Market Definition

The market involves the production and use of catalysts that convert harmful exhaust gases into less toxic substances in engines and industrial systems. These catalysts, typically based on platinum, palladium, and rhodium, are formulated for specific reactions such as oxidation and reduction.

Applications include automotive engines, power plants, marine engines, and industrial boilers. The market covers technologies for gasoline, diesel, and natural gas engines, aligned with regional emission standards.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Emission Control Catalyst Market Overview

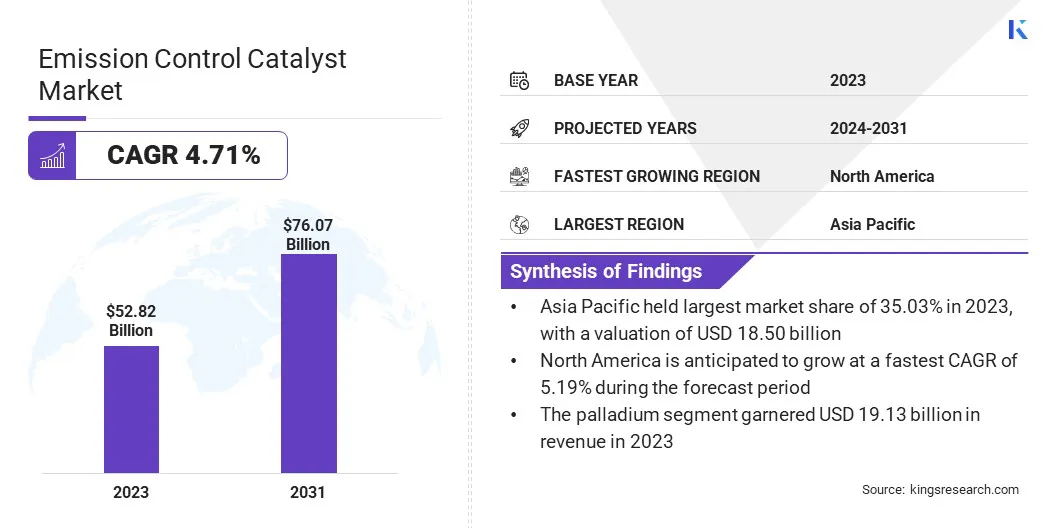

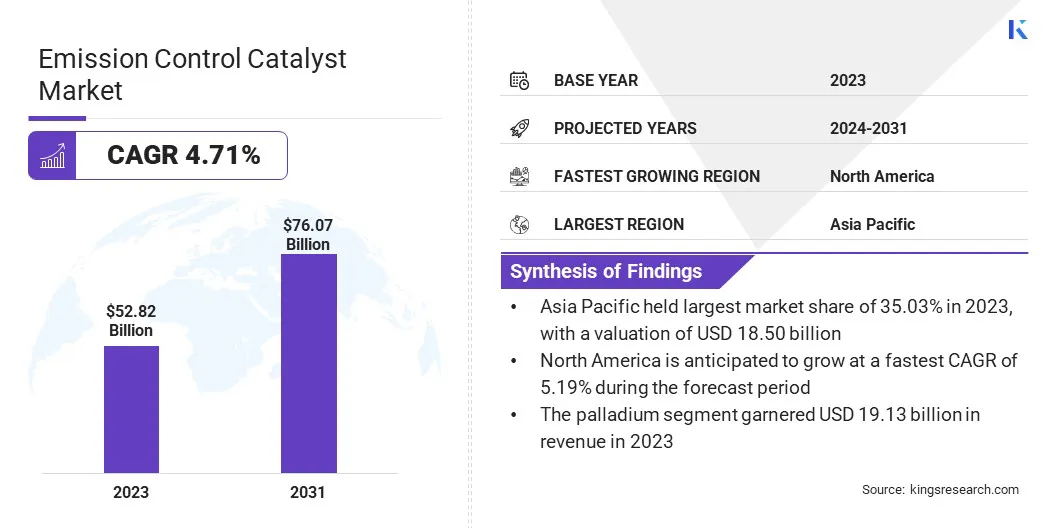

The global emission control catalyst market size was valued at USD 52.82 billion in 2023 and is projected to grow from USD 55.12 billion in 2024 to USD 76.07 billion by 2031, exhibiting a CAGR of 4.71% during the forecast period.

Market growth is driven by rising industrialization and expansion in power generation, which demand effective emission control solutions to meet regulatory standards. Additionally, technological advancements in catalyst materials are improving efficiency and durability, supporting their broader adoption across automotive, industrial, and energy sectors.

Major companies operating in the emission control catalyst industry are BASF, Johnson Matthey Plc, Umicore SA, Corning Incorporated, Solvay S.A., Tenneco Inc., Cataler Corporation, Heraeus Holding GmbH, Clariant, DCL International Inc., Cormetech Inc., Hitachi Zosen Corporation, NGK Insulators, Ltd., Faurecia, and Aerinox Inc.

The growth of market is significantly influenced by increasingly strict emission standards imposed by governments and regulatory agencies worldwide. Regions such as Europe, North America, and parts of Asia-Pacific have introduced aggressive policies to cut nitrogen oxides, carbon monoxide, and particulate matter from engines.

These evolving regulations require manufacturers to adopt advanced emission control catalysts to meet compliance, generating a strong demand across both light-duty and heavy-duty vehicle segments, as well as industrial engines and stationary equipment.

- In June 2023, Johnson Matthey launched its SCARF (Selective Catalytic Reduction Filter) technology, designed to enhance the reduction of nitrogen oxides (NOx) and particulate matter in light-duty diesel vehicles. The compact design allows for closer placement to the engine, benefiting from higher temperatures to improve catalyst efficiency.

Key Highlights

- The emission control catalyst industry size was valued at USD 52.82 billion in 2023.

- The market is projected to grow at a CAGR of 4.71% from 2024 to 2031.

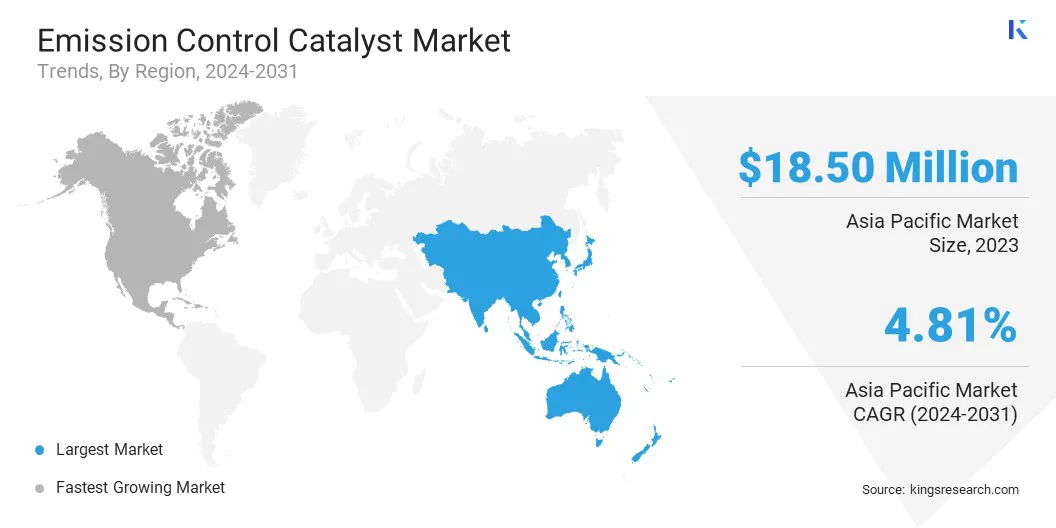

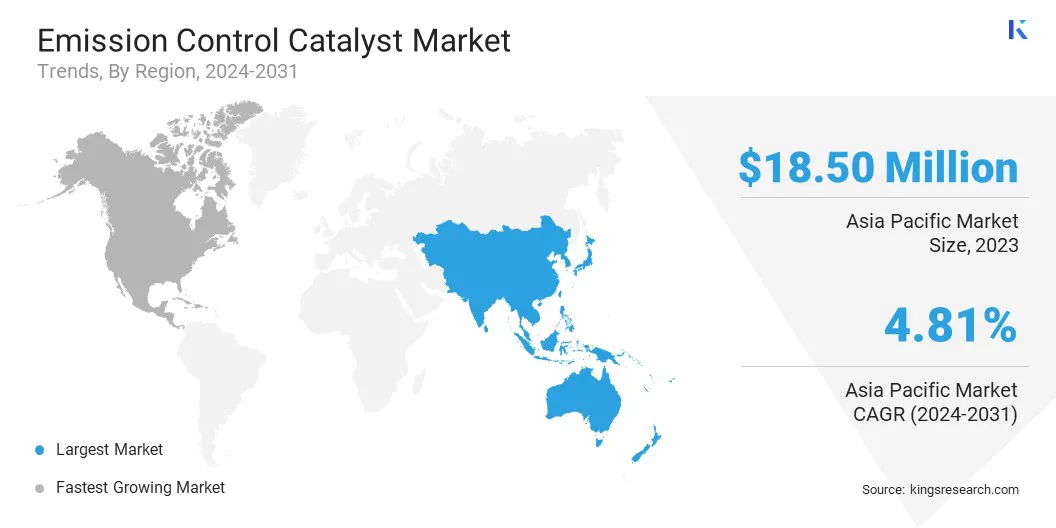

- Asia Pacific held a market share of 35.03% in 2023, with a valuation of USD 18.50 billion.

- The palladium segment garnered USD 19.13 billion in revenue in 2023.

- The mobile sources segment is expected to reach USD 45.95 billion by 2031.

- The automotive segment secured the largest revenue share of 40.47% in 2023.

- North America is anticipated to grow at a CAGR of 5.19% over the forecast period.

Market Driver

"Growth in Industrialization and Power Generation"

Rapid industrialization in developing economies is contributing to the growth of the emission control catalyst market. Power generation facilities, particularly coal-fired and gas-based plants, are major sources of harmful gases.

To align with air quality mandates and sustainability goals, operators are investing in advanced emission control systems. Catalysts are being deployed across SCR (Selective Catalytic Reduction) and oxidation processes in boilers, turbines, and incinerators, accelerating their use across energy-intensive industries.

- In March 2024, MAN Energy Solutions delivered its largest Selective Catalytic Reduction (SCR) system to MITSUI E&S Co., Ltd. The Cluster 5 Double Layer SCR, designed for ammonia engines, is the first of its kind. With a diameter of 3,900 mm and a weight of 28 metric tons, the system is capable of reducing NOx emissions by up to 90%. This advancement signifies a major step in emission control for large-scale industrial applications.

Market Challenge

"High Cost of Precious Metals in Catalyst Production"

A major challenge hampering the development of the emission control catalyst market is the rising cost of precious metals such as platinum, palladium, and rhodium, which are essential in catalyst formulations. These metals significantly increase production costs, making it difficult for manufacturers to offer cost-effective solutions.

To address this challenge, companies are investing in research to develop catalysts with lower metal loadings or alternative base metal formulations. Some are also optimizing catalyst structures to improve efficiency and reduce material use. Additionally, efforts in recycling and recovering precious metals from used catalysts are helping reduce dependence on newly mined materials and control overall costs.

Market Trend

"Technological Advancements in Catalyst Materials"

Ongoing innovations in catalyst material science are propelling the growth of the emission control catalyst market. The development of highly efficient formulations using platinum group metals, base metal catalysts, and nanomaterials is improving durability, efficiency, and thermal stability.

These advancements allow catalysts to operate under harsh conditions and extend the service life of emission control systems. Such improvements are critical to meeting evolving regulatory and performance demands across automotive and industrial applications.

- In November 2024, Researchers at Tohoku University's Advanced Institute for Materials Research designed a new platinum-nickel (Pt-Ni) core-shell catalyst, named Pt₁Ni₁@Pt/C, exhibiting enhanced activity and durability for the oxygen reduction reaction (ORR) in fuel cells. The catalyst demonstrated a mass activity of 1.424 A/mgPt and maintained 98.4% of its activity after 70,000 cycles, indicating its potential for long-term applications in energy technologies.

Emission Control Catalyst Market Report Snapshot

|

Segmentation

|

Details

|

|

By Metal

|

Palladium, Platinum, Rhodium, Others

|

|

By Application

|

Mobile Sources, Stationary Sources

|

|

By End-use

|

Automotive, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Metal (Palladium, Platinum, Rhodium, and Others): The palladium segment earned USD 19.13 billion in 2023 due to its high effectiveness in controlling emissions from gasoline engines, which hold a major share in global vehicle production and sales.

- By Application (Mobile Sources, and Stationary Sources): The mobile sources segment held a share of 61.92% in 2023, fueled by vehicle emission regulations and the high volume of on-road transportation requiring advanced catalytic solutions.

- By End-use (Automotive, Industrial, and Others): The automotive segment is projected to reach USD 30.46 billion by 2031, mainly propelled by the consistently large-scale demand for catalytic converters in passenger and commercial vehicles to meet tightening emission standards worldwide.

Emission Control Catalyst Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific emission control catalyst market share stood at around 35.03% in 2023, valued at USD 18.50 billion. Asia Pacific is home to some of the world's most active manufacturing hubs. The large-scale operation of cement, steel, chemical, and thermal power plants has increased the need for effective emission control solutions.

Emission control catalysts are being adopted to reduce NOx, VOCs, and other harmful gases released during production. This industrial expansion is propelling regional market expansion.

- In August 2023, Bharat Heavy Electricals Limited (BHEL) manufactured India's first indigenously produced Selective Catalytic Reduction (SCR) catalysts aimed at reducing nitrogen oxide (NOx) emissions from thermal power plants. These catalysts, previously imported, were developed at BHEL's Solar Business Division in Bengaluru. The first batch was dispatched to the 5×800 MW Yadadri Thermal Power Station in Telangana. This initiative aligns with India's 'Make in India' program and addresses the Ministry of Environment and Forests' directives on NOx emission reductions.

Moreover, rising pollution levels across Asia Pacific have prompted governments to introduce clean air programs and promote low-emission vehicles. These initiatives include mandatory emission testing, retrofitting of public transport systems, and upgrading emission standards for taxis and buses. These changes are increasing the use of advanced catalytic converters, supporting regional market expansion.

The North America emission control catalyst industry is estimated to grow at a CAGR of 5.19% over the forecast period. North America enforces some of the world's most advanced vehicle and industrial emission standards.

The EPA’s Tier 3 rules require significant reductions in NOx, hydrocarbons, and particulate matter from cars and trucks. These regulations demand high-performance catalytic converters and SCR systems, especially in gasoline and diesel vehicles, contributing to regional market growth.

Furthermore, North America houses several leading catalyst producers and R&D centers. Companies are investing in advanced catalyst formulations that use fewer precious metals while improving performance, aiding regional market growth.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces Tier 3 emission standards, reducing nitrogen oxides, particulate matter, and volatile organic compounds from vehicles. The National Emission Standards for Hazardous Air Pollutants (NESHAP) set limits for hazardous emissions from industrial sources, and the New Source Performance Standards (NSPS) regulate emissions from new power plants and facilities.

- In Europe, the Euro 6 standards govern emissions from vehicles, demanding advanced technologies such as selective catalytic reduction (SCR) systems and diesel particulate filters (DPF) to control pollutants. The upcoming Euro 7 proposal aims to tighten emission limits further and address non-exhaust emissions, reinforcing the need for improved catalyst systems.

- China’s Vehicle Emission Standard VI (China VI) sets stringent limits on nitrogen oxides, particulate matter, and other pollutants for light- and heavy-duty vehicles. This regulation requires advanced emission control technologies such as SCR and DPF systems to comply with the standards.

- Japan’s Post New Long-Term Regulations target significant reductions in nitrogen oxides and particulate matter from vehicles. These regulations necessitate the use of advanced emission control systems, including catalysts, in the automotive industry. Japan’s strict emission limits foster innovation in catalyst technologies, ensuring that vehicles meet environmental standards for clean air and reduced pollutants, particularly in urban centers.

Competitive Landscape

Leading players in the emission control catalyst industry are focusing on expanding their production facilities and research centers to support the growing demand. By increasing production capabilities, they can meet demand across sectors such as automotive and industrial.

Additionally, investment in product innovation are improving emission control performance and efficiency. These strategies are reinforcing market position and contributing to the overall expansion of the market.

- In August 2024, BASF Catalysts India inaugurated a new Research, Development, and Application (RD&A) lab in Chennai, India. This facility focuses on developing emissions control catalysts tailored to the Indian automotive market, aiming to address local environmental challenges and regulatory requirements.

List of Key Companies in Emission Control Catalyst Market:

- BASF

- Johnson Matthey Plc

- Umicore SA

- Corning Incorporated

- Solvay S.A.

- Tenneco Inc.

- Cataler Corporation

- Heraeus Holding GmbH

- Clariant

- DCL International Inc.

- Cormetech Inc.

- Hitachi Zosen Corporation

- NGK Insulators, Ltd.

- Faurecia

- Aerinox Inc.

Recent Developments (Partnerships/Product Launch)

- In December 2024, Clariant reported the successful performance of its EnviCat N2O-S nitrous oxide abatement catalyst at Sichuan Lutianhua’s nitric acid plant, which began operations in August. The catalyst is expected to cut annual emissions by 275 kilotons of CO₂ equivalent. It enables the removal of nitrous oxide and other nitrogen oxides by up to 99% in tertiary abatement and 95% in secondary abatement. The EnviCat N2O-S can be integrated into modern nitric acid plants without affecting production.

- In November 2024, DCL Europe GmbH showcased its advanced catalyst technology at EnergyDecentral 2024. The company's catalyst solutions are designed to deliver exceptional performance, with over 80% methane destruction efficiency, supporting decarbonization and emissions reduction efforts.

- In January 2024, Heraeus Precious Metals and Freudenberg e-Power Systems formed a technology partnership to co-develop catalyst-coated membranes (CCMs) for proton exchange membrane (PEM) fuel cells. The collaboration aims to accelerate commercialization by leveraging their complementary expertise .