Market Definition

The digital dentures market refers to the industry focused on the creation and distribution of dentures using digital technologies like CAD, CAM, and 3D printing. These technologies enable the design and production of more precise, comfortable, and esthetically pleasing dentures, offering a modern alternative to traditional denture fabrication methods.

Digital Dentures Market Overview

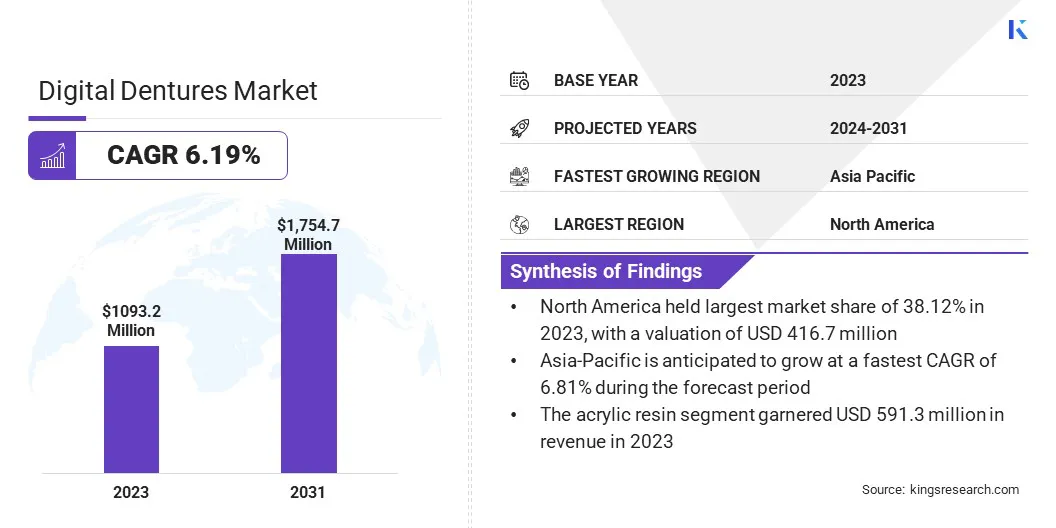

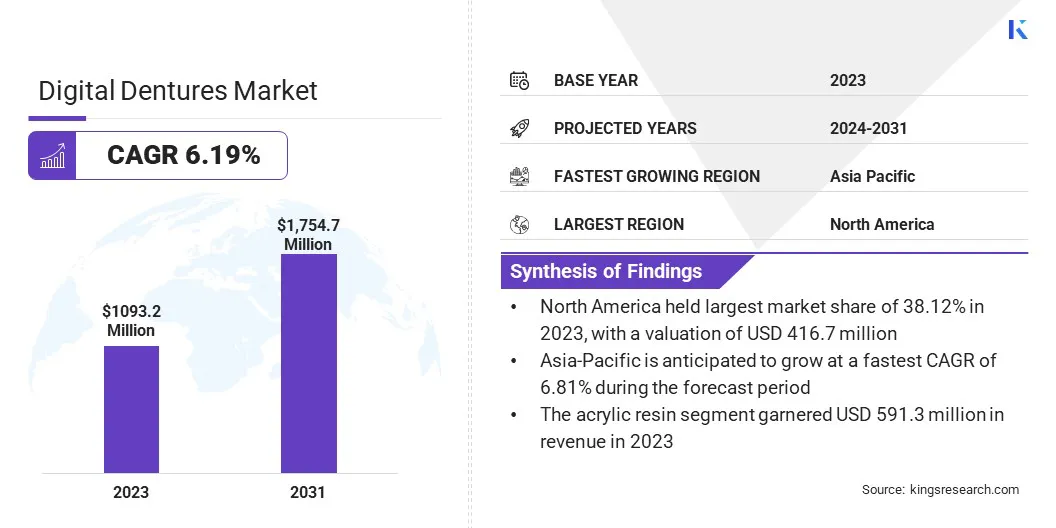

The global digital dentures market size was valued at USD 1,093.2 million in 2023, which is estimated to be USD 1,152.4 million in 2024 and reach USD 1,754.7 million by 2031, growing at a CAGR of 6.19% from 2024 to 2031.

The aging population is a key driver for the market, as older individuals often experience tooth loss and seek more efficient, customized solutions. Digital dentures offer improved comfort, precision, and quicker turnaround times, meeting the growing demand.

The enhanced fit and comfort offered by digital dentures result in better adaptation to the mouth, reducing discomfort and improving overall patient satisfaction, leading to higher demand for these advanced solutions.

Major companies operating in the global digital dentures industry are Dentsply Sirona, Ivoclar Vivadent, Modern Dental Laboratory USA , VITA Zahnfabrik, Mitsui Chemicals, Inc. (Kulzer GmbH), Global Dental Science, LLC, Stratasys , 3D Systems, Inc., Desktop Metal, Inc., Amann Girrbach AG, BEGO GmbH & Co. KG, Asiga, CARIMA Co., Ltd., Shandong Huge Dental Material Corporation, and Medit Co., Ltd.

An emerging opportunity in the market lies in the growing integration of artificial intelligence (AI) in the design and customization process. AI-driven tools are enhancing precision and personalization, enabling quicker adjustments and more accurate fits tailored to individual patient data.

This innovation is poised to improve patient outcomes and streamline production, offering dental professionals an efficient, cost-effective solution. As a result, the adoption of digital dentures is projected to expand, gaining traction in both established and emerging markets.

- In January 2025, a team from Metro South Oral Health is pioneering digital dentistry by integrating 3D printing, AI, and advanced materials to enhance dental prosthetics. This innovation supports the market by improving precision, speed, and patient outcomes, further driving broader adoption and efficiency in both clinical and production settings.

Key Highlights:

- The global digital dentures market size was valued at USD 1,093.2 million in 2023.

- The market is projected to grow at a CAGR of 6.19% from 2024 to 2031.

- North America held a market share of 38.12% in 2023, with a valuation of USD 416.7 million.

- The complete digital dentures segment garnered USD 438.6 million in revenue in 2023.

- The CAD/CAM (Computer-Aided Design & Manufacturing) segment is expected to reach USD 849.7 million by 2031.

- The acrylic resin segment held a market share of 54.09% in 2023.

- The dental clinics & prosthodontists segment is anticipated to register a CAGR of 6.83% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.81% during the forecast period.

Market Driver

"Aging Population"

The aging population is a significant growth driver of the digital dentures market. The demand for dental prosthetics, including dentures, increases as the global elderly population continues to rise.

- According to the WHO, by 2030, 1 in 6 people will be aged 60 years or older. By 2050, it will double to 2.1 billion, including 426 million people aged 80+.

Digital dentures offer a more comfortable, precise, and esthetically pleasing solution compared to traditional methods. With advancements in technology, these digital solutions provide better fit and faster production times, making them an attractive option for older individuals who require high-quality dental care. This demographic shift is fueling the market.

- In September 2024, Desktop Health's Flexcera resins were validated for LuxCreo 3D printers, enhancing the production of high-quality, FDA-cleared dental prosthetics. This development boosts the market by offering improved precision, durability, and customization for an aging population.

Market Challenge

"High Initial Costs"

A significant challenge in the digital dentures market is the high initial investment required for advanced digital technologies like CAD/CAM systems and 3D printers. This financial barrier limits adoption, especially among smaller dental practices.

Leasing options and financial support programs can be introduced, allowing dental professionals to access the necessary technology without bearing the full cost upfront. Additionally, the cost of equipment is expected to decrease as digital dentistry becomes more widespread, promoting broader market adoption.

Market Trend

"Advancements in Materials"

A notable trend in the digital dentures market is the development of advanced materials that enhance the performance and esthetics of prosthetics. New materials offer improved durability, wear resistance, and esthetic qualities, allowing for the production of high-quality, long-lasting dentures.

These innovations enable dental laboratories to deliver superior, monolithic dentures with better precision, faster production times, and reduced material waste. Digital dentures are becoming increasingly accessible, efficient, and tailored to patient needs as these materials continue to evolve, driving further market growth.

- In February 2024, 3D Systems introduced a jetted, monolithic denture solution using custom materials for both teeth and gums. This technology enhances durability, esthetics, and performance while reducing production times, waste, and office visits, boosting efficiency in digital dentures.

Digital Dentures Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Complete Digital Dentures, Partial Digital Dentures, Implant-supported Digital Dentures, Temporary Digital Dentures

|

|

By Technology

|

CAD/CAM (Computer-Aided Design & Manufacturing), 3D Printing (Additive Manufacturing), Intraoral Scanning & Digital Impression Systems

|

|

By Material Type

|

Acrylic Resin, Nylon & Polyamide-based Dentures, Composite Resins & Hybrid Materials

|

|

By End User

|

Dental Laboratories, Dental Clinics & Prosthodontists, Academic & Research Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Complete Digital Dentures, Partial Digital Dentures, Implant-supported Digital Dentures, Temporary Digital Dentures): The complete digital dentures segment earned USD 438.6 million in 2023, due to the increasing demand for customized solutions.

- By Technology [CAD/CAM (Computer-Aided Design & Manufacturing), 3D Printing (Additive Manufacturing), Intraoral Scanning & Digital Impression Systems]: The CAD/CAM segment held 49.12% share of the market in 2023, due to its efficiency in precision manufacturing and widespread adoption.

- By Material Type (Acrylic Resin, Nylon & Polyamide-based Dentures, Composite Resins & Hybrid Materials): The acrylic resin segment is projected to reach USD 897.2 million by 2031, owing to its durability, affordability, and esthetic appeal.

- By End User (Dental Laboratories, Dental Clinics & Prosthodontists, Academic & Research Institutes): The dental clinics & prosthodontists segment is anticipated to register a CAGR of 6.83% during the forecast period, due to increasing patient preferences for digital dentures.

Digital Dentures Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a share of around 38.12% in the global digital dentures market in 2023, with a valuation of USD 416.7 million. North America continues to dominate the market, due to the presence of advanced dental technologies, robust healthcare infrastructure, and high adoption rates of digital dentistry.

Countries like the U.S. and Canada have a well-established healthcare system with strong dental care networks, driving the demand for digital denture solutions. Moreover, the growing awareness about the benefits of digital dentures, including improved precision and comfort, further contributes to North America's leading position in the market.

- In February 2025, 3D Systems, a US-based company, introduced its NextDent 300 MultiJet 3D printer, designed to accelerate the production of multi-material monolithic dentures. This innovation, along with future solutions for night guards and clear aligners, enhances digital dental workflows, improving efficiency and patient satisfaction in dental labs globally.

The digital dentures industry in Asia Pacific is poised for significant growth at a robust CAGR of 6.81% over the forecast period. Asia Pacific is the fastest-growing region in the market, fueled by rising dental healthcare awareness and improving economic conditions.

An increasing number of people are seeking advanced dental solutions as the region registers rapid urbanization. Countries such as China and India are investing heavily in healthcare technologies, contributing to the adoption of digital dentures. The growing population and a shift toward modern dental practices are expected to propel the market in Asia Pacific at an accelerated pace.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) is responsible for protecting public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, medical devices, the nation's food supply, cosmetics, and products that emit radiation.

- The letters ‘CE’ appear on many products traded on the extended Single Market in the European Economic Area (EEA). They signify that products sold in the EEA have been assessed to meet high safety, health, and environmental protection requirements.

Competitive Landscape:

. In the digital dentures market, companies are forming collaborations to enhance innovation and improve production efficiency. By combining advanced 3D printing, specialized materials, and software solutions, these partnerships aim to create high-quality, customizable dentures. The goal is to streamline workflows, reduce costs, and address challenges like labor shortages, while offering better-fitting, esthetically pleasing dentures to patients.

- In April 2023, Stratasys Ltd. and VITA Zahnfabrik H. Rauter GmbH & Co. KG announced a collaboration to integrate VITA's certified tooth shades into Stratasys’ TrueDent 3D-printed denture solution. This partnership aims to enhance denture esthetics and improve production efficiency in dental labs, providing a more advanced, digitally precise workflow.

List of Key Companies in Digital Dentures Market:

- Dentsply Sirona

- Ivoclar Vivadent

- Modern Dental Laboratory USA

- VITA Zahnfabrik

- Mitsui Chemicals, Inc. (Kulzer GmbH)

- Global Dental Science, LLC

- Stratasys

- 3D Systems, Inc.

- Desktop Metal, Inc.

- Amann Girrbach AG

- BEGO GmbH & Co. KG

- Asiga

- CARIMA Co., Ltd.

- Shandong Huge Dental Material Corporation

- Medit Co., Ltd

Recent Developments (Acquisition/Launch)

- In October 2024, Barings provided financing support for The Zabel Companies’ acquisition of Golden Ceramic Dental Lab (GCDL), a leading dental lab specializing in digital dentures, clear aligners, and other dental solutions. This investment expands Barings' Global Private Finance platform and strengthens GCDL’s growth potential in the dental industry.

- In January 2025, Stratasys launched its TrueDent-D resin in Europe, marking a significant milestone. With strong customer interest, the monolithic digital denture solution offers scalable, cost-effective production, reducing labor costs, enhancing patient satisfaction, and improving denture fit, esthetics, and function.