Market Definition

Diabetes devices are medical tools designed to monitor blood sugar levels, administer insulin, and support other aspects of diabetes management. These devices are crucial in maintaining proper blood glucose control, which is essential for preventing diabetes-related complications.

Diabetes Devices Market Overview

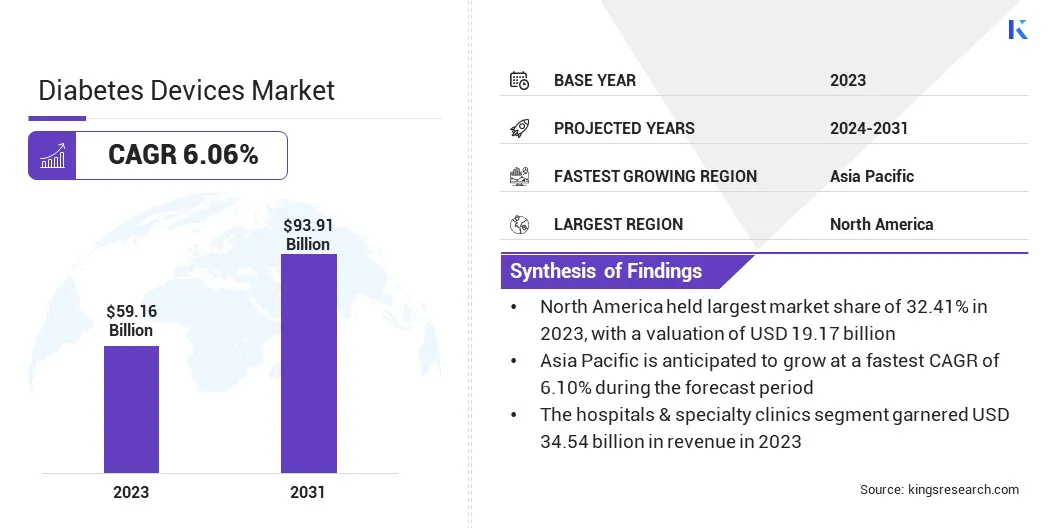

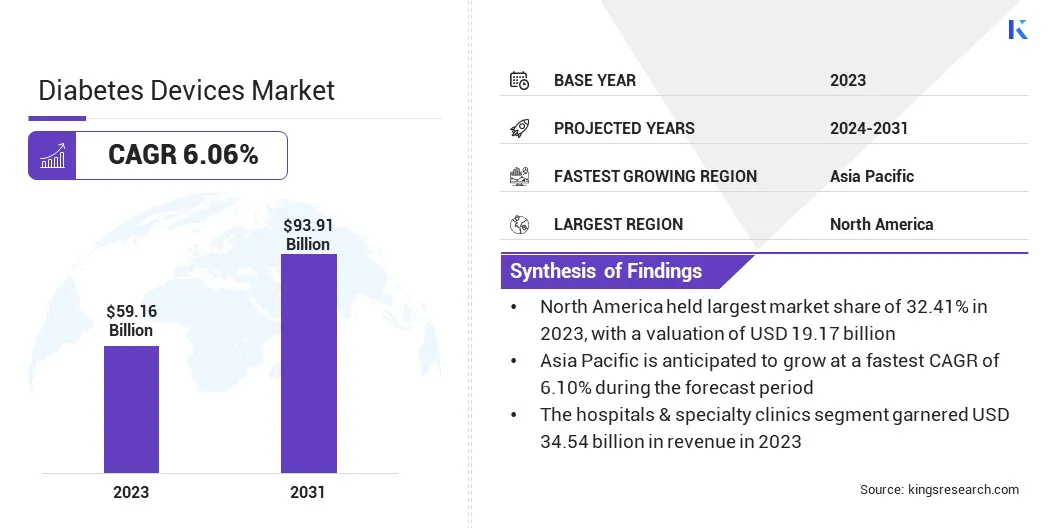

Global diabetes devices market size was valued at USD 59.16 billion in 2023 and is projected to grow from USD 62.21 billion in 2024 to USD 93.91 billion by 2031, growing at a CAGR of 6.06% from 2024 to 2031.

This market is expanding rapidly due to increasing demand for effective management solutions and growing consumer awareness of the importance of chronic disease care. This growth is further supported the shift toward more patient-centered care, with a major emphasis on improving patient quality of life through innovative device functionalities.

Additionally, healthcare systems are increasingly prioritizing cost-effective management strategies, promoting the adoption of devices that prevent complications and reduce hospitalizations, offering long-term benefits.

Major companies operating in the diabetes devices market are Medtronic Inc., Dexcom, Inc., Abbott Laboratories, Novo Holdings A/S, F. Hoffmann-La Roche Ltd, Sanofi, Johnson & Johnson Services, Inc., Eli Lilly and Company, Insulet Corporation, Tandem Diabetes Care, Inc., Ypsomed Holding AG, Ascensia Diabetes Care Holdings AG, Senseonics Holdings, Inc., Merck KGaA, B. Braun SE, and others.

The increasing adoption of wearable and non-invasive glucose monitoring devices presents numerous opportunities for market growth. Furthermore, supportive regulatory frameworks, particularly in developed markets, are streamlining approval processes for new technologies, enabling faster market access.

- For instance, in August 2024, the FDA approved Insulet's SmartAdjust technology as the first device to enable automated insulin dosing for adults with type 2 diabetes. This system automatically adjusts insulin delivery, reducing the burden of daily monitoring and injections.

Key Highlights:

- The diabetes devices industry size was recorded at USD 59.16 billion in 2023.

- The market is projected to grow at a CAGR of 6.06% from 2024 to 2031.

- North America held a share of 32.41% in 2023, valued at USD 19.17 billion.

- The monitoring segment garnered USD 32.92 billion in revenue in 2023.

- The hospitals & specialty clinics segment is expected to reach USD 54.91 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.10% through the forecast period.

Market Driver

"Rising Prevalence of Diabetes and Technological Advancements"

The rising global prevalence of diabetes, fueled by aging populations, sedentary lifestyles, and poor dietary habits, is creating a strong demand for advanced management tools such as continuous glucose monitor (CGM) and insulin pumps, thus propelling the growth of the diabetes devices market.

- For instance, in November 2024, the WHO reported a significant increase in the global prevalence of diabetes, rising from 200 million in 1990 to 830 million in 2022. Notably, the rise has been rpronounced in low- and middle-income countries compared to high-income countries.

Additionally, the integration of data analysis and remote monitoring technologies is revolutionizing diabetes care by enabling real-time tracking of glucose levels and other vital metrics, offering personalized insights and enhancing patient outcomes.

This shift toward data-driven management is further supported by the increasing demand for hybrid closed loop systems, which combine insulin pumps and CGMs to automate insulin delivery based on real-time glucose levels, providing patients with better control and convenience.

- For instance, in May 2024, CamDiab received FDA approval for its CamAPS FX app, an advanced hybrid closed loop system that adjusts insulin delivery based on glucose readings. The approval allows its use for individuals with type 1 diabetes aged two and older, including during pregnancy.

Market Challenge

"High Costs and Short Product Lifecycle of Diabetes Devices"

In developing countries, limited awareness of modern diabetes management technologies, such as CGM and insulin pumps, restricts access to these life-changing tools, often resulting in reliance on out dated or less effective methods.

Additionally, the high costs of diabetes devices, including initial investments and on-going maintenance expenses, present a significant barrier to the expansion of the diabetes devices market, particularly in low- and middle-income regions where affordability is a concern.

- For instance, in March 2024, Doctors Without Borders (MSF) published a study highlighting a global disparityin diabetes care. The study revealed that diabetes drugs, including insulin pens and GLP-1 medications such as Ozempic, are sold at inflated prices in high-income countries, while they remain largely unavailable in low- and middle-income countries.

Furthermore, the short product lifecycle of diabetes devices, fueled by rapid technological advancements, compels both consumers and healthcare systems to frequently upgrade or replace devices, increasing financial strain and complicating long-term access to these essential tools.

Market Trend

"Development of Continuous Glucose Monitoring System and AI Integration"

A notable trend in the diabetes devices industry is the rise of implantable continuous glucose monitoring systems, offering a long-term, minimally invasive solution for accurate glucose tracking with fewer sensor replacements.

Additionally, the integration of AI-powered insulin algorithms is optimizing insulin delivery by leveraging real-time data from CGM, enabling more personalized and automated treatment while enhancing glucose control.

- For instance, in July 2024, Roche received the CE Mark for its Accu-Chek SmartGuide continuous glucose monitoring solution. This AI-powered system provides real-time glucose readings and predictions, helping adults with type 1 and type 2 diabetes manage their glucose levels more effectively. Set to launch in select European markets, it aims to reduce risks such as nighttime hypoglycemia and promote proactive diabetes management.

The market is expanding into the preventive care sector, supported by an increasing focus on early intervention. The use of CGM and mobile health apps to monitor glucose levels in at-risk individuals supports lifestyle adjustments to prevent diabetes. These trends are fostering innovation and expanding market opportunities, positioning diabetes devices as essential tools in both management and prevention.

Diabetes Devices Market Report Snapshot

| Segmentation |

Details |

| By Type |

Monitoring (Self-monitoring Blood Glucose, Continuous Glucose Monitoring), Management (Insulin Pumps, Insulin Syringes, Insulin Cartridges, Disposable Pens, Jet Injectors, Others) |

| By End User |

Hospitals & specialty clinics, Homecare settings |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Monitoring, Management): The monitoring segment generated USD 32.92 billion in 2023, mainly due to the increasing demand for continuous glucose monitoring devices and wearables, providing real-time data and enhancing the ability to track glucose levels.

- By End User (Hospitals & Specialty Clinics and Homecare Settings): The hospitals & specialty clinics segment held a share of 58.39% in 2023, primarily attributed to the higher adoption of advanced diabetes management devices in clinical settings, where patients require specialized care and continuous monitoring.

Diabetes Devices Market Regional Analysis

North America diabetes devices market accounted for a substantial share of 32.41% and was valued at USD 19.17 billion in 2023. This dominance is reinforced by the high prevalence of diabetes, increasing healthcare expenditure, and a strong focus on advanced diabetes management solutions.

The regional market benefits from a significant healthcare infrastructure, widespread insurance coverage, and high adoption of cutting-edge technologies such as CGM and insulin pumps. Additionally, the growing emphasis on personalized care, supported by digital health tools and remote monitoring, propels regional market growth.

The presence of major industry players and favourable regulatory environments in the U.S. further foster innovation and the availability of new devices.

- In March 2024, DexCom, Inc. announced that the FDA cleared Stelo, the first over-the-counter glucose biosensor in the U.S. Stelo is designed for individuals with Type 2 diabetes not using insulin, providing glucose insights directly to users' smartphones. The device is engineered with the aim of improving access to continuous glucose monitoring technology for those without insurance coverage for CGM.

Asia-Pacific diabetes devices market is expected to grow at the fastest CAGR of 6.10% over the forecast period. This expansion is propelled by the increasing prevalence of diabetes, particularly in high-population countries such as China and India.

Factors such as rapid urbanization, changing lifestyles, and rising healthcare awareness are contributing to the surge in demand for effective diabetes management solutions. The region's expanding middle-class population and improving healthcare infrastructure are further fueling regional market growth, with the increased demand for affordable and accessible devices.

Additionally, government initiatives aimed at enhancing healthcare access and promoting diabetes awareness are supporting domestic market expansion.

The increasing presence of both local and international players offering cost-effective and tailored solutions, combined with the growing adoption of telemedicine and mobile health technologies, is accelerating the uptake of diabetes management devices in the region.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the FDA, part of the Department of Health and Human Services (HHS), regulates diabetes devices, ensuring their safety throughout their lifecycle and issuing public alerts if arises.

- In the European Union (EU), diabetes devices are regulated by national competent authorities within the member states, with the European Medicines Agency (EMA) involved in the regulatory process.

- In China, the National Medical Products Administration (NMPA) is responsible for regulating and approving medical devices, ensuring compliance with strict requirements for documentation, testing, and clinical data requirements.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour and Welfare (MHLW) oversee medical device regulation.

- In India, the Central Drugs Standard Control Organization (CDSCO), part of the Ministry of Health & Family Welfare, governs diabetes devices.

- Globally, the WHO provides a model regulatory framework for medical devices.

Competitive Landscape

The diabetes devices market is characterized by a large number of participants, including both established corporations and rising organizations. Innovation is a central focus, with companies prioritizing advancements in technologies such as CGM systems, insulin pumps, and integrated mobile health solutions to enhance patient outcomes and optimize disease management.

The market is highly competitive, with companies differentiating themselves through product features, reliability, ease of use, and patient support services.

Pricing strategies and reimbursement policies further aid market penetration, particularly in cost-sensitive regions. Strategic partnerships, collaborations, and acquisitions with healthcare providers and technology firms are being leveraged to expand product portfolios and extend market reach.

- In January 2025, Tandem Diabetes Care, Inc. and the University of Virginia Center for Diabetes Technology (UVA) announced a multi-year collaboration agreement to advance research and development of fully automated closed-loop insulin delivery systems. The partnership aims to leverage UVA’s expertise in automated insulin delivery algorithms and Tandem’s leadership in insulin delivery devices to enhance diabetes care.

List of Key Companies in Diabetes Devices Market:

- Medtronic Inc.

- Dexcom, Inc.

- Abbott Laboratories

- Novo Holdings A/S

- F. Hoffmann-La Roche Ltd

- Sanofi

- Johnson & Johnson Services, Inc.

- Eli Lilly and Company

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Ypsomed Holding AG

- Ascensia Diabetes Care Holdings AG

- Senseonics Holdings, Inc.

- Merck KGaA

- B. Braun SE

Recent Developments:

- In December 2024, DexCom, Inc. launched its proprietary Generative AI (GenAI) platform, becoming the first CGM manufacturer to integrate GenAI into glucose biosensing technology. The platform, built on Google Cloud’s Vertex AI and Gemini models, enhances Stelo’s Weekly Insights feature by providing personalized content.

- In November 2024, Abbott opened a new manufacturing facility in Kilkenny, Ireland, to meet the growing global demand for its FreeStyle Libre continuous glucose monitoring systems. The facility will produce sensors for the FreeStyle Libre 3.

- In November 2024, Dexcom, Inc. and ŌURA partenered to integrate Dexcom glucose data with vital signs, sleep, stress, heart health, and activity data from Oura Ring. This collaboration aims to improve metabolic health by providing users with a more comprehensive view of their overall health.

- In August 2024, Medtronic received FDA approval for its Simplera continuous glucose monitor, its first disposable, all-in-one CGM. The device is part of Medtronic's Smart MDI system, designed to simplify the user experience. Medtronic also forned a global partnership with Abbott to integrate Abbott's CGM technology with Medtronic's insulin delivery systems, expanding access to advanced diabetes management solutions.

- In May 2024, Eli Lilly and Company reported positive results from the QWINT-2 and QWINT-4 phase 3 trials for insulin efsitora alfa, a once-weekly insulin for type 2 diabetes. The trials demonstrated that efsitora was non-inferior to daily basal insulins in reducing A1C, with a safe and well-tolerated profile, potentially reducing treatment burden and improving patient adherence.

- In March 2024, Medical Technology and Devices acquired Ypsomed’s pen needle and blood glucose monitoring businesses. This acquisition strengthens MTD’s position as a leading global player in pen needle production and expands its diabetes care portfolio.