Diabetic Retinopathy Market Size

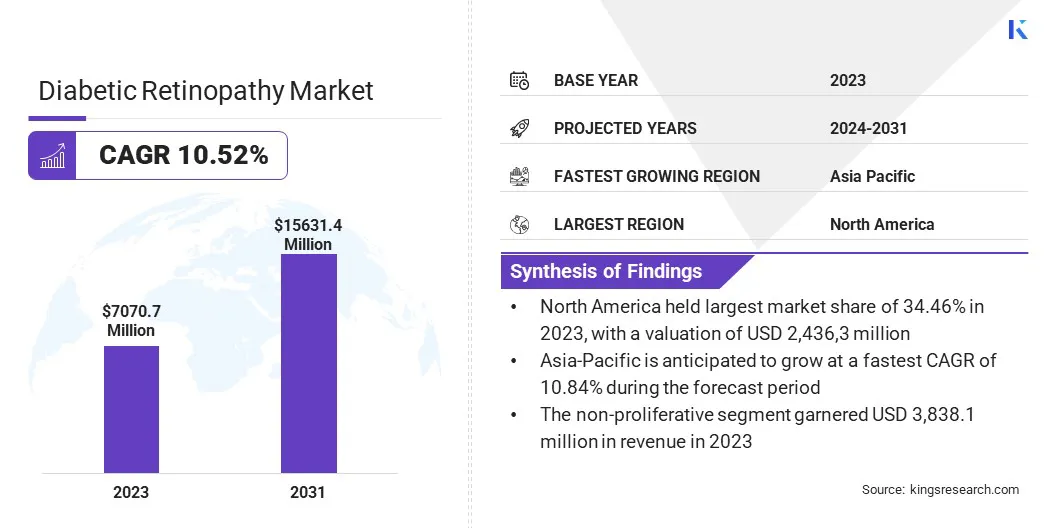

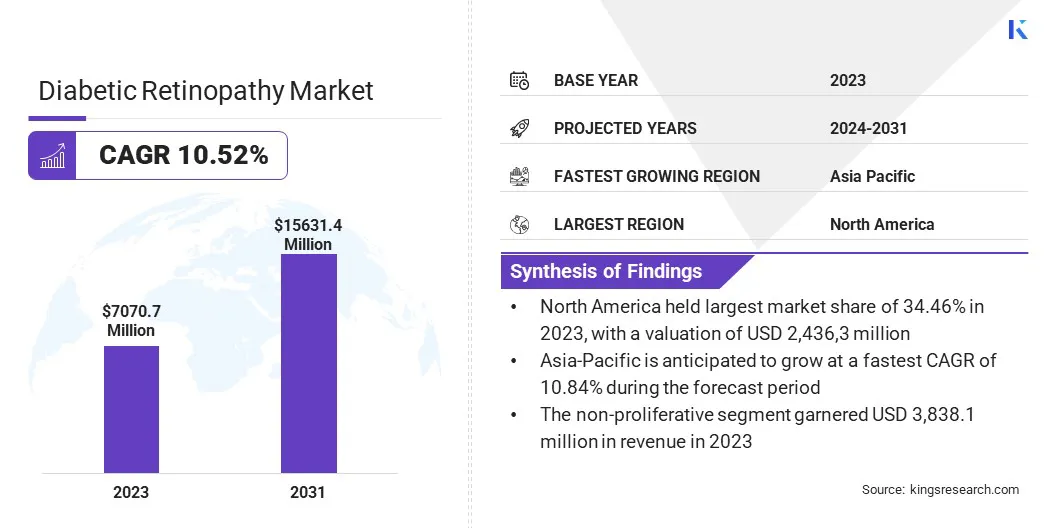

The global diabetic retinopathy market size was valued at USD 7,070.7 million in 2023 and is projected to grow from USD 7,759.0 million in 2024 to USD 15,631.4 million by 2031, exhibiting a CAGR of 10.52% during the forecast period.

The aging population is fueling the growth of the market, as older adults are more prone to developing the condition. This demographic shift increases the demand for early diagnostic tools and effective treatment options to manage diabetic retinopathy.

In the scope of work, the report includes products and services offered by companies such as Bayer AG, AbbVie Inc., Oxurion NV, Alimera Sciences, BCN PEPTIDES, S.A.U., Genentech, Inc, Novartis Pharmaceuticals Corporation, KODIAK SCIENCES INC., Regeneron Pharmaceuticals Inc, Kowa Company, Ltd., and others.

The diabetic retinopathy market addresses the needs of individuals with diabetes at risk of developing vision impairments due to retinal damage. As a progressive condition, it requires timely diagnosis and effective treatment to prevent severe complications.

The market includes a range of solutions aimed at improving patient outcomes, from early detection methods to advanced therapeutic interventions. Growing awareness and access to healthcare are central to ensuring that patients receive appropriate care, thereby improving their quality of life.

The market encompasses the development, manufacturing, and distribution of diagnostic tools, treatments, and technologies aimed at managing and treating this eye complication caused by diabetes. It includes a wide range of solutions for early detection, such as imaging devices, and therapies for advanced stages, including injections, laser treatments, and surgeries.

The primary goal is to reduce the risk of vision loss in individuals with diabetes through effective diagnosis and intervention, making it an essential area in the healthcare sector as the global prevalence of diabetes rises.

Analyst’s Review

The increasing prevalence of diabetes, particularly type 2, is boosting the growth of the diabetic retinopathy market. This is leading to the increased demand for early detection and effective treatments for diabetic retinopathy.

- In November 2024, The Lancet reported that over 800 million adults globally live with diabetes, highlighting the growing need for diabetic retinopathy care. The analysis, conducted by the Non-Communicable Disease Risk Factor Collaboration (NCD-RisC) with support from the World Health Organization (WHO), underscores the rising demand for diagnostic tools and treatments, contributing to the growth of the market.

Companies are focusing on innovations in diagnostic technologies and therapeutic options, while also investing in awareness campaigns and screening programs. Strategies such as collaborations, expansion of product portfolios, and the development of cost-effective treatments are being employed to cater to the rising patient population and expand market reach.

- In May 2024, Remidio Inc. marked a significant milestone by distributing its 1000th FOP-NM handheld retinal camera to healthcare providers across the U.S. This portable, user-friendly device enables retinal screenings for diabetic retinopathy in various settings, improving access and fostering market expansion.

Diabetic Retinopathy Market Growth Factors

The aging population is fueling the growth of the diabetic retinopathy market, as older adults are more susceptible to developing the condition due to prolonged exposure to risk factors such as high blood sugar levels.

As the global population ages, the number of individuals at risk increases, creating a demand for early diagnostic tools and effective treatments. This demographic shift highlights the need for solutions that can manage and prevent vision loss associated with diabetic retinopathy.

- According to the WHO, by 2030, 1 in 6 people will be aged 60 or older. By 2050, with the number doubling to 2.1 billion, including 426 million people aged 80+. This significant increase in the aging population will drive higher demand for diabetic retinopathy diagnostics and treatments, as older adults are more prone to the condition.

Limited access to healthcare in rural areas presents a significant challenge to the expansion of the diabetic retinopathy market due to lack of necessary infrastructure and skilled professionals. To address this challenge, telemedicine and portable diagnostic tools like handheld retinal cameras can be utilized, enabling remote screenings and consultations with specialists.

These technologies facilitates timely diagnoses and interventions. Collaborations between healthcare providers, local governments, and tech innovators can further enhance access to care in underserved regions, improving patient outcomes.

Diabetic Retinopathy Industry Trends

Telemedicine and AI integration is a growing trend in the diabetic retinopathy market, revolutionizing early detection and screening, particularly in underserved areas. Teleophthalmology enables remote consultations and image sharing, allowing specialists to diagnose and monitor patients without the need for in-person visits.

AI-powered diagnostic tools enhance this process by providing accurate, quick analysis of retinal images, enabling earlier interventions and reducing the burden on healthcare professionals. This trend improves accessibility, particularly in rural or resource-poor regions, and ensures timely care for patients at risk of vision loss.

- In November 2024, Avant Technologies and Ainnova Tech partnered to develop a cost-effective retinal camera integrated with Ainnova’s Vision AI software. This solution is designed to enhance early disease detection, particularly for diabetic retinopathy, by making retinal scans accessible in primary care settings, improving early diagnosis and patient outcomes.

The rise of portable diagnostic devices, such as handheld retinal cameras, is significantly transforming the diabetic retinopathy screening process. These compact and user-friendly devices offer greater flexibility, allowing screenings to be conducted in both clinical and remote settings.

Healthcare professionals can easily perform retinal exams in rural and underserved areas, improving accessibility to timely diagnoses. This trend is crucial for addressing the global rise in diabetic retinopathy cases, facilitating early detection and ensuring timely care.

- In May 2024, AEYE Health received approval for AEYE-DS, an autonomous AI system for diabetic retinopathy screening. Paired with a portable retinal camera, it enables efficient screenings in various settings, addressing logistical barriers and increasing accessibility for timely diagnosis and intervention, both in clinics and at home.

Segmentation Analysis

The global market has been segmented based on type, management, end user, and geography.

By Type

Based on type, the market has been bifurcated into proliferative and non-proliferative The non-proliferative segment led the diabetic retinopathy market in 2023, reaching a valuation of USD 3,838.1 million. This expansion is largely attributed to the rising global prevalence of diabetes.

As an early stage of diabetic retinopathy, NPDR (non-proliferative diabetic retinopathy) management involves timely detection and monitoring, fueling demand for diagnostic tools and therapeutic solutions. The increasing adoption of technologies such as handheld retinal cameras, AI-powered screening platforms, and telemedicine is contributing to this growth.

With advancements in treatments, such as anti-VEGF therapies, and growing awareness of the importance of early intervention, the NPDR segment is expected to witness notable expansion, offering new opportunities for healthcare providers and ophthalmic companies.

By Management

Based on management, the market has been segmented into anti VEGF, intraocular steroid injection, laser surgery, and vitrectomy. The anti VEGF segment secured the largest revenue share of 34.76% in 2023, mainly due to its proven efficacy in managing diabetic retinopathy.

Anti-VEGF agents are commonly used to treat both non-proliferative and proliferative diabetic retinopathy by reducing retinal edema and abnormal blood vessel growth. As the global prevalence of diabetes rises, the demand for effective treatments to manage diabetic retinopathy increases.

The expansion of anti-VEGF therapy is further supported by advancements in injection techniques, reimbursement policies, and the increasing awareness of early diagnosis and treatment, contributing to improved patient outcomes and segmental growth.

By End User

Based on end use, the market has been classified into hospitals and pharmacies, eye clinics, ambulatory surgical centres, and others. The hospitals and pharmacies applications segment is set to grow at a CAGR of 10.58% through the forecast period. This growth is largely attributed to the rising prevalence of diabetes and the increasing need for early diagnosis and effective treatment.

Hospitals play a key role in providing specialized care, including advanced diagnostic tools like retinal cameras and laser treatments for diabetic retinopathy. Pharmacies are increasingly involved in distributing medications and offering patient education on managing the disease.

The growth of healthcare infrastructure, coupled with improved access to treatments, is fueling segmental expansion. Additionally, strategic partnerships between pharmaceutical companies, hospitals, and pharmacies are enhancing patient access to timely interventions and creating new opportunities for growth.

Diabetic Retinopathy Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America diabetic retinopathy market held a notable share of around 34.46% in 2023, with a valuation of USD 2,436.3 million. This dominance is reinforced by the high prevalence of diabetes, advanced healthcare infrastructure, and significant investments in medical research and technology.

The region's well-established healthcare system, cutting-edge diagnostic and therapeutic solutions, and strong adoption of innovative treatments such as anti-VEGF therapies further support this growth. Additionally, the regional market benefits from government initiatives supporting diabetic care, along with robust reimbursement policies for retinal screenings and treatments.

Furthermore, increased awareness among healthcare providers and patients about the importance of early detection and intervention is propelling regional market growth.

Asia-Pacific is projected to grow at a CAGR of 10.84% through the projection period. This rapid growth is propelled by the rising diabetes prevalence, expanding healthcare infrastructure, and growing healthcare awareness. The region is experiencing significant improvements in medical technology and diagnostic services, which are facilitating better access to diabetic retinopathy screenings and treatments.

Countries such as China and India, with large diabetic populations, are witnessing a surge in demand for affordable and accessible healthcare solutions, including telemedicine and portable diagnostic devices. Moreover, government initiatives to combat diabetes and the rising adoption of advanced therapies are fueling regional market expansion.

- In May 2024, KakaoHealthcare signed a Memorandum of Agreement with Rumah Sakit Universitas Indonesia to expand its AI-based glucose management service, PASTA. This partnership emphasizes the growing role of AI in healthcare, particularly in diabetes care and diabetic retinopathy management, by delivering real-time glucose data for improved patient outcomes.

Competitive Landscape

The global diabetic retinopathy market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Diabetic Retinopathy Market

- Bayer AG

- AbbVie Inc.

- Oxurion NV

- Alimera Sciences

- BCN PEPTIDES, S.A.U.

- Genentech, Inc

- Novartis Pharmaceuticals Corporation

- KODIAK SCIENCES INC.

- Regeneron Pharmaceuticals Inc

- Kowa Company, Ltd.

Key Industry Developments

- June 2023 (Launch): Eyenuk received FDA clearance for its EyeArt AI system to automatically detect diabetic retinopathy using the Topcon NW400 retinal camera, expanding its reach to multiple camera models. This marks EyeArt as the first FDA-cleared AI system for various retinal cameras, enhancing access to screenings in primary care offices and improving patient outcomes through advanced image quality and real-time feedback, ensuring timely diagnosis of diabetic eye diseases for over 230,000 patients globally.

The global diabetic retinopathy market has been segmented as:

By Type

- Proliferative

- Non-proliferative

By Management

- Anti VEGF

- Intraocular Steroid Injection

- Laser Surgery

- Vitrectomy

By End User

- Hospitals and Pharmacies

- Eye Clinics

- Ambulatory Surgical Centres

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America