Market Definition

The market refers to the industry involved in the design, production, and distribution of protective enclosures that house electrical and electronic components. These enclosures safeguard equipment from environmental hazards, mechanical damage, and unauthorized access, ensuring operational reliability and safety.

The market is segmented based on various factors, including mounting type, protection level, material composition, form factor, and application. The report highlights the key drivers influencing market growth, along with an in-depth analysis of emerging trends and the evolving regulatory frameworks shaping the industry's trajectory.

Electrical Enclosure Market Overview

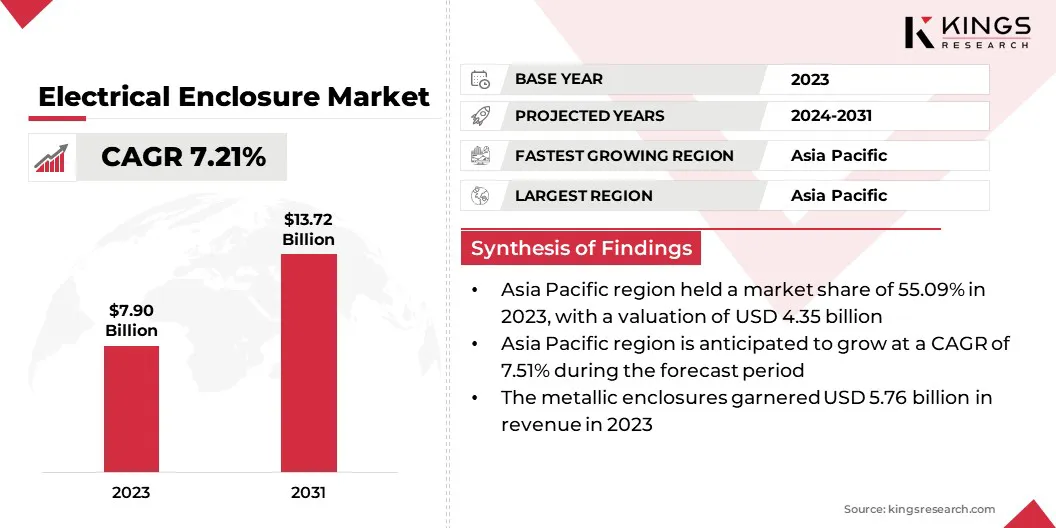

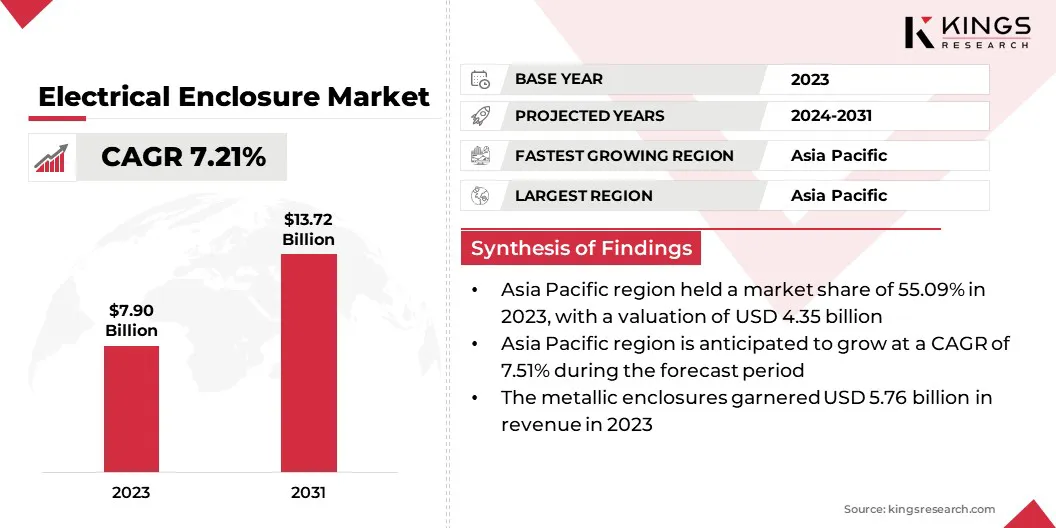

The global electrical enclosure market size was valued at USD 7.90 billion in 2023 and is projected to grow from USD 8.43 billion in 2024 to USD 13.72 billion by 2031, exhibiting a CAGR of 7.21% during the forecast period. The market is driven by increased investments in power infrastructure, particularly in transmission and distribution upgrades aimed at improving grid reliability and accommodating rising electricity demand.

Major companies operating in the electrical enclosure industry are Integra Enclosures, Ltd., Legrand, Saipwell Electric Co., Ltd., Rittal GmbH & Co. KG, BUD Industries, Bison Profab, nVent, ATLAS PRECISION SHEETMETAL SOLUTIONS, Hammond Manufacturing, Polycase, Schneider Electric, E-Abel, Eaton, Phoenix Mecano, and ABB.

Simultaneously, industries are increasingly seeking modular and customizable enclosures that align with the growing complexity and specificity of modern electrical systems. These solutions allow users to scale and configure their setups based on unique operational needs, whether in industrial automation, data centers, or smart infrastructure.

- In November 2023, ABB introduced its Protecta Power panel board, engineered for use in commercial, industrial, and institutional facilities. This latest-generation solution integrates advanced digital monitoring and control technologies to deliver stable, reliable, and flexible power distribution. Equipped with smart molded case circuit breakers (MCCBs) featuring built-in digital communication, protection, and control functions, the panel board also offers optional remote monitoring and precise sub-metering, supporting smarter energy management and enhanced operational efficiency.

Key Highlights:

- The electrical enclosure industry size was valued at USD 7.90 billion in 2023.

- The market is projected to grow at a CAGR of 7.21% from 2024 to 2031.

- Asia Pacific held a market share of 55.09% in 2023, with a valuation of USD 4.35 billion.

- The wall-mounted enclosures segment garnered USD 3.40 billion in revenue in 2023.

- The dust-tight enclosures segment is expected to reach USD 5.75 billion by 2031.

- The metallic enclosures segment is expected to reach USD 9.53 billion by 2031.

- The small enclosures segment is expected to reach USD 5.75 billion by 2031.

- The power distribution segment is expected to reach USD 4.27 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 7.28% during the forecast period.

Market Driver

Growing Investments in Power Infrastructure

The market is significantly driven by the growing investment in power infrastructure across both developed and emerging economies. The global demand for electricity is increasing rapidly. Thus, governments and utility providers are expanding and upgrading their transmission and distribution networks to ensure stable and efficient energy delivery.

This expansion requires a wide range of protective enclosures to house electrical components, such as circuit breakers, control panels, and transformers, which are essential for safe and reliable grid operation. Additionally, the shift toward renewable energy integration including solar, wind, and hybrid systems has created the need for specialized enclosures capable of withstanding harsh environmental conditions and housing advanced energy management equipment.

These developments are collectively driving the demand for electrical enclosures that can support modern power infrastructure needs while meeting evolving safety and performance standards.

- In November 2024, the government of India announced plans to invest USD 107 billion by 2032 to develop transmission lines, aiming to nearly triple its clean power capacity. Additionally, the nation's installed nuclear power capacity is projected to increase to 22,480 MW by 2031 from 7,480 MW, following the progressive completion of ongoing and sanctioned projects.

Market Challenge

Supply Chain Disruptions

A major challenge facing the electrical enclosure market is the ongoing disruption in global supply chains, particularly for raw materials such as metals, plastics, and specialized components. These disruptions, driven by geopolitical tensions, logistics constraints, and fluctuating commodity prices, have led to longer lead times, increased production costs, and delivery delays, affecting both manufacturers and end users.

A potential solution to this issue lies in regionalizing supply chains and increasing investment in local manufacturing capabilities. Companies can reduce dependency on global supply networks, enhance responsiveness to demand fluctuations, and ensure reliable product availability by sourcing materials locally and adopting agile manufacturing practices.

Market Trend

Growing Demand for Modular and Customizable Enclosures

The market is registering a notable shift toward modular and customizable enclosure solutions, driven by the evolving needs of end users across industries. The demand for enclosures that offer greater design flexibility and scalability is increasing as electrical systems become more complex and diversified.

Modular enclosures allow users to easily expand, reconfigure, or adapt systems without replacing the entire unit, making them ideal for dynamic environments such as industrial automation, data centers, and renewable energy installations.

Additionally, customizable enclosures enable tailored configurations based on specific application requirements, such as size, material, protection rating, and internal component layout. This trend not only improves operational efficiency but also supports cost-effectiveness and space optimization.

- In March 2024, Rockwell Automation, Inc. announced the broader rollout of its CUBIC product line across Asia Pacific. Initially available in select Asian markets, the CUBIC line features IEC-61439 compliant modular enclosure systems designed for building electrical and power panels, catering to fast-growing sectors such as renewable energy, mining, chemicals, data centers, food & beverage, and infrastructure.

Electrical Enclosure Market Report Snapshot

|

Segmentation

|

Details

|

|

By Mounting Type

|

Wall-mounted Enclosures, Free-standing Enclosures, Floor-mounted Enclosures, Underground Enclosures

|

|

By Protection Type

|

Dust-tight Enclosures, Water-tight Enclosures, Explosion-proof Enclosures, EMI/RFI Shielding Enclosures

|

|

By Material Type

|

Metallic Enclosures, Non-metallic Enclosures

|

|

By Form Factor

|

Small Enclosures, Compact Enclosures, Large Enclosures

|

|

By Application

|

Power Distribution, Industrial Automation, Renewable Energy, Telecommunications & Data Centers, Transportation, Oil & Gas

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Mounting Type (Wall-Mounted Enclosures, Free-Standing Enclosures, Floor-Mounted Enclosures, Underground Enclosures): The wall-mounted enclosures segment earned USD 3.40 billion in 2023, due to their widespread use in industrial & commercial facilities for space-efficient and secure electrical housing.

- By Protection Type (Dust-Tight Enclosures, Water-Tight Enclosures, Explosion-Proof Enclosures, and EMI/RFI Shielding Enclosures): The dust-tight enclosures segment held 45.90% share of the market in 2023, due to safety standards and increasing demand for protection against particulate contamination in industrial settings.

- By Material Type (Metallic Enclosures, Non-Metallic Enclosures): The metallic enclosures segment is projected to reach USD 9.53 billion by 2031, owing to their durability, high impact resistance, and preference in harsh environmental conditions.

- By Form Factor (Small Enclosures, Compact Enclosures, Large Enclosures): The small enclosures segment is projected to reach USD 5.75 billion by 2031, owing to the growing adoption of compact electrical & electronic devices in automation and control applications.

- By Application (Power Distribution, Industrial Automation, Renewable Energy, Telecommunications & Data Centers, Transportation, Oil & Gas): The power distribution segment is projected to reach USD 4.27 billion by 2031, owing to the expanding energy infrastructure and increasing investments in smart grid technologies.

Electrical Enclosure Market Regional Analysis

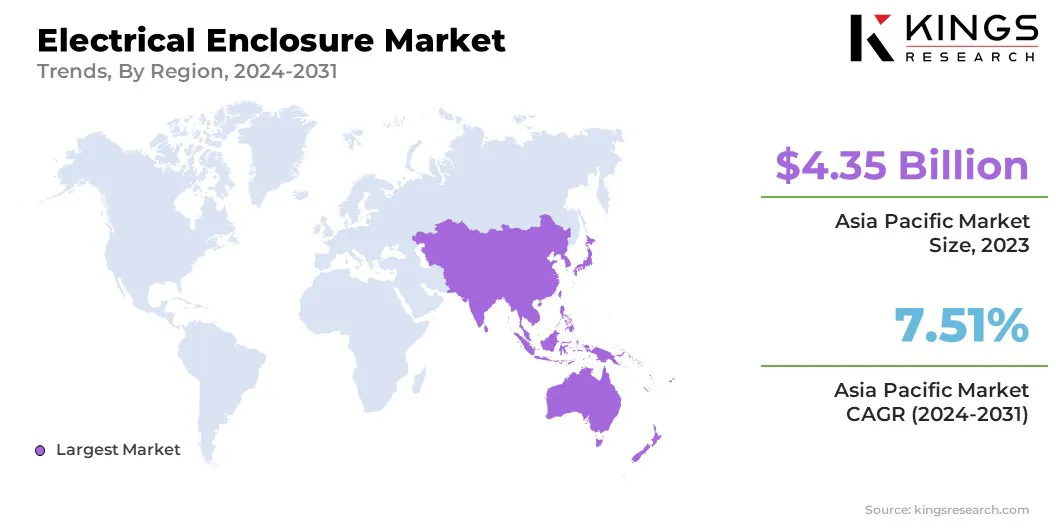

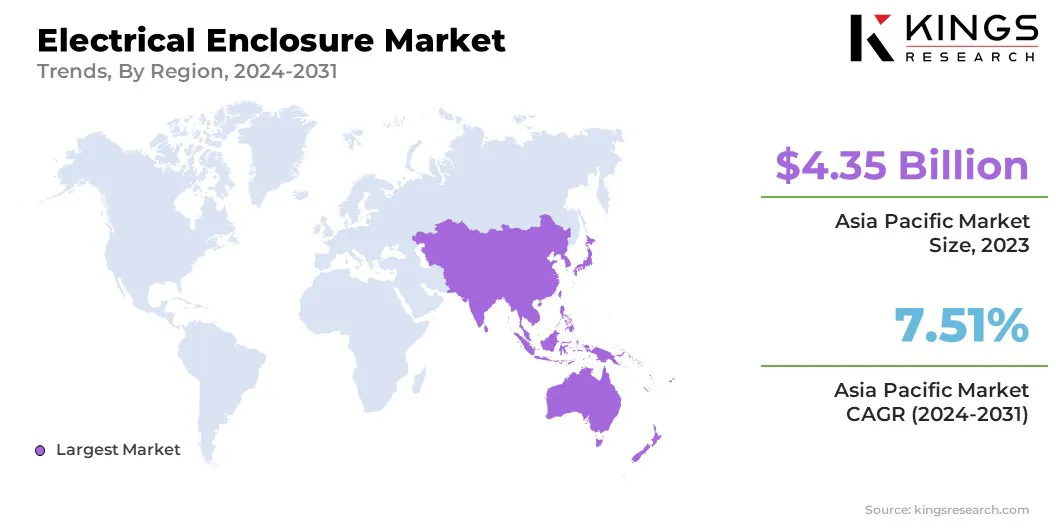

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 55.09% share of the electrical enclosure market in 2023, with a valuation of USD 4.35 billion. This dominance is primarily driven by rapid industrialization, expanding power infrastructure, and increasing investments in smart grid projects across major economies like China, India, Japan, and South Korea.

The growing adoption of industrial automation and IoT-enabled enclosures in manufacturing facilities has further fueled demand. Additionally, rising renewable energy projects, particularly in solar & wind power, have increased the need for durable and weather-resistant enclosures. Government initiatives supporting smart cities, urban electrification, and infrastructure modernization are also crucial in the market expansion in the region.

The market in North America is poised to grow at a significant CAGR of 7.51% over the forecast period, fueled by the growing need for safe and durable enclosures across various sectors. Factors such as the development of smart grids, increasing automation in industrial processes, and expansion of renewable energy installations are driving the market.

The U.S. and Canada, in particular, are registering increased investments in data centers, EV infrastructure, and oil & gas operations, all of which rely heavily on protective enclosures to ensure operational continuity. The region also benefits from a high rate of technology adoption and a strong focus on enhancing electrical system reliability and efficiency.

- In February 2025, the Government of Belize, in collaboration with the World Bank and the Government of Canada, launched the Belize Energy Resilience and Sustainability Project, a USD 58.4 million initiative aimed at strengthening the country’s power supply, improving electricity reliability, optimizing consumer costs, and enhancing the integration of renewable energy sources.

Regulatory Frameworks

- In Europe, electrical enclosures are regulated under the Low Voltage Directive (2014/35/EU) and must meet the requirements of the IEC 60529 standard for Ingress Protection (IP) ratings. Products must bear the CE marking to indicate compliance with applicable EU regulations, including electrical safety and electromagnetic compatibility.

- In India, the Bureau of Indian Standards (BIS) has issued a Quality Control Order (QCO) mandating that electrical accessories, including boxes and enclosures for household and similar fixed electrical installations, comply with Indian Standard IS 14772:2020.

Competitive Landscape:

The electrical enclosure industry is characterized by a dynamic and competitive environment, where leading companies employ various strategies to enhance their market position and address evolving customer needs. A primary focus is on product innovation, with firms investing in the development of enclosures that offer advanced features such as enhanced durability, modular designs, and compatibility with smart technologies.

This emphasis on innovation aims to provide solutions that cater to diverse applications across industries like energy, telecommunications, and industrial automation. In addition to innovation, companies are pursuing strategic mergers and acquisitions to broaden their product portfolios and enter new markets. Integrating complementary technologies and expertise through these acquisitions can help firms offer more comprehensive solutions to their customers.

For example, acquiring companies specializing in specific enclosure technologies or materials allows for the expansion of product offerings and the ability to meet specialized customer requirements. Companies are investing in automated manufacturing processes and establishing regional production facilities to improve operational efficiency and responsiveness to market demands. These initiatives aim to reduce production costs, shorten lead times, and better serve local markets.

- In June 2024, nVent Electric plc announced a definitive agreement to acquire Trachte, LLC for USD 695 million. Trachte, a leading provider of custom-made control building solutions for critical infrastructure protection, will enhance nVent’s enclosures portfolio and system protection capabilities. The acquisition strengthens nVent’s presence in high-growth sectors such as power utilities, data centers, and renewable energy.

List of Key Companies in Electrical Enclosure Market:

- Integra Enclosures, Ltd.

- Legrand

- Saipwell Electric Co., Ltd.

- Rittal GmbH & Co. KG

- BUD Industries

- Bison Profab

- nVent

- ATLAS PRECISION SHEETMETAL SOLUTIONS

- Hammond Manufacturing

- Polycase

- Schneider Electric

- E-Abel

- Eaton

- Phoenix Mecano

- ABB

Recent Developments (Product Launch)

- In January 2023, nVent Electric plc introduced its new nVent HOFFMAN Extreme Environments line of air conditioners and stainless-steel enclosures. Certified to leading industry standards, the product line is designed to provide reliable protection for critical equipment operating in harsh conditions, including extreme temperatures, corrosive environments, and high humidity.