Electric Vehicle Polymers Market Overview

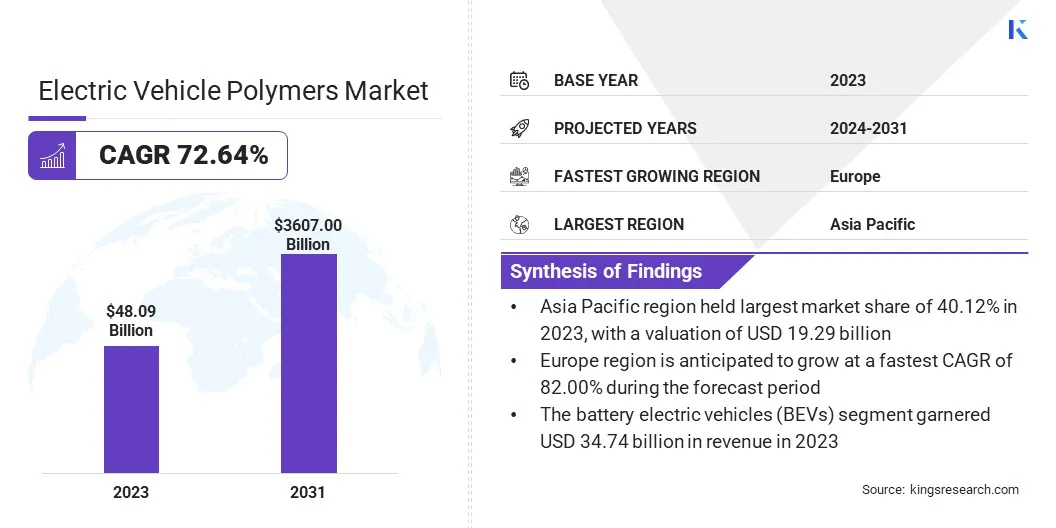

The global electric vehicle polymers market size was valued at USD 48.09 million in 2023 and is projected to grow from USD 78.91 billion in 2024 to USD 3,607.00 billion by 2031, exhibiting a CAGR of 72.64% during the forecast period. This growth is driven by the rapid adoption of electric vehicles, increasing demand for lightweight materials to enhance energy efficiency and continuous advancements in polymer technologies.

The market expansion is further supported by the increasing use of high-performance polymers in critical EV components. These materials offer enhanced durability, thermal stability and design flexibility, making them well-suited for modern EV manufacturing requirements.

Key Market Highlights:

- The electric vehicle polymers industry size was recorded at USD 48.09 billion in 2023.

- The market is projected to grow at a CAGR of 72.64% from 2024 to 2031.

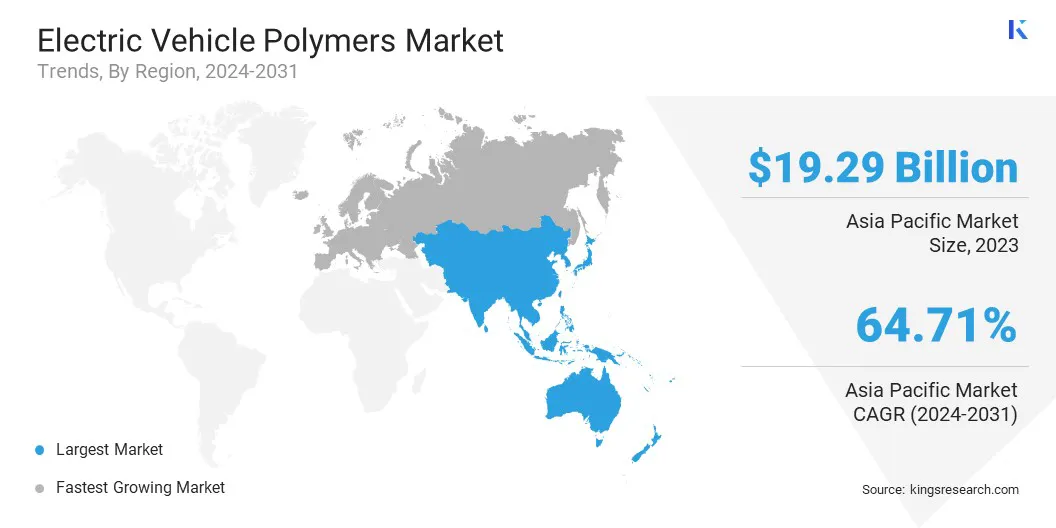

- Asia-Pacific held a market share of 40.12% in 2023, with a valuation of USD 19.29 billion.

- The engineering plastics segment garnered USD 32.74 billion in revenue in 2023.

- The battery electric vehicles (BEVs) segment is expected to reach USD 2,679.62 billion by 2031.

- The interior components segment is expected to reach USD 1,345.89 billion by 2031.

- Europe is anticipated to grow at a CAGR of 82.00% during the forecast period.

Major companies operating in the electric vehicle polymers market are Evonik Industries AG, Asahi Kasei Corporation, LG Chem, SABIC, DuPont, LANXESS, EMS-CHEMIE HOLDING AG, Celanese Corporation, Solvay, Arkema, Covestro AG, BASF, LyondellBasell Industries Holdings B.V., TORAY INDUSTRIES, INC., and Mitsubishi Chemical Group Corporation.

Automakers are increasingly adopting advanced polymer solutions to improve efficiency, durability, and design flexibility of electric vehicles. As electric mobility continues to evolve, demand for lightweight, heat-resistant, and sustainable polymers is expected to accelerate.

- In September 2024, Covestro partnered with Li Auto to develop advanced sustainable polymer solutions for next-generation EVs. This collaboration focuses on improving material efficiency, promoting circularity, and reducing carbon footprint in the production and lifecycle of electric vehicles.

Rising Electric Vehicle Adoption

The electric vehicle polymers market is witnessing strong growth driven by the rising adoption of electric vehicles (EVs). This shift in supported by changing consumer preference favoring vehicles that deliver high energy efficiency, extended battery life and innovative designs.

To meet these demands, automakers are increasingly utilizing advanced polymer materials to replace heavier metal components, achieving ssubstantial weight reductions that enhance vehicle range and performance.

The demand for specialized polymers particularly in battery enclosures, wiring systems, and interior components is rising as manufacturers seek materials that offer high thermal stability, durability, and design flexibility. These polymers are critical in ensuring the safety and efficiency of EV systems, especially under high-temperature and high-stress operating conditions.

- In 2023, the International Energy Agency (IEA) reported 14 million new electric vehicle registrations, raising the global EV fleet to 40 million. This rapid adoption of EVs is a key factor driving demand for high-performance polymers.

Recycling and Sustainability Issues

A major challenge in the market is recycling and sustainability. Unlike metals, many polymers used in EV components are complex composites, making separation and reuse difficult. The lack of efficient recycling infrastructure for polymer-based materials raises concerns about waste management and environmental impact.

As EV adoption accelerates globally, the volume of end-of-life polymer components will grow substantially. Without effective recycling solutions, this could lead to increased environmental impact and higher disposal costs.

To address this, companies in the market are investing in advanced recycling techniques such as chemical recycling and depolymerization. They enable polymers to be broken down into their base components and reused in manufacturing, offering a more sustainable lifecycle for these materials.

Additionally, collaboration between automakers, material scientists, and recycling industries will be essential to establish closed-loop systems that support the circular use of polymers.

- In December 2024, MBA Polymers UK partnered with Polestar to enhance plastic circularity in electric vehicles. The initiative aims to improve polymer recovery and reuse, providing a sustainable solution to reduce waste, lower production costs in EV manufacturing.

A key trend in the electric vehicle polymers market is the growing adoption of high-performance polymers (HPP's) in key applications such as battery systems, power electronics, and thermal management.

These advanced materials offer superior thermal stability, mechanical strength, chemical resistance, and electrical insulation, making them ideal for the demanding environments within EVs. As EV architectures become more compact and power-dense, traditional polymers fail to meet the thermal and structural requirements.

High-performance polymers, such as polyether ether ketone (PEEK), polyphenylene sulfide (PPS), and liquid crystal polymers (LCP), are increasingly used to ensure lightweight construction, enhanced safety, and improved durability.

- In May 2023, Solvay introduced Xydar LCP, a high-heat polymer for EV battery module insulation. It enhances thermal stability and safety in electric vehicles, meeting the evolving demands of Battery Electric Vehicles (BEVs) and Hybrid Electric Vehicles (HEVs).

Electric Vehicle Polymers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Engineering Plastics (Polycarbonate (PC), Polyamide (PA), Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), Polyurethane (PU), Others), Elastomers (Silicone Elastomers, Fluoroelastomers, Thermoplastic Elastomers (TPE))

|

|

By Vehicle Type

|

Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs)

|

|

By Application

|

Interior Components, Exterior Components, Battery Components, Powertrain System, Charging Infrastructure

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Engineering Plastics, Elastomers): The engineering plastics segment earned USD 32.74 billion in 2023 due to its superior mechanical properties, thermal stability, and cost efficiency.

- By Vehicle Type (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs)): The battery electric vehicles (BEVs) held 73.24% of the market in 2023, due to the growing consumer preference for zero emission mobility and advancements in battery technology.

- By Application (Interior Components, Exterior Components, Battery Components, Powertrain System, and Charging Infrastructure): The interior components segment is projected to reach USD 1,345.89 billion by 2031, owing to increased consumer demand for premium, aesthetically appealing, and functionally superior cabin solutions.

Electric Vehicle Polymers Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific electric vehicle polymers market share stood around 40.12% in 2023 in the global market, with a valuation of USD 19.29 billion. This dominance is primarily attributed to the region’s rapidly expanding electric vehicle (EV) industry, supported by strong manufacturing capabilities and a well-established polymer supply chain.

Leading EV-producing countries such as China, Japan, and South Korea are significantly contributing to market growth through large-scale production and increasing investments in lightweight, high-performance polymers. Addionally, India's expanding EV charging infrastructure and the rise of indigenous EV startups are further fueling the demand for specialized polymer materials.

The availability of cost-effective raw materials and progress in polymer recycling and sustainability are positioning India as a significant contributor to the market in Asia Pacific. As EV adoption continues to accelerate, the demand for innovative and efficient polymer solutions across Asia Pacific is expected to rise significantly.

- In 2023, according to the India Brand Equity Foundation (IBEF), India's market experienced significant growth, driven by a surge in EV registrations from 1.30 million in 2018 to 15.29 million in 2023. This rising adoption is fueling demand for engineering plastics and elastomers in key EV components.

The electric vehicle polymers industry in Europe is projected to grow at a significant CAGR of 82.00% over the forecast period. This rapid growth is driven by the increasing production and adoption of electric vehicles (EVs), along with a strong focus on sustainability and the use of lightweight materials. European automakers are actively integrating advanced polymer solutions to enhance vehicle efficiency, safety, and performance.

With the growing penetration of battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), the market in Europe is expected to witness substantial expansion, fueled by technological advancements and a robust EV manufacturing ecosystem .

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) regulates vehicle safety standards, impacting the market by enforcing material requirements for crash protection, battery enclosures, and structural integrity to enhance EV safety and performance.

- In Europe, the European Commission (EC) regulates the market by enforcing policies related to material safety, sustainability, and environmental compliance. The EC ensures that polymers used in electric vehicles meet stringent regulations under frameworks such as the Circular Economy Action Plan.

Competitive Landscape:

Leading players are significantly investing in research and development to improve key polymer properties, such as thermal stability, impact resistance, and recyclability, addressing the evolving requirements of EV manufacturers.

Strategic collaborations, mergers, and acquisitions are shaping market dynamics as companies aim to broaden their product portfolios and expand global reach. There is a growing focus on sustainable and bio-based polymers in response to increasing demand for eco-friendly materials.

The presence of well-established automotive polymer suppliers, coupled with emerging startups specializing in advanced composites, is intensifying competition.

- In April 2024, Avient Corporation introduced a new range of OnColor durable orange nylon colorants. This new range is designed to enhance heat resistance and long-term color stability in high-voltage EV connectors.

Key Companies in Electric Vehicle Polymers Market:

- Evonik Industries AG

- Asahi Kasei Corporation

- LG Chem

- SABIC

- DuPont

- LANXESS

- EMS-CHEMIE HOLDING AG

- Celanese Corporation

- Solvay

- Arkema

- Covestro AG

- BASF

- LyondellBasell Industries Holdings B.V.

- TORAY INDUSTRIES, INC.

- Mitsubishi Chemical Group Corporation

Recent Developments (New Product Launch)

- In February 2024, Panasonic Industry Co., Ltd. began mass production of its ZL series polymer capacitors. These high-capacitance models, designed to operate at 135°C, enhance thermal stability and reliability in electric vehicle applications.

- In May 2023, Borealis launched Stelora, a next-generation engineering polymer designed for superior performance and sustainability. This innovation enhances thermal stability, durability, and lightweight properties, making it ideal for electric vehicle components.