Engineering Plastics Market

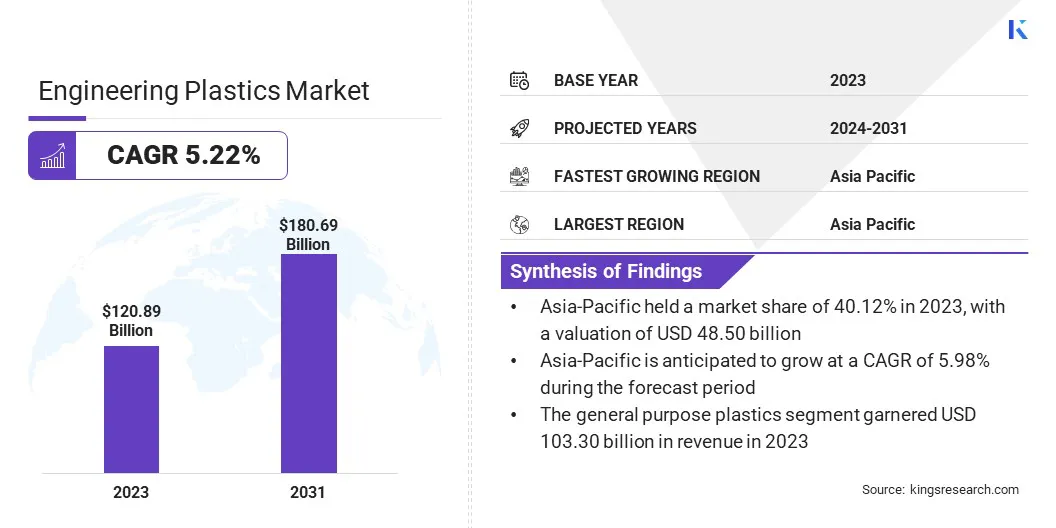

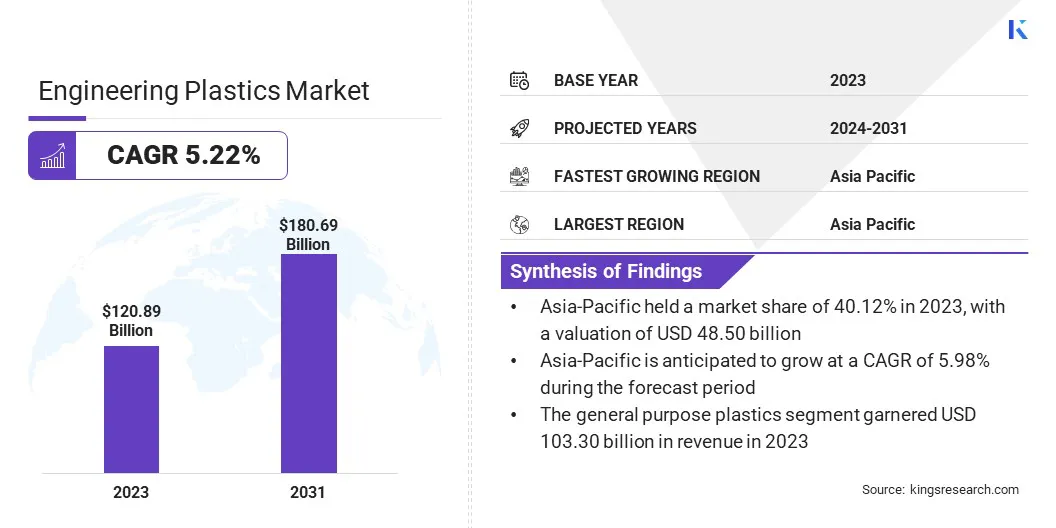

The global engineering plastics market size was valued at USD 120.89 billion in 2023 and is projected to grow from USD 126.58 billion in 2024 to USD 180.69 billion by 2031, exhibiting a CAGR of 5.22% during the forecast period.

The growth of engineering plastics is driven by strong demand from end-use industries such as automotive, electrical and electronics, and construction, where durability, strength, and heat resistance are essential for advanced applications.

In the scope of work, the report includes products offered by companies such as Mitsubishi Engineering-Plastics Corporation, Wittenburg Group, Daicel Corporation, Envalior, Celanese Corporation, Covestro AG, INEOS AG, GRAND PACIFIC PETROCHEMICAL Corporation, Ascend Performance Materials, Teknor Apex, and others.

The engineering plastics industry is marked by the widespread use of high-performance polymers that offer enhanced strength, heat resistance, and durability across various industries. These materials are integral to manufacturing processes in automotive, construction, electronics, and other industries, where specialized properties are essential.

Engineering plastics are increasingly replacing metals and other materials, due to their versatility, cost-effectiveness, and ability to meet demanding application requirements. The market is influenced by ongoing technological advancements, as new solutions that meet evolving industrial needs emerge, particularly in applications that require high strength, flexibility, and resistance to extreme conditions.

The engineering plastics market involves the manufacturing of specialized polymers that are designed to offer enhanced properties like high strength, heat resistance, and durability. These materials are commonly used in the automotive, construction, and electronics industries, where conventional materials like metals may not provide the necessary performance.

Engineering plastics are valued for their ability to withstand extreme conditions, making them suitable for a wide range of demanding applications. These polymers serve as cost-effective, lightweight alternatives to metals and offer versatility across various sectors, driving their importance in modern manufacturing processes.

The market is segmented by resin type, end-use industry, and category, allowing for tailored solutions in automotive parts, electrical components, and industrial machinery.

Analyst’s Review

The engineering plastics market is evolving rapidly, with manufacturers focusing on product innovation and the development of high-performance polymers tailored to meet the needs of the automotive, construction, and electronics industries.

As they invest heavily in research and development (R&D) to enhance strength, durability, and heat resistance, the engineering plastics industry is also prioritizing sustainability by creating eco-friendly alternatives. Strategic collaborations and expansions, particularly into emerging markets, allow companies to leverage the growing demand for engineered plastics.

The customization of engineering plastics is important for addressing specific application requirements. This ongoing innovation positions engineering plastics as a crucial material in industries that require lightweight, durable, and high-performance solutions.

- In October 2024, LG Chem and Lavergne formed a strategic partnership to enhance manufacturing, logistics efficiency, and technological innovation by leveraging each company's strengths. Over the past year, Lavergne has successfully met LG Chem’s stringent qualification process, producing high-quality engineering plastics that align with LG Chem's standards. Through this collaboration, LG Chem aims to strengthen its presence in North America and optimize the supply chain for post-consumer recycled engineering plastics, emphasizing its commitment to the circular economy and sustainable practices. This partnership underscores their shared commitment to excellence and future growth.

Engineering Plastics Market Growth Factors

The growth of engineering plastics is driven by several key factors such as the increasing adoption of these materials in the automotive industry to reduce vehicle weight and enhance fuel efficiency.

Engineering plastics offer an ideal solution, replacing heavier metals and contributing to lighter, more fuel-efficient vehicles. Additionally, advancements in material science have led to the development of engineering plastics with enhanced properties, such as greater heat resistance, durability, and strength.

These innovations enable the materials to meet the increasingly complex demands of the automotive, electronics, and construction industries, further boosting their adoption and expanding the engineering plastics market.

- According to the European Automobile Manufacturers Association (ACEA), the global car production reached 76 million units in 2023, marking a 10.2% increase compared to 2022. This surge in production has significantly driven the demand for engineering plastics, which play a crucial role in the manufacturing of modern vehicles. These materials are increasingly used for lightweighting, durability, and cost-efficiency in automotive components, further supporting the industry's growth.

A significant challenge in the engineering plastics industry is plastic waste contamination, as plastics do not break down in the Earth’s natural biogeochemical cycles. This persistent waste leads to environmental pollution and increased landfill burden. A solution to this issue lies in advancing recycling technologies, particularly in chemical recycling, which can better manage contaminated plastics.

Investing in efficient sorting systems and promoting the use of biodegradable or recyclable engineering plastics can reduce waste, contributing to a more sustainable circular economy in the market.

Engineering Plastics Industry Trends

A major trend in the market is the growing demand for lightweight materials, particularly in the automotive industry. As automakers strive to improve fuel efficiency and reduce carbon emissions, lightweight plastics are increasingly being used to replace heavier metals in vehicle components.

Engineering plastics, such as PP, PC, and ABS, offer the necessary strength and durability while significantly reducing vehicle weight. This shift supports environmental goals and enhances vehicle performance. The ongoing development of advanced polymers and composites, capable of withstanding high temperatures and stress, is further fueling this trend.

Sustainability has become a critical focus for the engineering plastics market, driven by growing environmental concerns and stricter regulations. The demand for recyclable and biodegradable plastics is increasing, as manufacturers and consumers prioritize eco-friendly solutions.

Chemical recycling technologies are being explored to address plastic waste and improve the recyclability of complex plastic materials. Companies are also investing in bio-based plastics and materials that can reduce reliance on fossil fuels. This trend is reshaping the market, as innovation and investment in sustainable plastic alternatives help meet environmental goals while still delivering high-performance materials.

- On December 5, 2024, it was announced that DURABIO, a bio-based engineering plastic from the Mitsubishi Chemical Group (MCG Group), was adopted for use in the front grille of Suzuki's new Fronx compact SUV. This innovative material highlights Mitsubishi’s commitment to sustainability and cutting-edge technology, as DURABIO offers superior durability, clarity, and resistance to UV degradation, showcasing both environmental responsibility and high-performance material engineering.

Segmentation Analysis

The global market is segmented based on resin type, end-use industry, category, and geography.

By Resin Type

Based on resin type, the market has been segmented into polyamide (PA) / nylon, polycarbonate (PC), polyoxymethylene (POM) / acetal, polypropylene (PP), polyethylene terephthalate (PET), acrylonitrile butadiene styrene (ABS), polyphenylene sulfide (PPS), polyetheretherketone (PEEK), polyphenylene oxide (PPO), and others.

The ABS segment led the engineering plastics market in 2023, reaching the valuation of USD 27.01 billion. ABS is gaining widespread use in the engineering materials market, due to its impressive properties. Its durability makes it impact-resistant and capable of withstanding heavy use and harsh environmental conditions.

ABS also offers excellent chemical resistance to acids, alkalis, and solvents, making it suitable for demanding industrial applications. Additionally, its good electrical insulating properties, heat resistance, and versatility in molding, sanding, and dyeing contribute to its popularity.

ABS is cost-effective, readily available, and fully recyclable, supporting sustainable manufacturing. Its antistatic performance further enhances its appeal in sensitive electronic applications, driving its growth across multiple industries.

By End-use Industry

Based on end-use industry, the market has been segmented into automotive, electrical and electronics, construction, consumer goods, healthcare, aerospace, packaging, and others. The electrical and electronics segment secured the largest revenue share of 33.45%. The wide use of engineering materials in the electrical and electronics industry is driven by several key factors.

These materials offer excellent electrical insulation properties, ensuring safety and efficient performance in devices and components. Their durability and resistance to heat, moisture, and chemicals make them suitable for long-lasting use in harsh environments.

Additionally, the versatility of engineering plastics allows for the creation of complex, lightweight, and compact components, essential for modern electronics. The cost-effectiveness, ease of processing, and recyclability of these materials also contribute to their widespread adoption, supporting the demand for energy-efficient and sustainable electronic products.

- For instance, in April 2024, Trinseo launched new flame-retardant EMERGE resins, which are designed without any additives. These resins maintain essential properties like heat resistance and flame retardancy, addressing regulatory concerns and supporting applications in electronics and electrical industries.

By Category

Based on category, the market is bifurcated into general-purpose plastics and advanced/super engineering plastics. The general-purpose plastics segment is poised for significant growth at a CAGR of 5.03% through the forecast period. General-purpose engineering plastics such as PC, ABS, PET, and PA are seeing significant growth, due to their versatility, cost-effectiveness, and performance.

PC’s impact resistance and transparency are driving its demand in the automotive and electronics industries. ABS, known for its durability and ease of processing, is expanding in automotive, consumer electronics, and household goods markets.

PET’s lightweight and chemical-resistant properties are fueling its use in packaging and electrical components, while PA’s mechanical strength and rigidity are driving its adoption in industrial applications. The continuous development and innovation of these materials are creating market opportunities, particularly in emerging sectors like EVs and smart electronics.

Engineering Plastics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 40.12% share of the engineering plastics market in 2023, with a valuation of USD 48.50 billion. This dominance can be attributed to rapid industrialization, strong manufacturing capabilities, and growing demand across the automotive, electronics, and construction industries.

The region's cost-effective production processes, large consumer base, and increasing investments in infrastructure further boost the demand for engineering plastics.

Additionally, countries like China and India offer robust growth opportunities driven by expanding middle-class populations, technological advancements, and supportive government policies promoting manufacturing, making Asia Pacific a hub for engineering plastics consumption and innovation.

The engineering plastics market in Europe is poised for significant growth over the forecast period at a CAGR of 4.91%. Europe is the fastest-growing region for engineering plastics, due to the increasing demand for high-performance materials in the automotive, aerospace, and electronics industries, driven by technological advancements and sustainability goals.

Additionally, Europe’s strong focus on electric vehicles (EVs), renewable energy, and infrastructure development is fueling growth. The region's advanced manufacturing capabilities, coupled with a shift toward lightweight, durable materials, make Europe a key player in the expansion of the market.

Competitive Landscape

The global engineering plastics market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for market growth.

List of Key Companies in Engineering Plastics Market

- Mitsubishi Engineering-Plastics Corporation

- Wittenburg Group

- Daicel Corporation

- Envalior

- Celanese Corporation

- Covestro AG

- INEOS AG

- GRAND PACIFIC PETROCHEMICAL Corporation

- Ascend Performance Materials

- Teknor Apex

Key Industry Developments

- January 2024 (Expansion): BASF is expanding the availability of select grades of its engineering plastics across North America, including the U.S., Canada, and Mexico, through authorized distributors like Bamberger Amco Polymers, M. Holland Company, Nexeo Plastics, and Polimeros Nacionales (exclusive to Mexico). This move reflects BASF's commitment to sustainability and advanced technology.

The global engineering plastics market is segmented as:

By Resin Type

- Polyamide (PA) / Nylon

- Polycarbonate (PC)

- Polyoxymethylene (POM) / Acetal

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyphenylene Sulfide (PPS)

- Polyetheretherketone (PEEK)

- Polyphenylene Oxide (PPO)

- Others

By End-use Industry

- Automotive Industry

- Engine Components

- Interior Components

- Exterior Components

- Powertrain & Drivetrain

- Others

- Electrical and Electronics

- Semiconductors and Circuit Boards

- Connectors and Switches

- Consumer Electronics

- Others

- Construction

- Building Materials

- Piping and Plumbing

- Roofing and Flooring

- Others

- Consumer Goods

- Healthcare

- Aerospace

- Packaging

- Others

By Category

- General-purpose Plastics

- Advanced/Super Engineering Plastics

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

engineering plastics market share stood around