Market Definition

The market encompasses the production and use of positive displacement pumps that utilize a flexible diaphragm to transfer fluids. These pumps are engineered to handle a wide range of viscosities, aggressive chemicals, slurries, and abrasive materials, making them vital in industries such as pharmaceuticals, water treatment, oil and gas, food processing, and chemicals.

Their compact build and capacity to handle solids make them suitable for both stationary and mobile operations. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Diaphragm Pump Market Overview

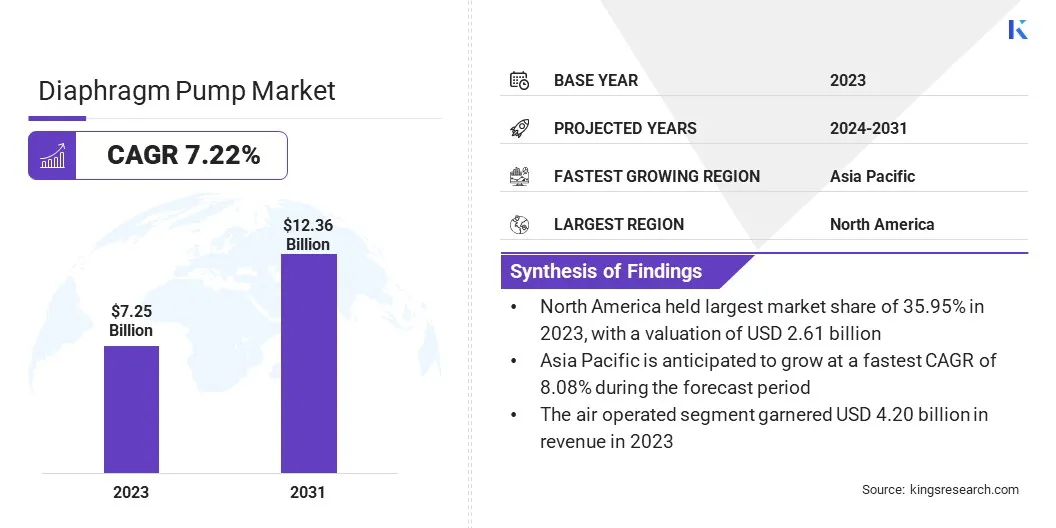

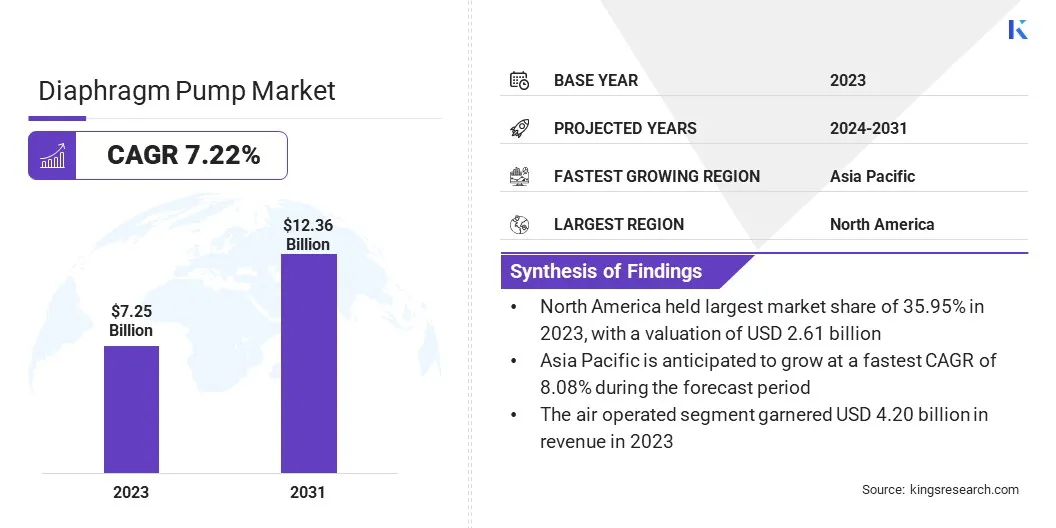

The global diaphragm pump market size was valued at USD 7.25 billion in 2023 and is projected to grow from USD 7.59 billion in 2024 to USD 12.36 billion by 2031, exhibiting a CAGR of 7.22% during the forecast period.

Market growth is primarily supported by rising demand across chemical processing industries, where precise fluid handling and resistance to aggressive media are essential.

Additionally, advancements in pumping technologies and materials, such as the integration of corrosion-resistant polymers and smart control systems, are enhancing efficiency and expanding industrial applicability.

Major companies operating in the diaphragm pump ndustry are IDEX, Yamada Corporation, PSG Dover, Graco, Sandpiper Group Parent Company Inc., Xylem Inc., Wanner Engineering, Inc., Flowserve Corporation, Ingersoll Rand (ARO), Wastecorp Pumps, Timmer GmbH, LIGAO PUMP TECHNOLOGY, Verder Liquids, Atlas Copco, and Grundfos Holding A/S.

The adoption of automation and smart factory infrastructure is highlighting the need for digitally controlled pumping solutions, boosting market growth. Modern diaphragm pumps integrated with IoT sensors, flow monitoring systems, and real-time diagnostics offer improved operational visibility and predictive maintenance.

These smart capabilities enable seamless integration with PLCs and SCADA systems, enhancing plant productivity and reducing downtime. The shift toward digital transformation in manufacturing is accelerating the growth of the market.

- In April 2025, Graco expanded its established QUANTM pump line by introducing the innovative XTREME TORQUE motor design, reducing weight and footprint to simplify deployment and maintenance. This advancement addresses changing customer requirements while supporting the transition to automated operations. Engineered for seamless integration into automated systems, meets evolving customer needs and supports next-generation industrial operations focused on efficiency.

Key Highlights:

- The diaphragm pump industry size was recorded at USD 7.25 billion in 2023.

- The market is projected to grow at a CAGR of 7.22% from 2024 to 2031.

- North America held a share of 35.95% in 2023, valued at USD 2.61 billion.

- The double acting segment garnered USD 4.01 billion in revenue in 2023.

- The air operated segment is expected to reach USD 7.14 billion by 2031.

- The water & wastewater segment secured the largest revenue share of 29.90% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 8.08% over the forecast period.

Market Driver

"Rising Demand Across Chemical Processing Industries"

Diaphragm pumps are widely used in chemical manufacturing and processing due to their compatibility with aggressive chemicals, acids, and solvents. Their leak-free and explosion-proof design meets safety standards in hazardous environments.

Growing investments in chemical plants and the rising production of specialty chemicals, polymers, and industrial coatings are creating strong demand for reliable, high-performance pumping systems, thereby fueling the growth of diaphragm pump market.

- In September 2024, Ingersoll Rand launched the EVO Series electric diaphragm pumps, engineered to improve energy efficiency and fluid handling performance in industries such as chemicals and petrochemicals. The series integrates key benefits of ARO air-operated pumps with select features from other technologies, delivering a precise and efficient electric diaphragm solution.

Market Challenge

"Operational Downtime and Maintenance Complexity"

A significant challenge hindering the growth of the diaphragm pump market is the operational downtime caused by frequent maintenance and component wear, particularly in abrasive or chemically aggressive environments. This impacts productivity and increases long-term operational costs for end users.

To address this challenge, companies are developing diaphragm pumps with improved wear-resistant materials, modular designs for faster servicing, and predictive maintenance features integrated with smart monitoring systems.

These efforts aim to reduce unscheduled downtime, enhance pump reliability, and ensure efficient long-term performance, supporting broader adoption across demanding industrial applications.

Market Trend

"Advancement in Pumping Technologies and Materials"

Technological improvements in pump design, such as electrically-operated double diaphragm (EODD) systems and smart pump controls, are contributing to the growth of the diaphragm pump market. The use of corrosion-resistant thermoplastics and elastomers enhances durability and reduces operational downtime.

Manufacturers are focusing on developing energy-efficient and compact models to meet space constraints in process facilities. These innovations enhance product appeal by supporting operational efficiency and cost optimization across industries.

- In April 2024, IDEX unveiled the Cognito 1-inch electrically operated double diaphragm (EODD) pump, a heavy-duty variant designed to set new standards in energy efficiency, reliability, and sustainability. The Cognito series is reshaping industrial fluid handling globally, offering a comprehensive lineup of heavy-duty EODD pumps ranging from 1 to 4 inches. These pumps are tailored to meet diverse flow rates and application demands across various industries.

Diaphragm Pump Market Report Snapshot

|

Segmentation

|

Details

|

|

By Operation

|

Single Acting, Double Acting

|

|

By Mechanism

|

Air Operated, Electrical Operated

|

|

By End Use

|

Water & Wastewater, Oil & Gas, Chemicals, Pharmaceuticals, Food & Beverages, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Operation (Single Acting and Double Acting): The double acting segment earned USD 4.01 billion in 2023 due to its ability to deliver continuous flow and higher discharge rates, making it ideal for high-volume and pressure-sensitive industrial applications.

- By Mechanism (Air Operated and Electrical Operated): The air operated segment held a share of 57.87% in 2023, fueled by its suitability for handling abrasive, viscous, and shear-sensitive fluids in hazardous and remote industrial environments without the need for electricity.

- By End Use (Water & Wastewater, Oil & Gas, Chemicals, and Pharmaceuticals): The water & wastewater segment is projected to reach USD 3.70 billion by 2031, propelled by its critical need for reliable, low-maintenance handling of sludge, slurry, and chemically treated fluids in municipal and industrial treatment processes.

Diaphragm Pump Market Regional Analysis

Based on region, the diaphragm pump industry has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America diaphragm pump market share stood at around 35.95% in 2023, valued at USD 2.61 billion. This dominance is reinforced by the growth of smart manufacturing and industrial automation.

Electrically operated diaphragm pumps (EODD) with smart diagnostics and real-time flow monitoring features are being adopted by manufacturers to optimize energy consumption and minimize manual intervention. Their integration into Industry 4.0 workflows is contributing to steady market expansion in high-precision industrial environments.

Additionally, the advanced food and beverage manufacturing sector is increasingly adopting diaphragm pumps to maintain product purity and comply with stringent FDA and 3-A sanitary standards.

Rising production of clean-label, plant-based, and specialty food production is further increasing demand for hygienic diaphragm pump tailored to high-viscosity and temperature-sensitive formulations.

Asia Pacific diaphragm pump industry is poised to grow at a CAGR of 8.08% over the forecast period. Asia Pacific is witnessing significant growth in chemical production, particularly within industrial corridors focused on petrochemicals, paints, and specialty chemicals.

Diaphragm pumps are widely utilized in these environments for transferring corrosive, viscous, and abrasive fluids under strict safety and reliability standards. The increasing rising adoption of closed-loop systems and modular chemical processing units is propelling regional market growth.

- In May 2024, Zero Carbon Analytics reported that Asia is projected to account for more than 60% of the incremental oil demand growth in the petrochemical sector through 2050. The region’s petrochemical capacity is projected to expand steadily, adding approximately 200,000 barrels per day of oil demand annually until 2035, propeled by ongoing industrial development and feedstock consumption.

Regulatory Frameworks

- In the U.S., diaphragm pumps must comply with ANSI/HI 10.1-10.5 and 10.6 standards set by the Hydraulic Institute, covering operational and testing requirements. FDA regulations apply to pumps used in food-grade applications, while EPA mandates emissions control standards for volatile compounds under environmental compliance frameworks like the Clean Air Act.

- In the EU, diaphragm pumps must comply with the Ecodesign Directive (2009/125/EC) and Regulation (EU) 547/2012 for energy efficiency. CE marking is mandatory, certifying conformity with health, safety, and environmental protection standards. The regulatory framework emphasizes sustainability and performance, particularly in industrial and water treatment sectors.

- In China, diaphragm pumps must meet GB (Guobiao) national standards, which specify safety, structural design, and performance benchmarks. The China Compulsory Certification (CCC) system applies to certain pump types, particularly for use in hazardous environments. Environmental and manufacturing compliance is strictly regulated for both domestic and exports markets.

- In South Korea, the Korean Industrial Standards (KS) regulate diaphragm pump specifications, ensuring mechanical durability and safety. Equipment used in food and pharmaceutical processing must comply with Ministry of Food and Drug Safety (MFDS) guidelines, which oversee material safety, sanitation, and suitability for hygienic environments, particularly in high-tech industries.

Competitive Landscape

Key players operating in the diaphragm pump industry are increasingly focusing on expanding their product portfolios to strengthen their position. By introducing technologically advanced and energy-efficient pump solutions tailored to diverse industrial needs, companies are addressing evolving customer demands and operational challenges.

This strategic emphasis on portfolio enhancement is enabling manufacturers to cater to a broader application base, drive product differentiation, and reinforce customer retention. These initiatives support performance-driven solutions aligned with modern industrial requirements.

- In March 2024, Ingersoll Rand expanded its ARO fluid handling portfolio with the launch of the EVO Series electric diaphragm pumps, now available via engineering distributor BMG. Developed to meet growing demands for energy-efficient and high-productivity solutions, the EVO Series combines advanced features previously unavailable in a single pump, enhancing both performance and serviceability.

List of Key Companies in Diaphragm Pump Market:

- IDEX

- Yamada Corporation

- PSG Dover

- Graco

- Sandpiper Group Parent Company Inc.

- Xylem Inc.

- Wanner Engineering, Inc.

- Flowserve Corporation

- Ingersoll Rand (ARO)

- Wastecorp Pumps.

- Timmer GmbH

- LIGAO PUMP TECHNOLOGY

- Verder Liquids

- Atlas Copco

- Grundfos Holding A/S

Recent Developments (Product Launch)

- In February 2025, Xylem unveiled the Jabsco Sensor-Max II, a next-generation variable speed pump engineered to optimize freshwater system efficiency in marine and RV environments. Positioned as the most advanced motor-driven diaphragm pump within Xylem’s comprehensive portfolio for boat and RV applications, the Sensor-Max II supports flow rates up to 5 gallons per minute (GPM). It delivers consistent, on-demand water pressure, ensuring a smooth flow without requiring an accumulator tank, making it a high-performance solution for compact and mobile water systems.

- In August 2023, PSG Dover expanded its portfolio of compact air-operated double-diaphragm (AODD) pumps with the launch of two new 6 mm Bolted Plastic Pump models: the Pro-Flo SHIFT Series PS25 and the Accu-Flo Series A25PS. Engineered for demanding fluid-handling tasks, these pumps deliver the reliability, energy efficiency, and operational consistency essential for precision-driven processes, making them well-suited for dosing and batching applications.