Market Definition

Distributed Temperature Sensing (DTS) is an advanced monitoring technology that utilizes optical fibers to measure temperature variations along their entire length in real time. It is widely used in industries such as oil & gas, power, and environmental monitoring, providing precise and continuous temperature data.

DTS enhances operational efficiency, ensures safety, and enables predictive maintenance by detecting temperature anomalies, ultimately reducing downtime, preventing failures, and improving system performance across diverse applications.

The report outlines the primary drivers of the market, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the market's trajectory.

Distributed Temperature Sensing Market Overview

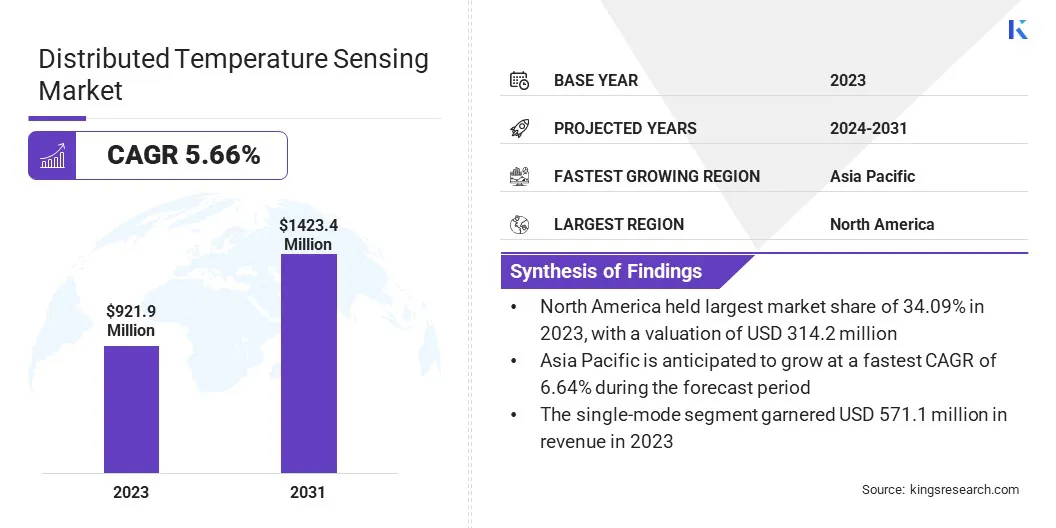

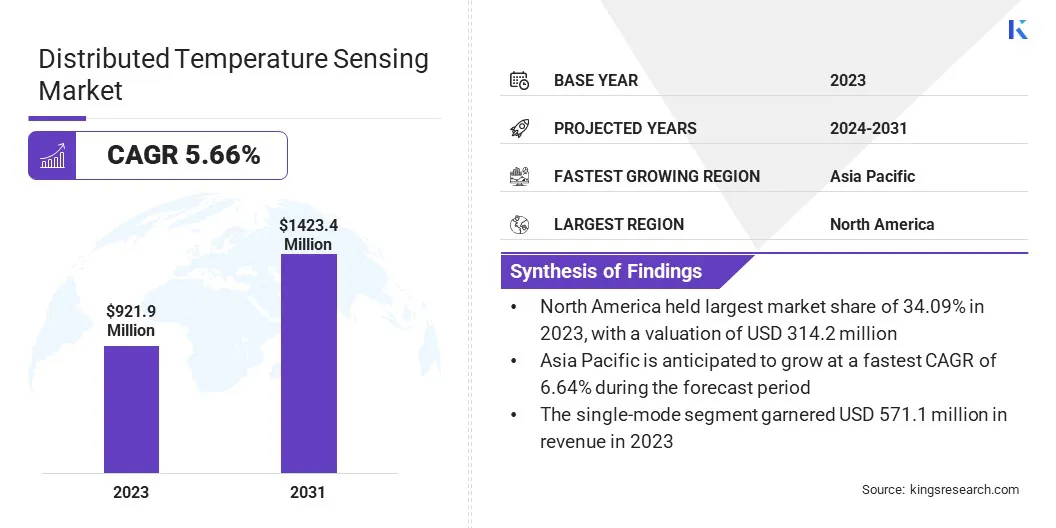

The global distributed temperature sensing market size was valued at USD 921.9 million in 2023 and is projected to grow from USD 968.2 million in 2024 to USD 1423.4 million by 2031, exhibiting a CAGR of 5.66% during the forecast period.

The market is registering growth, fueled by the increasing demand for real-time monitoring. DTS technologies improve operational efficiency, safety, and proactive maintenance, helping sectors like oil, gas, power transmission, and renewable energy optimize performance and mitigate risks.

Major companies operating in the distributed temperature sensing industry are STMicroelectronics, AP Sensing HQ, Bandweaver, NKT A/S, OFS Fitel LLC, Silixa Ltd, Yokogawa India Ltd, Sumitomo Electric Industries Ltd., NXP Semiconductors, Infineon Technologies AG, Qualcomm Technologies, Inc., Texas Instruments Incorporated, Robert Bosch GmbH, Luna Innovations, and Omicron Sensing Pvt Ltd.

The market is gaining momentum, due to the increasing demand for real-time monitoring across critical infrastructure sectors. DTS, along with simultaneous temperature and strain sensing, and distributed acoustic sensing, delivers continuous, high-resolution data essential for proactive maintenance and risk prevention.

These technologies enhance operational efficiency and safety in industries such as oil, gas, power transmission, and perimeter security, supporting the broader shift toward intelligent asset management and optimized resource utilization in high-risk environments.

- In July 2024, Viavi Solutions Inc. launched NITRO Fiber Sensing, a real-time asset monitoring and analytics solution designed for critical infrastructure such as oil, gas, water pipelines, and power transmission. The solution integrates DTS, simultaneous temperature and strain sensing, and Distributed Acoustic Sensing (DAS) technologies, enabling proactive maintenance and minimizing downtime by providing real-time health data to identify and address potential threats swiftly.

Key Highlights:

Key Highlights:

- The distributed temperature sensing industry size was valued at USD 921.9 million in 2023.

- The market is projected to grow at a CAGR of 5.66% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 314.2 million.

- The optical time domain reflectometry segment garnered USD 497.0 million in revenue in 2023.

- The single-mode segment is expected to reach USD 861.8 million by 2031.

- The environmental monitoring segment is anticipated to register the fastest CAGR of 5.96% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.64% during the forecast period.

Market Driver

"Increased Use in Renewable Energy"

The distributed temperature sensing market is registering growth, driven by the increased use of renewable energy sources, such as solar and wind. The need for advanced real-time monitoring solutions intensifies as renewable energy capacity expands, particularly in line with global carbon reduction goals.

DTS systems offer continuous temperature tracking, improving the efficiency, reliability, and safety of renewable energy infrastructure, reducing downtime, and enabling proactive maintenance, all of which fuel the market.

- In January 2024, according to the International Energy Agency (IEA), solar PV and wind are expected to represent 95% of global energy growth, surpassing coal to become the leading source of electricity by 2025. The need for DTS technologies will rise as countries aim to triple renewable energy capacity by 2030. Real-time temperature monitoring will be essential in optimizing performance, preventing failures, and ensuring safety across expanding solar & wind infrastructure.

Market Challenge

"High costs associated with DTS systems"

High costs associated with DTS systems pose a significant barrier to adoption, especially for businesses with limited budgets. Companies can focus on optimizing the scalability of DTS solutions, offering flexible pricing models, such as pay-per-use or subscription-based services, to reduce upfront investments.

Additionally, advancements in sensor technology and manufacturing processes can lower production costs, making DTS systems more affordable. Partnerships and collaborations with industry leaders can also help reduce costs through shared resources and bulk purchasing, educating potential customers on the long-term cost savings and operational benefits of DTS systems and encouraging adoption.

Market Trend

"Advancements in Fiber Optic Technology"

The distributed temperature sensing (DTS) market is experiencing a notable trend as advancements in fiber optic technology enhance sensing precision, extend measurement range, and improve signal integrity. These improvements enable more accurate and reliable temperature monitoring across a wide range of applications.

Industries such as oil & gas, power, and fire safety are benefiting from greater operational efficiency and safety. With evolving fiber optics capable of performing in extreme conditions, demand for advanced DTS systems continues to grow in global infrastructure projects.

- In March 2023, AP Sensing’s launch of the third-generation N45-Series fiber optic Linear Heat Detection (LHD) system, with a range of up to 16 km and four channels, exemplifies advancements in DTS. The system’s high reliability, with an Mean Time Between Failures (MTBF ) of 35 years, offers a cost-effective solution with low maintenance, immunity to electromagnetic interference (EMI), and precise fire event detection.

Distributed Temperature Sensing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Operating Principle

|

Optical Time Domain Reflectometry (OTDR), Optical Frequency Domain Reflectometry (OFDR)

|

|

By Fiber

|

Single-mode, Multi-mode

|

|

By Application

|

Oil & Gas, Power Cable Monitoring, Fire Detection, Process & Pipeline Monitoring, Environmental Monitoring, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E. , Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Operating Principle (Optical Time Domain Reflectometry (OTDR), Optical Frequency Domain Reflectometry (OFDR)): The optical time domain reflectometry segment earned USD 497.0 million in 2023, due to its ability to provide accurate, real-time monitoring and fault detection in fiber optic systems, which is critical for industries requiring high reliability and performance in their infrastructure.

- By Fiber (Single-mode, Multi-mode): The single-mode segment held 61.95% share of the market in 2023, due to its superior performance over long distances, higher data transmission capacity, and ability to maintain signal integrity, making it the preferred choice for high-demand applications in telecommunications and data centers.

- By Application (Oil & Gas, Power Cable Monitoring, Fire Detection, and Process & Pipeline Monitoring): The oil & gas segment is projected to reach USD 426.2 million by 2031, owing to the increasing need for real-time monitoring of pipelines, wellheads, and critical infrastructure to ensure safety, prevent leaks, and optimize operations in this high-risk industry.

Distributed Temperature Sensing Market Regional Analysis

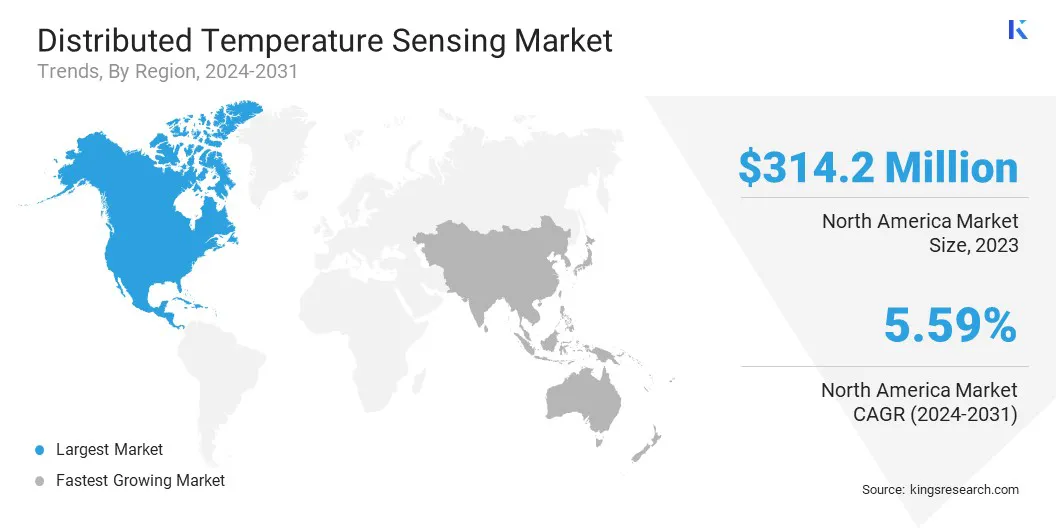

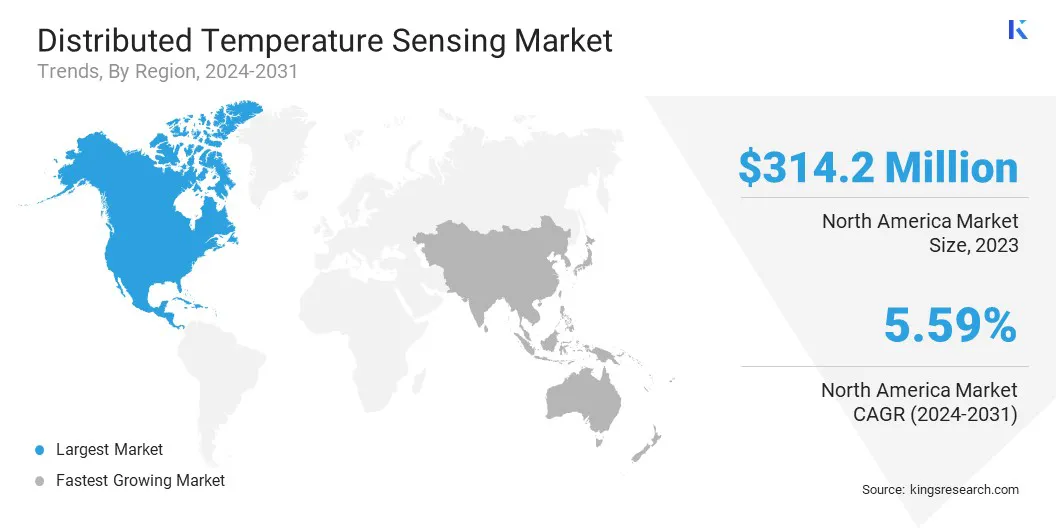

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America distributed temperature sensing market share stood at around 34.09% in 2023, with a valuation of USD 314.2 million. The market is driven by a strong industrial base in oil & gas, power, and technology sectors such as data centers, telecommunications, and renewable energy.

North America distributed temperature sensing market share stood at around 34.09% in 2023, with a valuation of USD 314.2 million. The market is driven by a strong industrial base in oil & gas, power, and technology sectors such as data centers, telecommunications, and renewable energy.

The region’s advanced infrastructure and robust R&D capabilities support the widespread adoption of DTS. Additionally, regulatory frameworks promoting energy efficiency, safety, and environmental monitoring drive demand. The presence of leading DTS manufacturers and a skilled workforce further solidify North America’s position as a global market leader in this technology.

The distributed temperature sensing industry in Asia-Pacific is poised for significant growth at a robust CAGR of 6.64% over the forecast period. A key driver of the market in Asia-Pacific is the rapid expansion of energy infrastructure, particularly in emerging economies such as China, India, and Southeast Asia.

Increasing investments in oil & gas exploration, power generation, and renewable energy projects is creating strong demand for advanced monitoring technologies like DTS.

Additionally, government initiatives focused on industrial automation, smart grids, and infrastructure safety are accelerating the adoption of DTS solutions to enhance operational efficiency and regulatory compliance.

Regulatory Frameworks

- In the U.S., distributed temperature sensing is governed by industry-specific safety and environmental standards, with key regulations enforced by agencies such as Occupational Safety and Health Administration (OSHA) and Pipeline and Hazardous Materials Safety Administration (PHMSA). These regulations mandate continuous monitoring of critical infrastructure to ensure operational safety and compliance.

- In India, DTS systems are regulated by various authorities such as the Petroleum and Natural Gas Regulatory Board (PNGRB) for oil & gas, Central Electricity Authority (CEA), and Power System Operation Corporation Limited (POSOCO) for the power sector, ensuring compliance across key industries.

- In Europe, the regulation of DTS is managed by individual member states, emphasizing safety, environmental impact, and data privacy. Regulations vary by application, such as oil & gas or power grids. Additionally, EU regulations like the General Data Protection Regulation (GDPR) govern the collection and processing of DTS data, ensuring compliance with privacy standards.

Competitive Landscape

The distributed temperature sensing industry is characterized by a large number of participants, including both established corporations and rising organizations. Key market players are leveraging strategies such as mergers and acquisitions, along with product launches, to drive growth in the market.

These approaches enable firms to expand their technological capabilities, diversify their product portfolios, and strengthen market positioning. Mergers and acquisitions provide access to complementary technologies and customer bases, while product innovations address evolving market demands, ensuring competitive advantage and fostering long-term business growth in the rapidly expanding DTS market.

- In December 2023, Luna Innovations expanded its fiber optic sensing portfolio with the acquisition of Silixa, strengthening its capabilities in DAS, DTS, and Distributed Strain Sensing (DSS). This strategic acquisition enhances Luna’s offerings for key industries, including energy, mining, and defense.

List of Key Companies in Distributed Temperature Sensing Market:

- STMicroelectronics

- AP Sensing HQ

- Bandweaver

- NKT A/S

- OFS Fitel, LLC

- Silixa Ltd

- Yokogawa India Ltd

- Sumitomo Electric Industries, Ltd.

- NXP Semiconductors

- Infineon Technologies AG

- Qualcomm Technologies, Inc.

- Texas Instruments Incorporated

- Robert Bosch GmbH

- Luna Innovations

- Omicron Sensing Pvt Ltd.

Recent Developments

- In December 2024, Yokogawa Electric Corporation launched OpreX Subsea Power Cable Monitoring, a system designed to monitor subsea cables used in offshore wind power transmission. Utilizing Yokogawa’s fiber optic temperature sensor, the system continuously tracks temperature variations, enabling condition-based maintenance, reducing inspection and maintenance costs, and optimizing operational efficiency by addressing issues at the most appropriate time.

- In December 2023, Infineon Technologies introduced the CoolMOS S7T product family, featuring an integrated temperature sensor to enhance junction temperature sensing accuracy. This integration improves durability, safety, and efficiency across various electronic applications. The CoolMOS S7T is particularly suited for solid-state relay (SSR) applications, offering superior R DS(on) performance and enhanced reliability through its highly accurate, embedded sensor.

Key Highlights:

Key Highlights: North America distributed temperature sensing market share stood at around 34.09% in 2023, with a valuation of USD 314.2 million. The market is driven by a strong industrial base in oil & gas, power, and technology sectors such as data centers, telecommunications, and renewable energy.

North America distributed temperature sensing market share stood at around 34.09% in 2023, with a valuation of USD 314.2 million. The market is driven by a strong industrial base in oil & gas, power, and technology sectors such as data centers, telecommunications, and renewable energy.