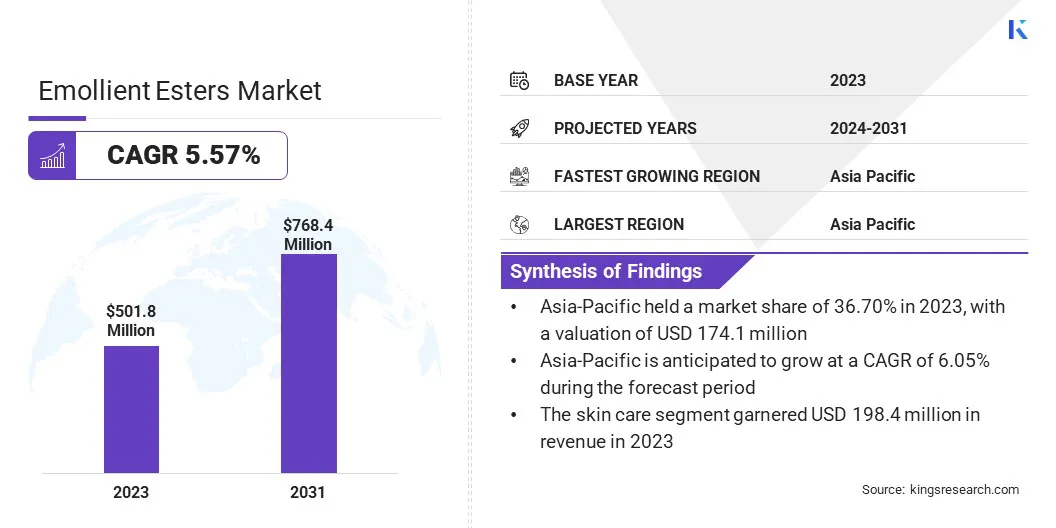

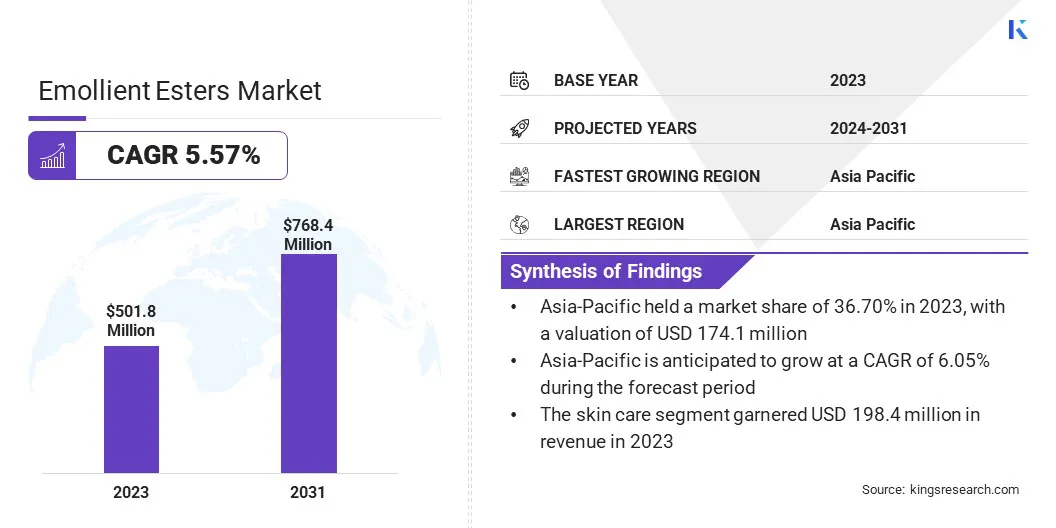

According to Kings Research, the emollient esters market size was valued at USD 501.8 million in 2023 and is projected to grow from USD 525.7 million in 2024 to USD 768.4 million by 2031, exhibiting a CAGR of 5.57% during the forecast period.

This growth is primarily driven by the increasing demand for personal care and cosmetic products, particularly those focused on skin hydration, anti-aging, and sun protection. The market is further bolstered by a growing preference for natural and organic ingredients, which has resulted in a higher adoption of plant-based emollient esters.

Major companies operating in the emollient esters market are Evonik, Croda International Plc, The Lubrizol Corporation, Lonza, Ashland, Clariant, Eastman Chemical Company, Schmidt Kunststoffverarbeitung Emsbüren GmbH & Co.KG, Cargill, Incorporated, Innospec, Oleon NV, Sonneborn LLC, Vantage Specialty Chemicals, Inc., Sensient Cosmetic Technologies, and BASF.

Ongoing innovations in product formulations, coupled with advancements within the skincare and cosmetic industries, are contributing to the rising popularity of emollient esters. The expansion of disposable incomes, especially in emerging markets, alongside the rapid growth of e-commerce platforms, is also fostering broader market penetration.

- In December 2023, Nordmann introduced Cosmacol R ELI, a new multifunctional emollient ester designed for use in personal care formulations. This sustainable ingredient is derived from renewable sources and offers an enhanced skin feel, making it ideal for use in skincare and cosmetic products.

Key Highlights:

- The emollient esters industry size was valued at USD 501.8 million in 2023.

- The market is projected to grow at a CAGR of 5.57% from 2024 to 2031.

- Asia Pacific held a market share of 34.70% in 2023, with a valuation of USD 174.1 million.

- The isopropyl myristate segment garnered USD 144.4 million in revenue in 2023.

- The skin care segment is expected to reach USD 317.5 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.05% during the forecast period.

Market Driver

"Growing Demand for Personal Care Products"

The increasing demand for personal care products is a significant driver of the emollient esters market. Consumers emphasize skin health and self-care, which boosts the preference for products that deliver enhanced moisturization, smooth application, and non-greasy finishes.

Emollient esters are critical in achieving these attributes, making them essential ingredients in a wide range of formulations, including lotions, creams, sunscreens, and hair care products. The influence of social media and emerging beauty trends have further fueled the demand for high-quality skincare solutions.

- In July 2024, OQ Chemicals launched OxBalance Neopentyl Glycol Diheptanoate (NPG Diheptanoate), a biomass-balanced light emollient ester designed for use in cosmetics. This product has been certified under the International Sustainability and Carbon Certification (ISCC) PLUS scheme, ensuring its sustainability credentials.

Market Challenge

"Raw Material Price Volatility"

The cost of essential raw materials, such as fatty acids and alcohols, can be highly volatile due to supply chain disruptions, agricultural conditions, and geopolitical factors. This price instability can significantly impact production costs, influencing the overall pricing strategies of manufacturers.

When raw material costs increase, companies may either absorb the additional costs or pass them on to consumers, which could affect market competitiveness and profit margins.

This challenge is particularly significant for emollient ester producers, as fluctuations in raw material prices directly affect the affordability and widespread adoption of these ingredients in personal care and cosmetic formulations.

Fluctuating prices of raw materials can be mitigated through several strategic measures adopted by manufacturers of emollient esters. Establishing long-term agreements with suppliers helps ensure price stability and a reliable supply of essential materials.

Diversifying the supplier base or vertically integrating to gain greater control over the supply chain reduces dependency on external factors. Investing in research and development to identify cost-effective and sustainable raw material alternatives can further alleviate price volatility.

Optimizing production processes to enhance operational efficiency and minimize waste also helps offset rising costs. Implementing these strategies can help manufacturers manage raw material price fluctuations and maintain competitive pricing structures.

Market Trend

"Growing Consumer Preference for Natural and Sustainable Ingredients"

The shift toward natural and sustainable ingredients is a prominent trend in the emollient esters market, driven by increasing consumer awareness of health and environmental concerns.

The preference for personal care products formulated with natural, plant-based, and sustainably sourced ingredients is growing, as consumers seek alternatives to synthetic chemicals due to their potential impact on both health and the environment.

Emollient esters, derived from renewable sources, are increasingly valued for their superior performance and environmental advantages. This trend is further fueled by the consumer demand for cruelty-free, biodegradable products and heightened expectations for transparency in ingredient sourcing.

- In September 2024, Evonik officially inaugurated its new production plant for cosmetic emollients at its site in Steinau, Germany. These esters are manufactured using an enzymatic process. The double-digit million-euro plant significantly increased Evonik’s production capacity, which catered to the growing customer demand for sustainable cosmetic emollients.

Emollient Esters Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Isopropyl Myristate, C12-C15 Alkyl Benzoate, Caprylic/Capric Triglyceride, Cetyl Palmitate, Myristyl Myristate

|

|

By End Use

|

Skin Care, Hair Care, Cosmetics, Oral Care, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Isopropyl Myristate, C12-C15 Alkyl Benzoate, Caprylic/Capric Triglyceride, Cetyl Palmitate, Myristyl Myristate): The isopropyl myristate segment earned USD 144.4 million in 2023, due to its widespread use as a solvent and skin conditioning agent in cosmetics, personal care products, and pharmaceuticals.

- By End Use (Skin Care, Hair Care, Cosmetics, Oral Care, Others): The skin care segment held 39.54% share of the market in 2023, due to the increasing demand for moisturization, anti-aging, and skin hydration products that utilize emollient esters for enhanced texture and performance.

Emollient Esters Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a 34.70% share of the emollient esters market in 2023, with a valuation of USD 174.1 million. This growth is primarily driven by the expanding personal care and cosmetics industry across key markets such as China, India, and Japan.

Increasing consumer demand for skincare and beauty products, coupled with a rising preference for natural and organic ingredients, has significantly contributed to the market's development.

Furthermore, factors such as growing disposable incomes, evolving lifestyles, and the influence of social media beauty trends are accelerating the adoption of emollient esters in both premium and mass-market products. The region's robust e-commerce sector also plays a pivotal role in enhancing accessibility, further driving the market.

The emollient esters industry in North America is poised for significant growth at a robust CAGR of 5.86% over the forecast period, driven by the increasing consumer awareness of skin health and rising demand for premium skincare & cosmetic products.

The growing preference for clean, natural, and sustainably sourced ingredients, particularly in the U.S. and Canada, is influencing product formulations across the personal care industry. The region's strong emphasis on innovation in product development and the expansion of e-commerce platforms are further contributing to the market growth.

The presence of leading manufacturers and the increasing adoption of emollient esters in personal care applications, including anti-aging and moisturizing products, are expected to support the market expansion in the region.

- In October 2024, Brenntag announced a distribution agreement with Stephenson for the personal care market in the U.S. and Canada. Brenntag Specialties will expand its product offering with a range of quality ingredients and multifunctional emulsifiers. Stephenson’s Durosoft emulsifiers, which are naturally derived esters, provide a sustainable alternative to synthetic ingredients, offering multifunctional, performance-driven solutions for skincare and haircare.

Regulatory Frameworks:

- The European Commission (EC), under Cosmetic Regulation (EC) No 1223/2009, sets safety and labeling requirements for cosmetic products sold within the European Union (EU), ensuring that they are safe for human health when used under normal conditions.

- The International Cooperation on Cosmetics Regulation (ICCR) ensures the safe use of cosmetic products, including emollient esters, by fostering the exchange of scientific data and aligning regulations across different markets.

- The European Commission (EC), through the REACH Regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals), aims to ensure that chemicals used in the EU are safe for human health and the environment.

Competitive Landscape

The emollient esters industry is characterized by several participants, including established corporations and rising organizations. Key market participants are focusing on mergers, acquisitions, and partnerships to expand their portfolios and enhance market share.

Companies are also investing in research and development to create innovative, natural, and sustainable products that meet the growing demand for clean beauty solutions. The competition is intensifying, as new entrants offer cost-effective and specialized products, while leading players prioritize sustainability and technological advancements to improve product quality and efficiency.

- In October 2023, Cargill announced the launch of CocoaDesign, a new feel-good emollient designed to enhance the sensory experience in personal care formulations. The innovative emollient is derived from sustainable cocoa butter, offering a luxurious texture and providing a smooth, silky feel to skincare and cosmetic products.

List of Key Companies in Emollient Esters Market:

- Evonik

- Croda International Plc

- The Lubrizol Corporation

- Lonza

- Ashland

- Clariant

- Eastman Chemical Company

- Schmidt Kunststoffverarbeitung Emsbüren GmbH & Co.KG

- Cargill, Incorporated

- Innospec

- Oleon NV

- Sonneborn LLC

- Vantage Specialty Chemicals, Inc.

- Sensient Cosmetic Technologies

- BASF

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, AAK Personal Care introduced LIPEX SheaLuxe TR, a sustainable emollient ester derived from renewable plant-based sources. This eco-friendly ingredient offers superior skin feel and performance, making it an ideal choice for cosmetic formulations.

- In November 2023, Sonneborn, LLClaunched SonneNatural NXG, a new plant-based emollient for use in the formulation of personal care products. The innovative new emollient offers a unique combination of properties, including non-greasy application, excellent moisture retention and an occlusive afterfeel that leaves skin feeling soft and luxurious.

- In February 2023, Croda International announced the acquisition of Solus Biotech, a move that expands its fast-growing beauty actives business in Asia. This acquisition enhances Croda’s ability to provide innovative, sustainable ingredients for beauty care, further strengthening its portfolio of high-performance solutions in the personal care sector.