Market Definition

The market encompasses the production, distribution, and innovation of electrically powered coolant pumps for automotive, industrial, and off-highway applications.

These pumps enhance thermal management efficiency in internal combustion engines, hybrid, and electric vehicles by optimizing coolant flow, reducing energy consumption, and improving performance. Unlike traditional mechanical pumps, electric coolant pumps operate independently of engine speed, allowing for precise temperature control, increased fuel efficiency, and lower emissions.

Electric Coolant Pump Market Overview

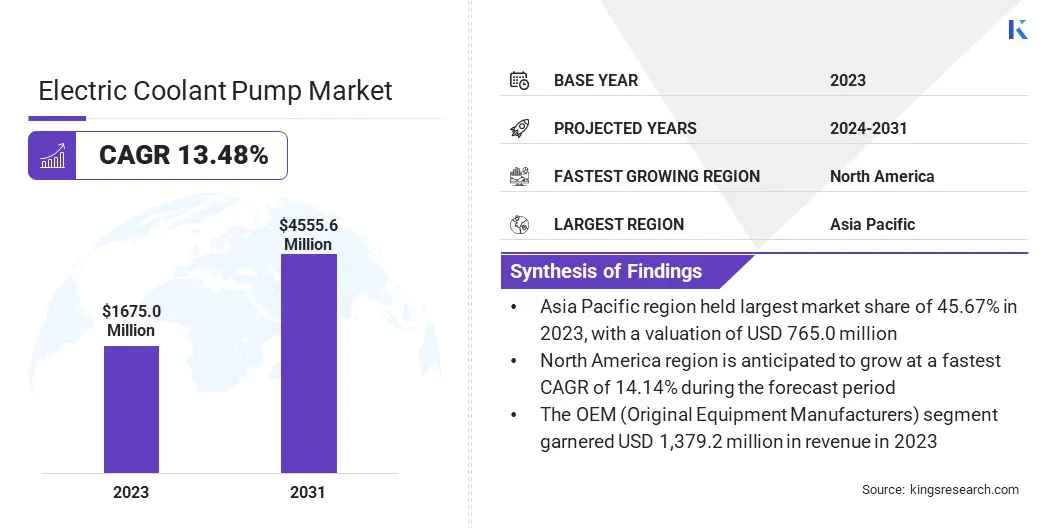

The global electric coolant pump market size was valued at USD 1,675.0 million in 2023 and is projected to grow from USD 1,879.3 million in 2024 to USD 4,555.6 million by 2031, exhibiting a CAGR of 13.48% during the forecast period.

This growth is primarily fueled by the increasing demand for efficient thermal management in modern vehicles, including internal combustion engine (ICE), hybrid, and electric cars. Electric coolant pumps offer precise cooling control, improving engine efficiency, fuel economy, and battery performance while reducing emissions.

Major companies operating in the electric coolant pump market are Robert Bosch GmbH, AISIN CORPORATION, Continental AG, Concentric AB, Hanon Systems, DENSO CORPORATION, Rheinmetall AG, BorgWarner Inc., MAHLE GmbH, Grayson Automotive Services Limited, Nidec Corporation, TBK Co., Ltd., Yamada Manufacturing Co., Ltd.

The surging adoption of hybrid and electric vehicles (EVs), stringent fuel efficiency and emission regulations, and advancements in smart thermal management systems are prompting automakers to replace electric coolant pumps with traditional mechanical pumps. Additionally, lightweight and compact designs, coupled with IoT-enabled monitoring features, are enhancing vehicle performance and durability.

- According to the International Energy Agency, electric vehicle sales in 2023 surged by 3.5 million units compared to 2022, marking a 35% year-on-year growth and a sixfold rise since 2018. Weekly registrations exceeded 250,000, surpassing total annual sales of 2013., reflecting the market's rapid expansion and strong consumer adoption.

Key Highlights:

- The electric coolant pump industry size was recorded at USD 1,675.0 million in 2023.

- The market is projected to grow at a CAGR of 13.48% from 2024 to 2031.

- Asia Pacific held a share of 45.67% in 2023, valued at USD 765.0 million.

- The 12V electric coolant pump segment garnered USD 1,007.0 million in revenue in 2023.

- The passenger vehicles segment is expected to reach USD 2,792.9 million by 2031.

- The engine cooling segment is projected to generate a revenue of USD 2,015.4 million by 2031.

- The OEMs (Original Equipment Manufacturers) segment is likely to reach USD 3,578.4 million by 2031.

- North America is anticipated to grow at a CAGR of 14.14% over the forecast period.

Market Driver

"Growing Demand for Efficient Thermal Management"

The electric coolant pump market is witnessing significant growth due to the increasing demand for efficient thermal management systems across various vehicle types, including passenger cars, commercial vehicles, and off-highway applications.

Unlike traditional mechanical pumps, electric coolant pumps operate independently of engine speed, allowing for precise coolant flow control, reducing energy consumption, and enhancing overall vehicle performance. Electric coolant pumps improve fuel efficiency, reduce emissions, and enhance the longevity of key components, including batteries, engines, and power electronics.

The increasing adoption of hybrid and electric vehicles (EVs) has further accelerated the demand for advanced cooling solutions, as maintaining optimal battery and motor temperatures directly impacts performance and lifespan.

- For instance, in 2023, according to the U.S. Department of Energy, hybrid electric vehicle (HEV) sales surged by 53%, reaching 1.2 million units. This rising demand underscores the need for efficient thermal management solutions, boosting the adoption of electric coolant pumps to enhance engine efficiency, battery cooling, and overall vehicle performance.

Market Challenge

"Complexity of Integration of These Pumps into Diverse Vehicles"

A major challenge hampering the growth of the electric coolant pump market is ensuring the long-term reliability and durability of these pumps, particularly in demanding operating conditions. Unlike mechanical coolant pumps, electric variants rely on electronic components and software controls, making them susceptible to electrical failures, overheating, and software malfunctions.

Failures in the electric coolant pump can cause inefficient cooling, resulting in engine overheating, battery degradation, or reduced vehicle performance.

To address these challenges, manufacturers are investing in robust design improvements and advanced diagnostic systems. The development of high-quality brushless DC motors, corrosion-resistant materials, and redundant safety mechanisms has enhanced the reliability of electric coolant pumps.

Additionally, integrating predictive maintenance technologies, including IoT-enabled diagnostics and real-time performance monitoring, enable early failure detection, improving reliability and operational efficiency.

Market Trend

"Smart and Adaptive Cooling Technologies"

A key trend influencing the electric coolant pump market is the increasing adoption of smart and adaptive cooling technologies that improve efficiency, performance, and sustainability.

Modern electric coolant pumps are being integrated with intelligent control systems, sensors, and AI-based algorithms to dynamically adjust coolant flow based on real-time temperature, load conditions, and vehicle operation modes. This trend is particularly prominent in hybrid and electric vehicles, where maintaining an optimal battery temperature is crucial for performance and longevity.

By using predictive cooling strategies, electric coolant pumps can adjust their speed and flow rate depending on driving conditions, optimizing energy consumption and reducing unnecessary coolant circulation.

Electric Coolant Pump Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

12V Electric Coolant Pump, 24V Electric Coolant Pump, 48V and Higher Voltage Pumps

|

|

By Vehicle Type

|

Passenger Vehicles, Commercial Vehicles (LCVs and HCVs), Electric and Hybrid Vehicles

|

|

By Application

|

Engine Cooling, Battery Cooling, Turbocharger Cooling, HVAC System Cooling

|

|

By Distribution Channel

|

OEMs (Original Equipment Manufacturers), Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (12V Electric Coolant Pump, 24V Electric Coolant Pump, and 48V and Higher Voltage Pumps): The 12V electric coolant pump segment earned USD 1,007.0 million in 2023 due to its widespread adoption in passenger vehicles for efficient engine and battery cooling.

- By Vehicle Type (Passenger Vehicles, Commercial Vehicles (LCVs and HCVs), and Electric and Hybrid Vehicles): The passenger vehicles held a substantial share of 63.45% in 2023, attributed to the rising vehicle production, increasing demand for fuel efficiency, and the widespread adoption of electrified powertrains.

- By Application (Engine Cooling, Battery Cooling, Turbocharger Cooling, and HVAC System Cooling): The engine cooling segment is projected to reach USD 2,015.4 million by 2031, owing to the necessity for precise thermal management in ICE and hybrid vehicles.

- By Distribution Channel (OEMs (Original Equipment Manufacturers) and Aftermarket): The OEM (Original Equipment Manufacturers) segment is projected to reach USD 3,578.4 million by 2031, primarily fueled by the integration of electric coolant pumps in newly manufactured vehicles as a standard thermal management solution.

Electric Coolant Pump Market Regional Analysis

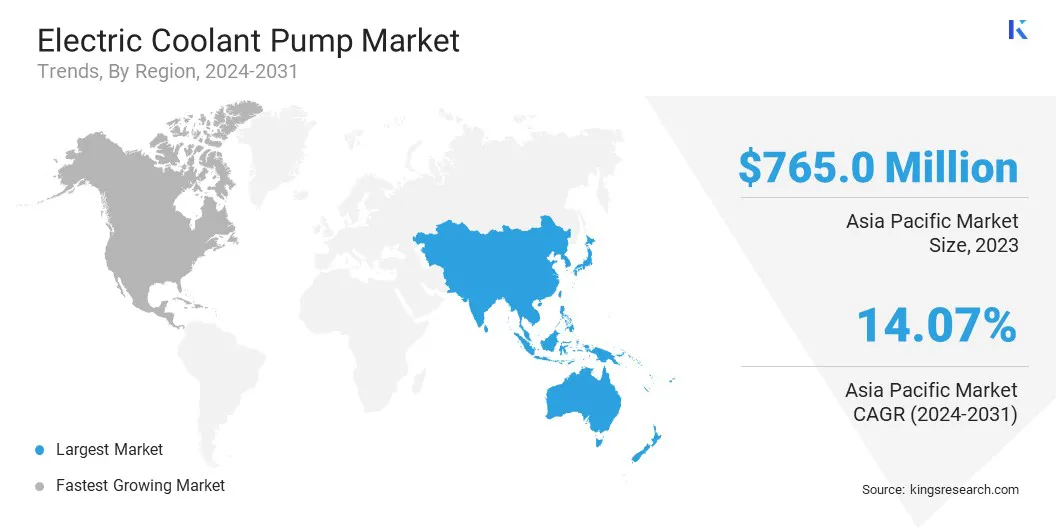

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific electric coolant pump market captured a notable share of around 45.67% in 2023, valued at USD 765.0 million. This dominance is reinforced by the high production and sales of passenger and commercial vehicles, particularly in China, Japan, South Korea, and India.

The rapid expansion of electric and hybrid vehicle adoption, coupled with stringent fuel efficiency regulations, is fueling demand for advanced cooling solutions.

Additionally, growing investments in automotive R&D, increasing disposable income, and the rising focus on vehicle electrification are boosting regional market growth. With continuous technological advancements, Asia Pacific is expected to remain a key market for electric coolant pumps.

- For instance, in 2023, according to the International Energy Agency, China recorded 8.1 million new electric car registrations, a 35% increase from 2022. This surge underscores the accelerating shift toward vehicle electrification, boosting demand for efficient thermal management solutions such as electric coolant pumps, which enhance battery performance, vehicle efficiency, and powertrain durability in modern EVs.

North America electric coolant pump industry is poised to grow at a significant CAGR of 14.07% over the forecast period. This growth is characterized by the rising adoption of hybrid and electric vehicles (EVs), stricter emission regulations, and increasing demand for energy-efficient automotive components.

The U.S. and Canada are leading the market, supported by advancements in thermal management technologies and automakers’ focus on sustainable mobility.

Regulatory Frameworks:

- In the U.S, the National Highway Traffic Safety Administration (NHTSA) regulates the market by enforcing vehicle safety standards to ensure performance, reliability, and compliance in modern vehicles. Compliance with NHTSA regulations is crucial for manufacturers to enhance vehicle efficiency and operational safety.

- In Europe, the European Commission (EC) oversees the market, enforcing emissions, energy efficiency, and safety standards to ensure compliance and sustainability.

Competitive Landscape

The electric coolant pump industry is characterized by a large number of participants, including both established corporations and emerging players.

Leading automotive component suppliers leverage advanced R&D, manufacturing technologies, and strategic partnerships to maintain a competitive edge. They focus on developing high-performance, energy-efficient electric coolant pumps tailored for internal combustion engine (ICE), hybrid, and electric vehicles (EVs).

Market participants are engaged in partnerships, mergers, and acquisitions to expand their product portfolios and strengthen their market presence.

Additionally, increasing regulatory pressure on fuel efficiency and emissions reduction is leading to increased investment in next-generation electric coolant pumps with improved energy efficiency and intelligent control features. As vehicle electrification and advanced thermal management systems advances, the market is expected to remain highly competitive and innovation-driven.

List of Key Companies in Electric Coolant Pump Market:

- Robert Bosch GmbH

- AISIN CORPORATION

- Continental AG

- Concentric AB

- Hanon Systems

- DENSO CORPORATION

- Rheinmetall AG

- BorgWarner Inc.

- MAHLE GmbH

- Grayson Automotive Services Limited

- Nidec Corporation

- TBK Co., Ltd.

- Yamada Manufacturing Co., Ltd.

Recent Developments (New Product Launch)

- In February 2024, Schaeffler expanded its INA brand portfolio with electric auxiliary water pumps, meeting OEM standards for combustion, hybrid, and electric vehicles. This strengthens the aftermarket supply, enhancing thermal management efficiency across a broad vehicle range.

- In September 2023, DENSO launched Everycool, ultra-compact EGR pump to enhance fuel efficiency and reduce emissions in hybrid vehicles. This innovation improves thermal management and engine performance, aligning with global emission regulations. The launch underscores DENSO’s commitment to sustainable mobility, strengthening its position in the market for hybrid and electric vehicles.