Market Definition

The market involves the use of advanced technologies, such as IoT, AI, drones, and data analytics to improve farming processes. It covers precision farming, crop health monitoring, soil analysis, and automated irrigation. These tools help optimize input use, increase yields, and ensure sustainable practices.

Digital agriculture also includes farm management software for planning, tracking, and decision-making. Its applications span crop production, livestock management, and greenhouse operations, supporting both small-scale farms and large agribusinesses globally.

Digital Agriculture Market Overview

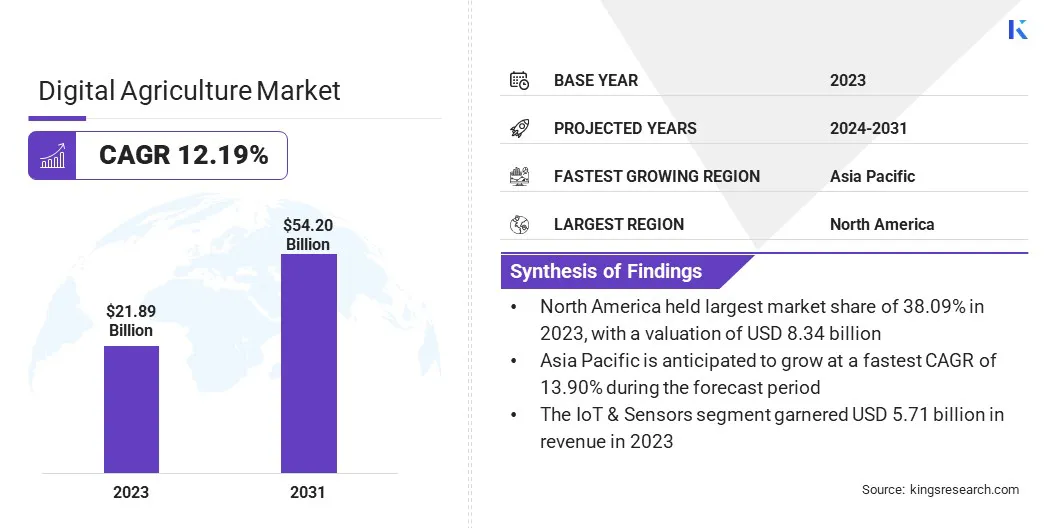

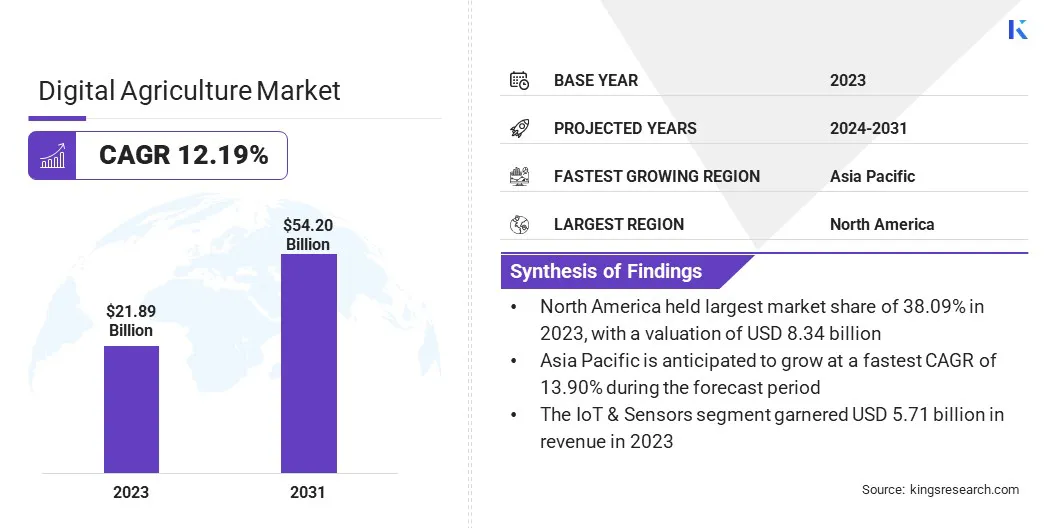

The global digital agriculture market size was valued at USD 21.89 billion in 2023 and is projected to grow from USD 24.23 billion in 2024 to USD 54.20 billion by 2031, exhibiting a CAGR of 12.19% during the forecast period.

The market is driven by the integration of IoT and sensor technologies, enabling real-time monitoring of soil, weather, and crop conditions. Additionally, the adoption of drones and satellite imagery enhances field analysis, supporting data-driven decisions that improve yields and resource management, fueling the market.

Key Market Highlights:

- The digital agriculture industry size was valued at USD 21.89 billion in 2023.

- The market is projected to grow at a CAGR of 12.19% from 2024 to 2031.

- North America held a market share of 38.09% in 2023, with a valuation of USD 8.34 billion.

- The IoT & sensors segment garnered USD 5.71 billion in revenue in 2023.

- The hardware segment is expected to reach USD 26.23 billion by 2031.

- The cloud-based segment secured the largest revenue share of 65.09% in 2023.

- The field mapping & soil health segment is poised for a robust CAGR of 16.75% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 13.90% during the forecast period.

Major companies operating in the digital agriculture market are AGCO Corporation, Microsoft, IBM, Deere & Company, Bayer, Trimble Inc., GAMAYA, AgEagle Aerial Systems Inc., Kubota Corporation, CNH Industrial N.V., Topcon Corporation, CLAAS KGaA mbH, Hexagon AB, Wipro, and Accenture.

Precision farming techniques, utilizing GPS technology and data analytics, allow for site-specific crop management. Farmers can optimize yields and reduce environmental impact by applying inputs like fertilizers and pesticides precisely where needed. This approach improves crop productivity and promotes sustainable farming practices, fueling the market.

- In April 2023, IBM partnered with Texas A&M AgriLife to support small-scale farmers such as Chapin through the development of Liquid Prep. This tool is designed to provide precise guidance on optimal irrigation timing and location, enhancing water efficiency. Farmers can install a soil moisture sensor in the field, connect it to a mobile app for real-time monitoring, and upload the data for analysis. The initiative is aimed at expansion across drought-prone regions in the U.S.

Integration of IoT and Sensor Technologies

The incorporation of Internet of Things (IoT) devices and sensors in agriculture enables real-time monitoring of soil conditions, crop health, and equipment performance. This technological advancement allows farmers to make data-driven decisions, enhancing efficiency and productivity.

The ability to collect and analyze data remotely reduces the need for manual labor and minimizes resource wastage, thereby contributing to the growth of the market.

- In February 2025, Topcon and Bonsai Robotics, a pioneer in vision-based autonomy for agriculture, announced a collaboration aimed at accelerating automation in permanent crop farming. The initiative combines Bonsai Robotics’ advanced autonomous driving technologies with Topcon Agriculture’s strengths in sensors, connectivity, and intelligent implements. Together, they plan to deliver enhanced efficiency and productivity solutions tailored to modern agricultural needs.

Limited Digital Infrastructure in Rural Areas

A major challenge hindering the growth of the digital agriculture market is the lack of reliable digital infrastructure in remote and rural farming regions. Many areas still face poor internet connectivity, making it difficult to implement advanced digital solutions effectively.

Companies are investing in satellite-based connectivity solutions and forming partnerships with telecom providers. Initiatives such as JDLink Boost and collaborations with Starlink are examples of efforts to ensure consistent connectivity. These steps help bridge the digital gap, allowing farmers in underserved regions to access precision technologies and participate fully in digital agriculture advancements.

Adoption of Drones and Satellite Imagery

The use of drones and satellite imagery in agriculture allows for detailed monitoring of crop health, soil conditions, and field variability. These technologies provide valuable data that can be used to make informed decisions regarding planting, irrigation, and harvesting. The enhanced monitoring capabilities contribute to increased efficiency and productivity, propelling the market.

- In April 2025, ARB IOT Group Limited launched its Smart AI Drone, an advanced plantation mapping solution that merges AI with drone technology. Equipped with high-resolution imaging, real-time analytics, and automated functions, the drone enables precise mapping, crop health assessment, pest identification, and targeted spraying. This cutting-edge tool is designed to help farmers and plantation managers optimize resource use and improve productivity through accurate, data-driven decision-making.

Digital Agriculture Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

IoT & Sensors, Remote Sensing & Drones, Artificial Intelligence, Big Data & Cloud, Blockchain, Robotics & Automation

|

|

By Component

|

Hardware, Software, Services

|

|

By Deployment Mode

|

Cloud-based, On-premise

|

|

By Application

|

Precision Farming, Smart Irrigation, Field Mapping & Soil Health, Crop Scouting & Protection, Livestock Monitoring, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (IoT & Sensors, Remote Sensing & Drones, Artificial Intelligence, Big Data & Cloud, Blockchain, and Robotics & Automation): The IoT & sensors segment earned USD 5.71 billion in 2023, due to its ability to provide real-time, data-driven insights that enhance decision-making, improve resource efficiency, and boost overall farm productivity.

- By Component (Hardware, Software, and Services): The hardware segment held 47.09% share of the market in 2023, due to the high demand for field-deployed devices such as sensors, drones, and GPS systems that enable real-time data collection and precision farming operations.

- By Deployment Mode (Cloud-based and On-premise): The cloud-based segment is projected to reach USD 34.08 billion by 2031, owing to its scalability, real-time data accessibility, and cost-effective deployment.

- By Application (Precision Farming, Smart Irrigation, Field Mapping & Soil Health, Crop Scouting & Protection, Livestock Monitoring, Others): The field mapping & soil health segment is poised for significant growth at a CAGR of 16.75% through the forecast period, due to its critical role in optimizing input use, enhancing yield predictions, and enabling data-driven decisions.

Digital Agriculture Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 38.09% share of the digital agriculture market in 2023, with a valuation of USD 8.34 billion. North America is home to a large number of agri-tech companies actively developing advanced digital farming tools. The region has registered consistent innovation in precision agriculture, AI-based crop monitoring, and automated machinery.

These companies frequently pilot their technologies on large-scale farms, contributing to the expansion of the market. Moreover, leading universities and research institutions in North America actively collaborate with private sector firms on agricultural innovation. These partnerships help test and refine digital solutions, speeding up commercialization. The ecosystem of academic support strengthens the market.

- In June 2024, the McKenna Institute at the University of New Brunswick (UNB) received a USD 3.75 million investment through a partnership led by McCain Foods and other New Brunswick organizations. The initiative aims to transform digital agriculture, advance regenerative farming methods, and reduce climate-related risks to farmland. As part of the effort, a digital simulation model will be developed to help farmers visualize the environmental and economic outcomes of adopting regenerative agriculture practices.

The digital agriculture industry in Asia Pacific is poised for significant growth at a robust CAGR of 13.90% over the forecast period. High mobile phone usage, even in remote farming regions, is enabling the widespread adoption of digital agriculture solutions.

Farmers are using mobile platforms to access weather updates, pest alerts, and crop advisory services. This mobile-first ecosystem is a major enabler of digital transformation in agriculture, significantly expanding the market’s reach in Asia Pacific. Furthermore, several regional governments have launched structured smart farming initiatives focused on increasing food security and improving farm productivity.

These programs fund digital infrastructure, subsidize agri-tech equipment, and promote farmer education on precision agriculture. The growing public sector involvement is accelerating the integration of digital tools in agriculture, driving steady growth of the market in Asia Pacific. The Digital Villages Initiative (DVI) for Asia and the Pacific helps member countries speed up the digital transformation of agrifood systems.

It aids in the development of digital agriculture strategies and conducts digital readiness assessments. Additionally, the DVI organizes regional forums focused on digital agriculture solutions and hosts knowledge-sharing platforms to promote cross-learning and exchange of insights on digital agriculture advancements in the region.

Regulatory Frameworks

- In the U.S., the Farm Bill allocates funding for precision agriculture initiatives and supports digital agriculture infrastructure. The Federal Trade Commission (FTC) enforces data privacy regulations, ensuring protection for agricultural data. Additionally, policies around broadband expansion and sustainability promote the adoption of digital tools to enhance farm productivity and environmental impact.

- The Common Agricultural Policy (CAP) in the European Union (EU) encourages the adoption of digital technologies to improve agricultural efficiency and sustainability. The General Data Protection Regulation (GDPR) plays a significant role by protecting personal data, including agricultural data, while promoting transparency and accountability in digital agriculture practices across the region.

- Japan’s Basic Act on Food, Agriculture and Rural Areas promotes the digital transformation of agriculture to improve food security and sustainability. The Act on the Protection of Personal Information regulates how personal and agricultural data are managed. Together, these laws help integrate digital solutions while ensuring privacy and innovation in farming.

- China’s National Smart Agriculture Action Plan (2024–2028) focuses on advancing digital farming through AI, big data, and IoT technologies. The Cybersecurity Law and PIPL regulate data protection and cybersecurity, addressing the growing concern over the management of digital agricultural data while fostering innovation in precision farming practices.

Competitive Landscape:

Market players in the digital agriculture industry are increasingly adopting strategies like partnerships and technological advancements to drive growth. Collaborations with technology leaders enable companies to leverage cutting-edge solutions, enhancing their offerings.

Integrating AI, data analytics, and IoT capabilities helps these companies improve farm productivity and sustainability, which strengthens their position in the market. As innovation continues, these strategic moves are helping companies meet the growing demand for smarter, more efficient agricultural solutions.

- In February 2025, Bayer Crop Science (BCS), a division of Bayer, partnered with Microsoft and Ernst & Young (EY) to develop its proof of concept (POC) on the Microsoft Azure AI Foundry. The collaboration utilized the Azure OpenAI Service, Azure AI Search, and the latest GPT-series models. According to BCS, Microsoft and EY significantly advanced their use of generative AI. Alongside Azure OpenAI Service, BCS also employed Azure Data Manager for Agriculture and the Microsoft Intelligent Data Platform, which integrates industry-specific data connectors to collect farm data from various sources like satellites, soil sensors, drones, and weather providers.

Key Companies in Digital Agriculture Market:

- AGCO Corporation

- Microsoft

- IBM

- Deere & Company

- Bayer

- Trimble Inc.

- GAMAYA

- AgEagle Aerial Systems Inc.

- Kubota Corporation

- CNH Industrial N.V.

- Topcon Corporation

- CLAAS KGaA mbH

- Hexagon AB

- Wipro

- Accenture

Recent Developments (Collaborations/Joint Ventures/Partnerships/Product Launches)

- In January 2025, Deere and Company launched JDLink Boost, a satellite connectivity solution designed to ensure uninterrupted operations in fields with limited or no cellular coverage. This new JDLink Boost feature supports the partnership between John Deere and Starlink by SpaceX, announced a year earlier, offering farmers in rural areas with connectivity challenges the ability to fully utilize precision agriculture technologies.

- In November 2024, Orbia's Precision Agriculture business, Netafim, and Bayer announced the expansion of their strategic collaboration, beginning with new digital farming solutions for fruit and vegetable growers. The solutions are designed to simplify primary data collection and provide tailored recommendations based on that data. The goal is to help growers enhance crop production, optimize resource use, and reduce environmental impact.

- In April 2024, AGCO Corporation and Trimble finalized their joint venture agreement, establishing a new entity named PTx Trimble. This venture merges Trimble’s precision agriculture division with AGCO’s JCA Technologies, aiming to deliver enhanced factory-fit and retrofit solutions tailored to the mixed-fleet precision agriculture market, providing greater value and flexibility for farmers.

- In February 2025, Topcon Corporation and FARO Technologies announced a partnership to co-develop and distribute advanced solutions in the laser scanning space. This collaboration is set to broaden access to digital reality technologies and enable integrated product development, including the seamless alignment of Topcon and Sokkia systems with FARO’s offerings. Bringing together their respective expertise, the two companies aim to enhance technological capabilities for professionals across various sectors, including precision agriculture.