Market Definition

The electronic chemicals market comprises the production, distribution, and application of high-purity chemicals and materials essential for manufacturing electronic components and devices. These chemicals are used in processes such as semiconductor fabrication, printed circuit board (PCB) manufacturing, and display panel production.

Key products in this market include photoresists, wet chemicals, specialty gases, chemical mechanical planarization (CMP) slurries, and etchants. These chemicals ensure precision, reliability, and efficiency in electronic manufacturing, making them critical for the production of advanced technologies across various industries.

Electronic Chemicals Market Overview

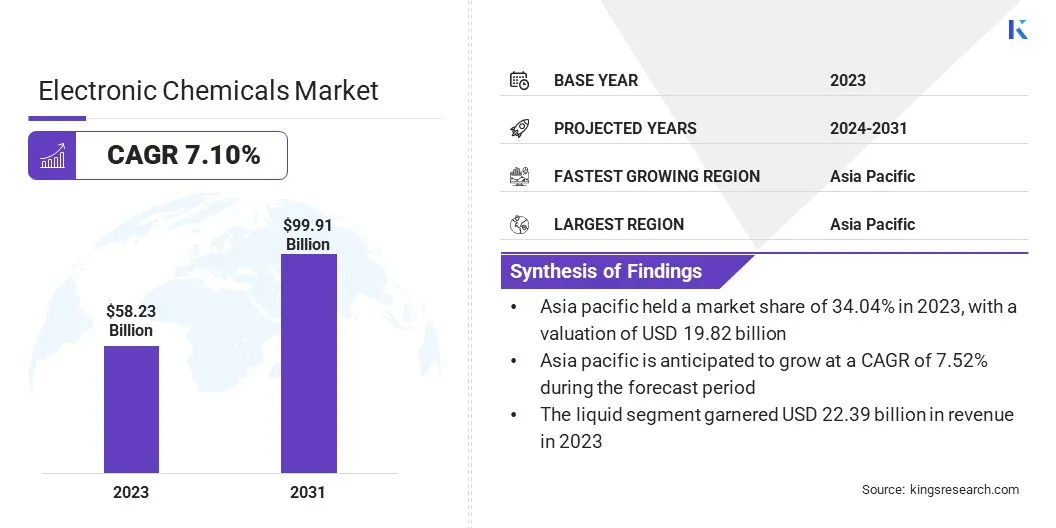

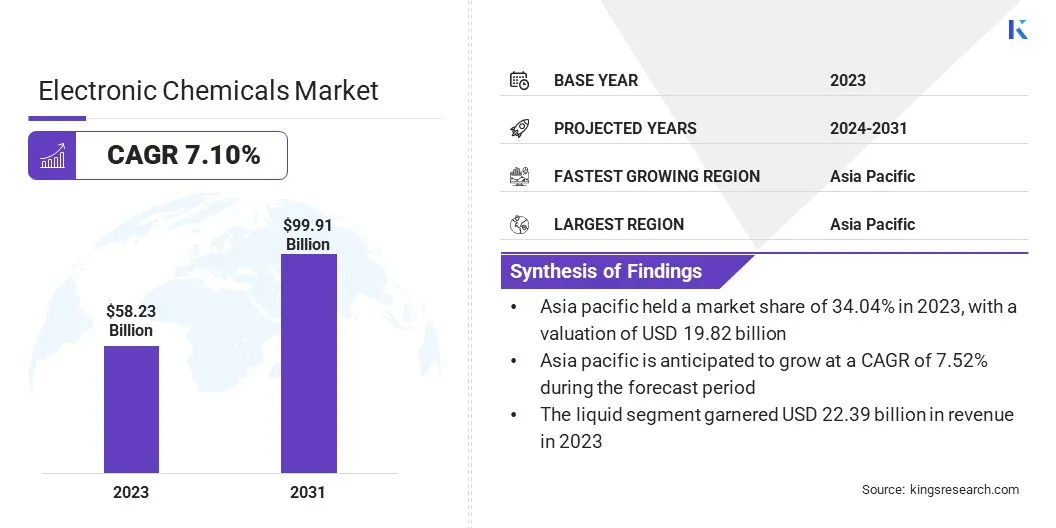

The global electronic chemicals market size was valued at USD 58.23 billion in 2023 and is projected to grow from USD 61.82 billion in 2024 to USD 99.91 billion by 2031, exhibiting a CAGR of 7.10% during the forecast period. Market growth is driven by the increasing demand for advanced semiconductors fueled by high-performance computing.

Additionally, the expansion of semiconductor manufacturing facilities, particularly in Asia-Pacific and North America, is highlighting the need for high-purity process chemicals. Strategic investments in R&D and sustainability initiatives are further fostering innovation in chemical formulations, advancing next-generation chip production.

Major companies operating in the global electronic chemicals industry are Linde plc, Air Products and Chemicals, Inc., Cabot Corporation, BASF, Resonac Holdings Corporation, Air Liquide Electronics, Solvay, Eastman Chemical Company, KANTO KAGAKU, Avantor, Inc., Honeywell International Inc., Evonik, FUJIFILM Holdings Corporation, Sumitomo Chemical Co., Ltd., SONGWON, and others.

The market is experiencing significant growth due to the increasing demand for semiconductors across industries such as consumer electronics, automotive, and telecommunications.

Rising adoption of advanced technologies, including artificial intelligence (AI), Internet of Things (IoT), and cloud computing, is driving semiconductor production, boosting demand for high-purity chemicals such as photoresists, etchants, and chemical mechanical planarization (CMP) slurries.

Companies are investing in semiconductor fabrication facilities to meet growing demand, further accelerating the need for electronic chemicals. Additionally, the expansion of 3D packaging and advanced node technologies underscores their critical role in enhancingprecision and efficiency in chip manufacturing.

- In February 2025, the Semiconductor Industry Association (SIA) reported global semiconductor sales of USD 627.6 billion in 2024, a 19.1% increase from USD 526.8 billion in 2023. Fourth quarter sales reached USD 170.9 billion, up 17.1% year-over-year and 3.0% from the previous quarter.

Key Highlights:

- The global electronic chemicals market size was recorded at USD 58.23 billion in 2023.

- The market is projected to grow at a CAGR of 7.10% from 2024 to 2031.

- Asia Pacific held a share of 34.04% in 2023, valued at USD 19.82 billion.

- The liquid segment garnered USD 22.39 billion in revenue in 2023.

- The formulated etchants segment is expected to reach USD 27.31 billion by 2031.

- The printed circuit boards segment secured the largest revenue share of 38.45% in 2023.

- Europe is anticipated to grow at a CAGR of 7.12% over the forecast period.

Market Driver

"Expansion of Data Centers and Cloud Computing"

The rising demand for data storage, processing, and artificial intelligence applications is accelerating the expansion of data centers, fueling the growth of the electronic chemicals market. Cloud service providers and hyperscale data centers rely on high-performance computing chips that require ultrapure chemicals for semiconductor fabrication.

The increasing adoption of AI accelerators, graphics processing units (GPUs), and high-bandwidth memory (HBM) modules is propelling demand for chemical mechanical planarization (CMP) slurries, specialty gases, and etchants.

As enterprises invest in advanced computing infrastructure, semiconductor manufacturers are scaling production, highlighting the need for high-quality electronic chemicals.

- The International Energy Agency's 2024 report highlights a surge in data centers investments over past two years, aided by digitalization and AI adoption, with further acceleration expected. In 2023, the combined capital investment of Google, Microsoft, and Amazon in AI and data center surpassed total U.S. oil and gas industry investment, accounting for approximately 0.5% of U.S. GDP.

Market Challenge

"Supply Chain Disruptions and Raw Material Shortages"

The electronic chemicals market faces challenges due to supply chain disruptions and raw material shortages, impacting production efficiency and cost stability. Fluctuations in the availability of critical raw materials, geopolitical tensions, and logistical constraints have intensified supply risks.

To address these issues, companies are diversifying their supplier base, localizing production facilities, and investing in strategic partnerships to secure a steady supply of high-purity chemicals.

Additionally, manufacturers are adopting advanced process innovations and circular economy initiatives to optimize resource utilization and reduce dependency on scarce materials, ensuring long-term sustainability and supply chain resilience in the electronic chemicals industry.

Market Trend

"Innovations in Molecular Engineering"

Breakthroughs in molecular engineering are enhancing the development of high-purity electronic chemicals, ensuring greater reliability in miniaturized electronic devices. Researchers are pioneering new molecular strategies to overcome barriers in electronic miniaturization.

- In September 2024, researchers at the University of Illinois, supported by the U.S. Department of Energy Office of Science, introduced a new synthesis method for molecular electronics. They created stable, shape-persistent molecules with precisely controlled conductance by utilizing ladder-type molecules—structures with interconnected chemical rings that lock their conformation. These rigid molecular backbones enhance charge transport efficiency and structural stability, addressing key challenges in nanoscale circuit design. This innovation strengthens semiconductor fabrication, improving transistor performance in AI processors, medical wearables, and next-generation consumer electronics.

These innovations support next-generation lithography and deposition processes, improving the performance of high-density transistors in AI processors, medical wearables, and compact consumer electronics, bolstering demand for ultra-high-purity electronic chemicals.

Electronic Chemicals Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Solid, Liquid, Gas

|

|

By Application

|

Formulated Etchants, Fluorides, Dopants, Semiconductor Grade Solvents, Single Crystal Substrates, Others

|

|

By End Use

|

Semiconductors & Integrated Circuits, Printed Circuit Boards, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Solid, Liquid, and Gas): The liquid segment earned USD 22.39 billion in 2023 due to its extensive use in semiconductor manufacturing processes, including cleaning, etching, and chemical mechanical planarization (CMP), where high-purity liquid chemicals ensure precision, defect reduction, and optimal performance in advanced chip production.

- By Application (Formulated Etchants, Fluorides, Dopants, Semiconductor Grade Solvents, Single Crystal Substrates, and Others): The formulated etchants segment held a share of 27.78% in 2023, largely attributed to its critical role in precision etching processes required for advanced semiconductor manufacturing, enabling the production of high-density, miniaturized circuits with superior accuracy and consistency.

- By End Use (Semiconductors & Integrated Circuits, Printed Circuit Boards, and Others,): The printed circuit boards segment is projected to reach USD 38.47 billion by 2031, owing to the rising production of consumer electronics, automotive electronics, and industrial equipment, necessitating advanced chemical solutions for etching, cleaning, and surface treatment.

Electronic Chemicals Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific electronic chemicals market share stood at around 34.04% in 2023, valued at USD 19.82 billion. This dominance is reinforced by increased semiconductor production, with countries such as China, Taiwan, South Korea, and Japan leading in fabrication capacity. The region’s robust investment in wafer fabs and chip manufacturing facilities is increasing the demand for ultra-high-purity electronic chemicals, including photoresists, etchants, and deposition materials.

Governments are actively supporting the semiconductor industry through incentives, subsidies, and strategic initiatives. TSMC (Taiwan), Samsung (South Korea), and SMIC (China) are expanding production, leading to increased demand for advanced chemical solutions to ensure high yield rates and process efficiency.

- The 2024 Asian Development Bank report highlights that East Asia and Southeast Asia account for over 80% of global semiconductor production. South Korea's Samsung and SK Hynix lead the memory chip market, while Japan is a key supplier of semiconductor manufacturing equipment and materials. China remains the largest producer of photovoltaic cells, reinforcing its critical role in semiconductor and renewable energy supply chains.

Additionally, Asia-Pacific is a major hub for consumer electronics manufacturing, with rising demand for smartphones, laptops, and wearable devices fueling the consumption of high-purity chemicals. T

he adoption of AI and high-performance computing (HPC) is accelerating the need for advanced semiconductor materials. The rising adoption of AI-driven applications, smart appliances, and 5G devices is boosting the demand for innovative chemical solutions to enhance semiconductor performance and reliability.

The Europe electronic chemicals industry is set to grow at a CAGR of 7.12% over the forecast period. The European Union is investing heavily in semiconductor manufacturing to reduce reliance on imports and enhance domestic production. The European Chips Act, with a budget exceeding €43 billion, is accelerating the development of fabrication facilities and advanced chip technologies.

Companies such as STMicroelectronics, Infineon, and ASML are expanding production, generating the demand for high-purity electronic chemicals, including photoresists, etchants, and deposition materials. These investments are fostering innovation in semiconductor processing, supporting regional market growth.

Furthermore, European semiconductor manufacturers, including Infineon and STMicroelectronics, are increasing investments in compound semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) for high-efficiency power electronics. These materials are critical for electric vehicles (EVs), aerospace applications, and renewable energy systems.

- In March 2023, Infineon Technologies AG acquired GaN Systems Inc., a leading provider of gallium nitride (GaN)-based power conversion solutions and advanced application expertise. This strategic move accelerates Infineon’s GaN development roadmap and strenghthens its position in power systems by integrating advanced semiconductor technologies, reinforcing its industry leadership.

As companies increase fabrication capacity, the demand for electronic chemicals tailored to these materials is rising, fostering advancements in power electronics.

Regulatory Frameworks:

- In the U.S., the Environmental Protection Agency (EPA) enforces the Toxic Substances Control Act (TSCA), requiring reporting, record-keeping, and testing of chemical substances. Additionally, the Consumer Product Safety Improvement Act (CPSIA) sets safety standards for consumer products, including electronics. California's Proposition 65 mandates warnings for significant exposures linked to cancer or reproductive harm.

- In Europe, the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation requires companies to register and provide data on chemicals manufactured or imported into the EU. The Restriction of Hazardous Substances (RoHS) Directive limits the use of specific hazardous materials in electrical and electronic equipment. The EU is also planning to ban per- and polyfluoroalkyl substances (PFAS), known as "forever chemicals," in consumer products due to environmental and health concerns.

- China's Administrative Measures for the Restriction of the Use of Hazardous Substances in Electrical and Electronic Products, commonly referred to as China RoHS, restricts hazardous substances in electronic products. The regulation requires proper labeling and disclosure of certain substances, aiming to align with international standards and promote environmentally friendly practices.

- South Korea's Act for Resource Recycling of Electrical and Electronic Equipment and Vehicles, often referred to as Korea RoHS, mirrors aspects of both RoHS and the Waste Electrical and Electronic Equipment (WEEE) Directive. This regulation aims to manage the use of hazardous substances and promote the recycling of electronic waste, ensuring environmental sustainability.

Competitive Landscape

Companies operating in the global electronic chemicals market are adopting strategies such as acquisitions and expansion of production capabilities to meet the surging demand for semiconductors. Companies are acquiring specialized firms to broaden their product portfolios and integrate advanced chemical formulations required for next-generation semiconductor manufacturing.

Expansions include establishing new manufacturing plants, upgrading existing facilities, and strengthening supply chain networks to ensure a consistent supply of high-purity electronic chemicals. These strategic moves improve production efficiency while aligning with evolving semiconductor fabrication technologies, supporting market expansion.

- In October 2024, FUJIFILM Corporation finalized the acquisition of Entegris, Inc.'s electronic chemicals business for USD 700 billion. This acquisition strenghthens Fujifilm’s product portfolio in electronic chemicals and integrates 593 skilled employees into its operations. It also adds 12 facilities, including seven manufacturing sites across the United States, Europe, and Singapore, establishing Fujifilm’s first electronic materials production facility in Southeast Asia.

List of Key Companies in Electronic Chemicals Market:

- Linde plc

- Air Products and Chemicals, Inc.

- Cabot Corporation

- BASF

- Resonac Holdings Corporation

- Air Liquide Electronics

- Solvay

- Eastman Chemical Company

- KANTO KAGAKU

- Avantor, Inc.

- Honeywell International Inc.

- Evonik

- FUJIFILM Holdings Corporation

- Sumitomo Chemical Co., Ltd.

- SONGWON

Recent Developments (Product Launch/Expansion)

- In September 2024, Eastman Chemical expanded its EastaPure electronic chemicals line with the launch of electronic-grade isopropyl alcohol (IPA). This domestically produced solvents offers U.S. semiconductor manufacturers a reliable supply with consistent quality. It serves as a highly effective wet-clean solvent used in wafer fabrication and various stages of the semiconductor manufacturing process.

- In October 2024, AGC Inc. launched the AGC Chemicals Technical Center in Hsinchu, Taiwan to provide technical support for semiconductor and electronic material chemicals. This initiative strengthens AGC's market presence and enhances its ability to meet the growing demand for advanced electronic chemicals.

- In July 2024, Kao Chemicals Kao Industrial (Thailand) Co., Ltd., through its Fine Cleaning business unit, presented its innovative chemical solutions at Thailand Electronics Circuit Asia 2024 (THECA). Developed through extensive research, these solutions address diverse customer needs, reinforcing Kao Chemicals’ commitment to innovation.