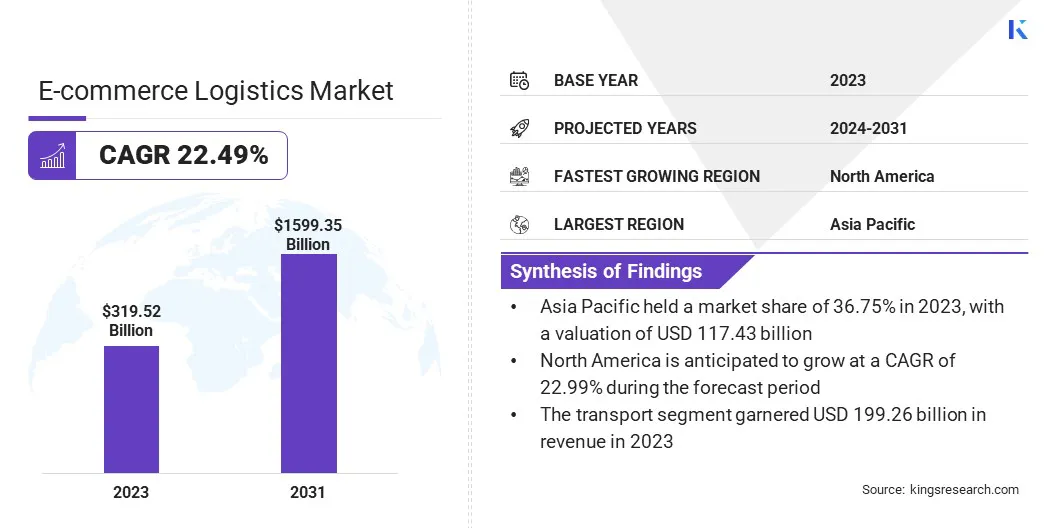

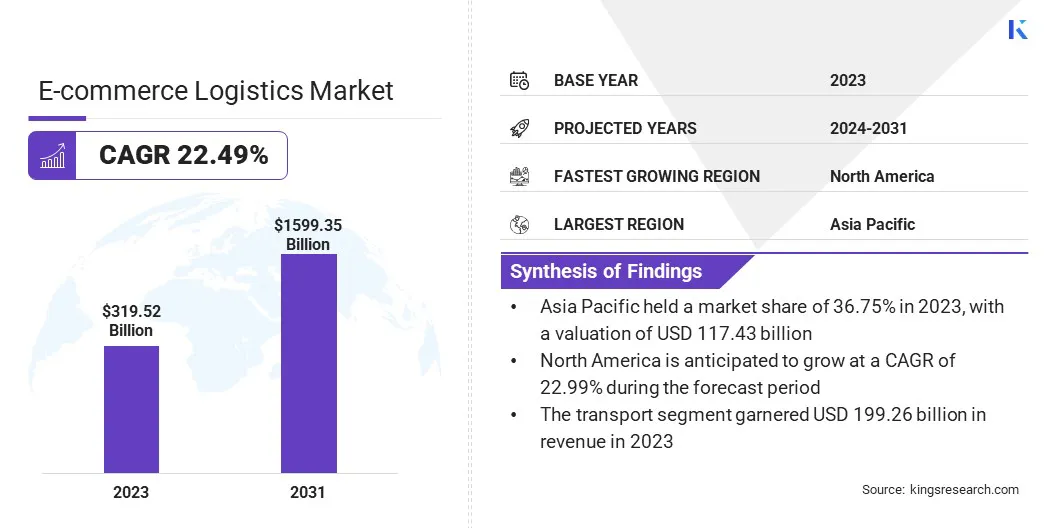

E-commerce Logistics Market Size

The global E-commerce Logistics Market size was valued at USD 319.52 billion in 2023 and is projected to grow from USD 386.59 billion in 2024 to USD 1599.35 billion by 2031, exhibiting a CAGR of 22.49% during the forecast period. The surge in e-commerce platforms globally has significantly impacted the logistics industry.

With businesses focusing on providing faster delivery services to enhance customer satisfaction, there has been a substantial rise in the demand for efficient logistics solutions, which is fueling the e-commerce logistics market growth. Companies are striving to meet consumer expectations for quick and reliable shipping, which has prompted logistics providers to innovate and improve their delivery networks.

In the scope of work, the report includes services offered by companies such as DHL International GmbH, FedEx, United Parcel Service, Inc. (UPS), Amazon.com, Inc. (Amazon Logistics), XPO Logistics, Inc., Kuehne + Nagel International AG, Aramex International LLC, SF Express, JD Logistics, CEVA Logistics, and others.

Moreover, the increasing trend of cross-border online shopping has spurred the demand for enhanced logistics services. Consumers from different regions are making purchases from international e-commerce platforms, necessitating the development of a global logistics infrastructure. To address this growing demand, logistics companies are expanding their networks and enhancing their capabilities to manage international shipments effectively.

- According to the International Trade Administration, global B2C e-commerce revenue is projected to increase from USD 3.6 trillion in 2023 to USD 5.5 trillion by 2027, reflecting a steady compound annual growth rate of 14.4%.

E-commerce logistics refers to the management and coordination of the flow of goods, services, and information from online retailers to consumers. It encompasses a range of activities, including warehousing, inventory management, order fulfillment, packaging, transportation, and last-mile delivery.

E-commerce logistics ensures timely and accurate delivery of online purchases, thereby enhancing customer satisfaction and operational efficiency. The rise of online shopping, has led to the adoption of advanced technologies such as automation, real-time tracking, and route optimization, which facilitate seamless supply chain management in the digital marketplace.

Analyst’s Review

Favorable government policies and initiatives are increasingly shaping the landscape of digital trade and e-commerce logistics. Strategic initiatives in digital infrastructure development, capacity building, and regulatory frameworks are resulting in significant advancements in this sector. Key policy issues, including the WTO e-commerce moratorium, cross-border data flow regulations, competition policies, and consumer protection, are pivotal for the e-commerce logistcs market expansion.

- According to WTO estimates, digitally delivered services have experienced remarkable growth in 2023, with their nearly quadrupling since 2005 and an average annual increase of 8.1%. This growth rate surpasses that of goods and other services exports, accounting for 54% of total services exports. This underscores the growing importance of digital services in the global economy.

- According to the International Telecommunication Union (ITU), in 2023, approximately 67% of the world’s population, or 5.4 billion people, were connected to the internet, reflecting a substantial increase from a decade ago. Despite this progress, approximately 2.6 billion people, primarily in low- and lower-middle-income economies, remain offline. High tariffs on ICT equipment and restrictions on enabling services contribute to the digital divide, impacting affordability and technology adoption.

Addressing these challenges requires a concerted domestic and international efforts. Initiatives such as the WTO-led Aid for Trade, UNCTAD-led eTrade for All, and the World Bank-led Digital Advisory and Trade Assistance (DATA) Fund play a key role in addressing the digital divide.

The WTO’s Aid for Trade work programme for 2023-24 prioritizes digital connectivity, highlighting the ongoing need for support in enhancing digital readiness and fostering inclusive growth in digital trade. As these policies and initiatives advance, they present significant opportunities for development in the digital economy.

E-commerce Logistics Market Growth Factors

The economic growth in emerging markets, particularly in regions such as Asia-Pacific, Latin America, and Africa, has fueled the expansion of e-commerce. Increasing disposable income, a growing middle-class population, and improved infrastructure have allowed more consumers to engage in online shopping.

As these markets continue to mature, the demand for efficient logistics solutions tailored to the e-commerce sector is expected to rise, substantially boosting the e-commerce logistics market growth. Companies are investing heavily in expanding their logistics networks in these regions to meet this growing demand.

- The International Monetary Fund's 2024 World Economic Outlook reports global real GDP growth at 4.2%, an increase from 4.1% recorded in 2022.

Moreover, the rapid proliferation of online retailers has significantly bolstered the expansion of the market. As an increasing number of businesses transition to online platforms, the demand for tailored logistics services grows. E-commerce companies, including small businesses and large-scale enterprises, are looking for logistics solutions that offer flexibility, scalability, and efficiency. This shift has prompted logistics providers to diversify their offerings to include tailored solutions for different sizes and types of businesses.

E-commerce Logistics Industry Trends

The increasing availability of high-speed internet and the ongoing global digital transformation are propelling the growth of the market. As internet access becomes more widespread, particularly in emerging markets, a larger segment of the global population is turning to online shopping.

Furthermore, the shift toward digital platforms has supported by the growing adoption of smartphones, allowing consumers to shop conveniently from mobile devices. This digital shift is creating a strong demand for reliable logistics services that handle the growing volume of online transactions, thereby boosting market expansion.

- According to the International Telecommunication Union (ITU), approximately 67% of the global population, equating to 5.4 billion people, were internet users in 2023. This marks a growth of 4.7% from 2022, surpassing the 3.5% increase recorded between 2021 and 2022.

Moreover, government policies and initiatives promoting digital trade and e-commerce are playing a pivotal role in propelling the development of the e-commerce logistics market . Several countries are implementing policies to enhance digital infrastructure, simplify cross-border trade regulations, and support the expansion of e-commerce ecosystems.

For instance, trade agreements and streamlined customs processes have facilitated international transactions, enabling logistics companies to manage cross-border shipments more effectively.

Segmentation Analysis

The global market has been segmented based on service type, operation, and geography.

By Service Type

Based on service type, the market has been segmented into transport, warehouse, and other services. The transport segment led the e-commerce logistics market in 2023, reaching a valuation of USD 199.26 billion. This growth is largely attributed to increased investments in advanced transportation technologies, including route optimization, real-time tracking, and autonomous delivery systems, all of which enhance operational efficiency.

The expansion of cross-border e-commerce increases logistical complexity, making transport services indispensable for managing the increasing volume and geographical reach of online orders.

By Operation

Based on operation, the market has been classified into domestic and international. The international segment is poised to witness significant growth at a robust CAGR of 23.15% through the forecast period. Globalization has led to an expansion of cross-border e-commerce, as consumers increasingly seek products from international retailers.

This trend necessitates robust logistics networks capable of handling complex international shipments, customs clearance, and diverse regulatory requirements. Furthermore, advancements in technology, such as real-time tracking and automated warehousing, facilitate efficient management of global supply chains.

E-commerce companies are investing heavily in international logistics to ensure timely delivery and enhance customer satisfaction, thereby stimulating segmental growth.

E-commerce Logistics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific e-commerce logistics market held a substantial share of around 36.75% in 2023, with a valuation of USD 117.43 billion. The expansion of e-commerce platforms has led to a surge in demand for efficient logistics solutions to support high order volumes and ensure timely deliveries.

This growth is further fueled by the widespread adoption of smartphones and internet access, which has democratized online shopping across diverse demographics. Additionally, the rise of digital payment systems and innovative shopping experiences, such as live commerce and personalized recommendations, boosts consumer engagement.

- According to the International Trade Administration in 2024, the e-commerce market in the Asia-Pacific region was valued at USD 19.3 trillion in 2023 and isprojected to exceedUSD 28.9 trillion by 2026.

The competitive nature of the e-commerce market in Asia-Pacific further spurs continuous improvements in logistics capabilities. Companies are leveraging technology to enhance operational efficiency, optimize supply chains, and meet consumer expectations for faster, reliable service. This trend highlights the need for advanced warehousing, transportation, and last-mile delivery solutions to align with the growing e-commerce landscape in the region.

North America is poised to witness significant growth at a robust CAGR of 22.99% over the forecast period. As consumers gain greater financial freedom, their purchasing power increases, leading to higher online spending. This boost in consumer spending enhances the demand for efficient and scalable logistics solutions to manage the higher volume of transactions and expedite delivery services.

- According to the Federal Reserve Bank of St. Louis, the real disposable personal income in the U.S. reached USD 17,002 billion in July 2024, an increase from USD 16,816.4 billion in the previous month.

Businesses are responding to this trend by investing in advanced logistics infrastructure, such as state-of-the-art fulfillment centers and optimized transportation networks, to meet the growing expectations of a more affluent customer base. The rise in disposable income underscores the need for sophisticated logistics operations, thereby contributing significantly to the expansion of the North America market.

Competitive Landscape

The global e-commerce logistics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in E-commerce Logistics Market

Key Industry Developments

- October 2023 (Business Expansion): DHL Supply Chain unveiled plans to expand its warehousing capacity,workforce, and sustainability efforts. The company aims to equip its warehouses with digital technologies, including assisted picking robots, indoor robotic transport, intelligent process automation, wearable devices, voice picking systems, inventory management robots, and algorithmic optimizations.

- August 2024 (Partnership): Amazon India and Indian Railways expanded their partnershipto enhance the rail network's capacity for quicker package delivery. A newly signed Memorandum of Understanding (MoU) outlines their collaboration to identify hub-and-spoke networks, prioritize railway zones, establish major parcel hubs, and implement strategies to streamline the movement of goods between hubs and spokes.

The global e-commerce logistics market is segmented as:

By Service Type

- Transport

- Warehouse

- Other Services

By Operation

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America